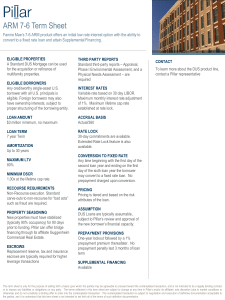

ARM 7-6 Term Sheet

... This term sheet is only for the purpose of setting forth a basis upon which the parties may be agreeable to proceed toward the contemplated transaction, and is not intended to be a legally binding contract or to impose any liabilities or obligations on any party. The terms reflected in this term she ...

... This term sheet is only for the purpose of setting forth a basis upon which the parties may be agreeable to proceed toward the contemplated transaction, and is not intended to be a legally binding contract or to impose any liabilities or obligations on any party. The terms reflected in this term she ...

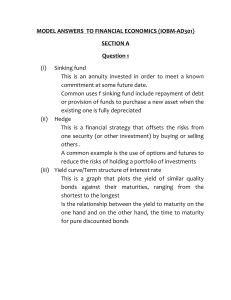

MODEL ANSWERS TO FINANCIAL ECONOMICS (IOBM

... investment and savings on the economy determine the level of long term interest rates while short term interest rates are determined by an economy’s financial and monetary conditions key components of the demand for lonable funds net investments and net additions to liquid reserves key components of ...

... investment and savings on the economy determine the level of long term interest rates while short term interest rates are determined by an economy’s financial and monetary conditions key components of the demand for lonable funds net investments and net additions to liquid reserves key components of ...

Econ 1A

... c. Explain carefully what is GDP? Find GDP in 2007 and 2008. Also find RGDP in terms of CPI in 2007 and 2008. [14] III. Potential GDP (Yp) model shows the relationship between employment (L) and Yp. 1. Explain carefully under what assumptions we can use Y = F(L;K,N,E) and LD and LS curves to describ ...

... c. Explain carefully what is GDP? Find GDP in 2007 and 2008. Also find RGDP in terms of CPI in 2007 and 2008. [14] III. Potential GDP (Yp) model shows the relationship between employment (L) and Yp. 1. Explain carefully under what assumptions we can use Y = F(L;K,N,E) and LD and LS curves to describ ...

Canadian Institute of Actuaries L`Institut canadien des actuaires

... Portable Alpha Strategy for LDI Portfolio Example ...

... Portable Alpha Strategy for LDI Portfolio Example ...

Econ 1A

... c. Explain carefully what is GDP? Find GDP in 2007 and 2008. Also find RGDP in terms of CPI in 2007 and 2008. [14] III. An economy’s Y was $8.0 billion in 2000 and $8.4 billion in 2001. This economy’s population was 200 million in 2000 and 202 million in 2001. a. b. c. d. ...

... c. Explain carefully what is GDP? Find GDP in 2007 and 2008. Also find RGDP in terms of CPI in 2007 and 2008. [14] III. An economy’s Y was $8.0 billion in 2000 and $8.4 billion in 2001. This economy’s population was 200 million in 2000 and 202 million in 2001. a. b. c. d. ...

Note Guide

... 26. What are the advantages and disadvantages to using the payback method? 27. What are the advantages and disadvantages to using NPV? 28. What are the advantages and disadvantages to using IRR? 29. Provide an example of an opportunity costs associated with most capital projects. 30. Why are sunk co ...

... 26. What are the advantages and disadvantages to using the payback method? 27. What are the advantages and disadvantages to using NPV? 28. What are the advantages and disadvantages to using IRR? 29. Provide an example of an opportunity costs associated with most capital projects. 30. Why are sunk co ...

Fund Snapshot Guide

... Loan to Value: the ratio of a loan/mortgage’s size to the value of the property at the time of funding. The loan-to-value ratio is a measure of risk used by lenders as it indicates the level of leverage used for a property. Yield to Maturity: the rate of return anticipated on a debt investment (mort ...

... Loan to Value: the ratio of a loan/mortgage’s size to the value of the property at the time of funding. The loan-to-value ratio is a measure of risk used by lenders as it indicates the level of leverage used for a property. Yield to Maturity: the rate of return anticipated on a debt investment (mort ...

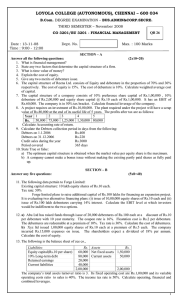

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

... 1. What is financial management? 2. State any two factors that determine the capital structure of a firm. 3. What is time value of money? 4. Explain the cost of equity. 5. Give any two merits of debenture issue. 6. The capital structure of Reena Ltd. consists of Equity and debenture in the proportio ...

... 1. What is financial management? 2. State any two factors that determine the capital structure of a firm. 3. What is time value of money? 4. Explain the cost of equity. 5. Give any two merits of debenture issue. 6. The capital structure of Reena Ltd. consists of Equity and debenture in the proportio ...

Internal rate of return RAB – Regulated Asset Base

... while the equity risk premium is based on long-run historic stock market returns data, taking into account the prevailing economic conditions. The cost of debt was estimated by Ofwat based on the cost of companies’ existing debt and an assessment of likely future debt costs. Debt costs were derived ...

... while the equity risk premium is based on long-run historic stock market returns data, taking into account the prevailing economic conditions. The cost of debt was estimated by Ofwat based on the cost of companies’ existing debt and an assessment of likely future debt costs. Debt costs were derived ...

Investment Considerations - a checklist

... Real estate is the easiest to understand since it is usually geared by a mortgage loan. The value/price of buying a home may rise at a 3-4% compound rate but the OPM factor multiplies this. For example, if you buy a house for $100,000 with a 90% mortgage then your investment is only $10,000. The pri ...

... Real estate is the easiest to understand since it is usually geared by a mortgage loan. The value/price of buying a home may rise at a 3-4% compound rate but the OPM factor multiplies this. For example, if you buy a house for $100,000 with a 90% mortgage then your investment is only $10,000. The pri ...

I. Rates of Return

... performance evaluation. Risk: the uncertainty that an investment will earn its expected rate of return. We typically use variance and/or stand deviation to measure the investment’s (total) risk. If we estimate variance and standard deviation using historical return observations: Variance (i2) ...

... performance evaluation. Risk: the uncertainty that an investment will earn its expected rate of return. We typically use variance and/or stand deviation to measure the investment’s (total) risk. If we estimate variance and standard deviation using historical return observations: Variance (i2) ...

FINAL EXAM—REVIEW SHEET (This sheet, while not all inclusive

... internal rate of return (IRR) for a capital budgeting project. Understand what the result for each computation means. For example, what does it mean if you find a project has an IRR equal to 14 percent? If NPV > 0, what is the relationship between the firm’s required rate of return and the project’s ...

... internal rate of return (IRR) for a capital budgeting project. Understand what the result for each computation means. For example, what does it mean if you find a project has an IRR equal to 14 percent? If NPV > 0, what is the relationship between the firm’s required rate of return and the project’s ...

Written exam 2008 spring

... amount, meaning the capital structure has not changed? The question is wrong because you can’t change proportion of debt and have the same capital structure, sorry b) Increasing growth rate? Higher cash-flows – higher value of the company c) The company takes on more debt and gets a higher financial ...

... amount, meaning the capital structure has not changed? The question is wrong because you can’t change proportion of debt and have the same capital structure, sorry b) Increasing growth rate? Higher cash-flows – higher value of the company c) The company takes on more debt and gets a higher financial ...

Two Ways to Calculate the Rate of Return on a Portfolio

... same amounts. Their TIME-weighted rates of return were exactly the same. But one had a gain and the other a loss. How then does an investor evaluate the different rates of return? Which rate of turn is right? Which is best? Actually there is no right or wrong or best – they just have different meani ...

... same amounts. Their TIME-weighted rates of return were exactly the same. But one had a gain and the other a loss. How then does an investor evaluate the different rates of return? Which rate of turn is right? Which is best? Actually there is no right or wrong or best – they just have different meani ...

1. value: 3.00 points Investors expect the market rate of return this

... Suppose investors believe the stock will sell for $53 at year-end. Is the stock a good or bad buy? What will investors do? ...

... Suppose investors believe the stock will sell for $53 at year-end. Is the stock a good or bad buy? What will investors do? ...