Investment in Financial Capital

... • Typically think of rate of return in terms of interest paid per $1.00 invested. But, the timing of when you get this return varies depending on… • income return - situation where the principal that is invested remains the same but the investor periodically receives income based on this investment. ...

... • Typically think of rate of return in terms of interest paid per $1.00 invested. But, the timing of when you get this return varies depending on… • income return - situation where the principal that is invested remains the same but the investor periodically receives income based on this investment. ...

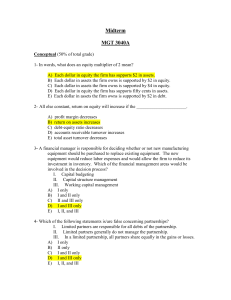

Answers to Midterm 3040A

... E) liabilities; sales 15- All else the same, which of the following occurs when a firm buys inventory with cash? A) The quick ratio goes up if it was greater than one before the change. B) The current ratio goes down if it was greater than one before the change. C) The current ratio goes down if it ...

... E) liabilities; sales 15- All else the same, which of the following occurs when a firm buys inventory with cash? A) The quick ratio goes up if it was greater than one before the change. B) The current ratio goes down if it was greater than one before the change. C) The current ratio goes down if it ...

SROI

... Deadweight: A measure of the amount of outcome that would have happened even if the activity had not taken place Discounting: The process by which future financial costs and benefits are recalculated based on discount rate to present-day values Displacement: An assessment of how much of the outcome ...

... Deadweight: A measure of the amount of outcome that would have happened even if the activity had not taken place Discounting: The process by which future financial costs and benefits are recalculated based on discount rate to present-day values Displacement: An assessment of how much of the outcome ...

I-45 Investments - Town of Cardston

... 1. Maintain the safety of the investment principal. Safety of the principal is the primary objective of the investment program. Investments of the Town are to be undertaken in a manner that seeks to maintain the safety of investment principal by mitigating credit risk and interest rate risk. In orde ...

... 1. Maintain the safety of the investment principal. Safety of the principal is the primary objective of the investment program. Investments of the Town are to be undertaken in a manner that seeks to maintain the safety of investment principal by mitigating credit risk and interest rate risk. In orde ...

Federated Mid-Cap Index Fund

... Out of 377 Mid-Cap Blend investments. An investment's overall Morningstar Rating, based on its risk-adjusted return, is a weighted average of its applicable 3-, 5-, and 10-year Ratings. See disclosure page for details. ...

... Out of 377 Mid-Cap Blend investments. An investment's overall Morningstar Rating, based on its risk-adjusted return, is a weighted average of its applicable 3-, 5-, and 10-year Ratings. See disclosure page for details. ...

14.02 Principles of Macroeconomics Spring 05 Quiz 2

... The nominal annual rental payment is $Zt . You expect it to increase at rate g (not in percentage) per year. For example, $Zt+2 = $Zt+1 (1 + g) : The nominal interest rate this period (from t to t + 1) is it (again, not in percentage), You have no idea whether the nominal interest rate will be highe ...

... The nominal annual rental payment is $Zt . You expect it to increase at rate g (not in percentage) per year. For example, $Zt+2 = $Zt+1 (1 + g) : The nominal interest rate this period (from t to t + 1) is it (again, not in percentage), You have no idea whether the nominal interest rate will be highe ...

Investment in Financial Capital

... • Typically think of rate of return in terms of interest paid per $1.00 invested. But, the timing of when you get this return varies depending on… • income return - situation where the principal that is invested remains the same but the investor periodically receives income based on this investment. ...

... • Typically think of rate of return in terms of interest paid per $1.00 invested. But, the timing of when you get this return varies depending on… • income return - situation where the principal that is invested remains the same but the investor periodically receives income based on this investment. ...

Nike Apparel: The Ten Essential Components (each worth a point)

... If you just extend the life of the project without allowing for capital maintenance, projects will always look better with longer lives than shorter ones. The key, though, is to match the capital maintenance assumptions to assumptions about project life. With the finite life scenario, it makes littl ...

... If you just extend the life of the project without allowing for capital maintenance, projects will always look better with longer lives than shorter ones. The key, though, is to match the capital maintenance assumptions to assumptions about project life. With the finite life scenario, it makes littl ...

The Discounted Cash Flow (DCF) Model -- Chart School

... cost of capital (WACC) refers to how much it cost the company to fund its operations. Companies raise money by either borrowing (debt) or issuing stock (equity). And yes, equity does have a cost involved, but it is way too complicated to get into here. The present value of money is based on the prem ...

... cost of capital (WACC) refers to how much it cost the company to fund its operations. Companies raise money by either borrowing (debt) or issuing stock (equity). And yes, equity does have a cost involved, but it is way too complicated to get into here. The present value of money is based on the prem ...

Chap 5 - TCU.edu

... believed that time diversification can reduce the total risk of a sequence of risky investments, you would have been tempted to conclude that the first alternative is less risky and therefore more attractive to more risk-averse investors. This is clearly not the case; the two-year standard deviation ...

... believed that time diversification can reduce the total risk of a sequence of risky investments, you would have been tempted to conclude that the first alternative is less risky and therefore more attractive to more risk-averse investors. This is clearly not the case; the two-year standard deviation ...

CALCULATING MATURITY VALUE

... CALCULATING MATURITY VALUE The maturity value (S), also called future value, is the sum of the principal and interest. ...

... CALCULATING MATURITY VALUE The maturity value (S), also called future value, is the sum of the principal and interest. ...

Landmine contamination has destroyed Angola`s agricultural

... incrementally builds their equity stake in the ownership of the land. Over time, fund investors will exit their land ownership, but the fund’s long term goal is the development and management of a regional smallholder commercial farming value chain. The Terra Limpa fund will partner with key organiz ...

... incrementally builds their equity stake in the ownership of the land. Over time, fund investors will exit their land ownership, but the fund’s long term goal is the development and management of a regional smallholder commercial farming value chain. The Terra Limpa fund will partner with key organiz ...

Investment and Savings

... sold for $100,000. How much is gross investment, depreciation, net investment? 2) Becky earned $50,000, paid $6k in taxes and consumed $43 k worth of goods. What is her Savings? Suppose she has $30,000 in her bank account, what is her wealth? 3) Jeremy purchases a bond that pays $600 in interest. If ...

... sold for $100,000. How much is gross investment, depreciation, net investment? 2) Becky earned $50,000, paid $6k in taxes and consumed $43 k worth of goods. What is her Savings? Suppose she has $30,000 in her bank account, what is her wealth? 3) Jeremy purchases a bond that pays $600 in interest. If ...

DFM04

... a. Briefly explain the Net Present Value technique of evaluating Capital Budgeting proposals. (15 marks) b. Determine the NPV under these conditions. (15 marks) c. Rather than use all cash, Carbon could partially finance the acquisition. It could obtain a loan of 3 million euros today that would be ...

... a. Briefly explain the Net Present Value technique of evaluating Capital Budgeting proposals. (15 marks) b. Determine the NPV under these conditions. (15 marks) c. Rather than use all cash, Carbon could partially finance the acquisition. It could obtain a loan of 3 million euros today that would be ...