Sample Questions

... 8. The Howe family recently bought a house. The house has a 30-year, $165,000 mortgage with monthly payments and a nominal (annual) interest rate of 8 percent. What is the total dollar amount of interest the family will pay during the first three years of their mortgage? (Assume that all payments ar ...

... 8. The Howe family recently bought a house. The house has a 30-year, $165,000 mortgage with monthly payments and a nominal (annual) interest rate of 8 percent. What is the total dollar amount of interest the family will pay during the first three years of their mortgage? (Assume that all payments ar ...

guest slides - WordPress.com

... Note attracts interest (10-15%) and a discount (20-40%) on next round (*if* the next round investor is sympathetic) – PLUS typical terms required by the investor e.g. liquidation pref ...

... Note attracts interest (10-15%) and a discount (20-40%) on next round (*if* the next round investor is sympathetic) – PLUS typical terms required by the investor e.g. liquidation pref ...

Syllabus - Baylor University

... 4. To recognize the essential elements of market efficiency and to understand the implications of market efficiency for developing sound management practices within publicly traded firms. 5. To derive an appropriate discount rate for use in a firm’s capital budgeting decisions (NPV analysis). 6. To ...

... 4. To recognize the essential elements of market efficiency and to understand the implications of market efficiency for developing sound management practices within publicly traded firms. 5. To derive an appropriate discount rate for use in a firm’s capital budgeting decisions (NPV analysis). 6. To ...

BR-101 Conference Call

... Copavel (consultant), based mainly on similar models for other highways (topography and geometry). • Projects using modern technologies and practices fully understood by the Group, with proven experience in the management of highly complex projects, such as the construction of the Second Lane on the ...

... Copavel (consultant), based mainly on similar models for other highways (topography and geometry). • Projects using modern technologies and practices fully understood by the Group, with proven experience in the management of highly complex projects, such as the construction of the Second Lane on the ...

During August 2012, company produced and sold 3000 boxes of

... approval has been given, implementation can begin. Implementing, monitoring and reviewing investments The time required to implement the investment proposal or project will depend on its size and complexity, and is likely to be several months. Following implementation, the investment project must be ...

... approval has been given, implementation can begin. Implementing, monitoring and reviewing investments The time required to implement the investment proposal or project will depend on its size and complexity, and is likely to be several months. Following implementation, the investment project must be ...

Chapter15OverheadsSpring2016

... Assume you purchase a Verizon Communications bond that pays 5.5% interest based on a face value of $1,000 until maturity in 2017. Also assume new corporate bond issues of comparable quality are currently paying 7%. The approximate market value of your Verizon bond is $786 calculated as follows: Do ...

... Assume you purchase a Verizon Communications bond that pays 5.5% interest based on a face value of $1,000 until maturity in 2017. Also assume new corporate bond issues of comparable quality are currently paying 7%. The approximate market value of your Verizon bond is $786 calculated as follows: Do ...

Stock Return Probabilities - The American Association of Individual

... physical capital stock, with productivity in Germany and Japan at only two-thirds of U.S. levels. According to the report, a number of factors explain the higher capital productivity. At the firm level, this includes not only better use of plants and equipment, but also better marketing and finance ...

... physical capital stock, with productivity in Germany and Japan at only two-thirds of U.S. levels. According to the report, a number of factors explain the higher capital productivity. At the firm level, this includes not only better use of plants and equipment, but also better marketing and finance ...

declining discount rate model

... where a is the fraction of the project’s cost which is financed by displaced consumption and (1-a) is the fraction which displaces investment. With foreign lending included, the weighted discount rate becomes (8-5) Weighted r with foreign lending = a•r1 + b•rf + (1-a-b)•r3 where r1 and r3 are the ...

... where a is the fraction of the project’s cost which is financed by displaced consumption and (1-a) is the fraction which displaces investment. With foreign lending included, the weighted discount rate becomes (8-5) Weighted r with foreign lending = a•r1 + b•rf + (1-a-b)•r3 where r1 and r3 are the ...

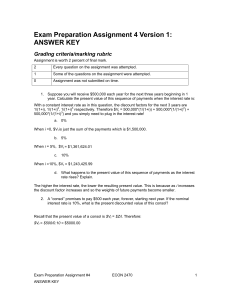

Exam Preparation Assignment 4 Version 1: ANSWER KEY

... increase by 0.5% (50 basis points) each year for the following three years. Determine the yield to maturity on a a. One-year bond = 5%. b. Two-year bond = 5.25% c. ...

... increase by 0.5% (50 basis points) each year for the following three years. Determine the yield to maturity on a a. One-year bond = 5%. b. Two-year bond = 5.25% c. ...

The Business-Investment Sector

... – Enabled the accumulation of large fortunes – Incorporation became the dominant form of business by the second half of the 19th century – Became the engine of economic growth – Was the facilitator of the economy of mass production and mass consumption ...

... – Enabled the accumulation of large fortunes – Incorporation became the dominant form of business by the second half of the 19th century – Became the engine of economic growth – Was the facilitator of the economy of mass production and mass consumption ...

Input Demand: The Capital Market and the Investment Decision

... • The expected rate of return is the annual rate of return that a firm expects to obtain through a capital investment. ...

... • The expected rate of return is the annual rate of return that a firm expects to obtain through a capital investment. ...

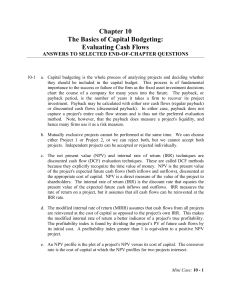

Chapter 10 The Basics of Capital Budgeting: Evaluating Cash Flows

... a. Capital budgeting is the whole process of analyzing projects and deciding whether they should be included in the capital budget. This process is of fundamental importance to the success or failure of the firm as the fixed asset investment decisions chart the course of a company for many years int ...

... a. Capital budgeting is the whole process of analyzing projects and deciding whether they should be included in the capital budget. This process is of fundamental importance to the success or failure of the firm as the fixed asset investment decisions chart the course of a company for many years int ...

international portfolio flows and exchange rate volatility in emerging

... rate volatility using monthly bilateral data for the UWS vis-a-vis seven Asian developing and emerging countries (India, Indonesia, Pakistan, the Philippines, South Korea, Taiwan and Thailand) over the period 1993:01-2015:11. GARCH models and Markov switching specifications with time-varying transit ...

... rate volatility using monthly bilateral data for the UWS vis-a-vis seven Asian developing and emerging countries (India, Indonesia, Pakistan, the Philippines, South Korea, Taiwan and Thailand) over the period 1993:01-2015:11. GARCH models and Markov switching specifications with time-varying transit ...

The Role of Cash Flows in Value Investing

... flows accruing to the firm and its owners. If the value today of the stream of cash flows generated by the assets of a firm exceeds the cost of those assets, the investments undertaken by the firm add value to the firm. When financial managers perform this primary function of acquiring funds and dir ...

... flows accruing to the firm and its owners. If the value today of the stream of cash flows generated by the assets of a firm exceeds the cost of those assets, the investments undertaken by the firm add value to the firm. When financial managers perform this primary function of acquiring funds and dir ...

ECONOMIC OPPORTUNITY COST OF CAPITAL (a)

... the real rate of return forgone in the economy when resources are shifted out of the capital market. • The EOCK or the social discount rate is considered the minimum economic rate of return that either a private or public sector investment must earn if it is to contribute to the growth of the econom ...

... the real rate of return forgone in the economy when resources are shifted out of the capital market. • The EOCK or the social discount rate is considered the minimum economic rate of return that either a private or public sector investment must earn if it is to contribute to the growth of the econom ...

MODEL MCQs – CAIIB, PAPER-2, MOD

... 57)When coding for odd number of periods The following is done a) subtract each value from the smallest value b) subtract each value from the highest value c) subtract each value from the middlemost term d) none of the above 58)A time series of annual data will contain which of the following compone ...

... 57)When coding for odd number of periods The following is done a) subtract each value from the smallest value b) subtract each value from the highest value c) subtract each value from the middlemost term d) none of the above 58)A time series of annual data will contain which of the following compone ...

Econ 1A

... the value of intermediate goods and subtract the value of import. direct taxes, subtracts corporate profit, and add investment. indirect taxes, subtract subsidies, and add capital consumption. subsidies, subtract indirect taxes and capital depreciation.. ...

... the value of intermediate goods and subtract the value of import. direct taxes, subtracts corporate profit, and add investment. indirect taxes, subtract subsidies, and add capital consumption. subsidies, subtract indirect taxes and capital depreciation.. ...

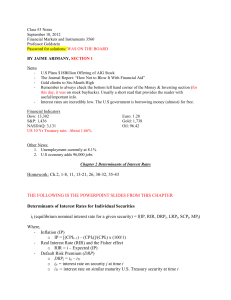

Jamie Arimany

... A rate applicable to a financial transaction that will take place in the future. Forward rates are based on the spot rate, adjusted for the cost of carry and refer to the rate that will be used to deliver a currency, bond or commodity at some future time. It may also refer to the rate fixed for a fu ...

... A rate applicable to a financial transaction that will take place in the future. Forward rates are based on the spot rate, adjusted for the cost of carry and refer to the rate that will be used to deliver a currency, bond or commodity at some future time. It may also refer to the rate fixed for a fu ...

State of Connecticut Stable Value Fund

... * The Barclays Capital U.S. Intermediate Aggregate Index is an unmanaged index of intermediate duration fixed-income securities. The index reflects reinvestment of all distributions and changes in market prices. Investors cannot invest directly in an index. ** The Barclays Capital U.S. Aggregate Bon ...

... * The Barclays Capital U.S. Intermediate Aggregate Index is an unmanaged index of intermediate duration fixed-income securities. The index reflects reinvestment of all distributions and changes in market prices. Investors cannot invest directly in an index. ** The Barclays Capital U.S. Aggregate Bon ...