Notice Concerning Establishment of Interest Rate Swaps

... May, August and November of every year and on the termination date (if a payment day is not a business day, payment will be made on the next business day; provided, however, that if such payment day falls in the next month, payment will be made on the immediately preceding business day). ...

... May, August and November of every year and on the termination date (if a payment day is not a business day, payment will be made on the next business day; provided, however, that if such payment day falls in the next month, payment will be made on the immediately preceding business day). ...

CFI-Letterhead Template

... comparison. For example, one would not compare a real estate’s rate of return to a CD rate or some other arbitrary measure given the level of risk taken in such a venture. Instead, the annual rate of return (ROR) percentage of the oldest global small-cap company mutual fund since inception will be t ...

... comparison. For example, one would not compare a real estate’s rate of return to a CD rate or some other arbitrary measure given the level of risk taken in such a venture. Instead, the annual rate of return (ROR) percentage of the oldest global small-cap company mutual fund since inception will be t ...

Saving and Investing on a Shoestring: Finding Money to Save

... Treasury bills, notes and bonds require $1,000 minimum investment ...

... Treasury bills, notes and bonds require $1,000 minimum investment ...

ExRiskValue

... should be low. However, stock prices are mainly determined by short term investors. Their discount rate is determined by CAPM model, which is derived from highly volatile stock prices. Since CAPM discount rates are standard practices in stock valuation, firms with steady cash flows are valued low, a ...

... should be low. However, stock prices are mainly determined by short term investors. Their discount rate is determined by CAPM model, which is derived from highly volatile stock prices. Since CAPM discount rates are standard practices in stock valuation, firms with steady cash flows are valued low, a ...

3B- Ch 8-4 APPS exponential functions

... This can be dealt with just like population growth. You use a negative r value. a. Write an equation describing the population over time. Use function notation. b. Is the base for this equation larger or less than 1? So, will the equation of the graph rise or fall with time? c. What will the populat ...

... This can be dealt with just like population growth. You use a negative r value. a. Write an equation describing the population over time. Use function notation. b. Is the base for this equation larger or less than 1? So, will the equation of the graph rise or fall with time? c. What will the populat ...

Exchange Fund Results for 2003

... This is the second highest on record, next only to 1999, but surpassing 1998, because interest rates, and therefore interest expenses, were much lower in 2003 than in 1998. In accordance with the agreed formula for calculating investment return for the fiscal reserves deposited with the Exchange Fun ...

... This is the second highest on record, next only to 1999, but surpassing 1998, because interest rates, and therefore interest expenses, were much lower in 2003 than in 1998. In accordance with the agreed formula for calculating investment return for the fiscal reserves deposited with the Exchange Fun ...

CLARENDON COLLEGE Book Value Market Value Book Value

... * Clarendon College does not use an Outside Investment Officer. *Clarendon College does not use soft dollar arrangements. *Clarendon Colelge is associated with two foundations: Mr. Walt Knorpp, P.O. Box Drawer A, Clarendon, TX 79226 is Chairman of the Clarendon College Foundation and the market valu ...

... * Clarendon College does not use an Outside Investment Officer. *Clarendon College does not use soft dollar arrangements. *Clarendon Colelge is associated with two foundations: Mr. Walt Knorpp, P.O. Box Drawer A, Clarendon, TX 79226 is Chairman of the Clarendon College Foundation and the market valu ...

Topic Note-3

... down to a steady rate afterward. To illustrate how to price equity in this case, consider the following problem. Problem 1: A company's dividend grows at 10% rate for the first five years, and thereafter settles down to a steady growth rate of 6%. If stockholders expect a rate of return of 14% from ...

... down to a steady rate afterward. To illustrate how to price equity in this case, consider the following problem. Problem 1: A company's dividend grows at 10% rate for the first five years, and thereafter settles down to a steady growth rate of 6%. If stockholders expect a rate of return of 14% from ...

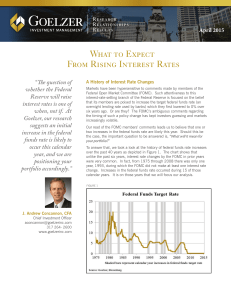

Federal Funds Rate

... When interest rates are low, businesses face a cheaper cost of borrowing, loosening up some cash flows They may be able to invest in riskier opportunities that may result in higher returns ( risk return) So when interest rates are low, investors can expect an appreciation in the equity markets s ...

... When interest rates are low, businesses face a cheaper cost of borrowing, loosening up some cash flows They may be able to invest in riskier opportunities that may result in higher returns ( risk return) So when interest rates are low, investors can expect an appreciation in the equity markets s ...

- Distribly

... end of the most recent year the firm had current assets of $50,000 net fixed assets of $250,000, current liabilities of $30,000, and long term debt of $100,000. a. Calculate Caraway’s stockholders equity. b. What is the firm’s net working capital? c. If Caraway’s current liabilities consist of $20,0 ...

... end of the most recent year the firm had current assets of $50,000 net fixed assets of $250,000, current liabilities of $30,000, and long term debt of $100,000. a. Calculate Caraway’s stockholders equity. b. What is the firm’s net working capital? c. If Caraway’s current liabilities consist of $20,0 ...

Every investor, whether conservative or aggressive, wants to see

... has earned over these long period of investing. Here, one should note that the average long-term return on sensex is about 17% and a 15% return is in that sense a conservative one. Consider a relatively riskier scheme that gives an average yearly return of 20%, that is three percentage points higher ...

... has earned over these long period of investing. Here, one should note that the average long-term return on sensex is about 17% and a 15% return is in that sense a conservative one. Consider a relatively riskier scheme that gives an average yearly return of 20%, that is three percentage points higher ...

project finance – a summarised roadmap - M

... What is the Project IRR ( IRR of cash flow available for debt service)? What will have a major impact on the Project IRR – can the risks be mitigated, by who and at what price? How cyclical or uncertain are the cash flows – can the cyclicality or uncertainty be mitigated? ...

... What is the Project IRR ( IRR of cash flow available for debt service)? What will have a major impact on the Project IRR – can the risks be mitigated, by who and at what price? How cyclical or uncertain are the cash flows – can the cyclicality or uncertainty be mitigated? ...

ch20 - Csulb.edu

... security (or portfolio) beta. It is an appropriate measure for both single securities as well as for portfolios. ...

... security (or portfolio) beta. It is an appropriate measure for both single securities as well as for portfolios. ...

The Venture Capital Industry`s Crisis: A Problem of

... was before the enormous bubble crashed but importantly Kaplan and Schoar found that some funds consistently had poor results and others consistently good results. Furthermore, a recent consultancy report offers evidence that small funds tend to offer bigger returns than larger funds9. This suggests ...

... was before the enormous bubble crashed but importantly Kaplan and Schoar found that some funds consistently had poor results and others consistently good results. Furthermore, a recent consultancy report offers evidence that small funds tend to offer bigger returns than larger funds9. This suggests ...

Stable Value Option

... The SVO pursues its goals by entering into investment contracts with insurance companies or banks that provide for the return of principal and a stated interest crediting rate. The SVO credited rate is determined by blending interest rates generated by these investment contracts and other cash inves ...

... The SVO pursues its goals by entering into investment contracts with insurance companies or banks that provide for the return of principal and a stated interest crediting rate. The SVO credited rate is determined by blending interest rates generated by these investment contracts and other cash inves ...

Slides

... • Project cost $1M for a guaranteed $200M return in 40 years may not be feasible in terms of cash flow even though it’s 2740% ROI @ 5% interest ...

... • Project cost $1M for a guaranteed $200M return in 40 years may not be feasible in terms of cash flow even though it’s 2740% ROI @ 5% interest ...

Returns and Statistics

... How can we compare investment results? Suppose you invest – $100 in asset A – $95 in asset B At the end of the year, your investment in – A has grown to $101 – B has grown to $101 So would you be indifferent between these two investments? ...

... How can we compare investment results? Suppose you invest – $100 in asset A – $95 in asset B At the end of the year, your investment in – A has grown to $101 – B has grown to $101 So would you be indifferent between these two investments? ...

Solution Key: Homework 2

... a) equilibrium condition: Y = C + I + G 8000 = 600 + 0.6(8000-3000) + 2000 - 6000r + 3000 -600 = -6000r so r = 0.10 C = 600 + 0.6(8000-3000) = 3600 and I = 2000 - 6000(0.10) = 1400 b) Taxes fall by 0.1*3000 = 300, from 3000 to 2700 Y = C + I + G means 8000 = 600 + 0.6(8000-2700) + 2000 - 6000r + 270 ...

... a) equilibrium condition: Y = C + I + G 8000 = 600 + 0.6(8000-3000) + 2000 - 6000r + 3000 -600 = -6000r so r = 0.10 C = 600 + 0.6(8000-3000) = 3600 and I = 2000 - 6000(0.10) = 1400 b) Taxes fall by 0.1*3000 = 300, from 3000 to 2700 Y = C + I + G means 8000 = 600 + 0.6(8000-2700) + 2000 - 6000r + 270 ...