1 - JustAnswer

... 24. If an investor had a choice of receiving $1,000 today, or $1,000 in five years, which would the average investor prefer? B a. $1,000 in five years because they are not good at saving money. b. $1,000 today because it will be worth more than $1,000 received in five years. c. $1,000 in five years ...

... 24. If an investor had a choice of receiving $1,000 today, or $1,000 in five years, which would the average investor prefer? B a. $1,000 in five years because they are not good at saving money. b. $1,000 today because it will be worth more than $1,000 received in five years. c. $1,000 in five years ...

Financial_Management_an_Overview

... Utility of EVA Continued (ii) EVA is a management tool that discloses the impact of both strategic as well as operational decision of the management. The examples of strategic decisions are: what investment to make, which business to exist, which financial structure is optimal, etc. While operationa ...

... Utility of EVA Continued (ii) EVA is a management tool that discloses the impact of both strategic as well as operational decision of the management. The examples of strategic decisions are: what investment to make, which business to exist, which financial structure is optimal, etc. While operationa ...

Topic Note-3

... directors which controls the firm and are entitled to the cash flows generated by the firm. However, stock holders are residual claimants: they get only the cash flow left over after paying interest to debt holders and other claimants. However, at this stage, we will assume that the firm is 100% equ ...

... directors which controls the firm and are entitled to the cash flows generated by the firm. However, stock holders are residual claimants: they get only the cash flow left over after paying interest to debt holders and other claimants. However, at this stage, we will assume that the firm is 100% equ ...

Chapter 1 -- The Role of Financial Management

... CEO/Chairman roles commonly same person in US, but separate in Britain (US moving this direction). ...

... CEO/Chairman roles commonly same person in US, but separate in Britain (US moving this direction). ...

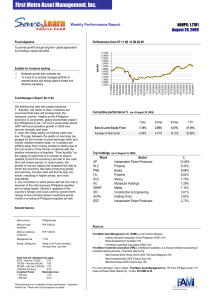

08.20.09-salef - First Metro Asset Management Inc

... Moderate growth with moderate risk. To invest in an actively managed portfolio of selected stocks with strong balance sheets and attractive valuations. ...

... Moderate growth with moderate risk. To invest in an actively managed portfolio of selected stocks with strong balance sheets and attractive valuations. ...

1 - BrainMass

... e. “Restructuring” a firm’s debt can involve forgiving a certain portion of the debt but does not involve changing the debt’s maturity or its contractual interest rate. 2. One objective of risk management is to reduce the volatility of a company’s cash flows. a. True b. False 3. Which of the followi ...

... e. “Restructuring” a firm’s debt can involve forgiving a certain portion of the debt but does not involve changing the debt’s maturity or its contractual interest rate. 2. One objective of risk management is to reduce the volatility of a company’s cash flows. a. True b. False 3. Which of the followi ...

CONDUCT, PERFORMANCE AND DISCIPLINARY PROCEDURE

... Clear and relevant experience of general banking and financial transactions, or appropriate equivalent experience in other related areas such as corporate or commercial, coupled with a strong interest to move into banking / finance ...

... Clear and relevant experience of general banking and financial transactions, or appropriate equivalent experience in other related areas such as corporate or commercial, coupled with a strong interest to move into banking / finance ...

1 An investor expects the value of a $1,000 investment to triple

... 7. ABC stock pays a $3 annual dividend today that’s expected to grow at an annual rate of 6 percent. If you want to earn 15 percent on your funds, what is the efficient price of this stock? Show your calculations. ...

... 7. ABC stock pays a $3 annual dividend today that’s expected to grow at an annual rate of 6 percent. If you want to earn 15 percent on your funds, what is the efficient price of this stock? Show your calculations. ...

PPT

... • Replacing “1” with “t” allows the formula to be used for cash flows that exist at any point in time. ...

... • Replacing “1” with “t” allows the formula to be used for cash flows that exist at any point in time. ...

Gearing Capital Funding

... End-of-term asset risk is passed to Residual Value Investors with no recourse to Municipality ...

... End-of-term asset risk is passed to Residual Value Investors with no recourse to Municipality ...

The Investment Environment

... policies are different. Banking industry gives high return but limited capital appericial. IT gives high return and high cap app but growth potential after 2002 is not ...

... policies are different. Banking industry gives high return but limited capital appericial. IT gives high return and high cap app but growth potential after 2002 is not ...

Year-end accounting balance sheet. Current Assets $500,000

... Expected sales for the upcoming year are $4,100,000. Costs of goods sold are 65% of sales and other operating expenses are $850,000. The interest rate on ABC’s short-term debt is 10% per annum. ABC’s tax-rate is 23%. Ignore depreciation in this problem. (c) ABC intends to expand its operations. Sale ...

... Expected sales for the upcoming year are $4,100,000. Costs of goods sold are 65% of sales and other operating expenses are $850,000. The interest rate on ABC’s short-term debt is 10% per annum. ABC’s tax-rate is 23%. Ignore depreciation in this problem. (c) ABC intends to expand its operations. Sale ...

9.2. International Financial Management

... institution, and markets. What strategies may regulatory bodies implement for efficient working of financial markets in changing scenario? How does the notion of risk and reward govern the behavior of ...

... institution, and markets. What strategies may regulatory bodies implement for efficient working of financial markets in changing scenario? How does the notion of risk and reward govern the behavior of ...

Highlights of Chapters 19, 16, 33, and 25

... Projects of different risk - If the project under consideration is more (or less) risky than the firm's existing assets, then calculate an "industry" WACC for the project's industry. Note: We didn’t take into account bankruptcy costs, agency costs, personal taxes, etc. in this analysis. See Chapter ...

... Projects of different risk - If the project under consideration is more (or less) risky than the firm's existing assets, then calculate an "industry" WACC for the project's industry. Note: We didn’t take into account bankruptcy costs, agency costs, personal taxes, etc. in this analysis. See Chapter ...

Alexandre ISSAD 67, rue d`Argout, 75002, Paris + 33 6 33 48 13 01

... Scientific Baccalauréat (with Highest Honours), equivalent to ‘A’ levels / High School Diploma ...

... Scientific Baccalauréat (with Highest Honours), equivalent to ‘A’ levels / High School Diploma ...

Quiz 3

... c. The returns that can be paid to common shareholders are diluted by the increase in dividends paid to preferred shareholders if the firm’s profits rise. d. Increasing the reliance on preferred shares will increase the firm’s weighed-averagecost-of-capital (WACC). e. Preferred shareholders may vote ...

... c. The returns that can be paid to common shareholders are diluted by the increase in dividends paid to preferred shareholders if the firm’s profits rise. d. Increasing the reliance on preferred shares will increase the firm’s weighed-averagecost-of-capital (WACC). e. Preferred shareholders may vote ...

Syllabus - Baylor University

... Each investor group has the same amount of money to invest and their total net worth equals the value of all securities. In other words, all the interest income from muni’s as well as all corporate NOI mentioned above must flow through securities purchased by the three investor groups listed above. ...

... Each investor group has the same amount of money to invest and their total net worth equals the value of all securities. In other words, all the interest income from muni’s as well as all corporate NOI mentioned above must flow through securities purchased by the three investor groups listed above. ...

AIRLINE VALUATION USING DISCOUNTED CASH FLOW METHOD

... Abstract: Since the beginning of the 1990s value based concept is discussed intensively as a new way for company management. According to its keynote capital augmentation and company’s value growth are priority aims of any organization. This article is devoted to discounted cash flow method, which i ...

... Abstract: Since the beginning of the 1990s value based concept is discussed intensively as a new way for company management. According to its keynote capital augmentation and company’s value growth are priority aims of any organization. This article is devoted to discounted cash flow method, which i ...

During the last few years, Harry Davis Industries has

... maturity is $1,153.72. Harry Davis does not use short-term interestbearing debt on a permanent basis. New bonds would be privately placed with no flotation cost. (3) The current price of the firm’s 10%, $100 par value, quarterly dividend, perpetual preferred stock is $116.95. Harry Davis would incu ...

... maturity is $1,153.72. Harry Davis does not use short-term interestbearing debt on a permanent basis. New bonds would be privately placed with no flotation cost. (3) The current price of the firm’s 10%, $100 par value, quarterly dividend, perpetual preferred stock is $116.95. Harry Davis would incu ...