Downlaod File

... Liquidity describes the amount of time that is expected to elapse until an asset is converted into cash or until a liability has to be paid. The ranking of the assets given in order of liquidity is: (1) Short-term investments. (2) Accounts receivable. (3) Inventories. (4) Buildings. (5) Goodwill. ...

... Liquidity describes the amount of time that is expected to elapse until an asset is converted into cash or until a liability has to be paid. The ranking of the assets given in order of liquidity is: (1) Short-term investments. (2) Accounts receivable. (3) Inventories. (4) Buildings. (5) Goodwill. ...

Key

... Note: Except possibly for questions in which you are required to provide a list, your answers to the following shortanswer questions should be no more than a sentence or two. If you write more, you will likely run out of time. 1. Assume that you previously purchased a call on Microsoft that you have ...

... Note: Except possibly for questions in which you are required to provide a list, your answers to the following shortanswer questions should be no more than a sentence or two. If you write more, you will likely run out of time. 1. Assume that you previously purchased a call on Microsoft that you have ...

How to Value Solar Energy Assets

... Ken Kramer has more than 30 years’ experience building businesses and consulting on valuation and banking for clients on techniques that support finance, investment, insurance, taxation and financial reporting requirements. Kramer has served in industries that include manufacturing, transportation, ...

... Ken Kramer has more than 30 years’ experience building businesses and consulting on valuation and banking for clients on techniques that support finance, investment, insurance, taxation and financial reporting requirements. Kramer has served in industries that include manufacturing, transportation, ...

doc chapter 1 solutions

... The REIT manager pools the resources of many investors and uses these resources to buy a portfolio of real estate assets. Each investor in the REIT owns a fraction of the total portfolio, in accordance with the size of the individual investment. The REIT gives the investor the ability to hold a dive ...

... The REIT manager pools the resources of many investors and uses these resources to buy a portfolio of real estate assets. Each investor in the REIT owns a fraction of the total portfolio, in accordance with the size of the individual investment. The REIT gives the investor the ability to hold a dive ...

Form 8-K - Value Line

... amount of $17.50 per share to all shareholders of record May 7, 2004. The dividend in the total sum of $174,678,000 is payable on May 19. The Company is making this special distribution from its Retained Earnings. Value Line is exceptionally strong financially, with $208,464,000 of Shareholders' Equ ...

... amount of $17.50 per share to all shareholders of record May 7, 2004. The dividend in the total sum of $174,678,000 is payable on May 19. The Company is making this special distribution from its Retained Earnings. Value Line is exceptionally strong financially, with $208,464,000 of Shareholders' Equ ...

Chapter 11 – Cost Of Capital (Block)

... $62.70. There is a selling cost of $3.30. What is the after-tax cost of preferred stock if the firm's tax rate is 33%? a. 2.02% b. 4.09% c. 5.79% d. 6.11% 9. The cost of equity capital in the form of new common stock will be higher than the cost of retained earnings because of a. The existence of ta ...

... $62.70. There is a selling cost of $3.30. What is the after-tax cost of preferred stock if the firm's tax rate is 33%? a. 2.02% b. 4.09% c. 5.79% d. 6.11% 9. The cost of equity capital in the form of new common stock will be higher than the cost of retained earnings because of a. The existence of ta ...

Cash Conversion Cycle: Example

... surplus b) Middle-of-the-road Policy c) Restrictive Policy -permanent need for short-term borrowing ...

... surplus b) Middle-of-the-road Policy c) Restrictive Policy -permanent need for short-term borrowing ...

Summary on Financial Markets The three main functions of the

... 2 . A financial intermediary buys a stock and then resells it a few days later at a higher price. Which intermediary would this most likely describe? A. Broker. B. Dealer. C. Arbitrageur. 3. Which of the following is most similar to a short position in the underlying asset? A. Buying a put. B. Writi ...

... 2 . A financial intermediary buys a stock and then resells it a few days later at a higher price. Which intermediary would this most likely describe? A. Broker. B. Dealer. C. Arbitrageur. 3. Which of the following is most similar to a short position in the underlying asset? A. Buying a put. B. Writi ...

November 15th, 2013

... • Fixed income/debt is a very safe investment • Many variations of debt (type, yield, maturity, • Provides investors with a fixed return that they can expect • Allows firms to raise large amounts of capital ...

... • Fixed income/debt is a very safe investment • Many variations of debt (type, yield, maturity, • Provides investors with a fixed return that they can expect • Allows firms to raise large amounts of capital ...

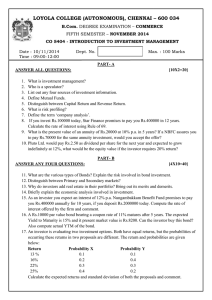

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

... 13. Why do investors add real estate in their portfolio? Bring out its merits and demerits. 14. Briefly explain the economic analysis involved in investment. 15. As an investor you expect an interest of 12% p.a. Nungambakkam Benefit Fund promises to pay you Rs.400000 annually for 10 years, if you de ...

... 13. Why do investors add real estate in their portfolio? Bring out its merits and demerits. 14. Briefly explain the economic analysis involved in investment. 15. As an investor you expect an interest of 12% p.a. Nungambakkam Benefit Fund promises to pay you Rs.400000 annually for 10 years, if you de ...