FINAL EXAM—REVIEW SHEET (This sheet, while not all inclusive

... internal rate of return (IRR) for a capital budgeting project. Understand what the result for each computation means. For example, what does it mean if you find a project has an IRR equal to 14 percent? If NPV > 0, what is the relationship between the firm’s required rate of return and the project’s ...

... internal rate of return (IRR) for a capital budgeting project. Understand what the result for each computation means. For example, what does it mean if you find a project has an IRR equal to 14 percent? If NPV > 0, what is the relationship between the firm’s required rate of return and the project’s ...

corporation - McGraw-Hill Education Canada

... uses of cash, indicates whether enough cash is available to carry on routine operations, and offers an analysis of all business transactions, reporting where the firm obtained its cash and how it chose to allocate the cash • Companies typically project cash flow statements on a monthly basis for the ...

... uses of cash, indicates whether enough cash is available to carry on routine operations, and offers an analysis of all business transactions, reporting where the firm obtained its cash and how it chose to allocate the cash • Companies typically project cash flow statements on a monthly basis for the ...

Capital Structure Decision

... Financial risk- The use of debt will increase the risk to share holders and thus Increase the variability of shareholder returns. Interest tax shield- The savings resulting from deductibility of interest payments. ...

... Financial risk- The use of debt will increase the risk to share holders and thus Increase the variability of shareholder returns. Interest tax shield- The savings resulting from deductibility of interest payments. ...

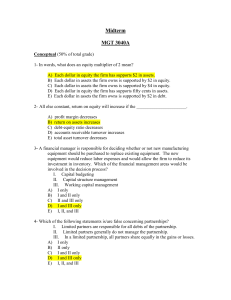

Answers to Midterm 3040A

... 14- In a common size statement, the balance sheet may be expressed as a percentage of ____________ while the income statement may be expressed as a percentage of ...

... 14- In a common size statement, the balance sheet may be expressed as a percentage of ____________ while the income statement may be expressed as a percentage of ...

Capital components: debt, preferred stock, and common stock

... Flotation costs depend on the risk of the firm and the type of capital being raised. The flotation costs are highest for common equity. However, since most firms issue equity infrequently, the per-project cost is fairly small. We will frequently ignore flotation costs when calculating the WACC ...

... Flotation costs depend on the risk of the firm and the type of capital being raised. The flotation costs are highest for common equity. However, since most firms issue equity infrequently, the per-project cost is fairly small. We will frequently ignore flotation costs when calculating the WACC ...

SENS 29 - 17 February 2004

... exceeds demand. Costs remain favourable subject to the exchange rate and oil prices. Further operating efficiencies are expected from the recent fleet upgrades in both the kulula.com and British Airways brands. However, prospects for the full year remain uncertain under current trading conditions. D ...

... exceeds demand. Costs remain favourable subject to the exchange rate and oil prices. Further operating efficiencies are expected from the recent fleet upgrades in both the kulula.com and British Airways brands. However, prospects for the full year remain uncertain under current trading conditions. D ...

Perfect Storm or Perfect Nonsense Size: 33.5kb Last

... The banking industry is suffering record losses and collapsing share prices. The industry lost over $250B in shareholder value during the first half of 2008 alone. Understandably, institutions are pre-occupied reacting to events. They are focusing on short-term survival actions including dilutive ca ...

... The banking industry is suffering record losses and collapsing share prices. The industry lost over $250B in shareholder value during the first half of 2008 alone. Understandably, institutions are pre-occupied reacting to events. They are focusing on short-term survival actions including dilutive ca ...

Concept 6 Kaufman

... Strategies used in the for-profit world can set not-for-profit organizations apart from their competitors. Debt/Equity Financing and Traditional/Nontraditional Financing Capital from external sources is classified as either debt capital or equity capital. Debt capital is available in three maj ...

... Strategies used in the for-profit world can set not-for-profit organizations apart from their competitors. Debt/Equity Financing and Traditional/Nontraditional Financing Capital from external sources is classified as either debt capital or equity capital. Debt capital is available in three maj ...

CHAPTER 1

... interest rate on the firm’s debt. e. Borrowing does not increase financial risk and the cost of equity if there is no risk of bankruptcy. f. Borrowing increases firm value if there is a clientele of investors with a reason to prefer debt. ...

... interest rate on the firm’s debt. e. Borrowing does not increase financial risk and the cost of equity if there is no risk of bankruptcy. f. Borrowing increases firm value if there is a clientele of investors with a reason to prefer debt. ...

TUGAS FINANCIAL MANAGEMENT Fery Purwa Ginanjar Eksekutif

... Corporation must decide whether to go ahead and develop the deposit. The most costeffective method of mining gold is sulfuric acid extraction, a process that could result in environmental damage. Before proceeding with the extraction, CTC must spend $900,000 for new mining equipment and pay $165,000 ...

... Corporation must decide whether to go ahead and develop the deposit. The most costeffective method of mining gold is sulfuric acid extraction, a process that could result in environmental damage. Before proceeding with the extraction, CTC must spend $900,000 for new mining equipment and pay $165,000 ...

UNIT 6: THE FINANCIAL PLAN When the company has more

... Whenever a supplier gives us a deferment of payment of those products that you have purchased we have got a short-term financing. The amount is the value of our purchase and the postponement by the provider, usually 30, 60 or 90 days. Although you can sometimes get higher postponement, it is unusual ...

... Whenever a supplier gives us a deferment of payment of those products that you have purchased we have got a short-term financing. The amount is the value of our purchase and the postponement by the provider, usually 30, 60 or 90 days. Although you can sometimes get higher postponement, it is unusual ...

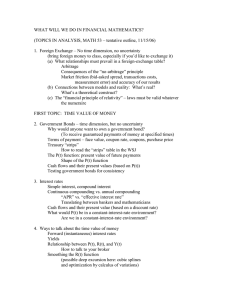

TopicsInAnalysis

... (You should maximize expected utility, with respect to some probability distribution) Real probabilities vs. “probabilities” in the theorem “Certainty equivalent” values Does certainty equivalent depend on mean and variance? What does Barry Schwartz think of all this? 8. Uncertain future payments (u ...

... (You should maximize expected utility, with respect to some probability distribution) Real probabilities vs. “probabilities” in the theorem “Certainty equivalent” values Does certainty equivalent depend on mean and variance? What does Barry Schwartz think of all this? 8. Uncertain future payments (u ...

Finance Slides 051915

... • One of the most important financial concepts is the concept of financial break even. • Why? Because you do not make a single dollar of profit until you first break even. • Most businesses fail to reach their profit potential because the owners have not performed B/E analysis. • Managing your fixed ...

... • One of the most important financial concepts is the concept of financial break even. • Why? Because you do not make a single dollar of profit until you first break even. • Most businesses fail to reach their profit potential because the owners have not performed B/E analysis. • Managing your fixed ...

Mergers and Acquisitions

... capital and fixed assets relative to the two firms operating separately Firms may be able to manage existing assets more effectively under one umbrella Some assets may be sold if they are redundant in the combined firm (this includes human capital as well) ...

... capital and fixed assets relative to the two firms operating separately Firms may be able to manage existing assets more effectively under one umbrella Some assets may be sold if they are redundant in the combined firm (this includes human capital as well) ...

N1DM01 - The University of Nottingham

... buildings are expected to increase in value by 8% per year. If divestment was to take place Rainall would be responsible for immediate redundancy payments, with an estimated pre tax cost of £2.5 million. Corporate tax is at the rate of 30% per year, payable in the year that it arises. Assume that it ...

... buildings are expected to increase in value by 8% per year. If divestment was to take place Rainall would be responsible for immediate redundancy payments, with an estimated pre tax cost of £2.5 million. Corporate tax is at the rate of 30% per year, payable in the year that it arises. Assume that it ...

C31CF_C4 - Heriot

... The purpose of this course is to provide an overview of some new and exciting research paths in the field of corporate finance. The course will emphasize the major decision arenas facing a firm, and develop the tools required to be a competitive professional in today’s environment. Therefore, the ai ...

... The purpose of this course is to provide an overview of some new and exciting research paths in the field of corporate finance. The course will emphasize the major decision arenas facing a firm, and develop the tools required to be a competitive professional in today’s environment. Therefore, the ai ...

Mackenzie Cundill Value Fund – Series C

... Jonathan Norwood, Senior Vice President, Investment Management, Mackenzie Investments† Richard Wong, Senior Vice President, Investment Management, Mackenzie Investments ...

... Jonathan Norwood, Senior Vice President, Investment Management, Mackenzie Investments† Richard Wong, Senior Vice President, Investment Management, Mackenzie Investments ...