The Dividend Controversy

... LoDiv cash flows are more valuable. Demand for LoDiv cash flows ...

... LoDiv cash flows are more valuable. Demand for LoDiv cash flows ...

Written exam 2008 spring

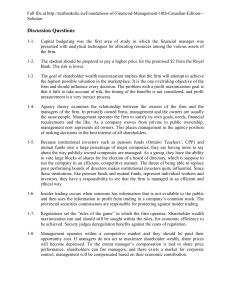

... a) When are the P/S-ratio better to use than the P/E-ratio? When the company has has negative earnings b) When is the relative valuation approach easiest to use? • This approach is easiest to use when: – There are a large number of assets comparable to the one being valued – These assets are priced ...

... a) When are the P/S-ratio better to use than the P/E-ratio? When the company has has negative earnings b) When is the relative valuation approach easiest to use? • This approach is easiest to use when: – There are a large number of assets comparable to the one being valued – These assets are priced ...

FREE Sample Here

... positive for share value. However a new product introduces a high degree of risk that will mitigate higher share values. More detailed financial information for investors should increase their confidence in the activities of the firm and lower the risk of their investment. This will be offset by the ...

... positive for share value. However a new product introduces a high degree of risk that will mitigate higher share values. More detailed financial information for investors should increase their confidence in the activities of the firm and lower the risk of their investment. This will be offset by the ...

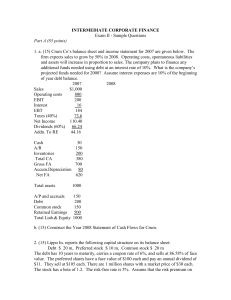

A corporate bond maturing in 5 years carries a 10% coupon rate and

... b. What is the weighted average cost of capital for the firm, if the current capital structure based on market values is the optimal capital structure? 3. (5) Roland & Company has a new management team that has developed an operating plan to improve upon last year's ROE. The new plan would place the ...

... b. What is the weighted average cost of capital for the firm, if the current capital structure based on market values is the optimal capital structure? 3. (5) Roland & Company has a new management team that has developed an operating plan to improve upon last year's ROE. The new plan would place the ...

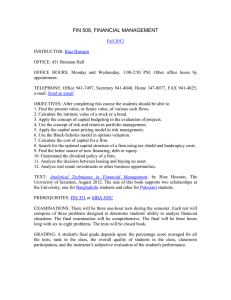

FIN 508: Financial Management

... OBJECTIVES: After completing this course the students should be able to 1. Find the present value, or future value, of various cash flows. 2. Calculate the intrinsic value of a stock or a bond. 3. Apply the concept of capital budgeting in the evaluation of projects. 4. Use the concept of risk and re ...

... OBJECTIVES: After completing this course the students should be able to 1. Find the present value, or future value, of various cash flows. 2. Calculate the intrinsic value of a stock or a bond. 3. Apply the concept of capital budgeting in the evaluation of projects. 4. Use the concept of risk and re ...

Corporate Finance

... implications, and any decision which affects the finances of a business is a corporate finance decision. Defined broadly, everything that a business does fits ...

... implications, and any decision which affects the finances of a business is a corporate finance decision. Defined broadly, everything that a business does fits ...