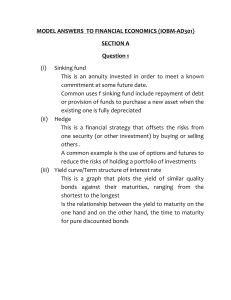

MODEL ANSWERS TO FINANCIAL ECONOMICS (IOBM

... investment and savings on the economy determine the level of long term interest rates while short term interest rates are determined by an economy’s financial and monetary conditions key components of the demand for lonable funds net investments and net additions to liquid reserves key components of ...

... investment and savings on the economy determine the level of long term interest rates while short term interest rates are determined by an economy’s financial and monetary conditions key components of the demand for lonable funds net investments and net additions to liquid reserves key components of ...

Bundle 4 Vocabulary

... Total amount of new funds the business generates from operations; broadest measure of profit for a firm because it includes both net income and noncash charges. ...

... Total amount of new funds the business generates from operations; broadest measure of profit for a firm because it includes both net income and noncash charges. ...

The cost of capital reflects the cost of funds

... A) determining the appropriate mix of short-term and long-term financing. B) deciding which individual short-term sources are best at a given point in time. C) analyzing quarterly budget and performance reports. D) deciding which individual long-term sources are best at a given point in time. 39. Th ...

... A) determining the appropriate mix of short-term and long-term financing. B) deciding which individual short-term sources are best at a given point in time. C) analyzing quarterly budget and performance reports. D) deciding which individual long-term sources are best at a given point in time. 39. Th ...

Document

... Suppose we want to prepare a set of pro forma financial statements for a project for Norma Desmond Enterprises. In order to do so, we must have some background information. In this case, assume: a. Sales of 10,000 units/year @ $5/unit. b. Variable cost/unit is $3. Fixed costs are $5,000/year. Projec ...

... Suppose we want to prepare a set of pro forma financial statements for a project for Norma Desmond Enterprises. In order to do so, we must have some background information. In this case, assume: a. Sales of 10,000 units/year @ $5/unit. b. Variable cost/unit is $3. Fixed costs are $5,000/year. Projec ...

1) Corporate financial plans are often used as a basis

... The ability to meet or exceed the targets embodied in a financial plan is obviously a reassuring indicator of management talent and motivation. Moreover, the financial plan focuses attention on the specific targets that top management deems most important. There are, however, several dangers. a.Fina ...

... The ability to meet or exceed the targets embodied in a financial plan is obviously a reassuring indicator of management talent and motivation. Moreover, the financial plan focuses attention on the specific targets that top management deems most important. There are, however, several dangers. a.Fina ...

Cost of Capital Corporations often use different costs of capital for

... average cost of capital (WACC) were used as the hurdle rate for all divisions, would more conservative or riskier divisions get a greater share of capital? Explain your reasoning. What are two techniques that you could use to develop a rough estimate for each division’s cost of capital? Your initial ...

... average cost of capital (WACC) were used as the hurdle rate for all divisions, would more conservative or riskier divisions get a greater share of capital? Explain your reasoning. What are two techniques that you could use to develop a rough estimate for each division’s cost of capital? Your initial ...

Week5.1 Money Markets - B-K

... Cash Investments • Text calls all these “money market” investments ...

... Cash Investments • Text calls all these “money market” investments ...

SYLLABUS COURSE TITLE Managerial Finance Faculty/Institute

... COURSE OBJECTIVES Students are acquainted with: fundamental concepts in Financial Management, (dis-) advantages of forms of business organization, linkage between stock price and intrinsic value, capital structure and dividend policy, investing in long-term assets. PREREQUISITES Basic acco ...

... COURSE OBJECTIVES Students are acquainted with: fundamental concepts in Financial Management, (dis-) advantages of forms of business organization, linkage between stock price and intrinsic value, capital structure and dividend policy, investing in long-term assets. PREREQUISITES Basic acco ...

subject : c 306 business financial management

... automate part of their production facilities. Project A costs $120,000 and would produce net cash flows of $37,000 annually for 5 years. Project B also costs $120,000 and will produce annual net cash flows of $25,000 for 10 years. Creative's cost of capital is 11 percent. Using the equivalent annual ...

... automate part of their production facilities. Project A costs $120,000 and would produce net cash flows of $37,000 annually for 5 years. Project B also costs $120,000 and will produce annual net cash flows of $25,000 for 10 years. Creative's cost of capital is 11 percent. Using the equivalent annual ...

Document

... Profit maximization is not a well-defined financial objective, for at least two reasons: 1. Maximize profits? Which year’s profits? A corporation may be able to increase current profits by cutting back on outlays for maintenance or staff training, but that may add value. Shareholders will not welc ...

... Profit maximization is not a well-defined financial objective, for at least two reasons: 1. Maximize profits? Which year’s profits? A corporation may be able to increase current profits by cutting back on outlays for maintenance or staff training, but that may add value. Shareholders will not welc ...

Investment Policy 2013

... 3. The Academy need to identify funds surplus to the immediate cash requirements and transfer these to an account bearing a higher interest rate 4. Periodically (at least annually) review interest rates and compare with other investment opportunities 5. The Academy’s current policy is to only invest ...

... 3. The Academy need to identify funds surplus to the immediate cash requirements and transfer these to an account bearing a higher interest rate 4. Periodically (at least annually) review interest rates and compare with other investment opportunities 5. The Academy’s current policy is to only invest ...

FIN 3000 Chapter 1 Principles of Finance

... There is no separation between the partnership and the owners ...

... There is no separation between the partnership and the owners ...

FridayMarch28thMeeting - Sites at Lafayette

... • New mortgage securities / lenders take initial losses • Private entities can purchase Gov. guarantees • Attempts to prevent careless lending ...

... • New mortgage securities / lenders take initial losses • Private entities can purchase Gov. guarantees • Attempts to prevent careless lending ...

1 - BrainMass

... constant-dollar dividend policy constant-payout-ratio-dividend policy residual dividend policy constant-dollar dividend with extra policy stable dividend policy ...

... constant-dollar dividend policy constant-payout-ratio-dividend policy residual dividend policy constant-dollar dividend with extra policy stable dividend policy ...