RBC Emerging Markets Bond Fund

... Please read the prospectus or Fund Facts document before investing. Except as otherwise noted, the indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distri ...

... Please read the prospectus or Fund Facts document before investing. Except as otherwise noted, the indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distri ...

Alberta Investor Tax Credit - Calgary Chamber of Commerce

... investment is a necessary component in allowing small businesses to grow and become sustainable enterprises. Enterprise Alberta is one body which provides public funding to such ventures. Yet, a sustainable ecosystem for small business investment in Alberta is not possible without greater private se ...

... investment is a necessary component in allowing small businesses to grow and become sustainable enterprises. Enterprise Alberta is one body which provides public funding to such ventures. Yet, a sustainable ecosystem for small business investment in Alberta is not possible without greater private se ...

Why are Active Managers Underperforming this

... Since the market low on February 11th of this year, the large cap U.S. indices have rallied approximately 20%. Many observable oddities mark this rally, particularly one which finds a significant portion of active managers, including Boston Advisors, underperforming stated benchmarks. As professiona ...

... Since the market low on February 11th of this year, the large cap U.S. indices have rallied approximately 20%. Many observable oddities mark this rally, particularly one which finds a significant portion of active managers, including Boston Advisors, underperforming stated benchmarks. As professiona ...

IIGCC appoints head of EU policy

... The Institutional Investors Group on Climate Change, which represents more than 100 European investors worth a combined €10 trillion, has appointed Martin Schoenberg as head of EU policy. Martin will be responsible for developing IIGCC’s policy engagement at EU level, working closely with IIGCC’s me ...

... The Institutional Investors Group on Climate Change, which represents more than 100 European investors worth a combined €10 trillion, has appointed Martin Schoenberg as head of EU policy. Martin will be responsible for developing IIGCC’s policy engagement at EU level, working closely with IIGCC’s me ...

STRATUS PROPERTIES INC (Form: DFAN14A

... about the cost of fighting off a dissident shareholder. Just another week in the battle between corporate America and activist hedge funds, you might think. Except these are not cases where a hedge fund run by titans such as Bill Ackman or Daniel Loeb is taking on a company they believe is mismanage ...

... about the cost of fighting off a dissident shareholder. Just another week in the battle between corporate America and activist hedge funds, you might think. Except these are not cases where a hedge fund run by titans such as Bill Ackman or Daniel Loeb is taking on a company they believe is mismanage ...

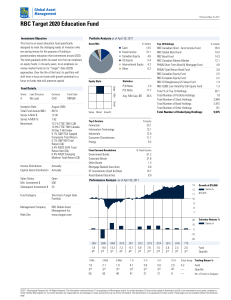

RBC Target 2020 Education Fund

... Please read the prospectus or Fund Facts document before investing. Except as otherwise noted, the indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distri ...

... Please read the prospectus or Fund Facts document before investing. Except as otherwise noted, the indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distri ...

Asset Allocation: A New Look at an Old Theme

... markets of the world have become more globalized, we find it important to have exposure to the broadest representation of international equities possible. For that reason, we include positions in mid and small cap stocks of the developed markets of the world, along with investments in emerging marke ...

... markets of the world have become more globalized, we find it important to have exposure to the broadest representation of international equities possible. For that reason, we include positions in mid and small cap stocks of the developed markets of the world, along with investments in emerging marke ...

235 2016-62-23 Order Approving Receiver`s Motion to Distribut

... The Receiver’s Motion to Release Private Placement is hereby approved, and the Receiver is authorized to: 1. Execute all documents necessary to facilitate the transfer of this Private Placement assets and funds and to sign the Termination of Intercreditor & Administrative Agent Agreement in the form ...

... The Receiver’s Motion to Release Private Placement is hereby approved, and the Receiver is authorized to: 1. Execute all documents necessary to facilitate the transfer of this Private Placement assets and funds and to sign the Termination of Intercreditor & Administrative Agent Agreement in the form ...

LSE Growth Commission Report: Innovation

... The Commission endorses the Vickers Report on banking regulation and encourages the government to implement both the letter and spirit of its recommendations (Independent Commission on Banking, 2011). Some Commissioners wanted to go further and recommend the structural separation of the investment a ...

... The Commission endorses the Vickers Report on banking regulation and encourages the government to implement both the letter and spirit of its recommendations (Independent Commission on Banking, 2011). Some Commissioners wanted to go further and recommend the structural separation of the investment a ...

Investment Policy Beaufort County Open Land Trust (BCOLT

... periodically to determine that the investment strategy of the Funds in agreement with this Investment Policy and that the objectives and policies set forth in this Investment Policy continue to be appropriate. The individually managed portfolios shall be monitored for return relative to objectives, ...

... periodically to determine that the investment strategy of the Funds in agreement with this Investment Policy and that the objectives and policies set forth in this Investment Policy continue to be appropriate. The individually managed portfolios shall be monitored for return relative to objectives, ...

1Q14 - Investors

... In connection with the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, we provide the following cautionary remarks regarding important risks and uncertainties which, among others, could cause our actual results to differ materially from our expectations, including t ...

... In connection with the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, we provide the following cautionary remarks regarding important risks and uncertainties which, among others, could cause our actual results to differ materially from our expectations, including t ...

Q1 Global Brief 2014

... What should we make of this? There clearly has been some progress to solidify financial institutions since the Lehman crisis – capital levels and liquidity buffers have improved markedly and progress is being made on the supervisory and regulatory front, although it remains a work in progress with a ...

... What should we make of this? There clearly has been some progress to solidify financial institutions since the Lehman crisis – capital levels and liquidity buffers have improved markedly and progress is being made on the supervisory and regulatory front, although it remains a work in progress with a ...

Role of Monetary Policy

... Policy Recommendations 1. Accelerate high quality debt restructuring 2. Improve corporate governance 3. Speed up capital market development for alternative funding sources 4. Enhancing corporate operational efficiency by improving the competition framework as well as encouraging a more active M&A ma ...

... Policy Recommendations 1. Accelerate high quality debt restructuring 2. Improve corporate governance 3. Speed up capital market development for alternative funding sources 4. Enhancing corporate operational efficiency by improving the competition framework as well as encouraging a more active M&A ma ...

Seven Solutions - ZAI Corporate Finance Ltd

... Rather, the correct approach is to investigate each of the 7 solutions, on the basis of the specific facts of each client’s case and to choose the best option from the results of ...

... Rather, the correct approach is to investigate each of the 7 solutions, on the basis of the specific facts of each client’s case and to choose the best option from the results of ...

PDF

... CMV represents the price that other processors would pay for raw product of similar quality and use. It is an industry-weighted average value for each commodity, with adjustments based on grading, compensation of services, and other differences in costs. To provide a fair and equitable distribution ...

... CMV represents the price that other processors would pay for raw product of similar quality and use. It is an industry-weighted average value for each commodity, with adjustments based on grading, compensation of services, and other differences in costs. To provide a fair and equitable distribution ...

Capital components: debt, preferred stock, and common stock

... The company has a target capital structure of 40 percent debt and 60 percent equity Bonds pay 10% coupon (semiannual), mature in 20 years and sell for $849.54 the company stock beta is 1.2 rf = 10%, market risk premium = 5% the company is a constant growth firm that just paid a dividend of ...

... The company has a target capital structure of 40 percent debt and 60 percent equity Bonds pay 10% coupon (semiannual), mature in 20 years and sell for $849.54 the company stock beta is 1.2 rf = 10%, market risk premium = 5% the company is a constant growth firm that just paid a dividend of ...

Comparing Mutual and Exchange-Traded Funds Activity Directions

... He started his account with $400 by his choice. He did not have to adhere to a minimum amount. Melissa started her mutual fund investment with a balance of $5,000. She regretted having to start her account with that large amount of money. Melissa and David know that they will have to pay fees for th ...

... He started his account with $400 by his choice. He did not have to adhere to a minimum amount. Melissa started her mutual fund investment with a balance of $5,000. She regretted having to start her account with that large amount of money. Melissa and David know that they will have to pay fees for th ...

managed futures strategy fund

... correlated to traditional asset classes and can increase a portfolio’s diversification. Experienced Management Team Longboard’s senior management has researched and implemented trend following strategies since the late 1990s. Research Investment approach is grounded in academic and practitioner rese ...

... correlated to traditional asset classes and can increase a portfolio’s diversification. Experienced Management Team Longboard’s senior management has researched and implemented trend following strategies since the late 1990s. Research Investment approach is grounded in academic and practitioner rese ...

Finance 419

... In A, the firm can distribute a total of $600 to stakeholders. In B, the firm can distribute $100+$540=$640 to stakeholders. The tax shield from debt gives the firm $40 more to distribute. This tax shield lowers the effective interest payment on debt to $60=$100(1-0.4) or 6% coupon rate. ...

... In A, the firm can distribute a total of $600 to stakeholders. In B, the firm can distribute $100+$540=$640 to stakeholders. The tax shield from debt gives the firm $40 more to distribute. This tax shield lowers the effective interest payment on debt to $60=$100(1-0.4) or 6% coupon rate. ...

No such thing as a free lunch, even with private REITs

... appraised value of the properties, which is typically updated quarterly. When investors want to withdraw their money, they get the stated net asset value (NAV) per unit at the time. Memories of the 2008 market meltdown have led investors such as Sharon Black of London, Ont., to seek out alternative, ...

... appraised value of the properties, which is typically updated quarterly. When investors want to withdraw their money, they get the stated net asset value (NAV) per unit at the time. Memories of the 2008 market meltdown have led investors such as Sharon Black of London, Ont., to seek out alternative, ...

Lecture 2

... The fact that PEs have to meet costly non-commercial objectives is likely to be the reason that they are extended special privileges in the first place. Governments may also choose to extend privileges or benefits to private firms faced with collapse a government can extend privileges to private ent ...

... The fact that PEs have to meet costly non-commercial objectives is likely to be the reason that they are extended special privileges in the first place. Governments may also choose to extend privileges or benefits to private firms faced with collapse a government can extend privileges to private ent ...

While investments always carry a certain amount of risk, the iStar

... early paying a predefined return provided certain criteria are met. Counterparties: We only select structured products from banks that are rated as investment grade, meaning they are defined as relatively low risk by major ratings agencies and other market metrics. Capital protection: The securities ...

... early paying a predefined return provided certain criteria are met. Counterparties: We only select structured products from banks that are rated as investment grade, meaning they are defined as relatively low risk by major ratings agencies and other market metrics. Capital protection: The securities ...

Banks benefit from a high debt to equity ratio - the

... The guaranties are the reason why bankruptcy costs are significantly lower for banks, because investors know that they will get their money back anyway. Therefore, it is more attractive for banks to have a high debt to equity ratio than it is for non-banks. For example, the average debt to equity r ...

... The guaranties are the reason why bankruptcy costs are significantly lower for banks, because investors know that they will get their money back anyway. Therefore, it is more attractive for banks to have a high debt to equity ratio than it is for non-banks. For example, the average debt to equity r ...

Ryerson Holding Corp (Form: 4, Received: 08/15/2014 16:34:46)

... Ms. Mary Ann Sigler is associated with Platinum Equity, LLC and its affiliated investment funds. Platinum Equity, LLC manages its affiliated investment funds, including Platinum Equity Capital Partners, L.P., Platinum Equity Capital Partners-PF, L.P., Platinum Equity Capital Partners-A, L.P., Platin ...

... Ms. Mary Ann Sigler is associated with Platinum Equity, LLC and its affiliated investment funds. Platinum Equity, LLC manages its affiliated investment funds, including Platinum Equity Capital Partners, L.P., Platinum Equity Capital Partners-PF, L.P., Platinum Equity Capital Partners-A, L.P., Platin ...

Private Equity Investment in Latin America

... regard to either the goals of the Company or the interests and expectations of the Original Shareholders and Investors. Therefore, it is important that the parties negotiate clear and effective mechanisms to regulate the relationship among all shareholders, especially the terms and conditions dealin ...

... regard to either the goals of the Company or the interests and expectations of the Original Shareholders and Investors. Therefore, it is important that the parties negotiate clear and effective mechanisms to regulate the relationship among all shareholders, especially the terms and conditions dealin ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.