diversified equity strategy fund

... prospects of particular companies and/or sectors in the economy. Investments in small and/or mid-sized company stocks typically involve greater risk, particularly in the short term, than those in larger, more established companies. Investments in either growth or value stocks may shift in and out of ...

... prospects of particular companies and/or sectors in the economy. Investments in small and/or mid-sized company stocks typically involve greater risk, particularly in the short term, than those in larger, more established companies. Investments in either growth or value stocks may shift in and out of ...

Q2.15: Cleantech and Renewable Energy

... increase on the $15.3 billion invested in Q1.15 and a 23% increase on the $13.5 billion invested in the corresponding quarter in 2014. Project finance totalled $15.9 billion in Q2.15, a 24% annual increase. This was caused by a small number of large offshore wind farms reaching financial close - Rac ...

... increase on the $15.3 billion invested in Q1.15 and a 23% increase on the $13.5 billion invested in the corresponding quarter in 2014. Project finance totalled $15.9 billion in Q2.15, a 24% annual increase. This was caused by a small number of large offshore wind farms reaching financial close - Rac ...

Long-Term Capital Market Assumptions

... are in U.S. dollar terms unless noted otherwise. Given the complex risk-reward trade-offs involved, we advise clients to rely on judgment as well as quantitative optimization approaches in setting strategic allocations to all the asset classes and strategies. References to future returns are not pro ...

... are in U.S. dollar terms unless noted otherwise. Given the complex risk-reward trade-offs involved, we advise clients to rely on judgment as well as quantitative optimization approaches in setting strategic allocations to all the asset classes and strategies. References to future returns are not pro ...

view presentation here - Asia Pacific Union For Housing Finance

... Premiums charged for the coverage Guarantees on portfolios, not to an institution Clear eligibility criteria and surveillance to ensure the desired targeting ...

... Premiums charged for the coverage Guarantees on portfolios, not to an institution Clear eligibility criteria and surveillance to ensure the desired targeting ...

Interview with Roi Villar Vázquez, Head of

... company Iproteos, raised 100k from investors. The Crowdfunding platform lasted during 6 months. Back in 2015, it took only 88 days for ZeClinics to reach the same amount from 62 investors showing how collective co-investment strengthens as a financial trend in Spain. 62 small investors could be a re ...

... company Iproteos, raised 100k from investors. The Crowdfunding platform lasted during 6 months. Back in 2015, it took only 88 days for ZeClinics to reach the same amount from 62 investors showing how collective co-investment strengthens as a financial trend in Spain. 62 small investors could be a re ...

Long-Term Investment Asset-Class Based Capital

... CAPM fails even on 1-month ahead prediction. Sadly, even FFM may or may not work. (Momentum and book-to-market may work—this is not the FFM!) ...

... CAPM fails even on 1-month ahead prediction. Sadly, even FFM may or may not work. (Momentum and book-to-market may work—this is not the FFM!) ...

Giga-tronics Announces a $1.6M Strategic Investment by AVI

... The Company filed terms of the warrant exercise and related agreements on two Current Reports on Form 8-K to which investors should refer for additional detail on the terms of the investment. About Giga-tronics Incorporated Giga-tronics is a publicly held company, traded on the NASDAQ Capital Market ...

... The Company filed terms of the warrant exercise and related agreements on two Current Reports on Form 8-K to which investors should refer for additional detail on the terms of the investment. About Giga-tronics Incorporated Giga-tronics is a publicly held company, traded on the NASDAQ Capital Market ...

“Games are won by players who focus on the playing field — not by

... grow without investing additional capital in the business. That frees up their capital to pay dividends, buy back stock, or pursue an acquisition while still growing organically. However, most businesses cannot grow without reinvesting capital in new plants, stores, warehouses, trucks or other areas ...

... grow without investing additional capital in the business. That frees up their capital to pay dividends, buy back stock, or pursue an acquisition while still growing organically. However, most businesses cannot grow without reinvesting capital in new plants, stores, warehouses, trucks or other areas ...

Portfolio Management

... • Management will breakdown by segment, product, division, geography • Will cover this topic extensively next week when we walk through a DCF model ...

... • Management will breakdown by segment, product, division, geography • Will cover this topic extensively next week when we walk through a DCF model ...

Fundamentals of Investing Chapter Fifteen

... Third Steps • Participate in any 401(k) or other savings / investing plan your employer may offer. • Add to your portfolio of mutual funds and exchange-traded funds. • Educate yourself about other possibilities, such as investing directly in the stock market. ...

... Third Steps • Participate in any 401(k) or other savings / investing plan your employer may offer. • Add to your portfolio of mutual funds and exchange-traded funds. • Educate yourself about other possibilities, such as investing directly in the stock market. ...

Quiz 3

... 3. When a firm issues preferred stock, it combines the disadvantages of equity finance with the disadvantages of debt finance. The disadvantage that preferred stock shares with equity (compared to debt finance) is: a. The dividends paid to preferred shareholders are paid out of the firm’s after-tax ...

... 3. When a firm issues preferred stock, it combines the disadvantages of equity finance with the disadvantages of debt finance. The disadvantage that preferred stock shares with equity (compared to debt finance) is: a. The dividends paid to preferred shareholders are paid out of the firm’s after-tax ...

CC Marsico Global Fund APIR CHN0002AU

... show revenue growth contributions from market share gains, rather than dependence on the macroeconomic environment. In a slow global growth environment, these stocks should outperform as investors seek out secular growth companies that can grow revenues. We tend to invest in companies that have stro ...

... show revenue growth contributions from market share gains, rather than dependence on the macroeconomic environment. In a slow global growth environment, these stocks should outperform as investors seek out secular growth companies that can grow revenues. We tend to invest in companies that have stro ...

how does a pooled vehicle deliver better risk

... investors could not only gain better diversification than on their own, but they can access other strategies as well. In addition, actively managing the allocation to specific strategies is part of the added value to be derived from using a professional advisor—an advisor who can guide investment in ...

... investors could not only gain better diversification than on their own, but they can access other strategies as well. In addition, actively managing the allocation to specific strategies is part of the added value to be derived from using a professional advisor—an advisor who can guide investment in ...

Busting the myth that value has underperformed since the financial

... environment. This benchmark is a broad-based index which is used for comparative/illustrative purposes only and has been selected as it is well known and easily recognizable by investors. Please refer to http://www.ftse.com/products/indices/uk for further information on this index. Comparisons to be ...

... environment. This benchmark is a broad-based index which is used for comparative/illustrative purposes only and has been selected as it is well known and easily recognizable by investors. Please refer to http://www.ftse.com/products/indices/uk for further information on this index. Comparisons to be ...

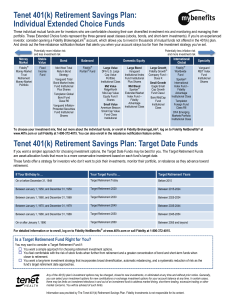

Tenet 401(k) Retirement Savings Plan: Individual Extended Choice

... Individual Extended Choice Funds ...

... Individual Extended Choice Funds ...

How_Much_International

... We invest internationally primarily to reduce portfolio risk. Cross border investing brings asset classes with low correlations to our domestic holdings, resulting in lower volatility for the investment plan. There is a wealth of academic theory and real world experience to support this thesis, but ...

... We invest internationally primarily to reduce portfolio risk. Cross border investing brings asset classes with low correlations to our domestic holdings, resulting in lower volatility for the investment plan. There is a wealth of academic theory and real world experience to support this thesis, but ...

Week 1 Discussion Assignment Problem Sets

... 4-1 (Days Sales Outstanding) and 4.2 (Debt Ratio) on page 147 of your course textbook. 4-1: Greene Sisters has a DSO of 20 days. The company’s average daily sales are $ 20,000. What is the level of its accounts receivable? Assume there are 365 days in a year. 4.2: Vigo Vacations has an equity multip ...

... 4-1 (Days Sales Outstanding) and 4.2 (Debt Ratio) on page 147 of your course textbook. 4-1: Greene Sisters has a DSO of 20 days. The company’s average daily sales are $ 20,000. What is the level of its accounts receivable? Assume there are 365 days in a year. 4.2: Vigo Vacations has an equity multip ...

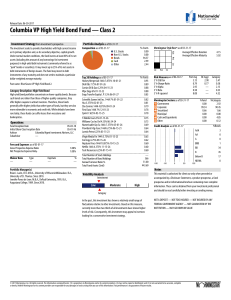

Columbia VP High Yield Bond Fund — Class 2

... Columbia VP High Yield Bond Fund — Class 2 Investment Strategy from investment’s prospectus The investment seeks to provide shareholders with high current income as its primary objective and, as its secondary objective, capital growth. Under normal market conditions, the fund invests at least 80% of ...

... Columbia VP High Yield Bond Fund — Class 2 Investment Strategy from investment’s prospectus The investment seeks to provide shareholders with high current income as its primary objective and, as its secondary objective, capital growth. Under normal market conditions, the fund invests at least 80% of ...

Private Real Estate Co-Investing Today

... Real estate managers seeking co-investment/joint venture capital are motivated to provide favorable terms relative to those in the primary fund in order to attract the additional investment. These terms might include lower management fees (with no “commitment fee”) and/or lower performance fees as w ...

... Real estate managers seeking co-investment/joint venture capital are motivated to provide favorable terms relative to those in the primary fund in order to attract the additional investment. These terms might include lower management fees (with no “commitment fee”) and/or lower performance fees as w ...

OPIC Support for Innovative Financial Intermediaries in

... pilot program launched in November 2013 in response to increased demand from fund managers for OPIC financing to financial intermediaries which focus on investing in small and medium enterprises. The program supports small equity funds, debt funds, funds combining debt and equity, and greenfield non ...

... pilot program launched in November 2013 in response to increased demand from fund managers for OPIC financing to financial intermediaries which focus on investing in small and medium enterprises. The program supports small equity funds, debt funds, funds combining debt and equity, and greenfield non ...

Investments Lecture Notes

... that the investor can exert a controlling influence over the investee. An investor who owns more than 50% of a company's voting stock has control over the investee. This investor can dominate all other shareholders in electing the corporation's board of directors and has control over the investee's ...

... that the investor can exert a controlling influence over the investee. An investor who owns more than 50% of a company's voting stock has control over the investee. This investor can dominate all other shareholders in electing the corporation's board of directors and has control over the investee's ...

2014-2015 Asset Worksheet

... Investment value means the current balance or market value of these investments as of today. Investment debt means only those debts that are related to the investments. Investments include real estate (do not include the home you live in), trust funds, UGMA and UTMA accounts, money market funds, mut ...

... Investment value means the current balance or market value of these investments as of today. Investment debt means only those debts that are related to the investments. Investments include real estate (do not include the home you live in), trust funds, UGMA and UTMA accounts, money market funds, mut ...

Panel_2_-_Leslie_Seidman

... • Record 100% of the assets acquired and liabilities assumed at FV on acquisition (control) date, not just the % purchased. – New guidance on noncontractual contingencies ...

... • Record 100% of the assets acquired and liabilities assumed at FV on acquisition (control) date, not just the % purchased. – New guidance on noncontractual contingencies ...

The cost of capital of levered equity is equal to the cost of capital of

... flow using the weighted average cost of capital. The value of the interest tax shield can then be found by comparing the value of the levered firm, VL, to the unlevered value, VU, of the free cash flow discounted at the firm’s unlevered cost of capital, the pretax WACC. VL = VU + PV(Interest Tax ...

... flow using the weighted average cost of capital. The value of the interest tax shield can then be found by comparing the value of the levered firm, VL, to the unlevered value, VU, of the free cash flow discounted at the firm’s unlevered cost of capital, the pretax WACC. VL = VU + PV(Interest Tax ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.