Foundations of Business

... Date, source By Ransdell Pierson NEW YORK, Jan 13 (Reuters) - One of Merck & Co's (MRK) most important experimental drugs, blood clot preventer Vorapaxar, has been deemed inappropriate for patients who have suffered a stroke, dashing investor hopes and erasing nearly $8 billion from its market value ...

... Date, source By Ransdell Pierson NEW YORK, Jan 13 (Reuters) - One of Merck & Co's (MRK) most important experimental drugs, blood clot preventer Vorapaxar, has been deemed inappropriate for patients who have suffered a stroke, dashing investor hopes and erasing nearly $8 billion from its market value ...

For Information Legislative Council Panel on Commerce and

... up in 1993 to provide funding support to technology ventures and research and development projects that have commercial potential. The Applied Research Council (ARC), a company wholly owned by the Government, was formed specifically to control and administer the ARF. The investments of the ARC fall ...

... up in 1993 to provide funding support to technology ventures and research and development projects that have commercial potential. The Applied Research Council (ARC), a company wholly owned by the Government, was formed specifically to control and administer the ARF. The investments of the ARC fall ...

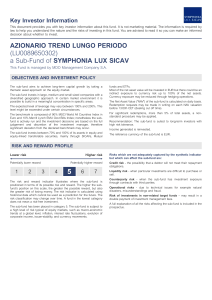

AZIONARIO TREND LUNGO PERIODO (LU0089650302) a Sub

... positioned in terms of its possible risk and reward. The higher the subfund's position on this scale, the greater the possible reward, but also the greater risk of losing money. The risk indicator is calculated using historical data which cannot be used as a prediction for the future. The risk class ...

... positioned in terms of its possible risk and reward. The higher the subfund's position on this scale, the greater the possible reward, but also the greater risk of losing money. The risk indicator is calculated using historical data which cannot be used as a prediction for the future. The risk class ...

Telegraph fund focus

... “I would be more worried [about emerging market volatility] if we were investing in a steel company or a property company in China, but healthcare is an area where there is significant tailwind.” Should you invest - and what are the alternatives? Mark Slater deserves credit for his stock selection o ...

... “I would be more worried [about emerging market volatility] if we were investing in a steel company or a property company in China, but healthcare is an area where there is significant tailwind.” Should you invest - and what are the alternatives? Mark Slater deserves credit for his stock selection o ...

A Dynamic Blend of Global Stocks and Bonds

... same factors, in addition to those associated with their relatively small size and lesser liquidity. The fund’s investment in derivative securities, such as financial futures and option contracts, and the fund’s use of foreign currency techniques involve special risks as such may not achieve the ant ...

... same factors, in addition to those associated with their relatively small size and lesser liquidity. The fund’s investment in derivative securities, such as financial futures and option contracts, and the fund’s use of foreign currency techniques involve special risks as such may not achieve the ant ...

January 10, 2012 FOR IMMEDIATE RELEASE GuideStone

... the underlying Select Funds. The principal risks of the Funds will change depending on the asset mix of the Select Funds in which they invest. You may directly invest in the Select Funds. The Funds’ value will go up and down in response to changes in the share prices of the investments that they own ...

... the underlying Select Funds. The principal risks of the Funds will change depending on the asset mix of the Select Funds in which they invest. You may directly invest in the Select Funds. The Funds’ value will go up and down in response to changes in the share prices of the investments that they own ...

Financial Results

... and comments contained in this material are not under the scope of investment advisory services. Investment advisory services are given according to the investment advisory contract, signed between the intermediary institutions, portfolio management companies, investment banks and the clients. Opini ...

... and comments contained in this material are not under the scope of investment advisory services. Investment advisory services are given according to the investment advisory contract, signed between the intermediary institutions, portfolio management companies, investment banks and the clients. Opini ...

OPIC`s Role in Impact Investment

... is providing insurance to Terra Global Capital, a U.S land‐use carbon development and investment company working with the Cambodian government to prevent deforestation in Oddar Meanchey province. Carbon credits from the project will be sold by Terra Global Capital in international carbon markets. ...

... is providing insurance to Terra Global Capital, a U.S land‐use carbon development and investment company working with the Cambodian government to prevent deforestation in Oddar Meanchey province. Carbon credits from the project will be sold by Terra Global Capital in international carbon markets. ...

Institutional Investor magazine`s 2015 US Investment Management

... *In May 2015, Institutional Investor's 6th Annual U.S. Investment Management Awards recognize U.S. institutional investors whose innovative strategies and fiduciary savvy resulted in impressive returns in 2014, as well as U.S. money managers in 36 asset classes who stood out in the eyes of the inves ...

... *In May 2015, Institutional Investor's 6th Annual U.S. Investment Management Awards recognize U.S. institutional investors whose innovative strategies and fiduciary savvy resulted in impressive returns in 2014, as well as U.S. money managers in 36 asset classes who stood out in the eyes of the inves ...

The European investment fund dedicated to microfinance in Africa

... Fefisol is entirely dedicated to Africa and at least 75% of its investments are to be made in SubSaharan Africa. All countries of the African continent are eligible. ...

... Fefisol is entirely dedicated to Africa and at least 75% of its investments are to be made in SubSaharan Africa. All countries of the African continent are eligible. ...

Blended Finance for private sector projects

... 1) What are the leading emission sectors in your country? 2) Do you see opportunities for private sector investments that could support low emissions development in those sectors? ...

... 1) What are the leading emission sectors in your country? 2) Do you see opportunities for private sector investments that could support low emissions development in those sectors? ...

4 - Cengage

... If the investor purchases between 20% and 50% of the outstanding stock of the investee, the investor is considered to have significant influence over the investee and the investment is accounted for using the equity method. ...

... If the investor purchases between 20% and 50% of the outstanding stock of the investee, the investor is considered to have significant influence over the investee and the investment is accounted for using the equity method. ...

Borrowing Costs Foreign Exchange

... Short‐term debt instruments‐ undiscounted amount Investments in publicly‐ traded securities – at fair value ...

... Short‐term debt instruments‐ undiscounted amount Investments in publicly‐ traded securities – at fair value ...

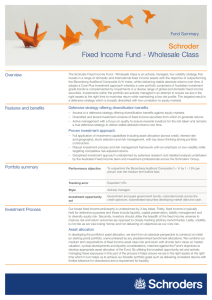

Schroder Fixed Income Fund - Wholesale Class Fund Summary Overview

... managing these exposures in this part of the process it helps ensure we are in the right assets at the right time which in turn helps us to achieve our broader portfolio goals such as delivering consistent returns with limited tolerance for drawdowns and a requirement for liquidity. ...

... managing these exposures in this part of the process it helps ensure we are in the right assets at the right time which in turn helps us to achieve our broader portfolio goals such as delivering consistent returns with limited tolerance for drawdowns and a requirement for liquidity. ...

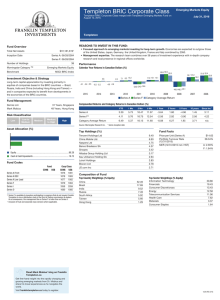

Templeton BRIC Corporate Class Series A

... Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus or fund facts document before investing. The indicated rates of return are historical annual compounded total returns including changes in unit value and rei ...

... Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus or fund facts document before investing. The indicated rates of return are historical annual compounded total returns including changes in unit value and rei ...

Debt, Growth & Politics - Robert Ricketts

... Productivity of “displaced” private/corporate investment is low, increasing the probability that government investment will be more productive than private investment. ● In economic slumps, government spending helps to maintain necessary level of total investment. ...

... Productivity of “displaced” private/corporate investment is low, increasing the probability that government investment will be more productive than private investment. ● In economic slumps, government spending helps to maintain necessary level of total investment. ...

Chapter 14: Introduction to Corporate Finance

... Debt has the unique feature of allowing the borrowers to walk away from their obligation to pay, in exchange for the assets of the company. “Default Risk” is the term used to describe the likelihood that a firm will walk away from its obligation, either voluntarily or involuntarily. “Bond Rati ...

... Debt has the unique feature of allowing the borrowers to walk away from their obligation to pay, in exchange for the assets of the company. “Default Risk” is the term used to describe the likelihood that a firm will walk away from its obligation, either voluntarily or involuntarily. “Bond Rati ...

WisdomTree Launches Emerging Markets High

... stocks to a measure of fundamental value. The company believes its approach provides investors with a viable alternative to market cap-weighted indexes. ...

... stocks to a measure of fundamental value. The company believes its approach provides investors with a viable alternative to market cap-weighted indexes. ...

G-7 recommends vigilance on hedge funds

... statement saying the practices of hedge funds, which have drawn growing concern among financial policy makers over the past few years, had "become more complex and challenging" in light of the industry's prominence and volatility. "Given the strong growth of the hedge fund industry and the instrumen ...

... statement saying the practices of hedge funds, which have drawn growing concern among financial policy makers over the past few years, had "become more complex and challenging" in light of the industry's prominence and volatility. "Given the strong growth of the hedge fund industry and the instrumen ...

CF Canlife Portfolio Funds

... equities, fixed income and property1. It has been active in the UK for more than 100 years, having first established its life insurance business here in 1903. As an asset manager, Canada Life Investments focuses on the long term and believes that active management is the best way to add value for cl ...

... equities, fixed income and property1. It has been active in the UK for more than 100 years, having first established its life insurance business here in 1903. As an asset manager, Canada Life Investments focuses on the long term and believes that active management is the best way to add value for cl ...

How the Market Works… and What It Means for Your Portfolio

... The market is considered “efficient” – not perfect, but sufficiently efficient that wise investors will recognize they cannot expect to regularly exploit mispricings Everything currently knowable is already incorporated into prices - stock prices move only in response to new information unexpect ...

... The market is considered “efficient” – not perfect, but sufficiently efficient that wise investors will recognize they cannot expect to regularly exploit mispricings Everything currently knowable is already incorporated into prices - stock prices move only in response to new information unexpect ...

Investment Update December 2011 Quarter

... Any opinions expressed in this communication constitute our judgement at the time of issue and are subject to change. We believe that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made as at the time ...

... Any opinions expressed in this communication constitute our judgement at the time of issue and are subject to change. We believe that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made as at the time ...

Why buyout investments are good for Canada

... A common misconception about Buyout firms is that they burden companies with too much debt. The perception is that this causes companies to be unable to produce sufficient cash flows to pay interest, forces them to undergo cost cutting and leads them to bankruptcy. In reality, all stakeholders are a ...

... A common misconception about Buyout firms is that they burden companies with too much debt. The perception is that this causes companies to be unable to produce sufficient cash flows to pay interest, forces them to undergo cost cutting and leads them to bankruptcy. In reality, all stakeholders are a ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.