The hidden risks of going passive

... management if they cannot find an active manager who can outperform over the long term. Certainly, research has contested whether active managers can demonstrate such an ability. But one recent study2 by Antti Petajisto, whilst a finance professor at the NYU Stern School of Business, has found that, ...

... management if they cannot find an active manager who can outperform over the long term. Certainly, research has contested whether active managers can demonstrate such an ability. But one recent study2 by Antti Petajisto, whilst a finance professor at the NYU Stern School of Business, has found that, ...

Party Like It`s 1999 - FBB Capital Partners

... We kept a balanced approach to equities by offsetting these additions with two sales, McDonalds and T. Rowe Price. We previously favored McDonalds’ management change and new growth strategies, but we believe execution risks are rising and investors are fully valuing the company’s improvements. We ex ...

... We kept a balanced approach to equities by offsetting these additions with two sales, McDonalds and T. Rowe Price. We previously favored McDonalds’ management change and new growth strategies, but we believe execution risks are rising and investors are fully valuing the company’s improvements. We ex ...

Click to download Firth AVF September 2014

... and the holding that has stimulated the most questions from observers of our portfolio. Our timing of the initial buying in the summer of 2011 was not ideal, but the purchases made subsequently to get to a full weighting were made at good prices. We began to sell in 2013 and, so far, the exit appear ...

... and the holding that has stimulated the most questions from observers of our portfolio. Our timing of the initial buying in the summer of 2011 was not ideal, but the purchases made subsequently to get to a full weighting were made at good prices. We began to sell in 2013 and, so far, the exit appear ...

JPM US Value X (acc)

... result, the Sub-Fund may be more volatile than more broadly diversified funds. The Sub-Fund may have greater volatility compared to broader market indices as a result of the Sub-Fund's focus on value securities. Movements in currency exchange rates can adversely affect the return of your investment. ...

... result, the Sub-Fund may be more volatile than more broadly diversified funds. The Sub-Fund may have greater volatility compared to broader market indices as a result of the Sub-Fund's focus on value securities. Movements in currency exchange rates can adversely affect the return of your investment. ...

Instructor`s Manual Chapter 11-7e

... ____11. "Extra" dividends are usually stock dividends paid out in an especially profitable year. ____12. The preferred dividend coverage ratio and the times interest earned ratio both express "margin of safety" relationships with respect to the firm's ability to cover fixed expenses. ____13. Financi ...

... ____11. "Extra" dividends are usually stock dividends paid out in an especially profitable year. ____12. The preferred dividend coverage ratio and the times interest earned ratio both express "margin of safety" relationships with respect to the firm's ability to cover fixed expenses. ____13. Financi ...

Alleghany`s common stockholders` equity per share at year

... market,” meaning it will write more business when prices, terms, and conditions are attractive, and less business when the market sets the wrong price, or insufficient terms and conditions, relative to the risk. This approach has produced superior underwriting results over time, but it should be cle ...

... market,” meaning it will write more business when prices, terms, and conditions are attractive, and less business when the market sets the wrong price, or insufficient terms and conditions, relative to the risk. This approach has produced superior underwriting results over time, but it should be cle ...

Market Volatility: a Friend of Active Management?

... In our experience, these assumptions do not hold up under real market conditions. Information is most certainly not available to all investors at all times. If that were the case, it would be impossible for all participants to act. Finally, the studies of Behavioral Finance (of which SEI is a propon ...

... In our experience, these assumptions do not hold up under real market conditions. Information is most certainly not available to all investors at all times. If that were the case, it would be impossible for all participants to act. Finally, the studies of Behavioral Finance (of which SEI is a propon ...

One Hat Too Many? Investment Desegregation in Private Equity

... Apollo Management, Kohlberg Kravis Roberts & Co., The Carlyle Group, and other buyout firms have recently launched new funds that specialize in such alternative investment strategies. These new investments undoubtedly make financial sense for the fund managers, as they likely expand the manager’s ex ...

... Apollo Management, Kohlberg Kravis Roberts & Co., The Carlyle Group, and other buyout firms have recently launched new funds that specialize in such alternative investment strategies. These new investments undoubtedly make financial sense for the fund managers, as they likely expand the manager’s ex ...

FDI Glossary - Office for National Statistics

... Dividends- Dividends are earnings distributed to shareholders from common and participating preferred stock, whether voting or non-voting, according to the contractual relationship between the enterprise and the various types of shareholders, before deduction for withholding taxes. Dividends exclude ...

... Dividends- Dividends are earnings distributed to shareholders from common and participating preferred stock, whether voting or non-voting, according to the contractual relationship between the enterprise and the various types of shareholders, before deduction for withholding taxes. Dividends exclude ...

Sofia, Bulgaria, October 13, 2006 Milen Markov Chairman of

... 4. Status of the already existing funds – determining their risk profile. Determining the type of fund for people who have not made a choice and for unpersonified contributions 5. The right to change funds managed by a single pensions company – taxes and how often it can be done 6. Binding the right ...

... 4. Status of the already existing funds – determining their risk profile. Determining the type of fund for people who have not made a choice and for unpersonified contributions 5. The right to change funds managed by a single pensions company – taxes and how often it can be done 6. Binding the right ...

EF projekt2_Layout 1 - Enterprise Funds Association

... Dillon Read, who was to head the programme in Poland. “He wanted to have investment professionals invest the money to rebuild the private sector – in a combination of public capital and private management”. Alongside the $240 million for Poland the SEED act provided $60 million for Hungary. In all, ...

... Dillon Read, who was to head the programme in Poland. “He wanted to have investment professionals invest the money to rebuild the private sector – in a combination of public capital and private management”. Alongside the $240 million for Poland the SEED act provided $60 million for Hungary. In all, ...

All material contained in this paper is written by way of general

... All material contained in this paper is written by way of general comment. No material should be accepted as authorative advice and any reader wishing to act upon material contained in this paper should first contact Worrells for properly considered professional advice, which take into account speci ...

... All material contained in this paper is written by way of general comment. No material should be accepted as authorative advice and any reader wishing to act upon material contained in this paper should first contact Worrells for properly considered professional advice, which take into account speci ...

Monetizing Your Parking Assets

... Guggenheim Securities and its affiliates do not provide legal, compliance, tax or accounting advice. Any statements contained herein as to tax matters were neither written nor intended by us to be used and cannot be used by any taxpayer for the purpose of avoiding tax penalties that may be imposed o ...

... Guggenheim Securities and its affiliates do not provide legal, compliance, tax or accounting advice. Any statements contained herein as to tax matters were neither written nor intended by us to be used and cannot be used by any taxpayer for the purpose of avoiding tax penalties that may be imposed o ...

CVP Analysis

... Assume a 50% Tax in both cases. Comment on Financial Leverage. 4. XYZ currently has an Equity Capital of Rs. 40 lacs consisting 40000 equity shares of Rs. 100 each. The management plans to raise another Rs. 30 lakhs to finance a major expansion through the following means: i) Entirely through Equity ...

... Assume a 50% Tax in both cases. Comment on Financial Leverage. 4. XYZ currently has an Equity Capital of Rs. 40 lacs consisting 40000 equity shares of Rs. 100 each. The management plans to raise another Rs. 30 lakhs to finance a major expansion through the following means: i) Entirely through Equity ...

VIT Multi-Strategy Alternatives Portfolio

... Equity securities are more volatile than bonds and subject to greater risks. Bonds are subject to interest rate, price and credit risks. Prices tend to be inversely affected by changes in interest rates. Investors should also consider some of the potential risks of alternative investments: Alternati ...

... Equity securities are more volatile than bonds and subject to greater risks. Bonds are subject to interest rate, price and credit risks. Prices tend to be inversely affected by changes in interest rates. Investors should also consider some of the potential risks of alternative investments: Alternati ...

Form: 6-K, Received: 02/26/2016 18:51:31

... in London, Hong Kong, Singapore, Mexico City, and Buenos Aires. The firm, founded in 1998, seeks to generate superior risk-adjusted returns through a comprehensive approach to emerging markets supported by a transparent and robust institutional platform. Gramercy invests through both alternative and ...

... in London, Hong Kong, Singapore, Mexico City, and Buenos Aires. The firm, founded in 1998, seeks to generate superior risk-adjusted returns through a comprehensive approach to emerging markets supported by a transparent and robust institutional platform. Gramercy invests through both alternative and ...

REIT Performance Evaluation: A Case Study of Washington Real

... well as stabilized properties that offer future upside growth potential. To this end, WRIT looks for well located properties, particularly those that they find to be poorly managed and needing new mechanical systems, cosmetics and so on, permitting them to reposition the property in its market place ...

... well as stabilized properties that offer future upside growth potential. To this end, WRIT looks for well located properties, particularly those that they find to be poorly managed and needing new mechanical systems, cosmetics and so on, permitting them to reposition the property in its market place ...

Mirae Asset Trigger Investment Plan (TRIP)

... Suppose you prefer to invest in a mutual fund when markets are at specic levels, you would need to keep track of markets and invest on the day markets reach their desired level. With the TRIP facility, you need not keep track of market movements. You can simply set four trigger levels to switch the ...

... Suppose you prefer to invest in a mutual fund when markets are at specic levels, you would need to keep track of markets and invest on the day markets reach their desired level. With the TRIP facility, you need not keep track of market movements. You can simply set four trigger levels to switch the ...

MANULIFE HIGH YIELD BOND FUND

... and using average month-end net asset value, per security. The distribution yield does not include any year-end capital gains distributions paid in addition to the regular monthly distributions. Distribution yield should not be confused with a fund’s performance or rate of return. ¤As of December 30 ...

... and using average month-end net asset value, per security. The distribution yield does not include any year-end capital gains distributions paid in addition to the regular monthly distributions. Distribution yield should not be confused with a fund’s performance or rate of return. ¤As of December 30 ...

PDF Download

... Direct Investment to bottom out this year Although direct investment is likely to fall to $103 billion this year, the lowest level since 1996, these flows still represent nearly two-thirds of total net private capital flows to emerging markets. The trough expected in FDI this year is attributable in ...

... Direct Investment to bottom out this year Although direct investment is likely to fall to $103 billion this year, the lowest level since 1996, these flows still represent nearly two-thirds of total net private capital flows to emerging markets. The trough expected in FDI this year is attributable in ...

ch03 - U of L Class Index

... Traded throughout the day on exchanges Lower management fees (e.g., 0.08% to 0.25% versus 2.5% average for active equity funds versus 0.75% average for Index funds) Lower portfolio turnover – reduces capital gains income and taxes payable ...

... Traded throughout the day on exchanges Lower management fees (e.g., 0.08% to 0.25% versus 2.5% average for active equity funds versus 0.75% average for Index funds) Lower portfolio turnover – reduces capital gains income and taxes payable ...

“Lost” Decade 2000 – 2009

... designed to measure the performance of the bond market as a whole, including Government, Corporate, and Mortgagebacked securities. • The Barclays U.S. Government/Credit Bond Index is designed to measure the performance of U.S. Treasuries that have remaining maturities of more than one year, governme ...

... designed to measure the performance of the bond market as a whole, including Government, Corporate, and Mortgagebacked securities. • The Barclays U.S. Government/Credit Bond Index is designed to measure the performance of U.S. Treasuries that have remaining maturities of more than one year, governme ...

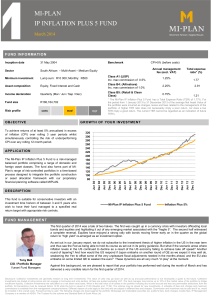

mi-plan ip inflation plus 5 fund

... investments are traded at ruling prices and can engage in borrowing and scrip lending. All fees are quoted excluding VAT. The fund manager may borrow up to 10% of the market value of the portfolio to bridge insufficient liquidity. Collective investments are calculated on a net asset value basis, whi ...

... investments are traded at ruling prices and can engage in borrowing and scrip lending. All fees are quoted excluding VAT. The fund manager may borrow up to 10% of the market value of the portfolio to bridge insufficient liquidity. Collective investments are calculated on a net asset value basis, whi ...

Private Equity - Gilbert + Tobin Lawyers

... of arrangement are broadly comparable and include details of the bidder’s intentions, funding arrangements for cash consideration, prospectus-level disclosure concerning the bidder and the merged entity if the offer consideration includes securities and all information known to the bidder that is ma ...

... of arrangement are broadly comparable and include details of the bidder’s intentions, funding arrangements for cash consideration, prospectus-level disclosure concerning the bidder and the merged entity if the offer consideration includes securities and all information known to the bidder that is ma ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.