Global Market Maturity Leads to Addition of New Fund: Janus

... In the nineties the trend continued, with even more of these historically conservative investors becoming willing to “taste” the market, in pursuit of higher returns. Technology enhanced the trading and information capabilities of both individual and institutional ...

... In the nineties the trend continued, with even more of these historically conservative investors becoming willing to “taste” the market, in pursuit of higher returns. Technology enhanced the trading and information capabilities of both individual and institutional ...

Vectis Capital The Supply Chain Software Market Excellent Market

... ► Adequate Management Team ► Time Horizon of 4 - 6 years ...

... ► Adequate Management Team ► Time Horizon of 4 - 6 years ...

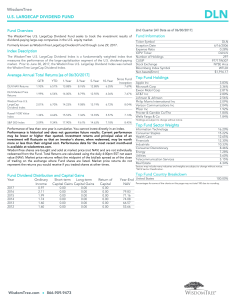

WisdomTree LargeCap Dividend Fund

... The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s (“S&P”), a division of The McGraw-Hill Companies, Inc. and is licensed for use by WisdomTree Investments, Inc. Neither MSCI, S&P nor any ...

... The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s (“S&P”), a division of The McGraw-Hill Companies, Inc. and is licensed for use by WisdomTree Investments, Inc. Neither MSCI, S&P nor any ...

OCB DESK * PRESENT POSITION

... Account Management 5)Market intervention • Sterilized intervention during too much capital flows- a situation of private benefit and public cost; but indirect cost to be reckoned • Now intervention only to smoothen volatility • Wide menu of hedging instruments • Off-shore trading of INR – implicatio ...

... Account Management 5)Market intervention • Sterilized intervention during too much capital flows- a situation of private benefit and public cost; but indirect cost to be reckoned • Now intervention only to smoothen volatility • Wide menu of hedging instruments • Off-shore trading of INR – implicatio ...

Why is the Cost of Capital so high in South Africa?

... What are the consequences of this for developing nations? 1. An asset is priced in the market where the marginal purchase/sale of its shares takes place 2. Companies able to access the deeper, broader capital pools of Developed Countries can afford to pay more for assets listed in shallower, narrow ...

... What are the consequences of this for developing nations? 1. An asset is priced in the market where the marginal purchase/sale of its shares takes place 2. Companies able to access the deeper, broader capital pools of Developed Countries can afford to pay more for assets listed in shallower, narrow ...

Public Private Partnerships in South Africa

... A PPP is defined in South African law as: A contract between government institution and private party Private party performs an institutional function and/or uses state property in terms of output specifications Substantial project risk (financial, technical, operational) transferred to the pr ...

... A PPP is defined in South African law as: A contract between government institution and private party Private party performs an institutional function and/or uses state property in terms of output specifications Substantial project risk (financial, technical, operational) transferred to the pr ...

Long term outperformance - Hearthstone Investments

... This information is intended for professional clients and investment professionals only and should not be relied upon by retail investors. While all reasonable care has been taken in the compilation of this publication, Hearthstone Investments PLC will not be under any legal liability in respect of ...

... This information is intended for professional clients and investment professionals only and should not be relied upon by retail investors. While all reasonable care has been taken in the compilation of this publication, Hearthstone Investments PLC will not be under any legal liability in respect of ...

BT Smaller Companies Fund

... Financial Services Limited ABN 20 000 241 127, AFSL 233716 are the Responsible Entities of the BT Investment Funds Product Disclosure Statement (PDS). BT Funds Management No. 2 Limited ABN 22 000 727 659, AFSL 233720 is the issuer of units in, the BT Smaller Companies Fund (the Fund). A PDS and Fina ...

... Financial Services Limited ABN 20 000 241 127, AFSL 233716 are the Responsible Entities of the BT Investment Funds Product Disclosure Statement (PDS). BT Funds Management No. 2 Limited ABN 22 000 727 659, AFSL 233720 is the issuer of units in, the BT Smaller Companies Fund (the Fund). A PDS and Fina ...

15 April Overview of Microfinance Investment Funds

... Prasad Viswanatha has 20 years of experience in the mainstream financial sector, of which the last 8 years have been spent in microfinance. He is the founder of Caspian Capital Partners, an Indian fund management company and co-founder of The Bellwether Microfinance Fund which was established in 20 ...

... Prasad Viswanatha has 20 years of experience in the mainstream financial sector, of which the last 8 years have been spent in microfinance. He is the founder of Caspian Capital Partners, an Indian fund management company and co-founder of The Bellwether Microfinance Fund which was established in 20 ...

Franklin Quotential Growth Portfolio Series A

... Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus or fund facts document before investing. The indicated rates of return are historical annual compounded total returns including changes in unit value and rei ...

... Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus or fund facts document before investing. The indicated rates of return are historical annual compounded total returns including changes in unit value and rei ...

Goldman Sachs Financial Square Government Fund

... quoted above. Please visit www.GSAMFUNDS.com to obtain the most recent month-end returns. Yields and returns will fluctuate as market conditions change. The yield quotations more closely reflect the current earnings of the Fund than the total return quotations. The Quarter-End Total Returns are aver ...

... quoted above. Please visit www.GSAMFUNDS.com to obtain the most recent month-end returns. Yields and returns will fluctuate as market conditions change. The yield quotations more closely reflect the current earnings of the Fund than the total return quotations. The Quarter-End Total Returns are aver ...

annexure

... The Insurance Act,1938 under section 27A (2) and 27B (3) refers to investment permitted under these sections as ‘Otherwise than in an Approved Investments’ and the IRDA (Investment) Regulations, 2000 had interpreted it as ‘Other than Approved Investments’. ...

... The Insurance Act,1938 under section 27A (2) and 27B (3) refers to investment permitted under these sections as ‘Otherwise than in an Approved Investments’ and the IRDA (Investment) Regulations, 2000 had interpreted it as ‘Other than Approved Investments’. ...

The Rise of Corporate Savings

... However, by the 2000s, the corporate sector had switched to being a net lender, and over the period 2003-2007, the sector was saving more than 5 percent of the value of its productive assets. Why have firms in the business of producing goods or services become lenders? This is quite at odds with tra ...

... However, by the 2000s, the corporate sector had switched to being a net lender, and over the period 2003-2007, the sector was saving more than 5 percent of the value of its productive assets. Why have firms in the business of producing goods or services become lenders? This is quite at odds with tra ...

Agenda - Hertfordshire County Council

... 13. PRIVATE EQUITY COMMITMENTS To update the Committee on the commitments the Pension Fund has made to private equity. Report of the Finance Director (copy attached). ...

... 13. PRIVATE EQUITY COMMITMENTS To update the Committee on the commitments the Pension Fund has made to private equity. Report of the Finance Director (copy attached). ...

December 2011 - Capital Markets Board of Turkey

... exchanges, academia and the central theme is exchanging views on current approaches and initiatives to financial market regulation namely for post financial crisis crucial topics such as regulation of credit rating agencies, OTC Derivatives, financial literacy, investor protection and systemic risk. ...

... exchanges, academia and the central theme is exchanging views on current approaches and initiatives to financial market regulation namely for post financial crisis crucial topics such as regulation of credit rating agencies, OTC Derivatives, financial literacy, investor protection and systemic risk. ...

Long-Term Financial Planning and Growth

... The previous scenario assumed the firm was operating at 100% of capacity Suppose that the company is currently operating at only 70% of capacity. Full Capacity sales = 1,000 / .70 = 1,429 Estimated sales = $1,250, so would still only be operating at 87.5% of capacity Therefore, no addition ...

... The previous scenario assumed the firm was operating at 100% of capacity Suppose that the company is currently operating at only 70% of capacity. Full Capacity sales = 1,000 / .70 = 1,429 Estimated sales = $1,250, so would still only be operating at 87.5% of capacity Therefore, no addition ...

Keep An Eye On The Earning Yield Of Equity Vs Bonds Indian

... The earnings yield is the recip r o c a l o f t h e p r i c e -to earnings ra tio, which would be 30/3, or 10. A high earnings yield indicates that the market is assuming a lower growth in profits in the future for the company while a low earnings yield indicates that the company is expected (by the ...

... The earnings yield is the recip r o c a l o f t h e p r i c e -to earnings ra tio, which would be 30/3, or 10. A high earnings yield indicates that the market is assuming a lower growth in profits in the future for the company while a low earnings yield indicates that the company is expected (by the ...

Average Debt and Equity Returns: Puzzling?

... Another expense that is relevant to the household is taxes. Until recently, dividends were taxed much more heavily, on average, than interest payments. The reason this was the case is that debt assets could be and were held as lifeinsurance and pension-fund reserves, thereby escaping most taxation, ...

... Another expense that is relevant to the household is taxes. Until recently, dividends were taxed much more heavily, on average, than interest payments. The reason this was the case is that debt assets could be and were held as lifeinsurance and pension-fund reserves, thereby escaping most taxation, ...

PPT

... Free Cash Flow to Firm = 3,287Mil DM To compute the cost of capital to apply to this cash flow, we assumed that the beta for the stock would be 1.00. The long term bond rate in Germany was 6%, whereas Daimler Benz could borrow long term at 6.1%. The market value of equity was 50,000 Mil DM, and ther ...

... Free Cash Flow to Firm = 3,287Mil DM To compute the cost of capital to apply to this cash flow, we assumed that the beta for the stock would be 1.00. The long term bond rate in Germany was 6%, whereas Daimler Benz could borrow long term at 6.1%. The market value of equity was 50,000 Mil DM, and ther ...

Fund Profile - nab asset management

... preparation. However, no representation or warranty (express or implied) is given as to its accuracy, reliability or completeness (which may change without notice). This communication contains general information and may constitute general advice. This report does not take account of an investor’s p ...

... preparation. However, no representation or warranty (express or implied) is given as to its accuracy, reliability or completeness (which may change without notice). This communication contains general information and may constitute general advice. This report does not take account of an investor’s p ...

sitarail

... only on the first five years of the concession. They have ignored long term needs that have proven to be much larger than anticipated as both Governments and private operators, at the concession bidding stage, have downplayed the decrepit state of rail infrastructure. Investments needs (2008/2020) ( ...

... only on the first five years of the concession. They have ignored long term needs that have proven to be much larger than anticipated as both Governments and private operators, at the concession bidding stage, have downplayed the decrepit state of rail infrastructure. Investments needs (2008/2020) ( ...

victory rs large cap alpha fund

... Performance returns for periods of less than one year are not annualized. Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an invest ...

... Performance returns for periods of less than one year are not annualized. Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an invest ...

Mutual Funds Sharekhan`s Top Equity Fund Picks

... This document has been prepared by Sharekhan Limited (Sharekhan) and is meant for sole use by the recipient and not for circulation. The information contained in this report is intended for general information purposes only. The information published should not be used as a substitute for any form o ...

... This document has been prepared by Sharekhan Limited (Sharekhan) and is meant for sole use by the recipient and not for circulation. The information contained in this report is intended for general information purposes only. The information published should not be used as a substitute for any form o ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.