Investment Methodology and the Batting Average

... 90% of its peer group’s portfolio turnover. High portfolio turnover indicates frequent trading and could lead to increased transaction costs for the fund A warning sign indicates the fund’s three-year standard deviation of returns (risk) is higher than 90% of its peer group ...

... 90% of its peer group’s portfolio turnover. High portfolio turnover indicates frequent trading and could lead to increased transaction costs for the fund A warning sign indicates the fund’s three-year standard deviation of returns (risk) is higher than 90% of its peer group ...

August 2016 FUND NAME ESTIMATED PRICE ESTIMATED

... IMPORTANT NOTIFICATION This document is confidential and contains copyright material. This communication is issued by Montrose Asset Management Limited, which is licensed by the Guernsey Financial Services Commission. This communication is strictly confidential and is intended only for the use of th ...

... IMPORTANT NOTIFICATION This document is confidential and contains copyright material. This communication is issued by Montrose Asset Management Limited, which is licensed by the Guernsey Financial Services Commission. This communication is strictly confidential and is intended only for the use of th ...

The City of Neenah Municipal Museum Fund

... of a long-term program. Equities are to be diversified by industry sector, size, and country. The manager shall emphasize quality in security selection and shall, to the extent practical, avoid risk through diversification in a portfolio of large, medium, and small capitalization stocks. The manager ...

... of a long-term program. Equities are to be diversified by industry sector, size, and country. The manager shall emphasize quality in security selection and shall, to the extent practical, avoid risk through diversification in a portfolio of large, medium, and small capitalization stocks. The manager ...

investment policy - University of Arkansas at Pine Bluff

... funding needs (liquidity) so that current transactional requirements and obligations can be met. To accomplish this objective, cash is maintained in interest bearing checking accounts and excess cash is reduced and made available to generate investment income. Safety of university assets is also a p ...

... funding needs (liquidity) so that current transactional requirements and obligations can be met. To accomplish this objective, cash is maintained in interest bearing checking accounts and excess cash is reduced and made available to generate investment income. Safety of university assets is also a p ...

Absolute and Relative Measures Explaining Consumption Risk

... model. The benchmark model predicts that investors maximize their risk-return trade-off by investing in identical international portfolios, which resemble the world portfolio. In our analysis, we capture the idea of the I-CAPM with two measures. First, we define an absolute home bias measure that sp ...

... model. The benchmark model predicts that investors maximize their risk-return trade-off by investing in identical international portfolios, which resemble the world portfolio. In our analysis, we capture the idea of the I-CAPM with two measures. First, we define an absolute home bias measure that sp ...

BMS Finance completes its second senior debt financing of bfinance

... BMS Finance, the boutique finance company specialising in providing debt finance to high growth SMEs, today announces the completion of £2.5 million of senior debt finance to bfinance. This new debt facility follows a facility provided by BMS Finance in 2009 which enabled the current management team ...

... BMS Finance, the boutique finance company specialising in providing debt finance to high growth SMEs, today announces the completion of £2.5 million of senior debt finance to bfinance. This new debt facility follows a facility provided by BMS Finance in 2009 which enabled the current management team ...

United Emerging Markets Bond Fund

... which may not be sustainable. The value of Units and any income from the Fund(s) may fall as well as rise. The above information is strictly for general information only and must not be construed as an offer or solicitation to deal in Units, nor a recommendation to invest in any company mentioned he ...

... which may not be sustainable. The value of Units and any income from the Fund(s) may fall as well as rise. The above information is strictly for general information only and must not be construed as an offer or solicitation to deal in Units, nor a recommendation to invest in any company mentioned he ...

CLOs, CDOs and the Search for High Yield

... Whilst considerable care has been taken to ensure the information contained within is accurate and up-to-date, no warranty is given as to the accuracy or completeness of any information and no liability is accepted for any errors or omissions in such information or any action taken on the basis of t ...

... Whilst considerable care has been taken to ensure the information contained within is accurate and up-to-date, no warranty is given as to the accuracy or completeness of any information and no liability is accepted for any errors or omissions in such information or any action taken on the basis of t ...

Equities and Indexes

... Mutual funds indexed to the S&P 500 Index S&P Depository Receipts (SPDR) S&P 500 Index Options and Futures ...

... Mutual funds indexed to the S&P 500 Index S&P Depository Receipts (SPDR) S&P 500 Index Options and Futures ...

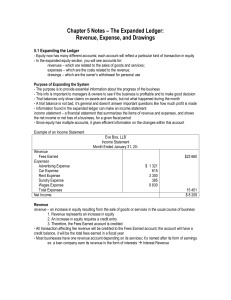

Chapter 5 Notes – The Expanded Ledger:

... - Equity now has many different accounts; each account will reflect a particular kind of transaction in equity - In the expanded equity section, you will see accounts for: revenues – which are related to the sales of goods and services; expenses – which are the costs related to the revenue; drawings ...

... - Equity now has many different accounts; each account will reflect a particular kind of transaction in equity - In the expanded equity section, you will see accounts for: revenues – which are related to the sales of goods and services; expenses – which are the costs related to the revenue; drawings ...

May 2016 Factsheet Monthly

... The fund invests in a diversified multi-asset portfolio of funds that invest in shares and bonds of companies in the UK and worldwide, government bonds and other fixed income securities. The fund may also invest directly in shares, bonds and money market instruments and hold cash and foreign currenc ...

... The fund invests in a diversified multi-asset portfolio of funds that invest in shares and bonds of companies in the UK and worldwide, government bonds and other fixed income securities. The fund may also invest directly in shares, bonds and money market instruments and hold cash and foreign currenc ...

Equity Investment Approach - Retirement Income Management

... price/earnings/growth are reasonable screeners to use, but we do not want to immediately remove a company in a first screen based just on valuation. Security Selection At this point of the process, fundamentals are used to further limit the companies to be used in the model portfolios. At the end of ...

... price/earnings/growth are reasonable screeners to use, but we do not want to immediately remove a company in a first screen based just on valuation. Security Selection At this point of the process, fundamentals are used to further limit the companies to be used in the model portfolios. At the end of ...

agenda for a new strategy of equity financing by the islamic

... that developmental role cannot be achieved by investing in bad projects or poorly conceived or poorly managed companies. It recognizes that some companies will inevitably fail, but investing in companies that are likely to do so is not the way to promote development. It translates its development ob ...

... that developmental role cannot be achieved by investing in bad projects or poorly conceived or poorly managed companies. It recognizes that some companies will inevitably fail, but investing in companies that are likely to do so is not the way to promote development. It translates its development ob ...

C. Declare expected annual rate of investment return for assets of

... Based on the above target allocation and expected long-term real returns for each asset class, the weighted average expected long-term real return net of inflation is 5.10%. The investment monitor also indicated that the inflation estimate was 2.0% producing an expected long-term rate of return net ...

... Based on the above target allocation and expected long-term real returns for each asset class, the weighted average expected long-term real return net of inflation is 5.10%. The investment monitor also indicated that the inflation estimate was 2.0% producing an expected long-term rate of return net ...

Sanlam Investment Management Value Fund Class A1

... long term (greater than 5 years). It is designed to substantially outperform the markets and therefore carries a long-term investment horizon (5 years and upwards). The portfolio will be diversified across all major asset classes with significant exposure to equities, and may include offshore equiti ...

... long term (greater than 5 years). It is designed to substantially outperform the markets and therefore carries a long-term investment horizon (5 years and upwards). The portfolio will be diversified across all major asset classes with significant exposure to equities, and may include offshore equiti ...

As you`ll see in the attached, the 2x Consumer Products Growth

... During the period between 2001 and 2006, the principals of the General Partner were approached by more than 1,200 emerging consumer products companies seeking their expertise and funding. However, many of these opportunities have been too early stage or too small for traditional private equity funds ...

... During the period between 2001 and 2006, the principals of the General Partner were approached by more than 1,200 emerging consumer products companies seeking their expertise and funding. However, many of these opportunities have been too early stage or too small for traditional private equity funds ...

China`s Equity Market Turmoil Raises Credit And Market Risks For

... less than 15% of total loans, and we believe a major chunk of these loans are backed by receivables, bank deposits, or other financial instruments. Moreover, the credit performance of these share-backed loans is determined more by the borrowers' operational performance than by the collateral valuati ...

... less than 15% of total loans, and we believe a major chunk of these loans are backed by receivables, bank deposits, or other financial instruments. Moreover, the credit performance of these share-backed loans is determined more by the borrowers' operational performance than by the collateral valuati ...

26-31 ISCA May - Focus (Cover story) V1.indd

... users of financial accounting information, they will understand that the loss in Q1 is caused by the accounting rule that requires immediate expensing of advertising expenditure. As a result, they will not be deterred by the temporary loss when Q1 results are released, and bid up the share price of ...

... users of financial accounting information, they will understand that the loss in Q1 is caused by the accounting rule that requires immediate expensing of advertising expenditure. As a result, they will not be deterred by the temporary loss when Q1 results are released, and bid up the share price of ...

LEVERAGE

... offsetting tax costs of leveraged capital structures (such as those discussed in my paper “Debt and Taxes” (1977) and its follow-up literature), tax savings alone cannot plausibly account for the observed LB0 premiums. 1.1 Leveraged buyouts: where the gains came from The source of the major gains in ...

... offsetting tax costs of leveraged capital structures (such as those discussed in my paper “Debt and Taxes” (1977) and its follow-up literature), tax savings alone cannot plausibly account for the observed LB0 premiums. 1.1 Leveraged buyouts: where the gains came from The source of the major gains in ...

MID-TERM #1

... Balance Sheet: States the organization’s financial position for a period of time. Income Statement: States the organization’s earnings for a period of time. Statement of Cash Flows: State the organization’s cash receipts and cash disbursements for a period of time. Statement of Owner’s Equity: State ...

... Balance Sheet: States the organization’s financial position for a period of time. Income Statement: States the organization’s earnings for a period of time. Statement of Cash Flows: State the organization’s cash receipts and cash disbursements for a period of time. Statement of Owner’s Equity: State ...

A Prudent Way To Invest - Brown Brothers Harriman

... Strong free cash flow. Free cash flow is the cash that a company generates after making capital investments and paying taxes. The ability to generate strong free cash flow reduces the likelihood of financial distress, which is particularly important during periods of economic weakness when capital i ...

... Strong free cash flow. Free cash flow is the cash that a company generates after making capital investments and paying taxes. The ability to generate strong free cash flow reduces the likelihood of financial distress, which is particularly important during periods of economic weakness when capital i ...

Final Examination for Financial Management

... The empirical evidence indicates that the shareholders of target firms take most of gains from M&A. In the short run, target firm gets above 20% excess return in a successful merger and tender offer. The firm who has won the bidding war in merger, its stock price has a greater possibility to go down ...

... The empirical evidence indicates that the shareholders of target firms take most of gains from M&A. In the short run, target firm gets above 20% excess return in a successful merger and tender offer. The firm who has won the bidding war in merger, its stock price has a greater possibility to go down ...

GEF Country Dialogue Workshops Programme Project

... “biodiversity friendly” through which producers would obtain a premium price on world markets. Achieve biodiversity goals, eg. maintenance of biodiversity shade, adopt or maintain biodiversity conservation friendly practices. GEF grants financed technical assistance to farmers and creation of the la ...

... “biodiversity friendly” through which producers would obtain a premium price on world markets. Achieve biodiversity goals, eg. maintenance of biodiversity shade, adopt or maintain biodiversity conservation friendly practices. GEF grants financed technical assistance to farmers and creation of the la ...

Asia Investment Grade Bond Fund

... offered for sale in the United States of America, its territories or possessions and all areas subject to its jurisdiction, or to United States Persons. This document is not intended in any way to indicate or guarantee future investment results as the value of investments may go down as well as up. ...

... offered for sale in the United States of America, its territories or possessions and all areas subject to its jurisdiction, or to United States Persons. This document is not intended in any way to indicate or guarantee future investment results as the value of investments may go down as well as up. ...

9th Annual Korea Institutional Investment Forum 8 September 2015

... How International Asset Owners are Managing Their Portfolios Presentation The head of Eaton Vance’s international investment business details how their clients are positioning their portfolios to cope with the current market environment. ...

... How International Asset Owners are Managing Their Portfolios Presentation The head of Eaton Vance’s international investment business details how their clients are positioning their portfolios to cope with the current market environment. ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.