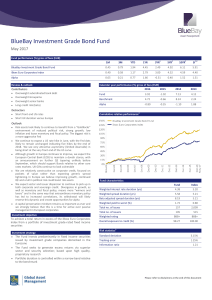

BlueBay Investment Grade Bond Fund

... 4. The Fund AUM is stated on a T+1 basis and includes non-fee earning assets. 5. CDS long exposure means sold protection and CDS short exposure means brought protection. This document is issued in the United Kingdom (UK) by BlueBay Asset Management LLP (BlueBay), which is authorised and regulated by ...

... 4. The Fund AUM is stated on a T+1 basis and includes non-fee earning assets. 5. CDS long exposure means sold protection and CDS short exposure means brought protection. This document is issued in the United Kingdom (UK) by BlueBay Asset Management LLP (BlueBay), which is authorised and regulated by ...

Cost of Capital and Efficient Capital Markets

... The cost of debt is the required return on our company’s debt We usually focus on the cost of long-term debt or bonds, why? The required return is best estimated by computing the yield-to-maturity on the existing debt We may also use estimates of current rates based on the bond rating we expec ...

... The cost of debt is the required return on our company’s debt We usually focus on the cost of long-term debt or bonds, why? The required return is best estimated by computing the yield-to-maturity on the existing debt We may also use estimates of current rates based on the bond rating we expec ...

Read case study

... NoviCap is one of the first Spanish platforms to offer access to a new asset class with high liquidity. The great advantage is that it is growing rapidly, and the drawback is that it is still in its early days. The more registered SMEs, the more invoices discounted, which will result in a more diver ...

... NoviCap is one of the first Spanish platforms to offer access to a new asset class with high liquidity. The great advantage is that it is growing rapidly, and the drawback is that it is still in its early days. The more registered SMEs, the more invoices discounted, which will result in a more diver ...

Key Changes Ahead

... the role of the MMF in their plans and determine which type of fund meets those needs. When the SEC reforms go into effect next October, there will be three main types of these funds: The first will be the “institutional” MMF. Unlike the current structure, these MMFs will be priced daily rather than ...

... the role of the MMF in their plans and determine which type of fund meets those needs. When the SEC reforms go into effect next October, there will be three main types of these funds: The first will be the “institutional” MMF. Unlike the current structure, these MMFs will be priced daily rather than ...

Focused Dynamic Growth - American Century Investments

... Investment return and principal value will fluctuate, and it is possible to lose money by investing. Because this fund may, at times, concentrate its investments in a specific area, during such times it may be subject to greater risks and market fluctuations than when the portfolio represents a broa ...

... Investment return and principal value will fluctuate, and it is possible to lose money by investing. Because this fund may, at times, concentrate its investments in a specific area, during such times it may be subject to greater risks and market fluctuations than when the portfolio represents a broa ...

TCP Capital Corp. Receives Investment Grade Ratings from

... TCP Capital Corp. (NASDAQ: TCPC) is a specialty finance company focused on performing credit lending to middle-market companies as well as small businesses. TCPC lends primarily to companies with established market positions, strong regional or national operations, differentiated products and servic ...

... TCP Capital Corp. (NASDAQ: TCPC) is a specialty finance company focused on performing credit lending to middle-market companies as well as small businesses. TCPC lends primarily to companies with established market positions, strong regional or national operations, differentiated products and servic ...

greatlink - Great Eastern Life

... # Information refers to Fidelity Funds – Emerging Markets Fund SR-ACC-SGD DISCLAIMER: This factsheet is compiled by Great Eastern Life. The information presented is for informational use only. A product summary and a Product Highlights Sheet in relation to the Fund may be obtained through Great East ...

... # Information refers to Fidelity Funds – Emerging Markets Fund SR-ACC-SGD DISCLAIMER: This factsheet is compiled by Great Eastern Life. The information presented is for informational use only. A product summary and a Product Highlights Sheet in relation to the Fund may be obtained through Great East ...

Introduction to Bloomberg

... security, you can choose from among the following and many other options. You can also skip the first three steps and go directly to the equity features by entering the ticker symbol and the Equity button (F8). For example, entering HD Equity (F8) would take you directly to the equity features for H ...

... security, you can choose from among the following and many other options. You can also skip the first three steps and go directly to the equity features by entering the ticker symbol and the Equity button (F8). For example, entering HD Equity (F8) would take you directly to the equity features for H ...

EXPLORING ALtERNAtIvE INvEstmENts Hedge Funds | Managed

... It must be noted that endowments generally enjoy longer time horizons than do most individual investors, allowing for a greater consideration of less liquid investment strategies. With shorter time horizons and additional constraints to take into account, individual investors are not afforded such f ...

... It must be noted that endowments generally enjoy longer time horizons than do most individual investors, allowing for a greater consideration of less liquid investment strategies. With shorter time horizons and additional constraints to take into account, individual investors are not afforded such f ...

BVR8ppt

... estimating debt ratios: For most companies, using book values will yield a lower cost of capital than using market value weights. Since accounting returns are computed based upon book value, consistency requires the use of book value in computing cost of capital: While it may seem consistent to use ...

... estimating debt ratios: For most companies, using book values will yield a lower cost of capital than using market value weights. Since accounting returns are computed based upon book value, consistency requires the use of book value in computing cost of capital: While it may seem consistent to use ...

Deepening diversification in trust portfolios

... neutrality—has an inherent advantage over other types of investors. Endowments can invest with a time horizon extending into perpetuity. This makes it possible for Yale and its peers to fund large allocations to alternatives, including illiquid assets such as private equity, venture capital, and di ...

... neutrality—has an inherent advantage over other types of investors. Endowments can invest with a time horizon extending into perpetuity. This makes it possible for Yale and its peers to fund large allocations to alternatives, including illiquid assets such as private equity, venture capital, and di ...

FocusPoint - NN Investment Partners

... Please note that the value of your investment may rise or fall and also that past performance is not indicative of future results and shall in no event be deemed as such. This document and information contained herein must not be copied, reproduced, distributed or passed to any person at any time wi ...

... Please note that the value of your investment may rise or fall and also that past performance is not indicative of future results and shall in no event be deemed as such. This document and information contained herein must not be copied, reproduced, distributed or passed to any person at any time wi ...

Appendix E (BIS Business Support)

... Small Business Research Initiative - SBRI: The SBRI programme uses the power of government procurement to drive innovation. It provides opportunities for innovative companies to engage with the public sector to solve specific problems. London has been the most successful region in the UK for busines ...

... Small Business Research Initiative - SBRI: The SBRI programme uses the power of government procurement to drive innovation. It provides opportunities for innovative companies to engage with the public sector to solve specific problems. London has been the most successful region in the UK for busines ...

Chapter 5 The Time Value of Money

... For example, when being appraised, managers want to be judged relative to accounting numbers, such as profits and return on investment (ROI), because they can control these numbers to some extent. ...

... For example, when being appraised, managers want to be judged relative to accounting numbers, such as profits and return on investment (ROI), because they can control these numbers to some extent. ...

iv special features - European Central Bank

... equity declines as well, and so does the rate of return investors require to hold equity. This effect offsets the increased weight of the more expensive equity in the capital structure, so that – absent taxes and other frictions – the overall cost of capital stays unchanged as bank leverage varies.1 ...

... equity declines as well, and so does the rate of return investors require to hold equity. This effect offsets the increased weight of the more expensive equity in the capital structure, so that – absent taxes and other frictions – the overall cost of capital stays unchanged as bank leverage varies.1 ...

required rate of return2

... methodology just described, and make adjustments for what they feel are better estimates of future risk. ...

... methodology just described, and make adjustments for what they feel are better estimates of future risk. ...

Finance Glossary of Terms

... Fund Functioning as Endowment (FFE) – Also known as “quasi-endowment.” An endowed fund which has been invested and administered as if it were a true endowment, with one exception: funds functioning as endowments may be expended in their entirety, i.e. the corpus may be invaded. General Endowment Poo ...

... Fund Functioning as Endowment (FFE) – Also known as “quasi-endowment.” An endowed fund which has been invested and administered as if it were a true endowment, with one exception: funds functioning as endowments may be expended in their entirety, i.e. the corpus may be invaded. General Endowment Poo ...

Investment Principles

... useful a ratio must be compared with: – Ratios from a previous period – The same ratio from a different firm (within ...

... useful a ratio must be compared with: – Ratios from a previous period – The same ratio from a different firm (within ...

Capital Structure: Basic Concepts

... Proposition I holds because shareholders can achieve any pattern of payouts they desire with homemade leverage. In a world of no taxes, M&M Proposition II states that leverage increases the risk and return to stockholders. ...

... Proposition I holds because shareholders can achieve any pattern of payouts they desire with homemade leverage. In a world of no taxes, M&M Proposition II states that leverage increases the risk and return to stockholders. ...

Click to download DSM LCG NOVEMBER 2011

... strong, albeit a bit slower than prior levels. Simply put, corporate balance sheets, profit margins and cash flows are in great shape. In the US, it is likely that year-over-year S&P 500 revenue and earnings growth will comfortably reach “double-digits”, easily exceeding expectations. Uncertainty re ...

... strong, albeit a bit slower than prior levels. Simply put, corporate balance sheets, profit margins and cash flows are in great shape. In the US, it is likely that year-over-year S&P 500 revenue and earnings growth will comfortably reach “double-digits”, easily exceeding expectations. Uncertainty re ...

The Henderson Global Equity Income Fund is designed to generate

... the MSCI World Index is reduced to around 20%. A global remit also maximises the opportunities at a sector level. For example, there are more higher yielding technology companies in the US or Asia than there are in Europe. Please consider before investing: Past performance is not a guide to future ...

... the MSCI World Index is reduced to around 20%. A global remit also maximises the opportunities at a sector level. For example, there are more higher yielding technology companies in the US or Asia than there are in Europe. Please consider before investing: Past performance is not a guide to future ...

Let`s Suppose... - Franklin Templeton Investments

... 5. Source: Morningstar®, 3/31/17. For each mutual fund and exchange traded fund with at least a 3-year history, Morningstar calculates a Morningstar Rating™ based on how a fund ranks on a Morningstar Risk-Adjusted Return measure against other funds in the same category. This measure takes into accou ...

... 5. Source: Morningstar®, 3/31/17. For each mutual fund and exchange traded fund with at least a 3-year history, Morningstar calculates a Morningstar Rating™ based on how a fund ranks on a Morningstar Risk-Adjusted Return measure against other funds in the same category. This measure takes into accou ...

“...one of the more evocative of the soft commodities and a hugely

... more difficult. Second, if growth problems in emerging economies lead to widespread debt defaults, this could feed back into the western financial system, were the exposure of banks to bad debt to limit their capacity to lend to western consumers and businesses. Taking the latter possibility first, ...

... more difficult. Second, if growth problems in emerging economies lead to widespread debt defaults, this could feed back into the western financial system, were the exposure of banks to bad debt to limit their capacity to lend to western consumers and businesses. Taking the latter possibility first, ...

arehousing demand on the rise, set to outstrip that for office space

... 100 per cent foreign direct investment (FDI) in warehouses and food storage facilities under automatic routes (where manufacturers can sell their products online directly) has made the sector attractive to foreign PE players. Private equity funds Already, some private equity funds that have invested ...

... 100 per cent foreign direct investment (FDI) in warehouses and food storage facilities under automatic routes (where manufacturers can sell their products online directly) has made the sector attractive to foreign PE players. Private equity funds Already, some private equity funds that have invested ...

Franklin Quotential Balanced Income Portfolio Series A

... Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus or fund facts document before investing. The indicated rates of return are historical annual compounded total returns including changes in unit value and rei ...

... Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus or fund facts document before investing. The indicated rates of return are historical annual compounded total returns including changes in unit value and rei ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.