Sale of Cascade Plaza - Sunstone Realty Advisors

... gross sale price of $25.5 million less standard closing costs and adjustments, including third party real estate commission. The Sunstone LP acquired its 50% interest in August 2004 for a purchase price of $19.85 million plus standard closing costs and adjustments. The remaining balance of the first ...

... gross sale price of $25.5 million less standard closing costs and adjustments, including third party real estate commission. The Sunstone LP acquired its 50% interest in August 2004 for a purchase price of $19.85 million plus standard closing costs and adjustments. The remaining balance of the first ...

Promoting and supporting SME development – the case of Kenya

... Streamlined due diligence; 7-day initial review; Standardized equity products and legal documents ...

... Streamlined due diligence; 7-day initial review; Standardized equity products and legal documents ...

Do large cash holdings and low leverage always

... This study provides the first empirical evidence on the validity of the ex ante investment efficiency measure in Biddle, Hilary, and Verdi (2009) and improves its ability to capture inefficient investments. We find that investments improve rather than deteriorate future performance for firms that ar ...

... This study provides the first empirical evidence on the validity of the ex ante investment efficiency measure in Biddle, Hilary, and Verdi (2009) and improves its ability to capture inefficient investments. We find that investments improve rather than deteriorate future performance for firms that ar ...

Theory of the Firm: Managerial Behavior, Agency Costs and

... • tastes of managers, the ease with which they can exercise their own preferences as opposed to value maximization in decision making, and the costs of monitoring and bonding activities. • cost of measuring the manager’s (agent’s) performance and evaluating it, the cost of devising and applying an i ...

... • tastes of managers, the ease with which they can exercise their own preferences as opposed to value maximization in decision making, and the costs of monitoring and bonding activities. • cost of measuring the manager’s (agent’s) performance and evaluating it, the cost of devising and applying an i ...

“Risk-On” Sentiment Leads to Rally in 4th Quarter

... The Price of Safety The major theme of 2011 was sentiment-driven equity market volatility and the resultant investor “flight to safety”. Bearish on Eurozone growth prospects and worried about financial sector exposure to potential sovereign debt defaults, investors have flocked to US dollar-based “s ...

... The Price of Safety The major theme of 2011 was sentiment-driven equity market volatility and the resultant investor “flight to safety”. Bearish on Eurozone growth prospects and worried about financial sector exposure to potential sovereign debt defaults, investors have flocked to US dollar-based “s ...

Corporate Taxation Chapter Three: Capital Structure Professors Wells Presentation:

... General Rule: The debt is payable in the equity of the issuer (or a related party). No deduction is allowed for interest paid or accrued on this “disqualified debt instrument”. Exception: Rev. Rul. 2003-97, Merrill Lynch’s “feline prides” – 5 year note and 3 year forward contract to purchase issuer’ ...

... General Rule: The debt is payable in the equity of the issuer (or a related party). No deduction is allowed for interest paid or accrued on this “disqualified debt instrument”. Exception: Rev. Rul. 2003-97, Merrill Lynch’s “feline prides” – 5 year note and 3 year forward contract to purchase issuer’ ...

Portfolios Factsheet April 2017 United Asian Local Currency

... Any extraordinary performance may be due to exceptional circumstances which may not be sustainable. The value of Units and any income from the Fund(s) may fall as well as rise. The above information is strictly for general information only and must not be construed as an offer or solicitation to dea ...

... Any extraordinary performance may be due to exceptional circumstances which may not be sustainable. The value of Units and any income from the Fund(s) may fall as well as rise. The above information is strictly for general information only and must not be construed as an offer or solicitation to dea ...

Catalyst - dealmakers.co.za

... what sets it apart from the rest of the private equity funds. Actis, a leading emerging market investor, lifted the lid on the R760m ($54m) deal in November; it had been simmering away for almost two-and-a-half years. Food Lover’s Market is estimated to be the largest independent food retail group i ...

... what sets it apart from the rest of the private equity funds. Actis, a leading emerging market investor, lifted the lid on the R760m ($54m) deal in November; it had been simmering away for almost two-and-a-half years. Food Lover’s Market is estimated to be the largest independent food retail group i ...

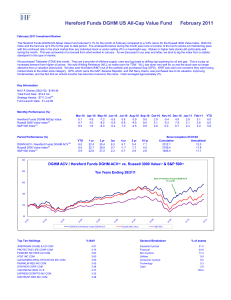

Click to download DGHM ACV FEBRUARY 2011

... The Hereford Funds DGHM US Allcap Value Fund returned 3.1% for the month of February compared to a 3.8% return for the Russell 3000 Value Index. Both the index and the fund are up 6.0% for the year to date period. The underperformance during the month was more a function of the fund’s stocks not mai ...

... The Hereford Funds DGHM US Allcap Value Fund returned 3.1% for the month of February compared to a 3.8% return for the Russell 3000 Value Index. Both the index and the fund are up 6.0% for the year to date period. The underperformance during the month was more a function of the fund’s stocks not mai ...

Trade-off theory

... using a machine having a fixed cost of $10,000 and variable costs of $1.00 per deck of cards. The other method would use a less expensive machine (fixed cost = $5,000), but it would require greater variable costs ($1.50 per deck of cards). If the selling price per deck of cards will be the same unde ...

... using a machine having a fixed cost of $10,000 and variable costs of $1.00 per deck of cards. The other method would use a less expensive machine (fixed cost = $5,000), but it would require greater variable costs ($1.50 per deck of cards). If the selling price per deck of cards will be the same unde ...

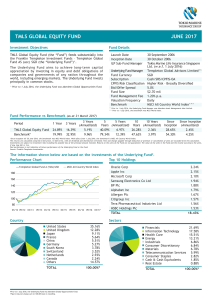

tmls global equity fund june 2017

... corporate earnings strength against the perception of elevated political risk in major western economies. Market trends shifted as the reflationary “Trump Trade” gave way to a more cautious view. • The portfolio underperformed its benchmark during the quarter. Market trends shifted as the pro-cycli ...

... corporate earnings strength against the perception of elevated political risk in major western economies. Market trends shifted as the reflationary “Trump Trade” gave way to a more cautious view. • The portfolio underperformed its benchmark during the quarter. Market trends shifted as the pro-cycli ...

SQUARING THE CIRCLE: HOW TO RECONCILE INVESTMENT PRINCIPLES WITH INVESTMENT ASPIRATIONS

... Financial investment is a complex business for all investors, from pension funds, to institutions, to endowments. Investors should reconcile the need to generate sustainable financial performance and fulfil their fiduciary responsibilities with the desire to invest responsibly to avoid damage to bot ...

... Financial investment is a complex business for all investors, from pension funds, to institutions, to endowments. Investors should reconcile the need to generate sustainable financial performance and fulfil their fiduciary responsibilities with the desire to invest responsibly to avoid damage to bot ...

Protecting Against Alternative Investment Risk

... for use with individual investors. This material may be distributed/issued in Canada, Australia and New Zealand by BlackRock Financial Management Inc. (BFM), which is registered as an International Advisor with the Ontario Securities Commission. In Australia, BFM is exempted under ASIC Class Order 0 ...

... for use with individual investors. This material may be distributed/issued in Canada, Australia and New Zealand by BlackRock Financial Management Inc. (BFM), which is registered as an International Advisor with the Ontario Securities Commission. In Australia, BFM is exempted under ASIC Class Order 0 ...

CHAPTER 9 The Cost of Capital

... More risky; although the firm has the option not to pay preferred dividend under certain circumstances. However, under company law, if preferred dividend is not paid (1) firm cannot pay common dividend, & (2) difficult to raise additional external funds. ...

... More risky; although the firm has the option not to pay preferred dividend under certain circumstances. However, under company law, if preferred dividend is not paid (1) firm cannot pay common dividend, & (2) difficult to raise additional external funds. ...

Downlaod File

... The WACC help to make long term capital investment decisions such as, capital budgeting. However, the types of capital include the WACC are used to pay for long term assets which is typically long term debt, common stock and preferred stock if it already used. The sources in the short term consist b ...

... The WACC help to make long term capital investment decisions such as, capital budgeting. However, the types of capital include the WACC are used to pay for long term assets which is typically long term debt, common stock and preferred stock if it already used. The sources in the short term consist b ...

Factsheet Total Emerging Markets Fund Class I USD

... Key Risks: The fund is actively managed and its characteristics will vary. Stock values fluctuate in price so the value of your investment can go down depending on market conditions. International investing involves special risks including, but not limited to currency fluctuations, illiquidity and v ...

... Key Risks: The fund is actively managed and its characteristics will vary. Stock values fluctuate in price so the value of your investment can go down depending on market conditions. International investing involves special risks including, but not limited to currency fluctuations, illiquidity and v ...

Download Document

... liability companies where there is no recourse to shareholders, this can alternatively be viewed as having lenders that are short a put option on the firm’s assets. Rather than pay debts when due, shareholders can merely deliver the assets of the firm to the creditors as part of a bankruptcy process ...

... liability companies where there is no recourse to shareholders, this can alternatively be viewed as having lenders that are short a put option on the firm’s assets. Rather than pay debts when due, shareholders can merely deliver the assets of the firm to the creditors as part of a bankruptcy process ...

Communiqué de presse

... in fixed income portfolios with a core focus on credit default swap (CDS) indices to deliver additional liquidity. The two parties have come together to launch UBP PG - Active Income, a strategy that will provide qualified investors with global exposure to private debt and credit markets. Co-managed ...

... in fixed income portfolios with a core focus on credit default swap (CDS) indices to deliver additional liquidity. The two parties have come together to launch UBP PG - Active Income, a strategy that will provide qualified investors with global exposure to private debt and credit markets. Co-managed ...

Investment Philosophy - St. Croix Valley Foundation

... Fixed Income. Bonds will represent 32% to 48% of the market value of the total long-term portfolio, with a targeted average of 40%. The objective is to earn a competitive yield with moderate risk to investment capital by investing in assets which have a maturity range from one to thirty years. The ...

... Fixed Income. Bonds will represent 32% to 48% of the market value of the total long-term portfolio, with a targeted average of 40%. The objective is to earn a competitive yield with moderate risk to investment capital by investing in assets which have a maturity range from one to thirty years. The ...

View White Paper - Winslow Capital

... Finding Opportunity through the Lens of Capital Allocation ...

... Finding Opportunity through the Lens of Capital Allocation ...

Processing`s Domino Effect

... One merchant-processing executive who speaks highly of his experiences with private-equity firms is Andrew Rueff, senior vice president of corporate development at Dallas-based TransFirst Holdings Inc. TransFirst was sold for $683 million this spring by one private-equity firm, GTCR Golder Rauner LL ...

... One merchant-processing executive who speaks highly of his experiences with private-equity firms is Andrew Rueff, senior vice president of corporate development at Dallas-based TransFirst Holdings Inc. TransFirst was sold for $683 million this spring by one private-equity firm, GTCR Golder Rauner LL ...

Co-operators Ethical Select Growth Portfolio - The Co

... $50 PAD or $250 lump sum NEI Investments ...

... $50 PAD or $250 lump sum NEI Investments ...

May 2014

... For professional investors only. The views and opinions contained herein are those of the Portfolio Solutions Team at Schroders, and do not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This newsletter is intended to be for information pur ...

... For professional investors only. The views and opinions contained herein are those of the Portfolio Solutions Team at Schroders, and do not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This newsletter is intended to be for information pur ...

Investment treaties: the emerging crisis

... between governments are allowing private companies and investors to sue countries for millions or even billions of dollars. The most recent cases involving investment include a $1.8 billion judgment against Ecuador obtained by the US oil company Occidental Petroleum, a $2 billion suit filed against ...

... between governments are allowing private companies and investors to sue countries for millions or even billions of dollars. The most recent cases involving investment include a $1.8 billion judgment against Ecuador obtained by the US oil company Occidental Petroleum, a $2 billion suit filed against ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.