Investment treaties: the emerging crisis

... between governments are allowing private companies and investors to sue countries for millions or even billions of dollars. The most recent cases involving investment include a $1.8 billion judgment against Ecuador obtained by the US oil company Occidental Petroleum, a $2 billion suit filed against ...

... between governments are allowing private companies and investors to sue countries for millions or even billions of dollars. The most recent cases involving investment include a $1.8 billion judgment against Ecuador obtained by the US oil company Occidental Petroleum, a $2 billion suit filed against ...

Practice set and Solutions 1

... The financial crisis and the collapse in stock and other security prices produced a sharp drop in mutual fund activity. At the end of 2008, total assets fell to $9,601.1 billion and the number of accounts to 264,499. Investor demand for certain types of mutual funds plummeted, driven in large part b ...

... The financial crisis and the collapse in stock and other security prices produced a sharp drop in mutual fund activity. At the end of 2008, total assets fell to $9,601.1 billion and the number of accounts to 264,499. Investor demand for certain types of mutual funds plummeted, driven in large part b ...

SAVINGS AND INNOVATION IN THE US CAPITAL MARKET

... developed an equilibrium model where they show that in a world where consumers are concerned about lifetime consumption it does make sense for the consumers (who are also the savers) to invest in options on future consumption. (Technically Breeden and Litzenberger show that if individuals have time- ...

... developed an equilibrium model where they show that in a world where consumers are concerned about lifetime consumption it does make sense for the consumers (who are also the savers) to invest in options on future consumption. (Technically Breeden and Litzenberger show that if individuals have time- ...

Delta Strategy Group Summary of Open Meeting (October 13, 2016)

... requests. Funds must classify their assets into four categories, which are based on how quickly the asset can be sold for cash. Commissioner Piwowar: The liquidity risk management recommendation reflects thoughtful consideration of comments received, and it makes many improvements to the original pr ...

... requests. Funds must classify their assets into four categories, which are based on how quickly the asset can be sold for cash. Commissioner Piwowar: The liquidity risk management recommendation reflects thoughtful consideration of comments received, and it makes many improvements to the original pr ...

Examination for FUNDAMENTAL ACCOUNTING

... beyond the end of the current period and should be charged to an asset. 9. When a company records a credit sale, the acid-test ratio will increase. 10. Data from one or more direct competitors of the company under analysis are usually preferred for developing standards for comparisons. ...

... beyond the end of the current period and should be charged to an asset. 9. When a company records a credit sale, the acid-test ratio will increase. 10. Data from one or more direct competitors of the company under analysis are usually preferred for developing standards for comparisons. ...

quantitative finance after the recent financial crisis

... time. Then it is not clear at all whether a rational individual should use the strategy, as those 1 percent cases may lead to huge losses. However, it is ...

... time. Then it is not clear at all whether a rational individual should use the strategy, as those 1 percent cases may lead to huge losses. However, it is ...

Investor Guide - Private Wealth Pools

... The fixed income and equity pools provide a 5% annual fixed rate distribution, which is paid monthly and is tax deferred (for corporate class). The income balanced pools provide a 4% annual fixed rate distribution that is paid monthly and is tax deferred (for corporate class). ...

... The fixed income and equity pools provide a 5% annual fixed rate distribution, which is paid monthly and is tax deferred (for corporate class). The income balanced pools provide a 4% annual fixed rate distribution that is paid monthly and is tax deferred (for corporate class). ...

Key investor information.

... by changes in the price of the investments. The fund mitigates this market risk by means of careful selection and diversification of investments. For a complete overview of all the risks attached to this fund please refer to the section Risk Factors within the prospectus. ...

... by changes in the price of the investments. The fund mitigates this market risk by means of careful selection and diversification of investments. For a complete overview of all the risks attached to this fund please refer to the section Risk Factors within the prospectus. ...

LU0028118809

... recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustr ...

... recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustr ...

harvard, yale, and alternative investments: a post

... Over 7,000 current charter holders in more than 80 countries Almost 20 vibrant chapters located in financial centers around the ...

... Over 7,000 current charter holders in more than 80 countries Almost 20 vibrant chapters located in financial centers around the ...

European Fund for Strategic Investment (EFSI) and EFSI

... IP Investors Other investors (incl. NPBs) ...

... IP Investors Other investors (incl. NPBs) ...

Need to Know

... money is currently limited, there is little competition among venture capitalists for startups. Therefore, VCs can negotiate tougher terms with companies in need of money. For instance, in a pertinent business journal article, one venture capitalist states “[w]e might get certain features in deals n ...

... money is currently limited, there is little competition among venture capitalists for startups. Therefore, VCs can negotiate tougher terms with companies in need of money. For instance, in a pertinent business journal article, one venture capitalist states “[w]e might get certain features in deals n ...

High tech venture-capital and the industrial revolution

... • Third stage – profitable but cash poor. Rapid expansion requires more working capital. Banks would supply some credit. • Fourth stage – rapid growth toward liquidity. Debt financing may be preferable to limit equity dilution. • Bridge stage – mezzanine investment. Exit vehicle and approximate timi ...

... • Third stage – profitable but cash poor. Rapid expansion requires more working capital. Banks would supply some credit. • Fourth stage – rapid growth toward liquidity. Debt financing may be preferable to limit equity dilution. • Bridge stage – mezzanine investment. Exit vehicle and approximate timi ...

Financial Markets and the Financing Choice of Firms

... when interest rates are controlled and the real after-tax cost of debt is negative (India going public; direct costs and underpinning. Together, these costs average 21.22% of the realized market value of securities issued for “firm commitments” offer and 31.87% for “best efforts” offers. ...

... when interest rates are controlled and the real after-tax cost of debt is negative (India going public; direct costs and underpinning. Together, these costs average 21.22% of the realized market value of securities issued for “firm commitments” offer and 31.87% for “best efforts” offers. ...

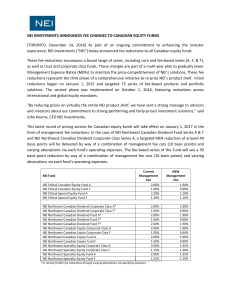

NEI Investments announces fee changes to Canadian equity funds

... experience, NEI Investments (“NEI”) today announced fee reductions to all Canadian equity funds. These fee reductions encompass a broad range of series, including core and fee-based series (A, F, & T), as well as trust and corporate class funds. These changes are part of a multi-year plan to gradual ...

... experience, NEI Investments (“NEI”) today announced fee reductions to all Canadian equity funds. These fee reductions encompass a broad range of series, including core and fee-based series (A, F, & T), as well as trust and corporate class funds. These changes are part of a multi-year plan to gradual ...

ifs_quickguide-0114

... rate of interest based on the face value of the bond when issued. TIPS bonds are designed to provide long-term inflation protection by attaching the face value of the bond to changes in inflation. When inflation increases, the face value of the bond also increases. If inflation becomes negative, the ...

... rate of interest based on the face value of the bond when issued. TIPS bonds are designed to provide long-term inflation protection by attaching the face value of the bond to changes in inflation. When inflation increases, the face value of the bond also increases. If inflation becomes negative, the ...

6. Key Indicators

... • Demonstrates ability to liquidate the firm, cover all liabilities out of all assets, and still have “cash” left over. • Should not exceed 0.50 to minimize financial risk exposure. • Some firms fail however at lower levels. 2. Leverage ratio: • Total debt divided by equity or net worth. • Often a c ...

... • Demonstrates ability to liquidate the firm, cover all liabilities out of all assets, and still have “cash” left over. • Should not exceed 0.50 to minimize financial risk exposure. • Some firms fail however at lower levels. 2. Leverage ratio: • Total debt divided by equity or net worth. • Often a c ...

Combining active and passive managements in a portfolio

... than try to beat it. Of course it’s fair to point out that passive funds don’t replicate their indices exactly. Other things being equal, they will trail it by their annual management costs. However, passive funds’ costs are relatively low and have been decreasing steadily. Third, passive funds now ...

... than try to beat it. Of course it’s fair to point out that passive funds don’t replicate their indices exactly. Other things being equal, they will trail it by their annual management costs. However, passive funds’ costs are relatively low and have been decreasing steadily. Third, passive funds now ...

Satrix Top 40 Index Fund

... Emerging Market (EM) Index (+12%), Brazil’s Bovespa (+12%) and Hong Kong’s Hang Seng (+10%), but it’s also been a strong quarter for developed market (DM) equities with the Europe Stoxx 600 (+8%) and in the US the S&P 500 (+6%). With the first three months of the year now done on a normalisation in ...

... Emerging Market (EM) Index (+12%), Brazil’s Bovespa (+12%) and Hong Kong’s Hang Seng (+10%), but it’s also been a strong quarter for developed market (DM) equities with the Europe Stoxx 600 (+8%) and in the US the S&P 500 (+6%). With the first three months of the year now done on a normalisation in ...

Mutual Funds - Iowa State University Extension and Outreach

... additional shares. The distributions must be reported by the investor as income annually unless the mutual fund is part of a tax-deferred account – e.g., 401(k) or an IRA. “Some of the income will be reported as dividends on your income tax return and taxed at your ordinary tax rate and some will b ...

... additional shares. The distributions must be reported by the investor as income annually unless the mutual fund is part of a tax-deferred account – e.g., 401(k) or an IRA. “Some of the income will be reported as dividends on your income tax return and taxed at your ordinary tax rate and some will b ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.