Specific Investment Policy and Procedures – Restricted and

... management of risk or to facilitate an economical substitution for a direct investment. Under no circumstances will derivatives be used to create leveraging of the portfolios. Asset-backed commercial paper is considered a prohibited investment. 3.01 Return Objectives / Expectations The portfolios ar ...

... management of risk or to facilitate an economical substitution for a direct investment. Under no circumstances will derivatives be used to create leveraging of the portfolios. Asset-backed commercial paper is considered a prohibited investment. 3.01 Return Objectives / Expectations The portfolios ar ...

Mutual Fund Intermediation, Equity Issues, and the Real Economy

... I Aggregate issues predict lower stock returns (Pontiff and Woodgate 2008) I Long-run underperformance is more pronounced when institutions increase their holdings around the issue (Edelen, Ince and Kadlec 2013) I Maybe due to change in risk following new equity issues (Eckbo, Masulis and Norli 2000 ...

... I Aggregate issues predict lower stock returns (Pontiff and Woodgate 2008) I Long-run underperformance is more pronounced when institutions increase their holdings around the issue (Edelen, Ince and Kadlec 2013) I Maybe due to change in risk following new equity issues (Eckbo, Masulis and Norli 2000 ...

foundation market-based investment funds

... The asset targets for this fund are 85% invested in investment grade intermediate term debt obligations, 10% in high yield bonds and 5% in cash. There may be some fluctuation in principal values as assets may be sold before they mature to provide liquidity, and the asset values will fluctuate on a d ...

... The asset targets for this fund are 85% invested in investment grade intermediate term debt obligations, 10% in high yield bonds and 5% in cash. There may be some fluctuation in principal values as assets may be sold before they mature to provide liquidity, and the asset values will fluctuate on a d ...

ALLIANCE HEALTHCARE AND BOOTS RETIREMENT SAVINGS

... investing and highlight some of the things you need to think about before making any investment. In addition, you’ll be able to access Legal & General’s online Attitude to Risk and Retirement Planner tools, which can help you to understand how you feel about investment risk and consider what you nee ...

... investing and highlight some of the things you need to think about before making any investment. In addition, you’ll be able to access Legal & General’s online Attitude to Risk and Retirement Planner tools, which can help you to understand how you feel about investment risk and consider what you nee ...

NFU Mutual Flexible Retirement Account fund switch form

... A fund switch will use the prices that apply on the date we receive your written request. We have the right to delay a fund switch from the Property Fund for up to 12 months. We may also delay a fund switch from one of the other funds for up to 3 months. If we delay a fund switch we will use the p ...

... A fund switch will use the prices that apply on the date we receive your written request. We have the right to delay a fund switch from the Property Fund for up to 12 months. We may also delay a fund switch from one of the other funds for up to 3 months. If we delay a fund switch we will use the p ...

TIAA-CREF Emerging Markets Debt Fund

... Mutual fund investing involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Non-U.S. investments involve risks such as currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standard ...

... Mutual fund investing involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Non-U.S. investments involve risks such as currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standard ...

Cash Flow Summary

... Cash flow has increased significantly in 2003. As displayed above, there is an approximate increase of $1.9 billion. While there are underlying factors for such a dramatic increase, we can see from the CCD for the two years, solid liquidity and a substantial increase in the ratio: Cash current debt ...

... Cash flow has increased significantly in 2003. As displayed above, there is an approximate increase of $1.9 billion. While there are underlying factors for such a dramatic increase, we can see from the CCD for the two years, solid liquidity and a substantial increase in the ratio: Cash current debt ...

CH07 - U of L Class Index

... ◦ Have to estimate beta, which also varies over time ◦ We are relying on the past to predict the future, which is not always reliable ...

... ◦ Have to estimate beta, which also varies over time ◦ We are relying on the past to predict the future, which is not always reliable ...

(BPM6) and Fourth Edition

... to exercise influence over another entity that is resident of a different economy. FDI reflects the objective of gaining control or a significant degree of influence by an entity in one economy over the management of an enterprise resident in another economy FDI is usually a precondition for establi ...

... to exercise influence over another entity that is resident of a different economy. FDI reflects the objective of gaining control or a significant degree of influence by an entity in one economy over the management of an enterprise resident in another economy FDI is usually a precondition for establi ...

PNC Large Cap Value Fund

... through the end of September 2017. For more information on fee waivers or expense reimbursements please see the expense table in the prospectus. If the waivers or reimbursements were not in effect the Fund’s performance would have been lower. 2 The Russell 1000 Value Index, an unmanaged index of 1,0 ...

... through the end of September 2017. For more information on fee waivers or expense reimbursements please see the expense table in the prospectus. If the waivers or reimbursements were not in effect the Fund’s performance would have been lower. 2 The Russell 1000 Value Index, an unmanaged index of 1,0 ...

Session 6: Post Class tests 1. The equity risk premium

... geometric averages. The standard error is computed by dividing the standard deviation of 20% by the square root of 100. 4. c. A historical risk premium with only ten to fifteen years of data will ...

... geometric averages. The standard error is computed by dividing the standard deviation of 20% by the square root of 100. 4. c. A historical risk premium with only ten to fifteen years of data will ...

06042015-Minutes-kl

... A MOTION TO APROVE THE MINUTES FROM MARCH 27, 2014 was made by Mr. Berube and seconded by Mr. Carr; MOTION CARRIED UNANIMOUSLY. ...

... A MOTION TO APROVE THE MINUTES FROM MARCH 27, 2014 was made by Mr. Berube and seconded by Mr. Carr; MOTION CARRIED UNANIMOUSLY. ...

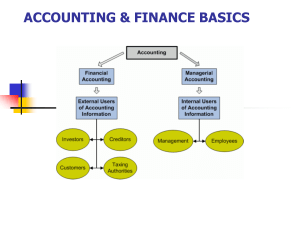

WIS ACCOUNTING BASICS

... affects three financial statements. Assets and equity increase on the balance sheet. The recognition of revenue causes net income to increase, and the cash inflow is shown as an operating activity on the statement of cash flows. Event No. 4 is the opposite of Event No. 3. Assets, equity and net inco ...

... affects three financial statements. Assets and equity increase on the balance sheet. The recognition of revenue causes net income to increase, and the cash inflow is shown as an operating activity on the statement of cash flows. Event No. 4 is the opposite of Event No. 3. Assets, equity and net inco ...

1494308082-Create a 10

... (a)What is the par or stated value of Coca-Cola's and PepsiCo's common or capital stock? (b)What percentage of authorized shares was issued by Coca-Cola at December 31, 2014, and by PepsiCo at December 31, 2014? (c)How many shares are held as treasury stock by Coca-Cola at December 31, 2014, and by ...

... (a)What is the par or stated value of Coca-Cola's and PepsiCo's common or capital stock? (b)What percentage of authorized shares was issued by Coca-Cola at December 31, 2014, and by PepsiCo at December 31, 2014? (c)How many shares are held as treasury stock by Coca-Cola at December 31, 2014, and by ...

Ind.

... If the building price is RM250 M, and the company put down RM50 M, the company can use the loan to leverage that cash so the ...

... If the building price is RM250 M, and the company put down RM50 M, the company can use the loan to leverage that cash so the ...

05 HF LCG MAY 2009

... in the stock market can be attributed to massive increases in the money supply created by Central Banks around the world. This cash must go somewhere, and because the “real economy” can not absorb the cash, much of it is finding its way into the stock market, driving prices higher. Some investors fe ...

... in the stock market can be attributed to massive increases in the money supply created by Central Banks around the world. This cash must go somewhere, and because the “real economy” can not absorb the cash, much of it is finding its way into the stock market, driving prices higher. Some investors fe ...

A REVIEW OF THE CAPITAL STRUCTURE THEORIES Popescu

... unlikely characterization of how real businesses are financed. A popular defense has been to argue as follows: “While the Modigliani-Miller theorem does not provide a realistic description of how firms finance their operations, it provides a means of finding reasons why financing may matter.” This d ...

... unlikely characterization of how real businesses are financed. A popular defense has been to argue as follows: “While the Modigliani-Miller theorem does not provide a realistic description of how firms finance their operations, it provides a means of finding reasons why financing may matter.” This d ...

Risk, Return and Capital Budgeting

... the analysis, it is more difficult to convert between asset and equity β’s and thus it is more difficult to use comparable firms’ data to determine the overall cost of capital for a specific project. The reason is that debt interest payments reduce taxes; thus, holding fixed the risk of the before-t ...

... the analysis, it is more difficult to convert between asset and equity β’s and thus it is more difficult to use comparable firms’ data to determine the overall cost of capital for a specific project. The reason is that debt interest payments reduce taxes; thus, holding fixed the risk of the before-t ...

Global Equity Tracker

... for example, technology. This increases the risk to you if this is your only investment. That's why it's best used in combination with other funds or types of investment so you're not entirely reliant on the success of one region or type of company. Some funds in this category may be more suitable f ...

... for example, technology. This increases the risk to you if this is your only investment. That's why it's best used in combination with other funds or types of investment so you're not entirely reliant on the success of one region or type of company. Some funds in this category may be more suitable f ...

Opportunities for Small Life Insurance Companies to Improve Asset

... asset allocation decisions and risk tolerance levels. With the exception of the 2008 crisis period, overall bond yields have declined meaningfully over the last decade, and opportunities to invest for yield have diminished. Looking at Figure 7, we can see smaller companies’ net yield has been impact ...

... asset allocation decisions and risk tolerance levels. With the exception of the 2008 crisis period, overall bond yields have declined meaningfully over the last decade, and opportunities to invest for yield have diminished. Looking at Figure 7, we can see smaller companies’ net yield has been impact ...

BT Core Hedged Global Share Fund

... Performance returns are calculated net of ICR (Management Fees) and pre tax. Past performance is not a reliable indicator of future performance, the value of your investment can go up and down. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Tota ...

... Performance returns are calculated net of ICR (Management Fees) and pre tax. Past performance is not a reliable indicator of future performance, the value of your investment can go up and down. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Tota ...

Outlook June 2016 #68

... Moreover, unlike in the United Kingdom, the U.S. prediction (betting) markets and the polls are in agreement, with the prediction markets assigning a 68% likelihood of a Clinton victory in November. In summary, the equity markets still face a variety of challenges. They are confronted with massive o ...

... Moreover, unlike in the United Kingdom, the U.S. prediction (betting) markets and the polls are in agreement, with the prediction markets assigning a 68% likelihood of a Clinton victory in November. In summary, the equity markets still face a variety of challenges. They are confronted with massive o ...

General - Website

... For existing and start up businesses£10000 to £100,000, secured and unsecured. Average deal size currently £25k. Up to 7 year loan period . Average 5 years. Can lend alone or as part of a package for large deals. Commercial rates of interest and fees- 12./base> min 10%. Compare banks for similar loa ...

... For existing and start up businesses£10000 to £100,000, secured and unsecured. Average deal size currently £25k. Up to 7 year loan period . Average 5 years. Can lend alone or as part of a package for large deals. Commercial rates of interest and fees- 12./base> min 10%. Compare banks for similar loa ...

Stars align for resurgent venture capital industry

... well. Accurately gauging a venture capitalist’s effectiveness with his or her portfolio companies is one of the challenges faced by limited partners. Another challenge is measuring the relative success of particular deals and indeed, individual entrepreneurs. “A comprehensive assessment can only rea ...

... well. Accurately gauging a venture capitalist’s effectiveness with his or her portfolio companies is one of the challenges faced by limited partners. Another challenge is measuring the relative success of particular deals and indeed, individual entrepreneurs. “A comprehensive assessment can only rea ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.