January 2017 - Franklin Templeton India

... on account of a slowdown in the growth momentum led by a sluggish investment recovery and private consumption. However, India continues to be fastest growing major economy among emerging markets supported by improving macroeconomic environment. The effects of currency replacement program have begun ...

... on account of a slowdown in the growth momentum led by a sluggish investment recovery and private consumption. However, India continues to be fastest growing major economy among emerging markets supported by improving macroeconomic environment. The effects of currency replacement program have begun ...

Private Placements and Infrastructure Finance.qxp

... companies as an alternative to bank loans or public bond issuance and as part of a diversified funding strategy. They are usually fixed-rate and longer-dated than bank loans (10 to 15 years on average). Examples of companies who have issued in the private placement market in recent years range from ...

... companies as an alternative to bank loans or public bond issuance and as part of a diversified funding strategy. They are usually fixed-rate and longer-dated than bank loans (10 to 15 years on average). Examples of companies who have issued in the private placement market in recent years range from ...

Hannah Capital Markets Proposal April 2006 Economic History

... The starting point is an estimate of the market values of outstanding corporate non- railway securities at the beginning of the century. Domestic railway securities were important in both London and New York (and to a lesser extent in Paris), but a case can be made for considering them separately. F ...

... The starting point is an estimate of the market values of outstanding corporate non- railway securities at the beginning of the century. Domestic railway securities were important in both London and New York (and to a lesser extent in Paris), but a case can be made for considering them separately. F ...

Insulin and Big Data Investing in Brazil

... implementing high governance standards aligned with improved technology that would lead to improved performance. Initially I bought two listed companies that were suppliers of the agribusiness sector and was able to bring them to performance. Upon restructuring those businesses, I sold them back to ...

... implementing high governance standards aligned with improved technology that would lead to improved performance. Initially I bought two listed companies that were suppliers of the agribusiness sector and was able to bring them to performance. Upon restructuring those businesses, I sold them back to ...

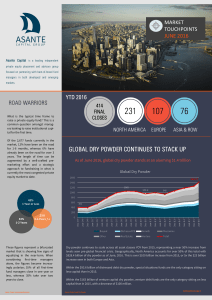

global dry powder continues to stack up

... As the market becomes increasingly bifurcated, the winners are closing oversubscribed funds faster than ever before. By the close of Q3, we expect the average number of months to final close to increase as funds that have been on the road for some time begin to close on capital. Source: Preqin Recen ...

... As the market becomes increasingly bifurcated, the winners are closing oversubscribed funds faster than ever before. By the close of Q3, we expect the average number of months to final close to increase as funds that have been on the road for some time begin to close on capital. Source: Preqin Recen ...

Did you notice - T3 Equity Labs LLC

... uncertainties and other factors could cause the actual results, financial position, development or performance to differ materially from the estimations presented herein. There is no guarantee; expressed or implied, investments involve risk. In making investment decisions it is your responsibility t ...

... uncertainties and other factors could cause the actual results, financial position, development or performance to differ materially from the estimations presented herein. There is no guarantee; expressed or implied, investments involve risk. In making investment decisions it is your responsibility t ...

Debt - IronHorse LLC

... • Easier to fund a $ 15 million deal than a $ 2 million deal. • Private equity sources generally want to put at least $ 5-8 million of their money to work. • Universe of small capital providers is specialized, scattered and expensive. • Costs about the same in terms of time to search, solicit, secur ...

... • Easier to fund a $ 15 million deal than a $ 2 million deal. • Private equity sources generally want to put at least $ 5-8 million of their money to work. • Universe of small capital providers is specialized, scattered and expensive. • Costs about the same in terms of time to search, solicit, secur ...

- Cambridge Capital Group

... Investors kept making up reasons to push stocks higher and higher with no fundamental basis. Like now, we felt very uncomfortable when managing previous portfolios during that period with the upside potential for equities and the stock market given the associated risk and repositioned a vast majorit ...

... Investors kept making up reasons to push stocks higher and higher with no fundamental basis. Like now, we felt very uncomfortable when managing previous portfolios during that period with the upside potential for equities and the stock market given the associated risk and repositioned a vast majorit ...

Firms and Financial Markets

... individuals and other financial institutions) to provide financing for private start-up companies when they are first founded. – For example, Venture capital firm, Kleiner Perkins Caufield & Byers (KPCB) was involved in the initial financing of Google. 2. Leveraged buyout firms acquire established f ...

... individuals and other financial institutions) to provide financing for private start-up companies when they are first founded. – For example, Venture capital firm, Kleiner Perkins Caufield & Byers (KPCB) was involved in the initial financing of Google. 2. Leveraged buyout firms acquire established f ...

xin zhang education experience projects

... Assisted in constructing private equity portfolios in energy and real estate sectors. Researched private equity confidential information memorandum to help selecting potential investment opportunities. Calculated the covariance matrix of different investment assets to optimize portfolios ...

... Assisted in constructing private equity portfolios in energy and real estate sectors. Researched private equity confidential information memorandum to help selecting potential investment opportunities. Calculated the covariance matrix of different investment assets to optimize portfolios ...

Beyond EBITDA: 5 Other Factors That Affect

... times revenue but ignored the fact that the business was a unique technology company growing at 300 percent annually. When talking to your clients, educate them on the importance of market factors. These include a big-picture profile of the company’s industry, industry trends, and opportunities for ...

... times revenue but ignored the fact that the business was a unique technology company growing at 300 percent annually. When talking to your clients, educate them on the importance of market factors. These include a big-picture profile of the company’s industry, industry trends, and opportunities for ...

The Missing Link: Financing the Industry

... companies that offer products and services that will benefit individuals with disabilities and add ease of use to these markets. We expect that the partnership will help to create a new clearing house of entrepreneurial investment opportunities within the industry. To that end, the goal of the partn ...

... companies that offer products and services that will benefit individuals with disabilities and add ease of use to these markets. We expect that the partnership will help to create a new clearing house of entrepreneurial investment opportunities within the industry. To that end, the goal of the partn ...

Corporate Financing

... a) Government Loss of Tax Revenues in LBO b) Wage Concessions after M & A ...

... a) Government Loss of Tax Revenues in LBO b) Wage Concessions after M & A ...

What effect has quantitative easing had on your share

... in these markets. Evidence from recent years shows ...

... in these markets. Evidence from recent years shows ...

Baltijas ieguldījumu fondu tirgus analīze

... Methodology and data (1) Choice of data 30 Baltic local domiciled equity funds; risk free rate – interest rate on Germany’s government 10 years bonds; benchmark portfolios – OMX Baltic Benchmark General Index (OMXBBGI) and MSCI Emerging Markets Eastern ...

... Methodology and data (1) Choice of data 30 Baltic local domiciled equity funds; risk free rate – interest rate on Germany’s government 10 years bonds; benchmark portfolios – OMX Baltic Benchmark General Index (OMXBBGI) and MSCI Emerging Markets Eastern ...

PRIVATE EQUITY PRIMER

... because companies today are so highly priced, the buy-and-bust approach rarely works anymore. In addition, banks and other lenders today are much more conservative about lending money for leveraged buyouts. As a result, buyouts today are financed with more equity. And the companies acquired are usua ...

... because companies today are so highly priced, the buy-and-bust approach rarely works anymore. In addition, banks and other lenders today are much more conservative about lending money for leveraged buyouts. As a result, buyouts today are financed with more equity. And the companies acquired are usua ...

2016 Capital Market Projections

... This chart articulates the asset mix and associated risk needed in order to achieve an expected 7.5% return at different points in history. ● Over time, achieving a 7.5% return has necessitated the assumption of three times the risk (standard deviation) ● Reality is that investors have had to make a ...

... This chart articulates the asset mix and associated risk needed in order to achieve an expected 7.5% return at different points in history. ● Over time, achieving a 7.5% return has necessitated the assumption of three times the risk (standard deviation) ● Reality is that investors have had to make a ...

October 2016 - Reynders, McVeigh Capital Management

... additional cash in response to current equity market strength. We are positioning clients to have a little extra liquidity to carry them through potential choppiness ahead, and we are adding “dry powder” in the form of ready cash to buy selected equities at discounts should markets correct. This tac ...

... additional cash in response to current equity market strength. We are positioning clients to have a little extra liquidity to carry them through potential choppiness ahead, and we are adding “dry powder” in the form of ready cash to buy selected equities at discounts should markets correct. This tac ...

mezzanine financing

... MB Capital investments are structured as subordinated investments with equity features. The investment term is usually for five years, requires payment of a market rate of interest and requires regular amortization of the investment. The equity component of the investment can take several forms. The ...

... MB Capital investments are structured as subordinated investments with equity features. The investment term is usually for five years, requires payment of a market rate of interest and requires regular amortization of the investment. The equity component of the investment can take several forms. The ...

XENETA RAISES $5.3 MILLION IN SERIES A

... 2003 and has in the last decade out of three funds with € 250 million under management invested in more than 40 companies, including Spotify, Epidemic Sound, Vivino, iZettle and Tictail. Visit www.creandum.com for more information. ...

... 2003 and has in the last decade out of three funds with € 250 million under management invested in more than 40 companies, including Spotify, Epidemic Sound, Vivino, iZettle and Tictail. Visit www.creandum.com for more information. ...

Gateway Low Volatility US Equity Fund

... REASONS TO INVEST IN GATEWAY LOW VOLATILITY U.S. EQUITY FUND FOCUS ON RISK-ADJUSTED RETURNS ...

... REASONS TO INVEST IN GATEWAY LOW VOLATILITY U.S. EQUITY FUND FOCUS ON RISK-ADJUSTED RETURNS ...

Private equity in the 2000s

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new ""Golden Age"" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007.