Actis Content - Rural Finance and Investment Learning Centre

... Achievable, but timescale can be longer, mitigated by yield-based return ...

... Achievable, but timescale can be longer, mitigated by yield-based return ...

THE CASE AGAINST INTEREST: IS IT COMPELLING?

... Reasons for the ineffectiveness of market discipline in the interest-based banking system: As a result of the absence of risk-sharing: Deposits are guaranteed - therefore depositors become complacent and do not monitor the banks carefully - do not demand transparency Banks rely on the crutches ...

... Reasons for the ineffectiveness of market discipline in the interest-based banking system: As a result of the absence of risk-sharing: Deposits are guaranteed - therefore depositors become complacent and do not monitor the banks carefully - do not demand transparency Banks rely on the crutches ...

FIN550 final exam

... Assume that the dividend payout ratio will be 55 percent when the rate on long-term government bonds falls to 9 percent. Since investors are becoming more risk averse, the equity risk premium will rise to 8 percent and investors will require a 7 percent return. The return on equity will be 13 percen ...

... Assume that the dividend payout ratio will be 55 percent when the rate on long-term government bonds falls to 9 percent. Since investors are becoming more risk averse, the equity risk premium will rise to 8 percent and investors will require a 7 percent return. The return on equity will be 13 percen ...

Edition 2 - 2017 - VZD Capital Management

... connect people thousands of miles away in milliseconds, it still isn’t possible to know exactly what the future will hold. As the philosopher Peter Drucker once said, “trying to predict the future is like trying to drive down a country road at night with no lights while looking out the back window.” ...

... connect people thousands of miles away in milliseconds, it still isn’t possible to know exactly what the future will hold. As the philosopher Peter Drucker once said, “trying to predict the future is like trying to drive down a country road at night with no lights while looking out the back window.” ...

THE CASE AGAINST INTEREST: IS IT COMPELLING?

... Reasons for the ineffectiveness of market discipline in the interest-based banking system: As a result of the absence of risk-sharing: Deposits are guaranteed - therefore depositors become complacent and do not monitor the banks carefully - do not demand transparency Banks rely on the crutches ...

... Reasons for the ineffectiveness of market discipline in the interest-based banking system: As a result of the absence of risk-sharing: Deposits are guaranteed - therefore depositors become complacent and do not monitor the banks carefully - do not demand transparency Banks rely on the crutches ...

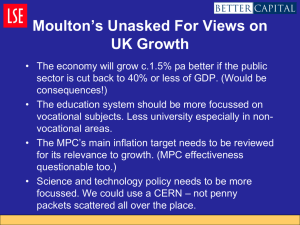

lseGC_30may2012_moulton

... • The education system should be more focussed on vocational subjects. Less university especially in nonvocational areas. • The MPC’s main inflation target needs to be reviewed for its relevance to growth. (MPC effectiveness questionable too.) • Science and technology policy needs to be more focusse ...

... • The education system should be more focussed on vocational subjects. Less university especially in nonvocational areas. • The MPC’s main inflation target needs to be reviewed for its relevance to growth. (MPC effectiveness questionable too.) • Science and technology policy needs to be more focusse ...

Download pdf | 172 KB |

... The biggest risk to the debt markets at present is the specter of a significant uptick in default rates Forecasters such as Moody’s expect the global default rate to almost triple over the next year The proliferation of highly leveraged deals “priced to perfection” over the past few years sugg ...

... The biggest risk to the debt markets at present is the specter of a significant uptick in default rates Forecasters such as Moody’s expect the global default rate to almost triple over the next year The proliferation of highly leveraged deals “priced to perfection” over the past few years sugg ...

PDF Download

... contracts between borrowers and banks were transformed into homogenous asset backed securities (ABSs), with distinct ratings, traded in global markets. Per se, securitisation is a good idea: by favouring diversification of mortgage risk, it can allow intermediaries to increase lending, to the benefi ...

... contracts between borrowers and banks were transformed into homogenous asset backed securities (ABSs), with distinct ratings, traded in global markets. Per se, securitisation is a good idea: by favouring diversification of mortgage risk, it can allow intermediaries to increase lending, to the benefi ...

4Q16 Firm Overview.ind.indd

... Wells Fargo Asset Management (WFAM) is a trade name used by the asset management businesses of Wells Fargo & Company. WFAM includes but is not limited to Analytic Investors, LLC; ECM Asset Management Ltd.; First International Advisors, LLC; Galliard Capital Management, Inc.; Golden Capital Managemen ...

... Wells Fargo Asset Management (WFAM) is a trade name used by the asset management businesses of Wells Fargo & Company. WFAM includes but is not limited to Analytic Investors, LLC; ECM Asset Management Ltd.; First International Advisors, LLC; Galliard Capital Management, Inc.; Golden Capital Managemen ...

Commentary by Skylands Capital LLC, Sub-Investment

... repurchases, and higher merger and acquisition activity. Further, given Perinvest Harbour US Equity investments in railroads, the fund manager tracks railroad car loadings on a weekly basis. Historically, this has been a good indicator for the economy. In recent months, railroad traffic has been sur ...

... repurchases, and higher merger and acquisition activity. Further, given Perinvest Harbour US Equity investments in railroads, the fund manager tracks railroad car loadings on a weekly basis. Historically, this has been a good indicator for the economy. In recent months, railroad traffic has been sur ...

Chapter 3 – Outline

... b. Spot Markets – assets that are bought and sold at current prices for immediate delivery c. Future Markets – assets that are bought and sold at a specified price to be delivered at a specified date d. Money Markets – assets that mature in a short period of time – typically less than one year e. Ca ...

... b. Spot Markets – assets that are bought and sold at current prices for immediate delivery c. Future Markets – assets that are bought and sold at a specified price to be delivered at a specified date d. Money Markets – assets that mature in a short period of time – typically less than one year e. Ca ...

Long-term Investing as asset prices rise

... been starved of investment in the seven years since the beginning of the Great Financial Crisis. Although rents have been rising, they remain below global average affordability levels. With a portfolio made up of close to 1,500 apartments and plenty of dry powder to buy assets at relatively attracti ...

... been starved of investment in the seven years since the beginning of the Great Financial Crisis. Although rents have been rising, they remain below global average affordability levels. With a portfolio made up of close to 1,500 apartments and plenty of dry powder to buy assets at relatively attracti ...

Please see the full description here.

... The Disciplined Equity Research Group at American Century Investments is looking for a sharp, critical thinker with a passion for analysis and big datasets. The work you do will directly contribute to enhancing the team’s research capabilities and stock-picking algorithms, which underlie over $13 bi ...

... The Disciplined Equity Research Group at American Century Investments is looking for a sharp, critical thinker with a passion for analysis and big datasets. The work you do will directly contribute to enhancing the team’s research capabilities and stock-picking algorithms, which underlie over $13 bi ...

Constructing the Appropriate Private Equity Investment

... US buyout investments of funds in which Adams Street Partners’ Core Portfolios invested on a primary basis, which investments were realized or substantially realized (all investments of which more than 90% of total value or initial investment cost have been realized) as of December 31, 2014. “Core P ...

... US buyout investments of funds in which Adams Street Partners’ Core Portfolios invested on a primary basis, which investments were realized or substantially realized (all investments of which more than 90% of total value or initial investment cost have been realized) as of December 31, 2014. “Core P ...

Venture Capital and SMEs Dr. Jay Jootar Faculty Member, College of Management

... other companies at much higher value than the investment ...

... other companies at much higher value than the investment ...

risk periods and “extreme” market conditions

... the hedge ratio is more like 75% - reducing carry and arbitrage profits …. But is this ratio too much protection? The Market has not really tested the hedge ratio except for small marked to market movements in a rallying spread environment. ...

... the hedge ratio is more like 75% - reducing carry and arbitrage profits …. But is this ratio too much protection? The Market has not really tested the hedge ratio except for small marked to market movements in a rallying spread environment. ...

About Alex - Hardy Financial Inc.

... Contact Alex: Bus: (416) 977.4804 ext. 112 Fax: (416) 977.0282 [email protected] www.hardyfinancialinc.com ...

... Contact Alex: Bus: (416) 977.4804 ext. 112 Fax: (416) 977.0282 [email protected] www.hardyfinancialinc.com ...

June 2002 - Roof Advisory Group

... For large fixed income positions, individual bonds are used to control risk through both quality and maturity. A client’s tax bracket/account type determines whether taxable or tax-free bonds are more advantageous. We typically emphasize short to mid term maturity investment-grade bonds, though redu ...

... For large fixed income positions, individual bonds are used to control risk through both quality and maturity. A client’s tax bracket/account type determines whether taxable or tax-free bonds are more advantageous. We typically emphasize short to mid term maturity investment-grade bonds, though redu ...

June 2008 Performance Review – Listed Hybrid Sector

... subsequent securities will trade at $90 implying yields in excess of 16%. We rate this alternative as the least likely as both issuers can finance from banks at much lower margins, although we suspect they will do a combination of equity and debt to refinance the hybrid. We have never seen this leve ...

... subsequent securities will trade at $90 implying yields in excess of 16%. We rate this alternative as the least likely as both issuers can finance from banks at much lower margins, although we suspect they will do a combination of equity and debt to refinance the hybrid. We have never seen this leve ...

Investment Letter: 8th May 2014 A cursory glance at the financial

... have ranked best in year to date returns. Whilst global aggregate equity performance has been flat overall, this has been a difficult patch for some equity managers. Particular themes that earned spades in 2013 have been less conductive this year. The bits that have hurt have been exposures to conce ...

... have ranked best in year to date returns. Whilst global aggregate equity performance has been flat overall, this has been a difficult patch for some equity managers. Particular themes that earned spades in 2013 have been less conductive this year. The bits that have hurt have been exposures to conce ...

the three stages of raising money

... one in ten first-round investments went further. If a firm does get off the ground and its future looks promising, it then goes through successive rounds of financing— second, third, fourth, and so on—until it is viable and ready for an IPO. New investments that come in during the later rounds are o ...

... one in ten first-round investments went further. If a firm does get off the ground and its future looks promising, it then goes through successive rounds of financing— second, third, fourth, and so on—until it is viable and ready for an IPO. New investments that come in during the later rounds are o ...

smarterinsightTM - Donald Wealth Management

... Equity markets have the ability to thrill and terrify investors in equal measure on a more or less daily basis - they always have and they always will. The present turmoil in the Eurozone and the lacklustre pace of recovery in the UK economy, combined with the sensationalist, headline grabbing repor ...

... Equity markets have the ability to thrill and terrify investors in equal measure on a more or less daily basis - they always have and they always will. The present turmoil in the Eurozone and the lacklustre pace of recovery in the UK economy, combined with the sensationalist, headline grabbing repor ...

Real Estate Investing

... The Search for a New Equilibrium • U.S. Economy is Facing a Protracted Economic Slump, One that Could Last a Decade or More • The Recent Rally in the “Dow” has been Accompanied by the Weakest U.S. GDP Growth of All the Bull Markets since 1949 • Paul Volcker Predicts that U.S. Structural Employment ...

... The Search for a New Equilibrium • U.S. Economy is Facing a Protracted Economic Slump, One that Could Last a Decade or More • The Recent Rally in the “Dow” has been Accompanied by the Weakest U.S. GDP Growth of All the Bull Markets since 1949 • Paul Volcker Predicts that U.S. Structural Employment ...

The Four Big Questions For Investors After `Black Monday

... for fearing the worst as billions were wiped off global indices. By mid-afternoon, the FTSE 100 had fallen 6%, although it recovered slightly to finish 4.7% lower at 5,899. This marked the first time the blue-chip index had sunk below the 6,000 mark since January 2013, with £96bn wiped off share val ...

... for fearing the worst as billions were wiped off global indices. By mid-afternoon, the FTSE 100 had fallen 6%, although it recovered slightly to finish 4.7% lower at 5,899. This marked the first time the blue-chip index had sunk below the 6,000 mark since January 2013, with £96bn wiped off share val ...

Private equity in the 2000s

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new ""Golden Age"" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007.