Financial Markets and Institutions

... – Additional shares sold by established publicly owned companies: the primary market ...

... – Additional shares sold by established publicly owned companies: the primary market ...

The Indian Private Equity Opportunity

... • Underleveraged economy with consumer Loan/GDP ratio at 8% as compared to 50% plus in developed markets • Indian consumer spending projected to grow from US$425 billion to USD$1.8 trillion by 2025 • Real estate still an under owned asset class with mortgage/GDP ratio at approximately 5% compared to ...

... • Underleveraged economy with consumer Loan/GDP ratio at 8% as compared to 50% plus in developed markets • Indian consumer spending projected to grow from US$425 billion to USD$1.8 trillion by 2025 • Real estate still an under owned asset class with mortgage/GDP ratio at approximately 5% compared to ...

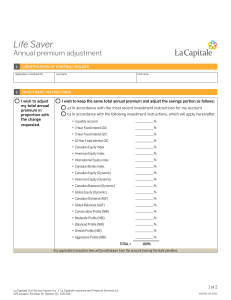

IND001E Life Saver - Annual Premium Adjustment

... may, depending on the performance of the market index or underlying fund, increase or decrease on a daily basis and even fall lower than the initial capital invested if the rate of return, after deduction of management fees, is negative. Should the market index or underlying fund be unavailable or c ...

... may, depending on the performance of the market index or underlying fund, increase or decrease on a daily basis and even fall lower than the initial capital invested if the rate of return, after deduction of management fees, is negative. Should the market index or underlying fund be unavailable or c ...

Mark A. Bonenfant

... representing OP Bancorp and Open Bank before the Federal Reserve, the FDIC, the California Department of Business Oversight, state securities authorities and FINRA Heritage Commerce Corp (NASDAQ) acquisition of Diablo Valley Bank Bank of Lakewood merger with Gateway Bancorp Family Savings Bank merge ...

... representing OP Bancorp and Open Bank before the Federal Reserve, the FDIC, the California Department of Business Oversight, state securities authorities and FINRA Heritage Commerce Corp (NASDAQ) acquisition of Diablo Valley Bank Bank of Lakewood merger with Gateway Bancorp Family Savings Bank merge ...

Taiwanese Delegation to Nigeria - Nigeria Investment Promotion

... The nature of assistance would primarily be in the form of equity or equity type instruments, though, in exceptional cases, assistance by way of loans may also be considered In case of equity/ equity type instruments, it is expected that the venture company would go in for an IPO within a reason ...

... The nature of assistance would primarily be in the form of equity or equity type instruments, though, in exceptional cases, assistance by way of loans may also be considered In case of equity/ equity type instruments, it is expected that the venture company would go in for an IPO within a reason ...

read ARTICLE - California Capital Partners

... from limited partners and $130 million from Small Business Administration matching funds. The fund had its first closing last year and is expected to receive government approval during the first half of 2008, said John Nelson, managing partner of California Capital Partners. Nelson said he's seen an ...

... from limited partners and $130 million from Small Business Administration matching funds. The fund had its first closing last year and is expected to receive government approval during the first half of 2008, said John Nelson, managing partner of California Capital Partners. Nelson said he's seen an ...

Newsletter-2007-12 - Patient Capital Management Inc

... The above noted concerns have raised worries among investors that the U.S. economy is headed for recession. These fears have been further stoked by weak fourth quarter earnings at prominent companies and more importantly their cautious outlook for 2008. The possibility of faltering earnings in a wea ...

... The above noted concerns have raised worries among investors that the U.S. economy is headed for recession. These fears have been further stoked by weak fourth quarter earnings at prominent companies and more importantly their cautious outlook for 2008. The possibility of faltering earnings in a wea ...

AIF 25 Anniversary Symposium: The Better Future of Finance 27

... financial) fraud among the U.S. companies with more than $750m in revenues is $380bn a year. • In 2012-14 financial institutions paid $139bn in fine, $113bn of which for mortgage fraud. • A whistleblower inside JPMorgan: 40 percent of the mortgages of some RMBS were based on overstated ...

... financial) fraud among the U.S. companies with more than $750m in revenues is $380bn a year. • In 2012-14 financial institutions paid $139bn in fine, $113bn of which for mortgage fraud. • A whistleblower inside JPMorgan: 40 percent of the mortgages of some RMBS were based on overstated ...

Factors which influence spot and forward rates

... Venture capital is a type of private equity capital typically provided by professional, outside investors to new, high-potential-growth companies in the interest of taking the company to an IPO or trade sale of the business. Angel investment - An angel investor or angel (known as a business angel or ...

... Venture capital is a type of private equity capital typically provided by professional, outside investors to new, high-potential-growth companies in the interest of taking the company to an IPO or trade sale of the business. Angel investment - An angel investor or angel (known as a business angel or ...

Form of Press Releases to be issued via the primary

... CHARLOTTE, N.C.– (BUSINESS WIRE) – January 19, 2016 – Bank of America Company (the "Corporation") informed its securities holders that it has filed a Current Report on Form 8-K with the U.S. Securities and Exchange Commission ("SEC") on January 19, 2016, announcing financial results for the fourth q ...

... CHARLOTTE, N.C.– (BUSINESS WIRE) – January 19, 2016 – Bank of America Company (the "Corporation") informed its securities holders that it has filed a Current Report on Form 8-K with the U.S. Securities and Exchange Commission ("SEC") on January 19, 2016, announcing financial results for the fourth q ...

SECTOR REPORT Islamic Asset Management — Asia vs Arabia

... have drawn in at least US$50 billion in private investor funds between late 2002 and mid 2007. This is a phenomenal amount considering that Islamic mutual funds themselves are also at about US$50 billion in AUM. In other words, Arabian investments in Islamic private equity were about equal to invest ...

... have drawn in at least US$50 billion in private investor funds between late 2002 and mid 2007. This is a phenomenal amount considering that Islamic mutual funds themselves are also at about US$50 billion in AUM. In other words, Arabian investments in Islamic private equity were about equal to invest ...

Our multi asset class funds: their diversification benefits and

... Each fund has its own objective, benchmark, typical asset allocation and therefore minimum investment horizon. As a result, the funds will have different but complementary outcomes over time and different risk and return characteristics. These funds will hold their places in the suite of funds throu ...

... Each fund has its own objective, benchmark, typical asset allocation and therefore minimum investment horizon. As a result, the funds will have different but complementary outcomes over time and different risk and return characteristics. These funds will hold their places in the suite of funds throu ...

Dowload as PDF

... FBC represents issuers, banks and underwriters in large and complex placements of equity and debt securities on the Israeli and international capital markets and is considered to be a pioneer in developing complex capital financing provided by insurance companies, and in advising on negotiable and n ...

... FBC represents issuers, banks and underwriters in large and complex placements of equity and debt securities on the Israeli and international capital markets and is considered to be a pioneer in developing complex capital financing provided by insurance companies, and in advising on negotiable and n ...

Risk-Spreading via Financial Intermediation: Life Insurance

... of capital the firm has; the nature and quantity of policies written for other customers; the probability of these customers dying; etc. In short, nearly everything about the company that the management knows, the customer would have to know and analyze. Essentially, the customer takes a (partial) e ...

... of capital the firm has; the nature and quantity of policies written for other customers; the probability of these customers dying; etc. In short, nearly everything about the company that the management knows, the customer would have to know and analyze. Essentially, the customer takes a (partial) e ...

About Our Private Investment Benchmarks

... conditions. Private investment contributions are invested “on paper” in a chosen public market index and distributions are taken out in the same proportion as in the private investment. With each distribution, mPME “sells” the same proportion of the dollar value of shares owned by the public equival ...

... conditions. Private investment contributions are invested “on paper” in a chosen public market index and distributions are taken out in the same proportion as in the private investment. With each distribution, mPME “sells” the same proportion of the dollar value of shares owned by the public equival ...

Download: The way forward: building a sustainable recovery and driving growth (pdf)

... socio-economic chain, offering greater numbers of sub-prime loans, which became packaged into more risky securities. • By 2003, the number of mortgage applicants rejected had halved to just 14 per cent, and sub prime backed bonds grew into a trillion dollar market. ...

... socio-economic chain, offering greater numbers of sub-prime loans, which became packaged into more risky securities. • By 2003, the number of mortgage applicants rejected had halved to just 14 per cent, and sub prime backed bonds grew into a trillion dollar market. ...

November 15th, 2013

... • For a corporate example, we will examine GE • GE wants to raise capital and issues bonds • Underwritten (think Scott Littlejohn) and offered to the secondary market (public) • Priced through the expected future cash flows from the bond (DCF etc.) • Can be purchased and held or traded, among other ...

... • For a corporate example, we will examine GE • GE wants to raise capital and issues bonds • Underwritten (think Scott Littlejohn) and offered to the secondary market (public) • Priced through the expected future cash flows from the bond (DCF etc.) • Can be purchased and held or traded, among other ...

Private Sector Commission of Guyana Ltd.

... Private Sector Commission Strongly Condemns Moves to Restrict Foreign Currency Market The Private Sector Commission has read with consternation the pronouncements of the Minister of State as these relate to the introduction of stricter regulations and closer monitoring of the foreign exchange market ...

... Private Sector Commission Strongly Condemns Moves to Restrict Foreign Currency Market The Private Sector Commission has read with consternation the pronouncements of the Minister of State as these relate to the introduction of stricter regulations and closer monitoring of the foreign exchange market ...

Crayon issues a NOK 650 million senior secured bond

... company”, says Henning Vold, Partner in Norvestor Equity and chairman of the board in Crayon. We see many growth possibilities going forward, both organic and through add-on acquisitions. This bond financing gives us the ability to further accelerate our growth, and take advantage of the opportuniti ...

... company”, says Henning Vold, Partner in Norvestor Equity and chairman of the board in Crayon. We see many growth possibilities going forward, both organic and through add-on acquisitions. This bond financing gives us the ability to further accelerate our growth, and take advantage of the opportuniti ...

structured return for all market conditions

... Return (to be launched by end of August according to the information available at the time of publication) will be a sub-fund of Allianz Global Investors Fund SICAV, an openended investment company with variable share capital organised under the laws of Luxembourg. The value of the shares which belo ...

... Return (to be launched by end of August according to the information available at the time of publication) will be a sub-fund of Allianz Global Investors Fund SICAV, an openended investment company with variable share capital organised under the laws of Luxembourg. The value of the shares which belo ...

Slide 1

... VC investment down 8.5% - 1st quarter 2008 vs 4th quarter 2007 (consistent with slowdown of US economy) VCs and angel investors more cautious, pursued later stage investments Shortage of money for seed and early stage ventures US Investment (California, Massachusetts, Texas, Washington, NY) ...

... VC investment down 8.5% - 1st quarter 2008 vs 4th quarter 2007 (consistent with slowdown of US economy) VCs and angel investors more cautious, pursued later stage investments Shortage of money for seed and early stage ventures US Investment (California, Massachusetts, Texas, Washington, NY) ...

For immediate distribution 4 August 2009 HFM Columbus warns on

... “Investing regularly each month – in other words, adopting a pound cost averaging strategy means that some months the investor will buy cheaper shares, and other months more expensive shares. Overall, however, the cost of the investment is averaged, and timing – which has caught out so many shorter ...

... “Investing regularly each month – in other words, adopting a pound cost averaging strategy means that some months the investor will buy cheaper shares, and other months more expensive shares. Overall, however, the cost of the investment is averaged, and timing – which has caught out so many shorter ...

Nedgroup Investments Positive Return Fund

... The fund seeks to offer investors total returns that are in excess of inflation over the medium-term through active asset allocation and with a high emphasis on capital protection. The fund specifically aims not to have negative returns over any 12-month period. The manager may invest in a mix of lo ...

... The fund seeks to offer investors total returns that are in excess of inflation over the medium-term through active asset allocation and with a high emphasis on capital protection. The fund specifically aims not to have negative returns over any 12-month period. The manager may invest in a mix of lo ...

Private equity in the 2000s

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new ""Golden Age"" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007.

![History Sheet Information entered by [ ]](http://s1.studyres.com/store/data/008202941_1-745098000e8c3b4ca6ac471bb8585e75-300x300.png)