File - BSC Economics

... 19) The purpose of diversification is to a) Reduce the volatility of a portfolio's return. b) Raise the volatility of a portfolio's return. c) Reduce the average return on a portfolio. d) Raise the average return on a portfolio. 20) Which of the following is a contractual savings institution? a) A l ...

... 19) The purpose of diversification is to a) Reduce the volatility of a portfolio's return. b) Raise the volatility of a portfolio's return. c) Reduce the average return on a portfolio. d) Raise the average return on a portfolio. 20) Which of the following is a contractual savings institution? a) A l ...

Overview • Equities enjoy strong returns as investors turn to risk

... where the high-yielding companies are based. In 1995, according to data from Newton, 20% of companies in the FTSE World Index yielding greater than 3 per cent were UK-based, whilst just 16% were based in Asia. Yet today, the picture is dramatically different – Asian companies now account for 29% of ...

... where the high-yielding companies are based. In 1995, according to data from Newton, 20% of companies in the FTSE World Index yielding greater than 3 per cent were UK-based, whilst just 16% were based in Asia. Yet today, the picture is dramatically different – Asian companies now account for 29% of ...

Presentation (PowerPoint Only)

... Event-driven mid-sized enterprise in strong asset class Take enterprises to “next level” through refinancing or new capital injection Local expertise and diverse investment strategies ...

... Event-driven mid-sized enterprise in strong asset class Take enterprises to “next level” through refinancing or new capital injection Local expertise and diverse investment strategies ...

guest slides - WordPress.com

... Growing, large, definable market Awareness of the competitive landscape Rapid growth and ability to scale Clear strategy to execute the route to market Capitalisation plan (how much money required?) ...

... Growing, large, definable market Awareness of the competitive landscape Rapid growth and ability to scale Clear strategy to execute the route to market Capitalisation plan (how much money required?) ...

Dividend Strategies Drive Returns

... Demand for dividend yield in a low absolute return environment continues to drive returns. At FSP, we believe an investment strategy that seeks dividend yield combined with lower volatility (in a market where volatility is blinding), will over time serve as the best offense for investors. 2016 is of ...

... Demand for dividend yield in a low absolute return environment continues to drive returns. At FSP, we believe an investment strategy that seeks dividend yield combined with lower volatility (in a market where volatility is blinding), will over time serve as the best offense for investors. 2016 is of ...

INVESTMENT OPPORTUNITIES

... at a higher return. Also means that you could lose more money. Lower risk usually means lower return. ...

... at a higher return. Also means that you could lose more money. Lower risk usually means lower return. ...

Pengana Capital Funds

... This alpha is far more stable, consistent and predictable, he says. The range of returns and maximum peak to trough loss (or maximum drawdown) is far narrower and the correlation with the equity market is negative in a number of periods. As to the cost, Crowley says ‘beta is cheap, but it isn’t fre ...

... This alpha is far more stable, consistent and predictable, he says. The range of returns and maximum peak to trough loss (or maximum drawdown) is far narrower and the correlation with the equity market is negative in a number of periods. As to the cost, Crowley says ‘beta is cheap, but it isn’t fre ...

Impact of market changes on business

... price tag of the merger was put at about $125 billion. Federal Communications Chairman William Kennard voiced his opposition immediately after the two companies made the announcement on Oct. 5, 1999. Kennard said the mega merger would be bad for competition in the long-distance market, and, therefor ...

... price tag of the merger was put at about $125 billion. Federal Communications Chairman William Kennard voiced his opposition immediately after the two companies made the announcement on Oct. 5, 1999. Kennard said the mega merger would be bad for competition in the long-distance market, and, therefor ...

Does PE Create Value.Apr 08

... Public company boards lack the incentives, time, training and information to adequately monitor firm’s derivative exposure Private equity firms help to offset these governance problems by exercising strong control ...

... Public company boards lack the incentives, time, training and information to adequately monitor firm’s derivative exposure Private equity firms help to offset these governance problems by exercising strong control ...

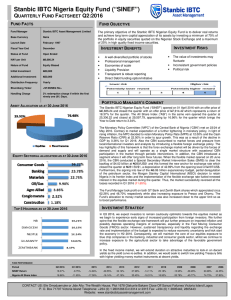

Nigerian Equity Fund - Stanbic IBTC Asset Management

... local/international investors and analysts by introducing a flexible foreign exchange policy. The key highlights of this framework is that the forex exchange market will be driven by the forces of demand and supply and will operate as a single market structure with occasional CBN participation in th ...

... local/international investors and analysts by introducing a flexible foreign exchange policy. The key highlights of this framework is that the forex exchange market will be driven by the forces of demand and supply and will operate as a single market structure with occasional CBN participation in th ...

Main Market – key eligibility criteria

... The Main Market is the London Stock Exchange’s flagship market for large, established companies and our regulated market for listed securities. Issuers of securities admitted to trading on the Main Market are also admitted to the UK Listing Authority’s Official List. There are two listing segments – ...

... The Main Market is the London Stock Exchange’s flagship market for large, established companies and our regulated market for listed securities. Issuers of securities admitted to trading on the Main Market are also admitted to the UK Listing Authority’s Official List. There are two listing segments – ...

The Indian Financial Market Is Touted as Benchmark in Today`s

... sectors like IT , Pharma & automobiles has been affected widely. In other words I want to state further that market is a backbone of Indian economy and regulatory structure of monetary system. With respect to china and US and specially Europe, India stands in a more stable condition as far as liquid ...

... sectors like IT , Pharma & automobiles has been affected widely. In other words I want to state further that market is a backbone of Indian economy and regulatory structure of monetary system. With respect to china and US and specially Europe, India stands in a more stable condition as far as liquid ...

BMO Asset Management Global Equity Fund

... The team builds focused portfolios of high quality companies which are held regardless of their popularity or size. The key risk to be avoided is that of losing money for our clients, not that of appearing different from a benchmark. The stock selection process includes two separate strands. The fir ...

... The team builds focused portfolios of high quality companies which are held regardless of their popularity or size. The key risk to be avoided is that of losing money for our clients, not that of appearing different from a benchmark. The stock selection process includes two separate strands. The fir ...

1 FRENCH PRIVATE EQUITY ACTIVITY IN 2015 • MORE THAN

... approaches the pre-crisis level (an annual average of 10.5 billion between 2005 and 2008). As in the two previous years, 2015’s fundraising did not include any operation exceeding the 1 billion euro mark. This signifies a better fundraising distribution for all private equity professionals. As for t ...

... approaches the pre-crisis level (an annual average of 10.5 billion between 2005 and 2008). As in the two previous years, 2015’s fundraising did not include any operation exceeding the 1 billion euro mark. This signifies a better fundraising distribution for all private equity professionals. As for t ...

Q1 2017 - Partnervest

... Bloomberg, Tudor, Pickering, Holt & Co. slashed its 2018 forecast for West Texas Intermediate by 13%, to $65 and expects U.S. output will rise by 1.2 million barrels per day, up 50% from earlier forecasts. ...

... Bloomberg, Tudor, Pickering, Holt & Co. slashed its 2018 forecast for West Texas Intermediate by 13%, to $65 and expects U.S. output will rise by 1.2 million barrels per day, up 50% from earlier forecasts. ...

private equity in mining - Berwin Leighton Paisner

... investment was being increased. The average size of the investment where there was an increased stake was $19.7m and again for the deals reported these were often investments in publicly listed companies. The additional percentage by which the funds’ holdings increased ranged from 0% ...

... investment was being increased. The average size of the investment where there was an increased stake was $19.7m and again for the deals reported these were often investments in publicly listed companies. The additional percentage by which the funds’ holdings increased ranged from 0% ...

Mergers, LBOs, Divestitures, and Holding Companies

... According to empirical evidence, acquisitions do create value as a result of economies of scale, other synergies, and/or better management. Shareholders of target firms reap most of the benefits, that is, the final price is close to full value. ...

... According to empirical evidence, acquisitions do create value as a result of economies of scale, other synergies, and/or better management. Shareholders of target firms reap most of the benefits, that is, the final price is close to full value. ...

Ted Bernhard - Stoel Rives

... – Near term – Standardized PURPA contracts will help make the transition less painful for them – Still need to remember, the projects must be valuable and profitable for all stakeholders, including those who buy and transmit the energy ...

... – Near term – Standardized PURPA contracts will help make the transition less painful for them – Still need to remember, the projects must be valuable and profitable for all stakeholders, including those who buy and transmit the energy ...

Market Commentary July 5, 2011

... The Dow Jones Industrial Average had a volatile six months, but managed to end June on a high note and finish the first half of the year up 7.2%. What to Watch: The end of quantitative easing, ongoing European sovereign-debt issues, and the U.S. budget battle could keep investors on edge over the su ...

... The Dow Jones Industrial Average had a volatile six months, but managed to end June on a high note and finish the first half of the year up 7.2%. What to Watch: The end of quantitative easing, ongoing European sovereign-debt issues, and the U.S. budget battle could keep investors on edge over the su ...

The Role of Debt and Equity Financing over the Business Cycle

... “The debt exposure [debt/gdp] has increased during the last 50 years” Frank and Goyal Stylized Fact #1 “Over long periods of time, leverage [debt/assets] is stationary” Frank and Goyal Stylized Fact #2 “Over the past half century, the aggregate marketbased leverage ratio has been about 0.32. There h ...

... “The debt exposure [debt/gdp] has increased during the last 50 years” Frank and Goyal Stylized Fact #1 “Over long periods of time, leverage [debt/assets] is stationary” Frank and Goyal Stylized Fact #2 “Over the past half century, the aggregate marketbased leverage ratio has been about 0.32. There h ...

Investing as a zero-sum game

... Index funds typically carry lower charges than their active counterparts. At the same time, the distribution of returns from index funds tends to be narrower, with fewer instances of significant out- or underperformance. Considering all of these factors, we believe that setting a long-term asset all ...

... Index funds typically carry lower charges than their active counterparts. At the same time, the distribution of returns from index funds tends to be narrower, with fewer instances of significant out- or underperformance. Considering all of these factors, we believe that setting a long-term asset all ...

Media - Profile Financial Services

... It's a hard time to make a buck. You can't make a decent return sitting in cash anymore; bonds are delivering historically low rewards – with government bonds in much of the world generating a negative yield for the first time in living memory – and the outlook for stocks is uncertain. But diversify ...

... It's a hard time to make a buck. You can't make a decent return sitting in cash anymore; bonds are delivering historically low rewards – with government bonds in much of the world generating a negative yield for the first time in living memory – and the outlook for stocks is uncertain. But diversify ...

Private Equity / Venture Capital Conceitos e perspectivas de

... Internet bubble burst Argentina default – Local factors: Devaluation (1999) Energy crisis (2001) Elections (2002) ...

... Internet bubble burst Argentina default – Local factors: Devaluation (1999) Energy crisis (2001) Elections (2002) ...

Turkish Capital Markets - Capital Markets Board of Turkey

... One of very few countries during the crisis, where there was ...

... One of very few countries during the crisis, where there was ...

Private equity in the 2000s

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new ""Golden Age"" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007.