financial engineer / front office quantitative researcher

... At Raiffeisen Centrobank, the equity house of Raiffeisen Bank International Group, we focus on equity trading and sales, structured products and company research – working closely together for the benefit of our clients. That makes us one of the leading investment banks in Austria and CEE. ...

... At Raiffeisen Centrobank, the equity house of Raiffeisen Bank International Group, we focus on equity trading and sales, structured products and company research – working closely together for the benefit of our clients. That makes us one of the leading investment banks in Austria and CEE. ...

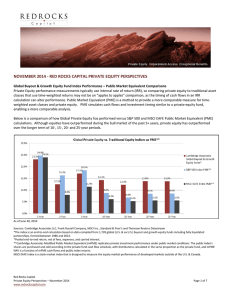

NOVEMBER 2014 - RED ROCKS CAPITAL PRIVATE EQUITY PERSPECTIVES

... Partners Group Seeks to Bring Private Equity to 401(k) Market Swiss-based Partners Group is launching a private equity investment product next year that targets the multitrillion dollar 401(k) market in the U.S. Casey Quirk & Company forecasts that the defined contribution market, including 401(k) p ...

... Partners Group Seeks to Bring Private Equity to 401(k) Market Swiss-based Partners Group is launching a private equity investment product next year that targets the multitrillion dollar 401(k) market in the U.S. Casey Quirk & Company forecasts that the defined contribution market, including 401(k) p ...

Morgan Stanley Dean Witter

... “The top franchises in global finance, with a breadth of competencies and product offerings to which every bank aspires to have.” – CSFB First Union reiterates STRONG BUY rating and target price of ...

... “The top franchises in global finance, with a breadth of competencies and product offerings to which every bank aspires to have.” – CSFB First Union reiterates STRONG BUY rating and target price of ...

October 2, 2012 Global equity markets generally performed well in

... be resolved. The implications of debt de-leveraging are not positive for robust economic growth. Any combination of tax increases and spending reductions will be a drag on GDP growth. These changes are going to be unpopular and take a long time. Investors will likely have to get used to slower growt ...

... be resolved. The implications of debt de-leveraging are not positive for robust economic growth. Any combination of tax increases and spending reductions will be a drag on GDP growth. These changes are going to be unpopular and take a long time. Investors will likely have to get used to slower growt ...

The Point - Fieldpoint Private

... rationalizing expenses have reached a natural conclusion. With interest rates at these stupid levels, company managements will be forced to take action, which we think will come in the form of increased debt issuance, with the proceeds to be used for (a) boosting dividends, (b) investing in new plan ...

... rationalizing expenses have reached a natural conclusion. With interest rates at these stupid levels, company managements will be forced to take action, which we think will come in the form of increased debt issuance, with the proceeds to be used for (a) boosting dividends, (b) investing in new plan ...

Equity Research Analyst - JHM Professional Development and

... own portfolio and track the companies daily. Join one or more relevant associations and start networking, conducting informational interviews and build your understanding of the career. ...

... own portfolio and track the companies daily. Join one or more relevant associations and start networking, conducting informational interviews and build your understanding of the career. ...

Listed market could be the out for PE hotel investors Article

... Wednesday, September 30, 2015 2:25 PM ET ...

... Wednesday, September 30, 2015 2:25 PM ET ...

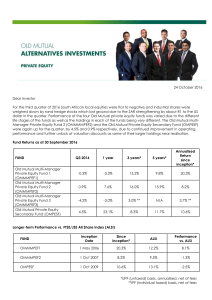

24 October 2016 Dear Investor For the third quarter of 2016 South

... equity J-curve as the underlying funds near maturity. It has outperformed the ALSI over one, three and five years and is now only 1.3% per annum behind the ALSI since inception. Further performance unlock is possible as more assets are realised over the next 15 months before the fund matures. OMMMPE ...

... equity J-curve as the underlying funds near maturity. It has outperformed the ALSI over one, three and five years and is now only 1.3% per annum behind the ALSI since inception. Further performance unlock is possible as more assets are realised over the next 15 months before the fund matures. OMMMPE ...

Watch for Private Equity Inflows into

... Private equity activity oftentimes is and has been decoupled from the overall macroeconomics in a particular country. Private equity is largely about industrial reallocation and industrial restructuring. And in many instances, although the capital markets might not be cooperative, those are very fal ...

... Private equity activity oftentimes is and has been decoupled from the overall macroeconomics in a particular country. Private equity is largely about industrial reallocation and industrial restructuring. And in many instances, although the capital markets might not be cooperative, those are very fal ...

Financing Non-P3 Infrastructure Projects

... Returns from most projects will be tied in some way to cash flow generated from mining activities, projects or companies Equity markets are well-acquainted with mining sector ...

... Returns from most projects will be tied in some way to cash flow generated from mining activities, projects or companies Equity markets are well-acquainted with mining sector ...

October 2011 - Roof Advisory Group

... crippling polarization in politics that exists today. In reality, there is plenty of blame to go around. Over the years, we have tried to remain as apolitical as possible when commenting on current conditions in the markets and economy. Candidly, elected officials have much less influence over the h ...

... crippling polarization in politics that exists today. In reality, there is plenty of blame to go around. Over the years, we have tried to remain as apolitical as possible when commenting on current conditions in the markets and economy. Candidly, elected officials have much less influence over the h ...

Emerging Markets Equity Corporate Class

... advisors and the strong partnership we have developed with them to create wealth and prosperity for Canadian families who entrust us with their affairs. CI Investments Inc. and Assante Wealth Management are wholly owned subsidiaries of CI Financial Corp., which is listed on the Toronto Stock Exchang ...

... advisors and the strong partnership we have developed with them to create wealth and prosperity for Canadian families who entrust us with their affairs. CI Investments Inc. and Assante Wealth Management are wholly owned subsidiaries of CI Financial Corp., which is listed on the Toronto Stock Exchang ...

Equity Linked Debentures

... The actual terms of these products may vary slightly, but the broad theme of ELD works in this manner… • These bonds are linked to an index like the Nifty or any/group of equity shares. • The issuer of bonds invests a pre-determined part of the principal amount collected in fixed income securities ...

... The actual terms of these products may vary slightly, but the broad theme of ELD works in this manner… • These bonds are linked to an index like the Nifty or any/group of equity shares. • The issuer of bonds invests a pre-determined part of the principal amount collected in fixed income securities ...

view - Ferguson Wellman

... time when domestic pension funds and foreign investors have largely been selling.” He further notes that U.S. companies bought back $644 billion of their own shares in 2016, a new record.5 It is also very interesting to us that the investor “euphoria” historically associated with the end of a bull m ...

... time when domestic pension funds and foreign investors have largely been selling.” He further notes that U.S. companies bought back $644 billion of their own shares in 2016, a new record.5 It is also very interesting to us that the investor “euphoria” historically associated with the end of a bull m ...

Emerging Market Equity: Private Equity, Public Equity, Risks

... Experience in deals as small as $2 million has been positive, suggesting that smaller companies are less risky than commonly perceived. ...

... Experience in deals as small as $2 million has been positive, suggesting that smaller companies are less risky than commonly perceived. ...

What can be learned from the banking crisis

... cannot properly appraise. The purchasers are almost never able to assess the true repayment probabilities correctly. Only the sellers that assemble the securitised packages have some idea of what they are selling. In the language of economists, these bank products are lemon goods, that is goods whos ...

... cannot properly appraise. The purchasers are almost never able to assess the true repayment probabilities correctly. Only the sellers that assemble the securitised packages have some idea of what they are selling. In the language of economists, these bank products are lemon goods, that is goods whos ...

Mid-Year Investment Review

... them out of their illiquidity upon discovering that the market wouldn’t buy their assets at anything close to modeled value; S&P and Moody’s are moving toward downgrades on nearly $20 billion in subprime mortgage backed securities, while intimating more such to come; and a half dozen new high-yield ...

... them out of their illiquidity upon discovering that the market wouldn’t buy their assets at anything close to modeled value; S&P and Moody’s are moving toward downgrades on nearly $20 billion in subprime mortgage backed securities, while intimating more such to come; and a half dozen new high-yield ...

Private Equity Demystified

... Probably made for strategic reasons with no expectation of selling on ...

... Probably made for strategic reasons with no expectation of selling on ...

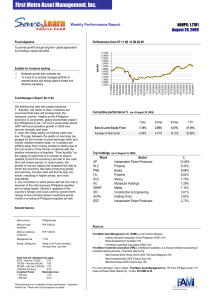

08.20.09-salef - First Metro Asset Management Inc

... Fund Manager’s Report 08.11.09 We believe this rally will sustain because: 1. “liquidity” will return to Asia. Investors are convinced that Asia will emerge from the recession sooner. Inasfar as the Philippine economy is concerned, global economists expect the Philippines to be 1 of only 4 economies ...

... Fund Manager’s Report 08.11.09 We believe this rally will sustain because: 1. “liquidity” will return to Asia. Investors are convinced that Asia will emerge from the recession sooner. Inasfar as the Philippine economy is concerned, global economists expect the Philippines to be 1 of only 4 economies ...

FASB Statement 149 and Redeemable Preferred

... preferred stocks (including both newly issued and currently outstanding preferred stock) will have to be classified as liabilities. This standard is currently applied to public companies at the insistence of the SEC, whereas the balance sheets of private companies today show redeemable preferred sto ...

... preferred stocks (including both newly issued and currently outstanding preferred stock) will have to be classified as liabilities. This standard is currently applied to public companies at the insistence of the SEC, whereas the balance sheets of private companies today show redeemable preferred sto ...

Deconstructing the time in the market mantra

... ‘Time in the market’ used to be the rationale why investors should hang on to equities come hell or high water. However this mantra rings hollow to many investors who have seen the value of their equity portfolios halved over the last year. While investing is still about taking a long term view what ...

... ‘Time in the market’ used to be the rationale why investors should hang on to equities come hell or high water. However this mantra rings hollow to many investors who have seen the value of their equity portfolios halved over the last year. While investing is still about taking a long term view what ...

new market tax credits - Massachusetts Institute of Technology

... of the credits requested. Two CDE’s in Massachusetts received a total of $26 million out of the $2.5 billion allocated nationally at the time. These CDEs then in turn provide have used these credits to provide both debt and equity to specific projects.2 The Massachusetts Housing Investment Corporati ...

... of the credits requested. Two CDE’s in Massachusetts received a total of $26 million out of the $2.5 billion allocated nationally at the time. These CDEs then in turn provide have used these credits to provide both debt and equity to specific projects.2 The Massachusetts Housing Investment Corporati ...

Quarterly Investment Letter

... China. Simultaneously, expectations of earnings’ growth in the developed markets have come down with analysts being generally more conservative. In fact, corporations which were able to improve margins through cost cutting, cheaper refinancing and productivity gains in the past, must now rely on sim ...

... China. Simultaneously, expectations of earnings’ growth in the developed markets have come down with analysts being generally more conservative. In fact, corporations which were able to improve margins through cost cutting, cheaper refinancing and productivity gains in the past, must now rely on sim ...

Double Double - Dana Investment Advisors

... (International Monetary Fund). Ms. Lagarde asked Janet Yellen, Chairwoman at the Federal Reserve, about the Fed’s policy of low interest rates leading to bubbles in financial markets. Ms. Yellen’s reply was that “equity market valuations at this point generally are quite high.” The stock market lost ...

... (International Monetary Fund). Ms. Lagarde asked Janet Yellen, Chairwoman at the Federal Reserve, about the Fed’s policy of low interest rates leading to bubbles in financial markets. Ms. Yellen’s reply was that “equity market valuations at this point generally are quite high.” The stock market lost ...

Private equity in the 2000s

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new ""Golden Age"" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007.