download

... • The numerator is the risk premium • The denominator is a measure of risk • The expression is the risk premium return per unit of risk • Risk averse investors prefer to maximize this value • This assumes a completely diversified portfolio leaving systematic risk as the relevant risk ...

... • The numerator is the risk premium • The denominator is a measure of risk • The expression is the risk premium return per unit of risk • Risk averse investors prefer to maximize this value • This assumes a completely diversified portfolio leaving systematic risk as the relevant risk ...

Security Valuation

... The Super-center concept, which combines groceries and general merchandise, is extreme success as 75 new Supercenters were opened last year alone. Another 95 will be opening over the next two years. Sam's clubs have also seen success as 99 Pace stores (Pace is one of Sam's former Competitors) were ...

... The Super-center concept, which combines groceries and general merchandise, is extreme success as 75 new Supercenters were opened last year alone. Another 95 will be opening over the next two years. Sam's clubs have also seen success as 99 Pace stores (Pace is one of Sam's former Competitors) were ...

Chapter 15

... 11 introduced the time value of money and showed how it is used to make financial decisions. Chapter 12 used the time value of money concept to determine if business investment activities should be undertaken. Chapters 13 and 14 explored the issues surrounding business financing decisions. Chapter 1 ...

... 11 introduced the time value of money and showed how it is used to make financial decisions. Chapter 12 used the time value of money concept to determine if business investment activities should be undertaken. Chapters 13 and 14 explored the issues surrounding business financing decisions. Chapter 1 ...

Lecture 3 - CSUN.edu

... Although the IRS allows all businesses to use the accrual method of accounting, most small businesses can instead use the cash method for tax purposes. The cash method can offer more flexibility in tax planning because you can sometimes time your receipt of revenue or payments of expenses to shift t ...

... Although the IRS allows all businesses to use the accrual method of accounting, most small businesses can instead use the cash method for tax purposes. The cash method can offer more flexibility in tax planning because you can sometimes time your receipt of revenue or payments of expenses to shift t ...

Tracking Error Regret Is the Enemy of Investors

... Since 2008, investors have been faced with a major test of their ability to ignore tracking error regret. From 2008 through 2015, major U.S. asset classes provided fairly similar returns. While the S&P 500 Index returned 6.5 percent per year, the MSCI Prime (Large) Value Index returned 5.1 percent, ...

... Since 2008, investors have been faced with a major test of their ability to ignore tracking error regret. From 2008 through 2015, major U.S. asset classes provided fairly similar returns. While the S&P 500 Index returned 6.5 percent per year, the MSCI Prime (Large) Value Index returned 5.1 percent, ...

Yet more on methods

... • A bank account object will need to contain – name of the account owner – balance of the account ...

... • A bank account object will need to contain – name of the account owner – balance of the account ...

PSF Conservative Balanced Portfolio

... principal value of an investment will fluctuate so that the units, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. Performance information as of the most recent month-end is available upon request. ...

... principal value of an investment will fluctuate so that the units, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. Performance information as of the most recent month-end is available upon request. ...

Lecture Presentation to accompany Investment

... • What is the relationship between covariance and correlation? • What is the formula for the standard deviation for a portfolio of risky assets and how does it differ from the standard deviation of an individual risky asset? • Given the formula for the standard deviation of a portfolio, why and how ...

... • What is the relationship between covariance and correlation? • What is the formula for the standard deviation for a portfolio of risky assets and how does it differ from the standard deviation of an individual risky asset? • Given the formula for the standard deviation of a portfolio, why and how ...

Return on Capital Employed The ROCE Formula Calculating ROCE

... relevant financial statement data. The financial data used for Wal-Mart is as of October 31, 2011, and for Target the data is as of October 29, 2011. We used AAII’s fundamental stock screening and research database program Stock Investor Pro as the source for the numbers. However, the data is easily f ...

... relevant financial statement data. The financial data used for Wal-Mart is as of October 31, 2011, and for Target the data is as of October 29, 2011. We used AAII’s fundamental stock screening and research database program Stock Investor Pro as the source for the numbers. However, the data is easily f ...

Diversification

... Derivatives are instruments based on the future, and therefore uncertain, price of another security, such as a share of stock, a government bond, a currency, or a commodity. Mutual funds are portfolios of investments designed to achieve maximum diversification with minimal cost through economies of ...

... Derivatives are instruments based on the future, and therefore uncertain, price of another security, such as a share of stock, a government bond, a currency, or a commodity. Mutual funds are portfolios of investments designed to achieve maximum diversification with minimal cost through economies of ...

Stocks

... Derivatives are instruments based on the future, and therefore uncertain, price of another security, such as a share of stock, a government bond, a currency, or a commodity. Mutual funds are portfolios of investments designed to achieve maximum diversification with minimal cost through economies of ...

... Derivatives are instruments based on the future, and therefore uncertain, price of another security, such as a share of stock, a government bond, a currency, or a commodity. Mutual funds are portfolios of investments designed to achieve maximum diversification with minimal cost through economies of ...

9 Ways to Increase Available Cash - Multi-SWAC

... Cash is the life blood of any business. More businesses suffer as a result of lack of cash than for any other reason. The following are nine ways to ensure that cash is being received by the business at the earliest possible time and to minimise outgoings. 1. Send out invoices at the earliest possi ...

... Cash is the life blood of any business. More businesses suffer as a result of lack of cash than for any other reason. The following are nine ways to ensure that cash is being received by the business at the earliest possible time and to minimise outgoings. 1. Send out invoices at the earliest possi ...

Current Report No. 3/2013 Buyback of shares The Board of

... to exceed the threshold of 25% of the average daily volume of shares of the Company traded (say: twenty-five percent), up to 50% % of the average daily volume of shares of the Company traded (say: fifty percent), provided that the following conditions are met: a) The Company shall notify the Polish ...

... to exceed the threshold of 25% of the average daily volume of shares of the Company traded (say: twenty-five percent), up to 50% % of the average daily volume of shares of the Company traded (say: fifty percent), provided that the following conditions are met: a) The Company shall notify the Polish ...

CREF Social Choice

... redeemed, may be worth more or less than their original cost. Current performance may differ from figures shown. For performance current to the most recent month-end, call 800-842-2252. Performance may reflect waivers or reimbursements of certain expenses. Absent these waivers or reimbursement arran ...

... redeemed, may be worth more or less than their original cost. Current performance may differ from figures shown. For performance current to the most recent month-end, call 800-842-2252. Performance may reflect waivers or reimbursements of certain expenses. Absent these waivers or reimbursement arran ...

A factor portfolio

... Clearly not: No matter what the systematic factor turns out to be, portfolio A outperforms portfolio B, leading to an arbitrage opportunity. If you sell short $1 million of B and buy $1 million of A, a 0 net investment strategy, your riskless payoff would be $20,000, as follows: ...

... Clearly not: No matter what the systematic factor turns out to be, portfolio A outperforms portfolio B, leading to an arbitrage opportunity. If you sell short $1 million of B and buy $1 million of A, a 0 net investment strategy, your riskless payoff would be $20,000, as follows: ...

To view this press release as a file

... The public's financial assets portfolio in the second quarter of 2014 During the second quarter of 2014 the value of the public's financial assets portfolio increased by about NIS 30 billion, an increase of about 0.5 percent in real terms, and reached about NIS 3.05 trillion at the end of June. ...

... The public's financial assets portfolio in the second quarter of 2014 During the second quarter of 2014 the value of the public's financial assets portfolio increased by about NIS 30 billion, an increase of about 0.5 percent in real terms, and reached about NIS 3.05 trillion at the end of June. ...

Chapter 7 - CSUN.edu

... The longer the maturity of a bond, the more of an effect a change in interest rates will have on it. The reason for this is that the price change is compounded into the bond price for more periods. Therefore, you can rule out statements b and e. A bond that pays coupons will be less affected by inte ...

... The longer the maturity of a bond, the more of an effect a change in interest rates will have on it. The reason for this is that the price change is compounded into the bond price for more periods. Therefore, you can rule out statements b and e. A bond that pays coupons will be less affected by inte ...

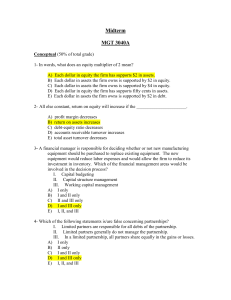

Answers to Midterm 3040A

... A) Choose the simple interest option because both have the same basic interest rate. B) Choose the compound interest option because it provides a higher return. C) Choose the compound interest option only if the compounding is for monthly periods. D) Choose the simple interest option only if compoun ...

... A) Choose the simple interest option because both have the same basic interest rate. B) Choose the compound interest option because it provides a higher return. C) Choose the compound interest option only if the compounding is for monthly periods. D) Choose the simple interest option only if compoun ...

File - Jason Murphy

... A store sells bread and milk. On Tuesday, 8 loaves of bread and 5 litres of milk were sold for $21.40. On Thursday, 6 loaves of bread and 9 litres of milk were sold for $23.40. If b = the price of a loaf of bread and m = the price of one litre of milk, Tuesday’s sales can be ...

... A store sells bread and milk. On Tuesday, 8 loaves of bread and 5 litres of milk were sold for $21.40. On Thursday, 6 loaves of bread and 9 litres of milk were sold for $23.40. If b = the price of a loaf of bread and m = the price of one litre of milk, Tuesday’s sales can be ...

Boston Partners Large Cap Value Equity

... Boston Partners Large Cap Value Equity Investment Performance Disclosure Boston Partners Global Investors, Inc. (“Boston Partners”) is an Investment Adviser registered with the Securities and Exchange Commission under the Investment Advisers Act of 1940. Boston Partners is a subsidiary of Robeco Gr ...

... Boston Partners Large Cap Value Equity Investment Performance Disclosure Boston Partners Global Investors, Inc. (“Boston Partners”) is an Investment Adviser registered with the Securities and Exchange Commission under the Investment Advisers Act of 1940. Boston Partners is a subsidiary of Robeco Gr ...

Why Has The Value Changed this Year

... flow figures are relevant in the estimation of anticipated benefits only to the extent that they give some insight as to the cash flow that the company is likely to generate in the future. For example, if the current year’s cash flow has increased by 25% from the previous year’s cash flow, this woul ...

... flow figures are relevant in the estimation of anticipated benefits only to the extent that they give some insight as to the cash flow that the company is likely to generate in the future. For example, if the current year’s cash flow has increased by 25% from the previous year’s cash flow, this woul ...