the case for real return investing

... ABN 86 000 431 827 and its subsidiaries). Total returns shown for the Perpetual Diversified Real Return Fund have been calculated using exit prices after taking into account all of Perpetual’s ongoing fees and assuming reinvestment of distributions. No allowance has been made for taxation. Past perf ...

... ABN 86 000 431 827 and its subsidiaries). Total returns shown for the Perpetual Diversified Real Return Fund have been calculated using exit prices after taking into account all of Perpetual’s ongoing fees and assuming reinvestment of distributions. No allowance has been made for taxation. Past perf ...

How the Market Works… and What It Means for Your Portfolio

... What s really quite remarkable in the investment world is that people are playing a game which, in some sense, cannot be played. There are so many people out there in the market; the idea that any single individual without extra information or extra market power can beat the market is extraordinaril ...

... What s really quite remarkable in the investment world is that people are playing a game which, in some sense, cannot be played. There are so many people out there in the market; the idea that any single individual without extra information or extra market power can beat the market is extraordinaril ...

An alternative school of thought

... Post-2008, investors are now more risk-averse. How can options help protect investors from catastrophic events or tail risks? We can’t predict the next crisis, but we have to be prepared for it, so we spend a lot of time on what-if scenarios. Options are like Legos—you use them to construct somethin ...

... Post-2008, investors are now more risk-averse. How can options help protect investors from catastrophic events or tail risks? We can’t predict the next crisis, but we have to be prepared for it, so we spend a lot of time on what-if scenarios. Options are like Legos—you use them to construct somethin ...

6.00 Understand Financial Analysis

... • Return on Capital - A measure of how well a business generates cash flow in relation to the capital it has already invested in itself. • A. It is a measure of how well a business generates cash flow in relation to the capital (both debt and equity) it has already invested into itself. • B. It is u ...

... • Return on Capital - A measure of how well a business generates cash flow in relation to the capital it has already invested in itself. • A. It is a measure of how well a business generates cash flow in relation to the capital (both debt and equity) it has already invested into itself. • B. It is u ...

CHAPTER 6 Risk, Return, and the Capital Asset Pricing Model 1

... No. Rational investors will minimize risk by holding portfolios. They bear only market risk, so prices and returns reflect this lower risk. The one-stock investor bears higher (stand-alone) risk, so the return is less than that required by the risk. ...

... No. Rational investors will minimize risk by holding portfolios. They bear only market risk, so prices and returns reflect this lower risk. The one-stock investor bears higher (stand-alone) risk, so the return is less than that required by the risk. ...

Modeling Portfolios that Contain Risky Assets I: Risk and

... Given the complexity of the dynamics underlying such market fluctuations, we adopt a statistical approach to quantifying their trends and correlations. More specifically, we will choose an appropriate set of statistics that will be computed from selected return rate histories of the relevant assets ...

... Given the complexity of the dynamics underlying such market fluctuations, we adopt a statistical approach to quantifying their trends and correlations. More specifically, we will choose an appropriate set of statistics that will be computed from selected return rate histories of the relevant assets ...

F.IF.B.4: Evaluating Exponential Expressions

... 8 The number of bacteria that grow in a petri dish is approximated by the function G(t) = 500e 0.216t , where t is time, in minutes. Use this model to approximate, to the nearest integer, the number of bacteria present after one half-hour. ...

... 8 The number of bacteria that grow in a petri dish is approximated by the function G(t) = 500e 0.216t , where t is time, in minutes. Use this model to approximate, to the nearest integer, the number of bacteria present after one half-hour. ...

ch13_IM_1E

... Solutions to Problems at End of Chapter Composition of the Market Portfolio 1. Capital markets in Flatland exhibit trade in four securities, the stocks X, Y and Z, and a riskless government security. Evaluated at current prices in US dollars, the total market values of these assets are, respectively ...

... Solutions to Problems at End of Chapter Composition of the Market Portfolio 1. Capital markets in Flatland exhibit trade in four securities, the stocks X, Y and Z, and a riskless government security. Evaluated at current prices in US dollars, the total market values of these assets are, respectively ...

client investment profile - Davis Financial Management

... I am satisfied with my investments just keeping pace with the rate of inflation, or being slightly above. I am willing to forego returns higher than inflation in order to limit the risk in my investments. I prefer to achieve returns that are slightly to moderately above the rate of inflation (2% to ...

... I am satisfied with my investments just keeping pace with the rate of inflation, or being slightly above. I am willing to forego returns higher than inflation in order to limit the risk in my investments. I prefer to achieve returns that are slightly to moderately above the rate of inflation (2% to ...

CI Signature Canadian Balanced Fund

... timely. Morningstar is not responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. This fund is an investment product offered under an insurance contract issued by Desjardins Financial Security. Desjardins Insurance refers t ...

... timely. Morningstar is not responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. This fund is an investment product offered under an insurance contract issued by Desjardins Financial Security. Desjardins Insurance refers t ...

1494308082-Create a 10

... Create a 10- to 12-slide presentation that addresses each question within the Comparative Analysis Case, Comparative Analysis Case The Coca-Cola Company and PepsiCo, Inc. The financial statements of Coca-Cola and PepsiCo are presented in Appendices C and D, respectively. The companies' complete annu ...

... Create a 10- to 12-slide presentation that addresses each question within the Comparative Analysis Case, Comparative Analysis Case The Coca-Cola Company and PepsiCo, Inc. The financial statements of Coca-Cola and PepsiCo are presented in Appendices C and D, respectively. The companies' complete annu ...

Appreciating Assets Part 1: Stocks and Bonds

... The stock market averages between 10% and 12% a year. But the annual return almost never falls in that range. Just look at the returns of the prior five years: 4.9%, 15.8%, 5.5%, -37.0%, and 26.5%. None of these fell even close to the 10% to 12% average. This return comes partly from a 4.5% annual i ...

... The stock market averages between 10% and 12% a year. But the annual return almost never falls in that range. Just look at the returns of the prior five years: 4.9%, 15.8%, 5.5%, -37.0%, and 26.5%. None of these fell even close to the 10% to 12% average. This return comes partly from a 4.5% annual i ...

FORM No. IV

... Personal loans/advance given to any person or entity including firm, company, trust, etc. and other receivables from debtors and the amount (exceeding two months basic pay or Rupees one lakh, as the case may be): Motor Vehicles (Details of Make, registration number year of purchase and amount paid) ...

... Personal loans/advance given to any person or entity including firm, company, trust, etc. and other receivables from debtors and the amount (exceeding two months basic pay or Rupees one lakh, as the case may be): Motor Vehicles (Details of Make, registration number year of purchase and amount paid) ...

Using the CAPM

... risk-free rate. Note that if the risk-free rate is constant over time, our estimates of α and β will be the same whether we use excess returns in our calculations or absolute returns. So if Rf is fairly constant over the time of our sample, we can disregard it in the regression. This is often done i ...

... risk-free rate. Note that if the risk-free rate is constant over time, our estimates of α and β will be the same whether we use excess returns in our calculations or absolute returns. So if Rf is fairly constant over the time of our sample, we can disregard it in the regression. This is often done i ...

Forecasting Bond Prices and Yields

... at a lower rate, the yield to maturity would overstate the actual return to the investor over the entire holding period. With a computer program, the financial institution could easily create a distribution of forecasted yields based on various forecasts for the required rate of return four years fr ...

... at a lower rate, the yield to maturity would overstate the actual return to the investor over the entire holding period. With a computer program, the financial institution could easily create a distribution of forecasted yields based on various forecasts for the required rate of return four years fr ...

The Returns and Risks From Investing

... Risk is the chance that the actual outcome is different than the expected ...

... Risk is the chance that the actual outcome is different than the expected ...

security analysis and portfolio management

... c) Ownership securities as returns are based on net profit—rates are variable. 2. Returns— A major factor influencing pattern of investment is its return—i.e. yield plus capital appreciation .(Yield is interest or dividend). Yield has to be calculated on the purchase price. ...

... c) Ownership securities as returns are based on net profit—rates are variable. 2. Returns— A major factor influencing pattern of investment is its return—i.e. yield plus capital appreciation .(Yield is interest or dividend). Yield has to be calculated on the purchase price. ...

The Returns and Risks From Investing

... When cumulating or compounding, negative returns are problem ...

... When cumulating or compounding, negative returns are problem ...

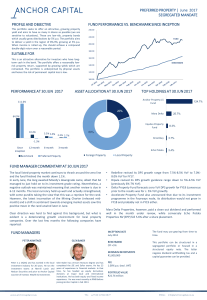

fund performance vs. benchmark since inception

... yield and aims to have as many A shares as possible (we are sensitive to valuations). These are low-risk, property bonds which usually grow distributions by 5% p.a. The portfolio aims to deliver a yield in the region of 8%-9%, growing at 5% p.a. When income is rolled up, this should achieve a compou ...

... yield and aims to have as many A shares as possible (we are sensitive to valuations). These are low-risk, property bonds which usually grow distributions by 5% p.a. The portfolio aims to deliver a yield in the region of 8%-9%, growing at 5% p.a. When income is rolled up, this should achieve a compou ...

Finance&ExcelCh10

... – Examples: Depression and the 2007-2010 Housing Crisis. – 2007-2010 Housing Crisis: housing prices where well above the present value of future rent cash flows. ...

... – Examples: Depression and the 2007-2010 Housing Crisis. – 2007-2010 Housing Crisis: housing prices where well above the present value of future rent cash flows. ...