FACTORS DETERMINING THE FIRM`S COST OF CAPITAL

... earns the required rates of return of all the sources of financing. Furthermore, if the firm earns the investor’s required rates of return on all its sources of financing, including that of the common shareholders, then the value of its common stock will not be changed by the investment. By the same ...

... earns the required rates of return of all the sources of financing. Furthermore, if the firm earns the investor’s required rates of return on all its sources of financing, including that of the common shareholders, then the value of its common stock will not be changed by the investment. By the same ...

Leveraged ETF credit risks

... defaults, as American International Group (NYSE:AIG - News) was threatening to earlier this week, the investment bank may not have enough capital to make the other parties whole and may be forced into default. Although this seems like a lot of risk, there are mitigants. The first bit of good news is ...

... defaults, as American International Group (NYSE:AIG - News) was threatening to earlier this week, the investment bank may not have enough capital to make the other parties whole and may be forced into default. Although this seems like a lot of risk, there are mitigants. The first bit of good news is ...

Lazard Emerging Markets Equity Portfolio

... 1 As June 30, 2017 © 2017 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content ...

... 1 As June 30, 2017 © 2017 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content ...

Large Cap Research Equity

... The table above shows the Portfolio’s past performance, which is no guarantee of future results. The value of an investment in the Portfolio will vary over time, and you could lose money by investing in the Portfolio. Returns are shown net of the Portfolio’s fees and expenses, and include the reinve ...

... The table above shows the Portfolio’s past performance, which is no guarantee of future results. The value of an investment in the Portfolio will vary over time, and you could lose money by investing in the Portfolio. Returns are shown net of the Portfolio’s fees and expenses, and include the reinve ...

TCW Concentrated Core (Large Cap Growth)

... confidence remained on solid ground. The second quarter began with a sluggish nonfarm payroll print (+98k vs. +180k consensus) and a disappointing initial U.S. GDP print of +0.7% (later revised upward to +1.2%) but the May employment report included news that the unemployment rate fell to a 16-year ...

... confidence remained on solid ground. The second quarter began with a sluggish nonfarm payroll print (+98k vs. +180k consensus) and a disappointing initial U.S. GDP print of +0.7% (later revised upward to +1.2%) but the May employment report included news that the unemployment rate fell to a 16-year ...

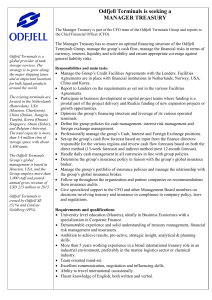

Odfjell Terminals is seeking a MANAGER TREASURY

... Optimize the group’s financing structure and leverage of its various operated China (Dalian, Jiangyin, terminals. Tianjin), Korea (Onsan), Singapore, Oman (Sohar), Define the group policies for cash management, interest risk management and and Belgium (Antwerp). foreign exchange management. The ...

... Optimize the group’s financing structure and leverage of its various operated China (Dalian, Jiangyin, terminals. Tianjin), Korea (Onsan), Singapore, Oman (Sohar), Define the group policies for cash management, interest risk management and and Belgium (Antwerp). foreign exchange management. The ...

CLTL - PowerShares Treasury Collateral Portfolio fund in

... CLTL tracks the ICE U.S. Treasury Short Bond Index, providing exposure to a basket of Treasury securities with a maturity of one year or less. Currently, Treasury Bills are one of the most common types of instruments used by institutions as a collateral pledge to cover margin requirements on derivat ...

... CLTL tracks the ICE U.S. Treasury Short Bond Index, providing exposure to a basket of Treasury securities with a maturity of one year or less. Currently, Treasury Bills are one of the most common types of instruments used by institutions as a collateral pledge to cover margin requirements on derivat ...

Slide 1

... now) • ..but the Chinese economy is well-placed to weather the storm (good news for Australia) • The US Federal Reserve now understands the magnitude of the problem, and is responding.. • ..and the economy and financial markets will eventually ...

... now) • ..but the Chinese economy is well-placed to weather the storm (good news for Australia) • The US Federal Reserve now understands the magnitude of the problem, and is responding.. • ..and the economy and financial markets will eventually ...

Certain U.S. accounting standards have been, and will be, amended

... the objectives of holding derivatives and the strategies for achieving them ...

... the objectives of holding derivatives and the strategies for achieving them ...

Asset Allocation Decision

... • Identify investment needs, risk tolerance, and familiarity with capital markets • Identify objectives and constraints • Enhance investment plans by accurate formulation of a policy statement ...

... • Identify investment needs, risk tolerance, and familiarity with capital markets • Identify objectives and constraints • Enhance investment plans by accurate formulation of a policy statement ...

View - Elite Wealth Management

... The major stock indexes moved higher this month as investors appeared to disregard the old adage to “sell in May and go away.” The S&P 500 gained 1.05% for the month of May while the DJIA and NASDAQ logged gains of 0.95% and 2.60%, respectively. Once again, tech stocks led the bull market's charge a ...

... The major stock indexes moved higher this month as investors appeared to disregard the old adage to “sell in May and go away.” The S&P 500 gained 1.05% for the month of May while the DJIA and NASDAQ logged gains of 0.95% and 2.60%, respectively. Once again, tech stocks led the bull market's charge a ...

FACTSHEET – 05.07.2017 Solactive Panthera World Market

... For more information, please visit www.solactive.com. * Past performance is no guarantee of future results and may be lower or higher than current performance. Index returns are no guarantee for any returns of financial products linked to the index. Any performance information regarding financial pr ...

... For more information, please visit www.solactive.com. * Past performance is no guarantee of future results and may be lower or higher than current performance. Index returns are no guarantee for any returns of financial products linked to the index. Any performance information regarding financial pr ...

Financial Definitions and Ratios as they are used

... you never actually write a check for Depreciation. The money is sitting in the Cash account like a check that has not been cashed. It follows that Free Cash Flow must subtract Capital Expenditures, the investments in plant and equipment. c. If it turns out that you are plowing money back into plant ...

... you never actually write a check for Depreciation. The money is sitting in the Cash account like a check that has not been cashed. It follows that Free Cash Flow must subtract Capital Expenditures, the investments in plant and equipment. c. If it turns out that you are plowing money back into plant ...

1 - JustAnswer.de

... a.) Due, but not payable for more than one year b.) Due and receivable within one year c.) Due, but not receivable for more than one year d.) Due and payable within one year 2.) 2.) Notes may be issued a.) To creditors to temporarily satisfy an account payable created earlier b.) When borrowing mone ...

... a.) Due, but not payable for more than one year b.) Due and receivable within one year c.) Due, but not receivable for more than one year d.) Due and payable within one year 2.) 2.) Notes may be issued a.) To creditors to temporarily satisfy an account payable created earlier b.) When borrowing mone ...

Ch797

... Expected Rate Of Return On The Portfolio E(R) • Calculate All Possible Return on the Portfolio, and Then Calculate its E(R) ...

... Expected Rate Of Return On The Portfolio E(R) • Calculate All Possible Return on the Portfolio, and Then Calculate its E(R) ...

Advanced Practicum in Investment Management (FBE453a and

... Advanced Practicum in Investment Management (FBE453a and FBE453b), aka, USC MARSHALL Undergraduate Student Investment Fund (USIF) Program FBE453ab is the capstone class of the USC Investment Management program. With the generosity of Catherine Nicholas and other donors to the University, the USIF pr ...

... Advanced Practicum in Investment Management (FBE453a and FBE453b), aka, USC MARSHALL Undergraduate Student Investment Fund (USIF) Program FBE453ab is the capstone class of the USC Investment Management program. With the generosity of Catherine Nicholas and other donors to the University, the USIF pr ...

Portfolio Management Workshop

... The remaining holdings are excellent companies with a great capacity to grow their earnings. However, the numbers tell you that, at best, based upon what they are now worth, you would grow your investments (even after dividends) at no more than 5% for Merck and 3.5% for Biomet over the next five yea ...

... The remaining holdings are excellent companies with a great capacity to grow their earnings. However, the numbers tell you that, at best, based upon what they are now worth, you would grow your investments (even after dividends) at no more than 5% for Merck and 3.5% for Biomet over the next five yea ...