Portfolio Update

... At the launch of BACIT, we expected this US$ exposure to dampen volatility, but as we reported in January the dollar’s inverse correlation to risk assets broke down at the start of the year, as the trajectory of the US recovery and those of Europe and Asia diverged. Notwithstanding softer data since ...

... At the launch of BACIT, we expected this US$ exposure to dampen volatility, but as we reported in January the dollar’s inverse correlation to risk assets broke down at the start of the year, as the trajectory of the US recovery and those of Europe and Asia diverged. Notwithstanding softer data since ...

Lecture Presentation to accompany Investment Analysis & Portfolio

... Why do individuals invest ? What is an investment ? How do we measure the rate of return on an investment ? How do investors measure risk related to alternative investments ? What factors contribute to the rate of return that an investor requires on an investment? What macroeconomic and microeco ...

... Why do individuals invest ? What is an investment ? How do we measure the rate of return on an investment ? How do investors measure risk related to alternative investments ? What factors contribute to the rate of return that an investor requires on an investment? What macroeconomic and microeco ...

Eco-30004 Tutorial 1

... exchange rate is $1.70£. What final profit or loss would the fund have realized, in terms of dollars, had it originally hedged its initial investment in British stocks? What was its dollar based annualized rate of return? What would have been its dollar denominated profit and rate of return, had it ...

... exchange rate is $1.70£. What final profit or loss would the fund have realized, in terms of dollars, had it originally hedged its initial investment in British stocks? What was its dollar based annualized rate of return? What would have been its dollar denominated profit and rate of return, had it ...

Portfolio Analysis and Theory in a Nutshell

... • Suppose investors A and B choose portfolios by throwing darts at the Wall Street Journal. Assume that the average return and average standard deviation of stock in the paper is 10% and 14%, respectively. If investor A throws one dart, then his expected return and risk will be 10% and 14%. If inves ...

... • Suppose investors A and B choose portfolios by throwing darts at the Wall Street Journal. Assume that the average return and average standard deviation of stock in the paper is 10% and 14%, respectively. If investor A throws one dart, then his expected return and risk will be 10% and 14%. If inves ...

Bond Valuation - Duke University

... » Can be different from company’s beta » Can often use industry as approximation The Security Market Line provides an estimate of an appropriate discount rate for the project based upon the project’s beta. » Same company may use different discount rates for different projects This discount rate is u ...

... » Can be different from company’s beta » Can often use industry as approximation The Security Market Line provides an estimate of an appropriate discount rate for the project based upon the project’s beta. » Same company may use different discount rates for different projects This discount rate is u ...

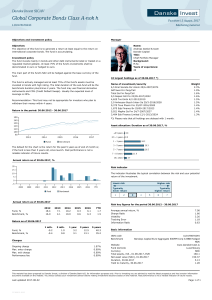

Global Corporate Bonds Class A-nok h

... The fund invests mainly in bonds and other debt instruments listed or traded on a regulated market globally. At least 75% of the fund's investments shall be denominated in euro or hedged to euro. The main part of the fund's NAV will be hedged against the base currency of the fund. The fund is active ...

... The fund invests mainly in bonds and other debt instruments listed or traded on a regulated market globally. At least 75% of the fund's investments shall be denominated in euro or hedged to euro. The main part of the fund's NAV will be hedged against the base currency of the fund. The fund is active ...

Selecting Project Portfolios by Optimizing Simulations

... Modern portfolio theory is still largely based on the Markowitz model of meanvariance efficiency [16], or on assumptions related to it. An underlying assumption for this theory is that portfolio returns are normally distributed. While the mean-variance efficiency theory is still used throughout indu ...

... Modern portfolio theory is still largely based on the Markowitz model of meanvariance efficiency [16], or on assumptions related to it. An underlying assumption for this theory is that portfolio returns are normally distributed. While the mean-variance efficiency theory is still used throughout indu ...

prudential qma strategic value fund

... Enhanced cash strategies are variations on traditional money market vehicles. They are designed to provide liquidity and principal preservation, but with more of an emphasis on seeking returns that are superior to those of traditional money market offerings. Average weighted market capitalization is ...

... Enhanced cash strategies are variations on traditional money market vehicles. They are designed to provide liquidity and principal preservation, but with more of an emphasis on seeking returns that are superior to those of traditional money market offerings. Average weighted market capitalization is ...

Strategy RIsk and the Central Paradox for Active Management

... multiple of tracking error. In a simple conceptual sense, tracking error represents the risks that external events will impact our investment result, while strategy risk represents what we can do to ourselves to contribute to an adverse outcome relative to expectations. ...

... multiple of tracking error. In a simple conceptual sense, tracking error represents the risks that external events will impact our investment result, while strategy risk represents what we can do to ourselves to contribute to an adverse outcome relative to expectations. ...

Summary Report on OECD-China Events on Intellectual Property

... SNA describes exploration in terms of costs of various activities such as borings, aerial surveys etc. Some readers have interpreted this to mean the activity is valued as “sum of costs” ie non-market This is loose wording in the SNA. Own account exploration would be valued at the sum of costs (incl ...

... SNA describes exploration in terms of costs of various activities such as borings, aerial surveys etc. Some readers have interpreted this to mean the activity is valued as “sum of costs” ie non-market This is loose wording in the SNA. Own account exploration would be valued at the sum of costs (incl ...

Prince Charming`s Kiss on Value Stocks I have witnessed many

... buying dollar bills for 80 cents or less. But never forget: In repurchase decisions, price is allimportant. Value is destroyed when purchases are made above intrinsic value.” Sometimes value stocks awaken with a kiss and other times with patience, either way the time to own them is before they make ...

... buying dollar bills for 80 cents or less. But never forget: In repurchase decisions, price is allimportant. Value is destroyed when purchases are made above intrinsic value.” Sometimes value stocks awaken with a kiss and other times with patience, either way the time to own them is before they make ...

Chapter 10

... the end of year 5. There is no impact on net working capital. The marginal tax rate is 40%. The required return is 8%. • Click on the Excel icon to work through the ...

... the end of year 5. There is no impact on net working capital. The marginal tax rate is 40%. The required return is 8%. • Click on the Excel icon to work through the ...

Private Cash Flow Statements

... • Inflows include new debt proceeds, contributions restricted to capital acquisitions (current GAAP), new endowment and other gift • Outflows include capital bond, mortgage and note principal payments, capitalized lease payment, capital debt interest payments, capital acquisitions and capital item s ...

... • Inflows include new debt proceeds, contributions restricted to capital acquisitions (current GAAP), new endowment and other gift • Outflows include capital bond, mortgage and note principal payments, capitalized lease payment, capital debt interest payments, capital acquisitions and capital item s ...

198 - uwcentre

... 198. You have been offered the opportunity to invest in a project which will pay $1,000 per year at the end of years one through 10 and $2,000 per year at the end of years 21 through 30. If the appropriate discount rate is 8%, what is the present value of this cash flow pattern? 199. You are saving ...

... 198. You have been offered the opportunity to invest in a project which will pay $1,000 per year at the end of years one through 10 and $2,000 per year at the end of years 21 through 30. If the appropriate discount rate is 8%, what is the present value of this cash flow pattern? 199. You are saving ...

Portfolio Perspectives - Ryan Wealth Management

... is priced similar to a company with lower profitability. That indicates that either there is something about the higher profitability company that the market has deemed more risky, or there is some reason that analysts do not believe the profitability will continue into the future. As with all inves ...

... is priced similar to a company with lower profitability. That indicates that either there is something about the higher profitability company that the market has deemed more risky, or there is some reason that analysts do not believe the profitability will continue into the future. As with all inves ...

Input Demand: The Capital Market and the Investment Decision

... When they evaluate a project, they estimate the future benefits from the investment and compare it to the possible alternative uses of the funds. ...

... When they evaluate a project, they estimate the future benefits from the investment and compare it to the possible alternative uses of the funds. ...

The Case for a Concentrated Portfolio

... outperformance decreases. Further, a large number of different securities in a portfolio typically means the equity positions are so small (sometimes only 0.2% to 1%) that no individual stock can affect portfolio returns—negatively or positively—with any real degree of significance. The result is of ...

... outperformance decreases. Further, a large number of different securities in a portfolio typically means the equity positions are so small (sometimes only 0.2% to 1%) that no individual stock can affect portfolio returns—negatively or positively—with any real degree of significance. The result is of ...

Other binomial approaches –

... We have explored the equivalent martingale method for derivative pricing and also examined the central role of the replicating portfolio. Recall that for a European call option with strike price, k, and expiration date T, and letting t=0, the value of the derivative is equivalent to the expectation; ...

... We have explored the equivalent martingale method for derivative pricing and also examined the central role of the replicating portfolio. Recall that for a European call option with strike price, k, and expiration date T, and letting t=0, the value of the derivative is equivalent to the expectation; ...

First Quarter 2015 Securities Markets Commentary Index

... than they have seen since the early nineties, and foreign use of their currency, the yuan, has correspondingly decreased. Meanwhile the European Central Bank (ECB), through its President Mario Draghi, is battling a sputtering economy with massive quantitative easing (QE). You will recall from last ...

... than they have seen since the early nineties, and foreign use of their currency, the yuan, has correspondingly decreased. Meanwhile the European Central Bank (ECB), through its President Mario Draghi, is battling a sputtering economy with massive quantitative easing (QE). You will recall from last ...

Mutual Fund Scheme Analysis

... conditions and the scheme’s volatile nature (as it invests in mid & small cap stocks), investing through Systematic Investment Plan (SIP) is advisable at this point of time. Performance Appraisal: The scheme, ICICI Pru Discovery registered decent returns over long run compared to the other schemes i ...

... conditions and the scheme’s volatile nature (as it invests in mid & small cap stocks), investing through Systematic Investment Plan (SIP) is advisable at this point of time. Performance Appraisal: The scheme, ICICI Pru Discovery registered decent returns over long run compared to the other schemes i ...

The GreaT DebaTe: Income vs . ToTal reTurn

... Material presented has been derived from sources considered to be reliable, but the accuracy and completeness cannot be guaranteed. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, other investments or to adopt any investment strat ...

... Material presented has been derived from sources considered to be reliable, but the accuracy and completeness cannot be guaranteed. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, other investments or to adopt any investment strat ...