Cap Value Fiduciary Services Equity Investment

... Morgan Stanley include all fee-paying portfolios with no investment restrictions. New accounts are included upon the first full quarter of performance. Terminated accounts are removed in the quarter in which they terminate. Performance is calculated on a total return basis and by asset weighting the ...

... Morgan Stanley include all fee-paying portfolios with no investment restrictions. New accounts are included upon the first full quarter of performance. Terminated accounts are removed in the quarter in which they terminate. Performance is calculated on a total return basis and by asset weighting the ...

Common Errors in DCF Models

... embrace an approach that packs all of those same assumptions, without any transparency, into a single number: the multiple. 3 Multiples are not valuation; they represent shorthand for the valuation process. Like most forms of shorthand, multiples come with blind spots and biases that few investors t ...

... embrace an approach that packs all of those same assumptions, without any transparency, into a single number: the multiple. 3 Multiples are not valuation; they represent shorthand for the valuation process. Like most forms of shorthand, multiples come with blind spots and biases that few investors t ...

Cash Flow

... 8.8 Cash Flow Statements On completion, the student should: • Understand the importance of cash flow statements/data • Be able to explain the difference between profit and cash • Be able to identify and treat items not involving the movement of cash • Be able to identify and classify the sources of ...

... 8.8 Cash Flow Statements On completion, the student should: • Understand the importance of cash flow statements/data • Be able to explain the difference between profit and cash • Be able to identify and treat items not involving the movement of cash • Be able to identify and classify the sources of ...

Java Software Structures, 4th Edition Exercise Solutions, Ch. 8

... String result = text; if (text.length() > 1) result = text.charAt(text.length()-1) + reverse (text.substring(0, text.length()-1)); return result; ...

... String result = text; if (text.length() > 1) result = text.charAt(text.length()-1) + reverse (text.substring(0, text.length()-1)); return result; ...

THE EXTRAORDINARY DIVIDEND

... downloads page or from our registered office. If you have a financial adviser, you should seek their advice before investing. Woodford Investment Management Ltd is not authorised to provide investment advice. ...

... downloads page or from our registered office. If you have a financial adviser, you should seek their advice before investing. Woodford Investment Management Ltd is not authorised to provide investment advice. ...

CEO ownership, stock market performance, and managerial discretion

... Our paper has two main parts. In the first part, we derive our main results and show that they are robust and economically meaningful. In the second part, we discuss different potential explanations for our results. ...

... Our paper has two main parts. In the first part, we derive our main results and show that they are robust and economically meaningful. In the second part, we discuss different potential explanations for our results. ...

Ch7 Portf theory sols 12ed

... With some arranging, the similarities between the CML and SML are obvious. When in this form, both have the same market price of risk, or slope, (rM - rRF)/σM. The measure of risk in the CML is σp. Since the CML applies only to efficient portfolios, σp not only represents the portfolio's total risk, ...

... With some arranging, the similarities between the CML and SML are obvious. When in this form, both have the same market price of risk, or slope, (rM - rRF)/σM. The measure of risk in the CML is σp. Since the CML applies only to efficient portfolios, σp not only represents the portfolio's total risk, ...

Presented by

... officers, directors, members, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this presentation or its contents. The securities discussed in this presentation may not be suitable for all investors. The value of and income from any investment ...

... officers, directors, members, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this presentation or its contents. The securities discussed in this presentation may not be suitable for all investors. The value of and income from any investment ...

A New Strategy for Social Security Investment in Latin America

... investors in a balanced portfolio of stocks and bonds has been about 6.5 percent. In addition, the federal, state and local governments collect taxes equal to about 3.5 cents per year for every extra dollar of capital put in place. So all together the national real rate of return on incremental savi ...

... investors in a balanced portfolio of stocks and bonds has been about 6.5 percent. In addition, the federal, state and local governments collect taxes equal to about 3.5 cents per year for every extra dollar of capital put in place. So all together the national real rate of return on incremental savi ...

Case 2–1 - Fisher College of Business

... (increased $33,200). If owners' equity increased $33,200 and $4,800 of this was the result of additional issuance of stock, net income must have been $33,200 – $4,800, or $28,400. ...

... (increased $33,200). If owners' equity increased $33,200 and $4,800 of this was the result of additional issuance of stock, net income must have been $33,200 – $4,800, or $28,400. ...

Journal of Monetary Economics 22 (1988) 133-136. North

... rea~ m~er¢~ rate ~,!d the ?robabflity of the extreme event move inversely wouid be useful m rationalizing movements in the real interest rate during the last 100 years. For example, the perceived probability of a recurrence of a depression was probably high just after World War II and then declined. ...

... rea~ m~er¢~ rate ~,!d the ?robabflity of the extreme event move inversely wouid be useful m rationalizing movements in the real interest rate during the last 100 years. For example, the perceived probability of a recurrence of a depression was probably high just after World War II and then declined. ...

Answers to Before You Go On Questions

... same by assuming repeated investments over some identical period and then comparing the NPVs of their costs. o A less cumbersome and more powerful method to handle the problem is to compute the equivalent annual cost (EAC). The EAC can be calculated as ...

... same by assuming repeated investments over some identical period and then comparing the NPVs of their costs. o A less cumbersome and more powerful method to handle the problem is to compute the equivalent annual cost (EAC). The EAC can be calculated as ...

Syllabus - Baylor University

... Each investor group has the same amount of money to invest and their total net worth equals the value of all securities. In other words, all the interest income from muni’s as well as all corporate NOI mentioned above must flow through securities purchased by the three investor groups listed above. ...

... Each investor group has the same amount of money to invest and their total net worth equals the value of all securities. In other words, all the interest income from muni’s as well as all corporate NOI mentioned above must flow through securities purchased by the three investor groups listed above. ...

Fund Update - Platypus Asset Management

... Asset and Sector allocations are calculated on the average holdings of the portfolio for the month. ...

... Asset and Sector allocations are calculated on the average holdings of the portfolio for the month. ...

bmo funds transfer of account request investor class of shares

... The cost basis reporting method on your account will be used to deplete the shares for this transaction. The BMO Funds default cost basis method is average cost. If you wish to change your cost basis method, please complete a BMO Funds Cost Basis Reporting Election Form and send it in with this form ...

... The cost basis reporting method on your account will be used to deplete the shares for this transaction. The BMO Funds default cost basis method is average cost. If you wish to change your cost basis method, please complete a BMO Funds Cost Basis Reporting Election Form and send it in with this form ...

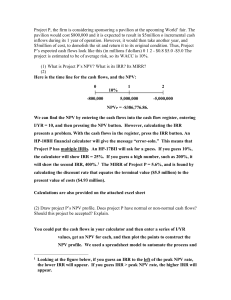

For Taxpayer filing Form 510 and Using the Distributable Cash Flow

... that would have been reported under the cash method of accounting). Line B - Enter any cash receipts received by the PTE that were not included in gross income including capital contributions and loan proceeds. Line C - Enter the allowable depreciation, amortization and/or depletion used as a deduct ...

... that would have been reported under the cash method of accounting). Line B - Enter any cash receipts received by the PTE that were not included in gross income including capital contributions and loan proceeds. Line C - Enter the allowable depreciation, amortization and/or depletion used as a deduct ...

derivative security - the School of Economics and Finance

... $100 is deposited for a year at quoted annual percentage rate (APR) of 12% with monthly compounding. Given 12% APR, the monthly interest rate is 1%. At the end of each month, interest is calculated and added to the principle to earn more interest. • End of month 1: $100(1+1%) • End of month 2: $100( ...

... $100 is deposited for a year at quoted annual percentage rate (APR) of 12% with monthly compounding. Given 12% APR, the monthly interest rate is 1%. At the end of each month, interest is calculated and added to the principle to earn more interest. • End of month 1: $100(1+1%) • End of month 2: $100( ...

Portfolio Management: Course Introduction

... MVO: All risky assets (market) and one risk-free asset • We can generalize our previous results by considering all risky assets and one risk-free asset. The tangency (optimal risky) portfolio is the market portfolio. All investors will hold a combination of the risk-free asset and this market portf ...

... MVO: All risky assets (market) and one risk-free asset • We can generalize our previous results by considering all risky assets and one risk-free asset. The tangency (optimal risky) portfolio is the market portfolio. All investors will hold a combination of the risk-free asset and this market portf ...

Helpful Comments: Excel Financial functions perform common

... Problem #3: Luis purchased a condominium five years ago. At that time he took a 15year $100,000 home mortgage at 10% per year, compounded monthly. Payments on the loan are made at the end of each month. a) What is Luis monthly payment? b) What is the remaining principal on Luis' mortgage after makin ...

... Problem #3: Luis purchased a condominium five years ago. At that time he took a 15year $100,000 home mortgage at 10% per year, compounded monthly. Payments on the loan are made at the end of each month. a) What is Luis monthly payment? b) What is the remaining principal on Luis' mortgage after makin ...

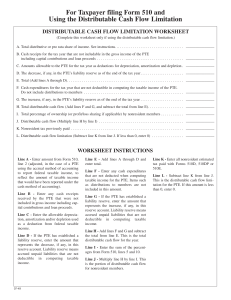

Capital Budgeting in Projects

... • Depends on assumptions that cannot be managed or controlled. • Will overall results be close to predicted value? • Sensitivity and risk analysis produce information about uncertainties. • Sensitivity analysis - which assumptions are most important in controlling overall ...

... • Depends on assumptions that cannot be managed or controlled. • Will overall results be close to predicted value? • Sensitivity and risk analysis produce information about uncertainties. • Sensitivity analysis - which assumptions are most important in controlling overall ...