Test Bank for Quiz-2 FINA252 Financial Management

... An examination of the sources and uses of funds statement is part of: a forecasting techniques a funds flow analysis a ratio analysis calculations for preparing the balance sheet. ...

... An examination of the sources and uses of funds statement is part of: a forecasting techniques a funds flow analysis a ratio analysis calculations for preparing the balance sheet. ...

Market measures of performance and value

... Investor ratios There are a number of important ratios that are used to help the investor. Some are mixed ratios in that they require access to figures both in the accounts and from market sources. The income statement and the current quoted price per share for the company provide most of the inform ...

... Investor ratios There are a number of important ratios that are used to help the investor. Some are mixed ratios in that they require access to figures both in the accounts and from market sources. The income statement and the current quoted price per share for the company provide most of the inform ...

During August 2012, company produced and sold 3000 boxes of

... proposal is financially acceptable. The investment proposal has a positive net present value (NPV) of $366,722 and is therefore financially acceptable. The results of the other investment appraisal methods do not alter this financial acceptability, as the NPV decision rule will always offer the corr ...

... proposal is financially acceptable. The investment proposal has a positive net present value (NPV) of $366,722 and is therefore financially acceptable. The results of the other investment appraisal methods do not alter this financial acceptability, as the NPV decision rule will always offer the corr ...

a comparison of basic and extended markowitz model on croatian

... basic Markowitz model, on the Zagreb Stock Exchange, we were faced with unexpected results. Although we expected that the inclusion of transaction costs would decrease the returns for every level of risk for each portfolio on the efficient frontier, the opposite happened. The explanation for this ca ...

... basic Markowitz model, on the Zagreb Stock Exchange, we were faced with unexpected results. Although we expected that the inclusion of transaction costs would decrease the returns for every level of risk for each portfolio on the efficient frontier, the opposite happened. The explanation for this ca ...

Back to the Future – A Round-Trip with Discounted Cash Flows

... For many claims there will be no certainty as to what the business’ historical (and future) cash flows would have been. Accordingly, these cash flows should be discounted by WACC. Sometimes, however, there may be reasonable certainty as to what a business’ historical cash flows would have been. For ...

... For many claims there will be no certainty as to what the business’ historical (and future) cash flows would have been. Accordingly, these cash flows should be discounted by WACC. Sometimes, however, there may be reasonable certainty as to what a business’ historical cash flows would have been. For ...

end of the golden age? - Virtus Investment Partners

... Unless stated otherwise, any sources and opinions expressed are those of Aviva Investors Global Services Limited (Aviva Investors) as of May 4, 2016. Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are ...

... Unless stated otherwise, any sources and opinions expressed are those of Aviva Investors Global Services Limited (Aviva Investors) as of May 4, 2016. Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are ...

6. Key Indicators

... • Demonstrates ability to liquidate the firm, cover all liabilities out of all assets, and still have “cash” left over. • Should not exceed 0.50 to minimize financial risk exposure. • Some firms fail however at lower levels. 2. Leverage ratio: • Total debt divided by equity or net worth. • Often a c ...

... • Demonstrates ability to liquidate the firm, cover all liabilities out of all assets, and still have “cash” left over. • Should not exceed 0.50 to minimize financial risk exposure. • Some firms fail however at lower levels. 2. Leverage ratio: • Total debt divided by equity or net worth. • Often a c ...

FIN 397 1-Investment Theory and Practice-Hallman

... This Tuckman book is available on-line through Amazon for a reasonable price. You can also sometimes pick up a used copy on-line. Additionally, you can purchase the necessary chapters on a per-chapter basis for $4.50/chapter at the following website: http://www.garpdigitallibrary.org/display/author. ...

... This Tuckman book is available on-line through Amazon for a reasonable price. You can also sometimes pick up a used copy on-line. Additionally, you can purchase the necessary chapters on a per-chapter basis for $4.50/chapter at the following website: http://www.garpdigitallibrary.org/display/author. ...

1Q14 - Investors

... This presentation contains, and management may make, certain statements that are not historical facts but that are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements ...

... This presentation contains, and management may make, certain statements that are not historical facts but that are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements ...

View White Paper - Winslow Capital

... free cash flows. Companies with low returns on invested capital generate less cash flow to distribute to shareholders. These entities deserve low valuation metrics, such as low price-toearnings multiples. Monitoring trends in ROIC is critical in assessing if a company’s competitive advantages are er ...

... free cash flows. Companies with low returns on invested capital generate less cash flow to distribute to shareholders. These entities deserve low valuation metrics, such as low price-toearnings multiples. Monitoring trends in ROIC is critical in assessing if a company’s competitive advantages are er ...

Lecture Notes_Chapter 1 - the School of Economics and Finance

... 1. An interest rate is quoted as 5% per annum with semiannual compounding. What is the equivalent rate with (a) annual compounding, (b) monthly compounding, and (c) continuous compounding? 2. An investor receives $1,100 in one year in return for an investment of $1,000 now. Calculate the percentage ...

... 1. An interest rate is quoted as 5% per annum with semiannual compounding. What is the equivalent rate with (a) annual compounding, (b) monthly compounding, and (c) continuous compounding? 2. An investor receives $1,100 in one year in return for an investment of $1,000 now. Calculate the percentage ...

IASB Update Note No. 6 – Peter Wright and Nick Dexter This is the

... reflecting current market returns either for the actual portfolio of assets the insurer holds or for a replicating portfolio. (b) The insurer should use an estimate that is consistent with the IASB’s guidance on fair value measurement (c) Cash flows of the instruments should be adjusted for timing a ...

... reflecting current market returns either for the actual portfolio of assets the insurer holds or for a replicating portfolio. (b) The insurer should use an estimate that is consistent with the IASB’s guidance on fair value measurement (c) Cash flows of the instruments should be adjusted for timing a ...

Ayotte - NYU School of Law

... Good investments have high IRRs & good financing has low IRR o Multiple rates of return Some investments have two IRRs (cash flow changes sign at least 2x) = in these situations NPV is more useful Also IRR may not exist! (may never cross zero) o Mutually exclusive IRR could say two investmen ...

... Good investments have high IRRs & good financing has low IRR o Multiple rates of return Some investments have two IRRs (cash flow changes sign at least 2x) = in these situations NPV is more useful Also IRR may not exist! (may never cross zero) o Mutually exclusive IRR could say two investmen ...

Returns, Absolute Returns and Risk

... Importantly in this connection, I continue to insist that no asset class and no investment technique possesses a natural or embedded rate of return. Fixed income comes closest, with its promise of interest and the repayment of principal. But for the holder of a 20-year bond, most of the total return ...

... Importantly in this connection, I continue to insist that no asset class and no investment technique possesses a natural or embedded rate of return. Fixed income comes closest, with its promise of interest and the repayment of principal. But for the holder of a 20-year bond, most of the total return ...

Investment Strategy for Pensions Actuaries A Multi Asset Class

... Past performance is not a guide to future returns. The value of investments can fall as well as rise as a result of market movements. Investments in smaller companies may be less liquid than in larger companies and price swings may therefore be greater than in larger company funds. Exchange rate cha ...

... Past performance is not a guide to future returns. The value of investments can fall as well as rise as a result of market movements. Investments in smaller companies may be less liquid than in larger companies and price swings may therefore be greater than in larger company funds. Exchange rate cha ...

Newsletter for Investors Large blue chip growth stocks

... quote and always refer to it when you are about to make an important investment decision. Far too often individual investors get emotional about their investments at exactly the wrong time. We have seen and written about phenomenon such as the internet bubble of 1999-2000 and more recently the resid ...

... quote and always refer to it when you are about to make an important investment decision. Far too often individual investors get emotional about their investments at exactly the wrong time. We have seen and written about phenomenon such as the internet bubble of 1999-2000 and more recently the resid ...

FINDING RELATIVE VALUE OPPORTUNITIES IN FIXED INCOME

... matter what the label on the tin says, bonds, particularly those trading at historical low yields, can and do lose money in rising interest rate environments. For example, a 10 year government bond would be expected to lose approximately 8.5% (price change) when interest rates increase by 1%. Given ...

... matter what the label on the tin says, bonds, particularly those trading at historical low yields, can and do lose money in rising interest rate environments. For example, a 10 year government bond would be expected to lose approximately 8.5% (price change) when interest rates increase by 1%. Given ...

Chap 5 - TCU.edu

... instruments will increase significantly above the current 6% yield, then the money market fund might result in a higher HPR than the savings deposit. The 20-year Treasury bond offers a yield to maturity of 9% per year, which is 150 basis points higher than the rate on the one-year savings deposit; h ...

... instruments will increase significantly above the current 6% yield, then the money market fund might result in a higher HPR than the savings deposit. The 20-year Treasury bond offers a yield to maturity of 9% per year, which is 150 basis points higher than the rate on the one-year savings deposit; h ...

Answers to Concepts Review and Critical Thinking Questions

... exceed $35, then they should fight the offer from the outside company. If management believes that this bidder or other unidentified bidders will actually pay more than $35 per share to acquire the company, then they should still fight the offer. However, if the current management cannot increase th ...

... exceed $35, then they should fight the offer from the outside company. If management believes that this bidder or other unidentified bidders will actually pay more than $35 per share to acquire the company, then they should still fight the offer. However, if the current management cannot increase th ...

Risk and return (1)

... • The average annual return on U.S. stocks from 1926 – 2001 was 11.6%. The average risk premium was 7.9%. • Stocks are quite risky. The standard deviation of monthly returns for the overall market is 4.5% (15.6% annually). • Individual stocks are much riskier. The average monthly standard deviation ...

... • The average annual return on U.S. stocks from 1926 – 2001 was 11.6%. The average risk premium was 7.9%. • Stocks are quite risky. The standard deviation of monthly returns for the overall market is 4.5% (15.6% annually). • Individual stocks are much riskier. The average monthly standard deviation ...

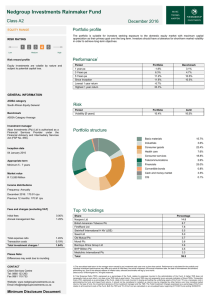

Fact sheets - Nedgroup Investments

... The JSE All Share Index recorded a gain of 1.0% in December and 2.6% for the 2016 calendar year. For the month of December, Financials gained 3.5% and Industrials +1.8%. Resources lagged in December (-3.6%) but still ended the year well ahead of the other major sectors in performance terms. Our hold ...

... The JSE All Share Index recorded a gain of 1.0% in December and 2.6% for the 2016 calendar year. For the month of December, Financials gained 3.5% and Industrials +1.8%. Resources lagged in December (-3.6%) but still ended the year well ahead of the other major sectors in performance terms. Our hold ...