Additional Computer Exercise 3

... Future value (fv) – the value of the investment or loan after all payments have been made. (F) Number of periods (nper) – the total number of payments or periods of an investment. (n) Payment (pmt) – the amount paid periodically to an investment or loan. (A) Present value (pv) – the value of an inve ...

... Future value (fv) – the value of the investment or loan after all payments have been made. (F) Number of periods (nper) – the total number of payments or periods of an investment. (n) Payment (pmt) – the amount paid periodically to an investment or loan. (A) Present value (pv) – the value of an inve ...

Introduction to Managerial Accounting

... The payback period is the length of time that it takes for a project to recover its initial cost out of the cash receipts that it generates. When the net annual cash inflow is the same each year, this formula can be used to compute the payback period: Payback period = ...

... The payback period is the length of time that it takes for a project to recover its initial cost out of the cash receipts that it generates. When the net annual cash inflow is the same each year, this formula can be used to compute the payback period: Payback period = ...

Solution - UW AFSA

... this omission on its balance sheet at December 31, 20A, (end of the accounting period) was that A) assets and shareholder's equity were overstated but liabilities were not affected. B) shareholder's equity was the only item affected by the omission. C) assets and liabilities were understated but sha ...

... this omission on its balance sheet at December 31, 20A, (end of the accounting period) was that A) assets and shareholder's equity were overstated but liabilities were not affected. B) shareholder's equity was the only item affected by the omission. C) assets and liabilities were understated but sha ...

Valuation Risk chapter 02

... is independent of the passage of time • e.g., you buy a bond for $950, receive $80 in interest, and later sell the bond for $980 – The return is ($80 + $30)/$950 = 11.58 percent – The 11.58 percent could have been earned over one year or one week ...

... is independent of the passage of time • e.g., you buy a bond for $950, receive $80 in interest, and later sell the bond for $980 – The return is ($80 + $30)/$950 = 11.58 percent – The 11.58 percent could have been earned over one year or one week ...

StrongPCMP4e-ch02

... one time. The wheel contains numbers 1 through 100, and a pointer selects one number when the wheel stops. The payoff alternatives are on the next slide. Which alternative would you choose? ...

... one time. The wheel contains numbers 1 through 100, and a pointer selects one number when the wheel stops. The payoff alternatives are on the next slide. Which alternative would you choose? ...

Mackenzie Investments

... • In their view, the main culprit behind the world’s current state of affairs is decades of moral hazard and the related roles of short-term bailout mentality and central banks disrupting the efficient functioning of capital markets. • In terms of central banks, while their actions have been well-in ...

... • In their view, the main culprit behind the world’s current state of affairs is decades of moral hazard and the related roles of short-term bailout mentality and central banks disrupting the efficient functioning of capital markets. • In terms of central banks, while their actions have been well-in ...

Investment Strategies and Alternative Investments in Insurance and

... It can be seen that most of the monthly returns come from alpha. The model can replicate the monthly return for hedge funds with lower volatility. However, this is based on in-sample regression. Out of sample tests have not been performed ...

... It can be seen that most of the monthly returns come from alpha. The model can replicate the monthly return for hedge funds with lower volatility. However, this is based on in-sample regression. Out of sample tests have not been performed ...

Homework 10 solution

... 4. Impact of Interest Rates. How are the interest rate, the required rate of return on a stock, and the valuation of a stock related? ANSWER: Given a choice of risk-free Treasury securities or stocks, stocks should be purchased only if they are appropriately priced to reflect a sufficiently high exp ...

... 4. Impact of Interest Rates. How are the interest rate, the required rate of return on a stock, and the valuation of a stock related? ANSWER: Given a choice of risk-free Treasury securities or stocks, stocks should be purchased only if they are appropriately priced to reflect a sufficiently high exp ...

ch02

... Purchase price • E.g., you buy a bond for $950, receive $80 in interest, and later sell the bond for $980 – The return is ($80 + $30)/$950 = 11.58% – The 11.58% could have been earned over one year or one week ...

... Purchase price • E.g., you buy a bond for $950, receive $80 in interest, and later sell the bond for $980 – The return is ($80 + $30)/$950 = 11.58% – The 11.58% could have been earned over one year or one week ...

fulga

... This method is uses in the first step scenario generation techniques, that means producing a large number of future price scenarios. The next step, the portfolio valuation, consists in computing a portfolio value for each scenario. In the final step, the summary, we report the results of the simulat ...

... This method is uses in the first step scenario generation techniques, that means producing a large number of future price scenarios. The next step, the portfolio valuation, consists in computing a portfolio value for each scenario. In the final step, the summary, we report the results of the simulat ...

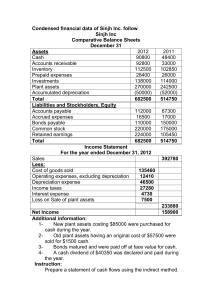

Condensed financial data of Sinjh Inc. follow Sinjh Inc Comparative

... 1New plant assets costing $85000 were purchased for cash during the year. 2Old plant assets having an original cost of $57500 were sold for $1500 cash. 3Bonds matured and were paid off at face value for cash. 4A cash dividend of $40350 was declared and paid during the year. Instruction: Prepare a st ...

... 1New plant assets costing $85000 were purchased for cash during the year. 2Old plant assets having an original cost of $57500 were sold for $1500 cash. 3Bonds matured and were paid off at face value for cash. 4A cash dividend of $40350 was declared and paid during the year. Instruction: Prepare a st ...

Capital Budgeting Processes And Techniques

... working capital (NWC) = Current assets minus current liabilities An increase in NWC requires a cash outflow, while a decrease creates a cash inflow. ...

... working capital (NWC) = Current assets minus current liabilities An increase in NWC requires a cash outflow, while a decrease creates a cash inflow. ...

FIN 303 Chap 9 Fall 2009

... Note: The value you put on the stock could be different from its current price in the market. Example: Suppose IBM is trading for $84/share. But you estimate it is worth $100/share. Based on that belief, you might buy IBM stock. You’d be betting others would figure out you are right and buy IBM stoc ...

... Note: The value you put on the stock could be different from its current price in the market. Example: Suppose IBM is trading for $84/share. But you estimate it is worth $100/share. Based on that belief, you might buy IBM stock. You’d be betting others would figure out you are right and buy IBM stoc ...

Class Definitions

... may be added to end the method before all its code is ended Example public void writeMesssage( ) { System.out.println( “status” ); if ( ) { System.out.println( “nothing” ); return; ...

... may be added to end the method before all its code is ended Example public void writeMesssage( ) { System.out.println( “status” ); if ( ) { System.out.println( “nothing” ); return; ...

Exam 3 Practice Questions

... b. Using a constant growth dividend discount model, Black estimated the value of NewSoft to be $28 per share and the value of Capital Corp. to be $34 per share. Briefly discuss weaknesses of this dividend discount model and explain why this model may be less suitable for valuing NewSoft than for val ...

... b. Using a constant growth dividend discount model, Black estimated the value of NewSoft to be $28 per share and the value of Capital Corp. to be $34 per share. Briefly discuss weaknesses of this dividend discount model and explain why this model may be less suitable for valuing NewSoft than for val ...

Dissecting the `MAC` Universe Multi-Asset Credit

... Unconstrained Fixed Income, Multi-Sector Total Return Bonds, Strategic Income Bond and Multi-Asset Credit are suggestive of a particular strategy but may be at odds with what a manager is actually doing in practice. There has been some disappointment in these products from investors who did not unde ...

... Unconstrained Fixed Income, Multi-Sector Total Return Bonds, Strategic Income Bond and Multi-Asset Credit are suggestive of a particular strategy but may be at odds with what a manager is actually doing in practice. There has been some disappointment in these products from investors who did not unde ...

Performance of Equity Managers: Style versus "Neural Network

... – Lakonishok, Shleiffer and Vishny (LSV) argue that the money management industry is a “cottage” industry riddled with agency costs – Coggin, Fabozzi and Rahman (CFR) conclude that money-managers add substantial value over “style” benchmarks – Christopherson, Ferson and Glassman (CFG) conclude • per ...

... – Lakonishok, Shleiffer and Vishny (LSV) argue that the money management industry is a “cottage” industry riddled with agency costs – Coggin, Fabozzi and Rahman (CFR) conclude that money-managers add substantial value over “style” benchmarks – Christopherson, Ferson and Glassman (CFG) conclude • per ...

PPT

... Firm Value = $78,982/1.0916**3 = $60,721 million Equity Value = $60,721 million - 26,281 million = $34,440 million This is an approximation because it assumes cash flows over the first three years, while Daimler normalizes earnings, will be zero. ...

... Firm Value = $78,982/1.0916**3 = $60,721 million Equity Value = $60,721 million - 26,281 million = $34,440 million This is an approximation because it assumes cash flows over the first three years, while Daimler normalizes earnings, will be zero. ...

Measuring Risk Adjusted Return (Sharpe Ratio) of the Selected

... Indian economy were opened one by one and many are in pipeline. Financial sector was also one of the part of it. Indian capital market has observed so many fundamental changes by SEBI. In earlier times there were only few investment options available to investors for investment but with the initiali ...

... Indian economy were opened one by one and many are in pipeline. Financial sector was also one of the part of it. Indian capital market has observed so many fundamental changes by SEBI. In earlier times there were only few investment options available to investors for investment but with the initiali ...

Whole Foods Market Reports First Quarter Results

... beyond the control of the Company, as well other risks listed in the Company’s Annual Report on Form 10-K for the fiscal year ended September 27, 2015, and other risks and uncertainties not presently known to us or that we currently deem immaterial. We wish to caution you that you should not place u ...

... beyond the control of the Company, as well other risks listed in the Company’s Annual Report on Form 10-K for the fiscal year ended September 27, 2015, and other risks and uncertainties not presently known to us or that we currently deem immaterial. We wish to caution you that you should not place u ...

Developing a Business Plan for the Start-up Law Firm

... Accrual basis: The accrual basis attempts to match earned revenues (whether collected or not) with expenses (whether paid or not) in the same period. Accrual accounting is sometimes referred to as “generally accepted accounting principles”, or GAAP. The rules for measurement and presentation of f ...

... Accrual basis: The accrual basis attempts to match earned revenues (whether collected or not) with expenses (whether paid or not) in the same period. Accrual accounting is sometimes referred to as “generally accepted accounting principles”, or GAAP. The rules for measurement and presentation of f ...

Element of the cash flow statement

... There are two types of cash flow statements - the direct cash flow statement and the indirect cash flow statement. The direct cash flow statement is basically a cash T - account split into the three components. The indirect cash flow statement also has three parts. The investing and financing sectio ...

... There are two types of cash flow statements - the direct cash flow statement and the indirect cash flow statement. The direct cash flow statement is basically a cash T - account split into the three components. The indirect cash flow statement also has three parts. The investing and financing sectio ...

Public Capital: Measurement Issues and Policy Implications Matilde

... They develop a new model, including (some) intangibles as investment, instead of following the NA practice of treating them as intermediate consumption goods and services. Following their proposal, “any use of resources that reduces current consumption in order to increase it in the future […] q ...

... They develop a new model, including (some) intangibles as investment, instead of following the NA practice of treating them as intermediate consumption goods and services. Following their proposal, “any use of resources that reduces current consumption in order to increase it in the future […] q ...