Dynamic portfolio and mortgage choice for homeowners

... Stocks: dS / S R f S S dt S dzS Real riskless rate: dr r r dt r dzr Expected inflation rate: d dt dz ...

... Stocks: dS / S R f S S dt S dzS Real riskless rate: dr r r dt r dzr Expected inflation rate: d dt dz ...

File: ch10 Type: Multiple Choice 1. Which are the two major

... dividend will be, but he does know that the company just paid a dividend of $1.00 per share. He expects this dividend to grow by 4% per year, and he has also determined that 11% is an appropriate rate to discount these flows. What is the highest amount he should pay for this stock? a) $1.00 b) $9.09 ...

... dividend will be, but he does know that the company just paid a dividend of $1.00 per share. He expects this dividend to grow by 4% per year, and he has also determined that 11% is an appropriate rate to discount these flows. What is the highest amount he should pay for this stock? a) $1.00 b) $9.09 ...

Introduction to Financial Theory

... In the case pf the stock one recovers the martingale property q(1) S1 +q(2) S2 +…+q(M) SM = S(0) ( 1+R) (martingale property). ...

... In the case pf the stock one recovers the martingale property q(1) S1 +q(2) S2 +…+q(M) SM = S(0) ( 1+R) (martingale property). ...

New Frontier - listing - Business Plan (00142711

... intends to raise additional sums of $50 million in 2017 and $50 million in 2018. The Company has entered into the Forward Sale Agreement with Treemo (Pty) Ltd, in terms of which it will acquire from Treemo the Listed Portfolio, valued at approximately the ZAR equivalent of $313 million, which purcha ...

... intends to raise additional sums of $50 million in 2017 and $50 million in 2018. The Company has entered into the Forward Sale Agreement with Treemo (Pty) Ltd, in terms of which it will acquire from Treemo the Listed Portfolio, valued at approximately the ZAR equivalent of $313 million, which purcha ...

MIM700 - Prof Dimond

... • What is the expected growth of EPS for next year? • What is the average growth of earnings implied in the price? • How do these figures look for your team’s company? Michael Dimond School of Business Administration ...

... • What is the expected growth of EPS for next year? • What is the average growth of earnings implied in the price? • How do these figures look for your team’s company? Michael Dimond School of Business Administration ...

Implied Expected Returns and the Choice of a Mean–Variance

... variance efficient portfolio. Traditionally the standard choice has been to use the market capitalization weighted portfolio. The proponents of this approach tend to emphasize the result that under the capital asset pricing model (CAPM) the market capitalization portfolio is mean–variance efficient. ...

... variance efficient portfolio. Traditionally the standard choice has been to use the market capitalization weighted portfolio. The proponents of this approach tend to emphasize the result that under the capital asset pricing model (CAPM) the market capitalization portfolio is mean–variance efficient. ...

Investment risks - Lecture 10: Asset allocation methods

... • Such a trading strategy is also called market timing. The objective of market timing is to be invested in stocks in a bull market, and to be invested in bonds/cash in a bear market. ...

... • Such a trading strategy is also called market timing. The objective of market timing is to be invested in stocks in a bull market, and to be invested in bonds/cash in a bear market. ...

What`s the right SASS investment allocation?

... This information is of a general nature only and is not specific to your personal circumstances or needs. It is published for your interest. Before making any decisions based on this information you should consider its appropriateness to you. Every effort has been made to ensure the information cont ...

... This information is of a general nature only and is not specific to your personal circumstances or needs. It is published for your interest. Before making any decisions based on this information you should consider its appropriateness to you. Every effort has been made to ensure the information cont ...

Lotus Notes can be a tough Email client to test your HTML

... – both in the economy and investment returns – remains highly uncertain. What kind of news would we need to hear, what questions need to be answered and what developments would we like to see in order to become more optimistic? Here is a list, but by no means an exhaustive one. So far, the loan an ...

... – both in the economy and investment returns – remains highly uncertain. What kind of news would we need to hear, what questions need to be answered and what developments would we like to see in order to become more optimistic? Here is a list, but by no means an exhaustive one. So far, the loan an ...

Portfolio Funding Profile

... Solid end points = Average Market Conditions (50% Confidence) Transparent end points = Extended Down Markets (90% Confidence) ...

... Solid end points = Average Market Conditions (50% Confidence) Transparent end points = Extended Down Markets (90% Confidence) ...

performance analysis for the two-minute portfolio in both canadian

... equal-weight portfolio beat the capitalisation-weighted S&P 500 benchmark by an average of about three percent annually. Shimizu (2010) evaluates the equal-weight rebalancing strategy mathematically with all investment strategies with the following conditions: … (1) we have a certain number of asse ...

... equal-weight portfolio beat the capitalisation-weighted S&P 500 benchmark by an average of about three percent annually. Shimizu (2010) evaluates the equal-weight rebalancing strategy mathematically with all investment strategies with the following conditions: … (1) we have a certain number of asse ...

quarterly report

... Last quarter we claimed that equity markets seemed to be coming around to our way of thinking about the long-term future of oil and energy related stocks. We’ve put the champagne away and locked the cupboard – the price of Brent crude declined 15% over the ensuing quarter, and most oil-related stock ...

... Last quarter we claimed that equity markets seemed to be coming around to our way of thinking about the long-term future of oil and energy related stocks. We’ve put the champagne away and locked the cupboard – the price of Brent crude declined 15% over the ensuing quarter, and most oil-related stock ...

PDF

... The fourth section is devoted to the capital-asset pricing model and contains a discussion of the properties of the approach, whereas the last section presents the extended Gini's mean difference (Yitzhaki, 1980) and applies it to portfolio analysis. Much of the discussion in this paper is based on ...

... The fourth section is devoted to the capital-asset pricing model and contains a discussion of the properties of the approach, whereas the last section presents the extended Gini's mean difference (Yitzhaki, 1980) and applies it to portfolio analysis. Much of the discussion in this paper is based on ...

Future Value and Present Value Assignment

... STEP 1: STEP 2: STEP 3: STEP 4: STEP 5: STEP 5: STEP 6: ...

... STEP 1: STEP 2: STEP 3: STEP 4: STEP 5: STEP 5: STEP 6: ...

The Power of a Low Volatility Investing Approach

... Researchers from EDHEC-Risk Institute have therefore developed a new multi-factor dynamic defensive strategy approach. Instead of being solely exposed to the low volatility factor, the Scientific Beta MultiBeta Multi-Strategy Relative Volatility (90%) index reduces portfolio volatility by allocating ...

... Researchers from EDHEC-Risk Institute have therefore developed a new multi-factor dynamic defensive strategy approach. Instead of being solely exposed to the low volatility factor, the Scientific Beta MultiBeta Multi-Strategy Relative Volatility (90%) index reduces portfolio volatility by allocating ...

Investments: An Introduction Sixth Edition

... Ultimately the purpose of the analysis is to determine if the firm’s securities (i.e., its stocks and bonds) are undervalued and should be purchased for inclusion in an individual’s or investment company’s portfolio. ...

... Ultimately the purpose of the analysis is to determine if the firm’s securities (i.e., its stocks and bonds) are undervalued and should be purchased for inclusion in an individual’s or investment company’s portfolio. ...

Document

... what information does it provide when analyzing a true growth company and evaluating its stock? ...

... what information does it provide when analyzing a true growth company and evaluating its stock? ...

chapter 31 - Pearsoncmg.com

... Concept Check Questions and Answers 31.1.1. What assumptions are necessary for internationally integrated capital markets? We make the following assumptions: any investor can exchange either currency in any amount at the spot rate or forward rate and is free to purchase or sell any security in any a ...

... Concept Check Questions and Answers 31.1.1. What assumptions are necessary for internationally integrated capital markets? We make the following assumptions: any investor can exchange either currency in any amount at the spot rate or forward rate and is free to purchase or sell any security in any a ...

IFM7 Chapter 3

... Rosenberg and others (for example, Ibbotson Associates) who work with fundamental betas sell those betas rather than give them away—they are proprietary products, so little research has been reported on whether a fundamental beta calculated in 2001 is a better or worse predictor of the actual beta d ...

... Rosenberg and others (for example, Ibbotson Associates) who work with fundamental betas sell those betas rather than give them away—they are proprietary products, so little research has been reported on whether a fundamental beta calculated in 2001 is a better or worse predictor of the actual beta d ...

Chapter 1

... Thus, while intangible benefits from a project cannot be measured precisely, they must be included in the capital-budgeting process. ...

... Thus, while intangible benefits from a project cannot be measured precisely, they must be included in the capital-budgeting process. ...

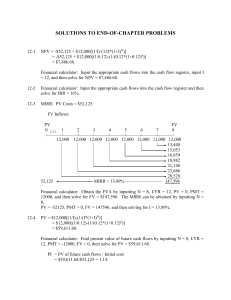

solutions to end-of

... d. The NPV method implicitly assumes that the opportunity exists to reinvest the cash flows generated by a project at the cost of capital, while use of the IRR method implies the opportunity to reinvest at the IRR. If the firm's cost of capital is constant at 10 percent, all projects with an NPV > 0 ...

... d. The NPV method implicitly assumes that the opportunity exists to reinvest the cash flows generated by a project at the cost of capital, while use of the IRR method implies the opportunity to reinvest at the IRR. If the firm's cost of capital is constant at 10 percent, all projects with an NPV > 0 ...

Answers

... company to invest in all projects with a positive net present value, but this is theoretically possible only in a perfect capital market, i.e. a capital market where there is no limit on the finance available. Since investment funds are limited in the real world, it is not possible in the real world ...

... company to invest in all projects with a positive net present value, but this is theoretically possible only in a perfect capital market, i.e. a capital market where there is no limit on the finance available. Since investment funds are limited in the real world, it is not possible in the real world ...