CUSTOMER_CODE SMUDE DIVISION_CODE SMUDE

... net present value of the cash inflow. Is does not differentiate between profits of current year with the profits to be earned in later years •The concept of profit maximization fails to consider the fluctuations in profits earned from year to year. Fluctuations may be attributed to the business risk ...

... net present value of the cash inflow. Is does not differentiate between profits of current year with the profits to be earned in later years •The concept of profit maximization fails to consider the fluctuations in profits earned from year to year. Fluctuations may be attributed to the business risk ...

International Bond - American Century Investments

... the fund will decline. The opposite is true when interest rates decline. The fund is classified as nondiversified. Because it is non-diversified, it may hold large positions in a small number of securities. To the extent it maintains such positions; a price change in any one of those securities may ...

... the fund will decline. The opposite is true when interest rates decline. The fund is classified as nondiversified. Because it is non-diversified, it may hold large positions in a small number of securities. To the extent it maintains such positions; a price change in any one of those securities may ...

A Different Way to Invest

... wholly owned subsidiary of Bank of America Corporation. Bloomberg Barclays data provided by Bloomberg. Citi fixed income indices copyright 2017 by Citigroup. Indices are not available for direct investment. ...

... wholly owned subsidiary of Bank of America Corporation. Bloomberg Barclays data provided by Bloomberg. Citi fixed income indices copyright 2017 by Citigroup. Indices are not available for direct investment. ...

The Phoenix CFA Society Wendell Licon, CFA

... • Get paid back during the 4th year. We need $1MM entering yr 4, and get $10MM for the whole year. If we assume $10MM comes evenly throughout the year, then we reach $20MM in {1MM/10MM} or .1 yrs. • So, payback = 3.1 years. • Do we accept or reject the project? ...

... • Get paid back during the 4th year. We need $1MM entering yr 4, and get $10MM for the whole year. If we assume $10MM comes evenly throughout the year, then we reach $20MM in {1MM/10MM} or .1 yrs. • So, payback = 3.1 years. • Do we accept or reject the project? ...

- SlideBoom

... 4. Serox stock was selling for $20 two years ago. The stock sold for $25 one year ago, and it is currently selling for $28. Serox pays a $1.10 dividend per year. What was the rate of return for owning Serox in the most recent year? (Round to the nearest percent.) ...

... 4. Serox stock was selling for $20 two years ago. The stock sold for $25 one year ago, and it is currently selling for $28. Serox pays a $1.10 dividend per year. What was the rate of return for owning Serox in the most recent year? (Round to the nearest percent.) ...

tactallocbrochure - Railroad Street Weaith Management LLC

... classes, but the tactical part of the strategy is to use a concept such as DWA’s Tactical Portfolio Research (TPR) to determine the weighting of each asset class, and that that weighting won’t stay exactly the same over time; it will fluctuate depending on trends in the market. Recall that TPR is de ...

... classes, but the tactical part of the strategy is to use a concept such as DWA’s Tactical Portfolio Research (TPR) to determine the weighting of each asset class, and that that weighting won’t stay exactly the same over time; it will fluctuate depending on trends in the market. Recall that TPR is de ...

General Presentations Template - Texas Municipal Retirement System

... TMRS Asset Allocation Philosophy Current policy assists to ensure that the risk tolerance remains appropriate The Strategic Target Allocation will be reviewed at least annually to ensure that the longterm return objective and risk tolerance continues to be appropriate considering significant economi ...

... TMRS Asset Allocation Philosophy Current policy assists to ensure that the risk tolerance remains appropriate The Strategic Target Allocation will be reviewed at least annually to ensure that the longterm return objective and risk tolerance continues to be appropriate considering significant economi ...

Handout 4 - Wharton Finance Department

... In real life, the most common case we encounter is that ρ > 0. For example, in the case above, ρ = .2. The intuition for the positive correlation case is exactly the same as in the zero-correlation case, though the gains from diversification are less powerful. Below, ρ = .2 and ρ = .5 are added into ...

... In real life, the most common case we encounter is that ρ > 0. For example, in the case above, ρ = .2. The intuition for the positive correlation case is exactly the same as in the zero-correlation case, though the gains from diversification are less powerful. Below, ρ = .2 and ρ = .5 are added into ...

1 BEM 103: Introduction to Finance J-L Rosenthal Lectures MW 9

... The journals, once turned in will allow the instructor to produce a data base of student choices that will be use solely for expositional purposes. For instance, it is likely that students will be more engaged in discussion of yield curves and risk return trade‐offs if they see a distribution of ...

... The journals, once turned in will allow the instructor to produce a data base of student choices that will be use solely for expositional purposes. For instance, it is likely that students will be more engaged in discussion of yield curves and risk return trade‐offs if they see a distribution of ...

finc 5000 lesson notes -- session 2

... - Example: Suppose you looked in the Wall St Journal and found that the Microsoft bond we've been discussing was selling for “111.470.” Bond prices are quoted as a percentage of par ($1,000), so a quote of 111.470 translates into a dollar price of $1,114.70. If you bought the bond and held it to mat ...

... - Example: Suppose you looked in the Wall St Journal and found that the Microsoft bond we've been discussing was selling for “111.470.” Bond prices are quoted as a percentage of par ($1,000), so a quote of 111.470 translates into a dollar price of $1,114.70. If you bought the bond and held it to mat ...

May 15, 2013, The Citizen`s Share: History, Research, Policy

... Employees with shares: are more loyal, more willing to work harder for the firm, & more willing to innovate. ...

... Employees with shares: are more loyal, more willing to work harder for the firm, & more willing to innovate. ...

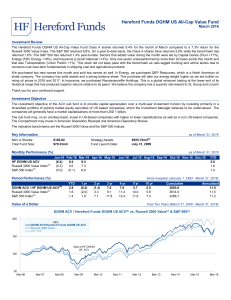

Click to download DGHM ACV March 2016

... This document is for information purposes and internal use only. It is neither an advice nor a recommendation to enter into any investment. Investment suitability must be determined individually for each investor, and the financial instruments described above may not be suitable for all investors. T ...

... This document is for information purposes and internal use only. It is neither an advice nor a recommendation to enter into any investment. Investment suitability must be determined individually for each investor, and the financial instruments described above may not be suitable for all investors. T ...

A Prudent Way To Invest - Brown Brothers Harriman

... The Benefits of Customer Loyalty Many investors do not fully appreciate the importance of customer loyalty. A business with consistently high customer retention rates has much stronger future prospects than a company with mediocre or poor retention rates. As described in more detail below, high cust ...

... The Benefits of Customer Loyalty Many investors do not fully appreciate the importance of customer loyalty. A business with consistently high customer retention rates has much stronger future prospects than a company with mediocre or poor retention rates. As described in more detail below, high cust ...

Asian Total Return Bond Fund

... FIL Investment Management (Singapore) Limited [FIMSL] (Co. Reg. No.: 199006300E) is a responsible entity for the fund in Singapore. Prospectus of the fund is available from FIMSL or its distributors upon request. Potential investors should read the prospectus before investing. All views expressed an ...

... FIL Investment Management (Singapore) Limited [FIMSL] (Co. Reg. No.: 199006300E) is a responsible entity for the fund in Singapore. Prospectus of the fund is available from FIMSL or its distributors upon request. Potential investors should read the prospectus before investing. All views expressed an ...

statement of investment policy

... B. Liquidity: An adequate percentage of the portfolio will be maintained in liquid, shortterm securities which can be converted to cash if necessary to meet disbursements requirements. Since all cash requirements cannot be anticipated, investments in securities with active secondary or resale market ...

... B. Liquidity: An adequate percentage of the portfolio will be maintained in liquid, shortterm securities which can be converted to cash if necessary to meet disbursements requirements. Since all cash requirements cannot be anticipated, investments in securities with active secondary or resale market ...

1 A $1000 bond has a coupon of 6% and matures after

... have on your answer to part e? Would the answer be different if the rate were 14%? g) If the firm's cost of capital had been 10%, what would be investment A's internal rate of return? h) The payback method of capital budgeting selects which investment? Why? ...

... have on your answer to part e? Would the answer be different if the rate were 14%? g) If the firm's cost of capital had been 10%, what would be investment A's internal rate of return? h) The payback method of capital budgeting selects which investment? Why? ...

Cash Flow Forecast Worksheet - 4

... involves looking ahead to when you believe cash is flowing into your business, and when it needs to flow out. Review your cash flow forecast once a week. This worksheet is a template to help you determine the cash flow for your business. ...

... involves looking ahead to when you believe cash is flowing into your business, and when it needs to flow out. Review your cash flow forecast once a week. This worksheet is a template to help you determine the cash flow for your business. ...

Investment Seminar

... indicated that decades of high perceived market risk have been followed by decades of lower perceived market risk. ...

... indicated that decades of high perceived market risk have been followed by decades of lower perceived market risk. ...

J. Maloney William No.

... input markets are competitive. Where appropriate, we will discuss the influence of product market structure on the results of the paper. Since we are using an explicit valuation framework, the input price of capital need not include a capitalization rate. The assumption of additive uncertainty is ma ...

... input markets are competitive. Where appropriate, we will discuss the influence of product market structure on the results of the paper. Since we are using an explicit valuation framework, the input price of capital need not include a capitalization rate. The assumption of additive uncertainty is ma ...

C 0 - chass.utoronto

... making decision of what to produce. • Fisher Separation Theorem implies even the two investors differ in their subjective perception of how to consume between now and future, they both has one unified objective, i.e, to maximize their current wealth. • Doing so means the firm can maximize its value. ...

... making decision of what to produce. • Fisher Separation Theorem implies even the two investors differ in their subjective perception of how to consume between now and future, they both has one unified objective, i.e, to maximize their current wealth. • Doing so means the firm can maximize its value. ...