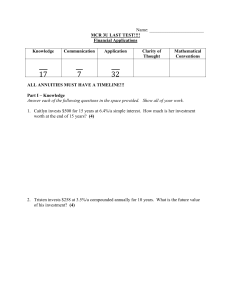

Sample: EBC*L Exam Level A KNOWLEDGE QUESTIONS (4 points

... 12. What is the main advantage of the legal form “private limited company”? What are its drawbacks (please name 3 of them)? ...

... 12. What is the main advantage of the legal form “private limited company”? What are its drawbacks (please name 3 of them)? ...

Blue Harbour`s Formula For Successful Activism

... for companies with market caps of no more than $10 billion, and usually less than $5 billion, that have a good business and strong management, but who might not be aware of all the options available to them. “These are great operators with plenty of intellectual firepower, but when we start talking ...

... for companies with market caps of no more than $10 billion, and usually less than $5 billion, that have a good business and strong management, but who might not be aware of all the options available to them. “These are great operators with plenty of intellectual firepower, but when we start talking ...

Will my portfolio give me an inflation plus return?

... most, although Japan has never entirely recovered from its recession. For other developed countries growth and disinflation resumed, as did attractive positive returns, though at a lower level than during the economic miracle. There was little during this disinflationary era that active asset alloca ...

... most, although Japan has never entirely recovered from its recession. For other developed countries growth and disinflation resumed, as did attractive positive returns, though at a lower level than during the economic miracle. There was little during this disinflationary era that active asset alloca ...

1 Binomial Model Hull, Chapter 11 + Sections 17.1 and 17.2

... Three-period binomial tree (N = 3) for a call option with K = 80 expiring at the end of the third period. Initial stock price is S = 80 at the node (0,0), the risk free rate r is such that exp(r∆t) = 1.1, and the discount factors for one, two and three periods are: exp(- r∆t) = 0.909, exp(- 2r∆t) = ...

... Three-period binomial tree (N = 3) for a call option with K = 80 expiring at the end of the third period. Initial stock price is S = 80 at the node (0,0), the risk free rate r is such that exp(r∆t) = 1.1, and the discount factors for one, two and three periods are: exp(- r∆t) = 0.909, exp(- 2r∆t) = ...

THE COST OF CAPITAL FOR FOREIGN INVESTMENTS

... k0 is used as the discount rate in the calculation of Net Present Value. 2. Two Caveats a. Weights must be a proportion using market, not book value. b. Calculating WACC, weights must be marginal reflecting future debt structure. ...

... k0 is used as the discount rate in the calculation of Net Present Value. 2. Two Caveats a. Weights must be a proportion using market, not book value. b. Calculating WACC, weights must be marginal reflecting future debt structure. ...

new financial package for all development projects

... RESEARCH CONSULTING & INVESTMENT (CRCI) NIGERIA LIMITED In 40 business days, the client will receive $150 million USD. According to the client’s financing needs, CRCI will repeat the process until the client gets the amount needed to finance the ...

... RESEARCH CONSULTING & INVESTMENT (CRCI) NIGERIA LIMITED In 40 business days, the client will receive $150 million USD. According to the client’s financing needs, CRCI will repeat the process until the client gets the amount needed to finance the ...

Topic No. D-36 Topic: Selection of Discount Rates Used for

... Pursuant to paragraph 44, an employer may look to rates of return on high-quality fixed-income investments in determining assumed discount rates. The objective of selecting assumed discount rates is to measure the single amount that, if invested at the measurement date in a portfolio of high-quality ...

... Pursuant to paragraph 44, an employer may look to rates of return on high-quality fixed-income investments in determining assumed discount rates. The objective of selecting assumed discount rates is to measure the single amount that, if invested at the measurement date in a portfolio of high-quality ...

India's Experience with Capital Flow Management

... End use restrictions and minimum maturity. NRI deposits - interest rate ceiling linked to LIBOR/SWAP In sum, gradual and calibrated liberalization - sequencing 13 ...

... End use restrictions and minimum maturity. NRI deposits - interest rate ceiling linked to LIBOR/SWAP In sum, gradual and calibrated liberalization - sequencing 13 ...

CommonSenseEconomics

... 16. Saving, and the power of compound interest, can make it possible for you to consume more and achieve a higher living standard in the future. True. Funds saved will grow in value which will make higher future consumption possible. 17. If you have funds in an investment account earning a 10 percen ...

... 16. Saving, and the power of compound interest, can make it possible for you to consume more and achieve a higher living standard in the future. True. Funds saved will grow in value which will make higher future consumption possible. 17. If you have funds in an investment account earning a 10 percen ...

Expected Return Standard Deviation

... Their risk will be determined by the industry sector and gearing. Some shares will be more risky and some less. ...

... Their risk will be determined by the industry sector and gearing. Some shares will be more risky and some less. ...

The RAM Opportunistic Value Portfolio

... to existing positions if prices fall. By using volatility to our advantage, it is common for us to reduce our cost basis in particular stocks by 10-30% from initial purchase price. ...

... to existing positions if prices fall. By using volatility to our advantage, it is common for us to reduce our cost basis in particular stocks by 10-30% from initial purchase price. ...

NOTEBOOK12.1 - Plymouth State College

... Days Sales Outstanding (DSO) is a measure of the firm's ability to manage one portion of its assets accounts receivable. Sometimes called "average collection period", it is a measure of how quickly receivables can be converted into cash. Fewer days is better than more days, and an average of a month ...

... Days Sales Outstanding (DSO) is a measure of the firm's ability to manage one portion of its assets accounts receivable. Sometimes called "average collection period", it is a measure of how quickly receivables can be converted into cash. Fewer days is better than more days, and an average of a month ...

A: An investment

... NOTE: Purchasing power is not adjusted or expressed Real Returns Inflation adjusted returns Nominal returns adjusted for inflation. Real Return = [(1+ TR)/(1+IF)] – 1 IF = inflation rate ...

... NOTE: Purchasing power is not adjusted or expressed Real Returns Inflation adjusted returns Nominal returns adjusted for inflation. Real Return = [(1+ TR)/(1+IF)] – 1 IF = inflation rate ...

Trump Portfolios

... The Classification and Performance Once the cycles were identified, the performance of the individual stocks during each of the cycles was calculated and the stocks were ranked in ascending order and divided into 10 portfolios consisting of approximately an equal number of stocks. In cases where the ...

... The Classification and Performance Once the cycles were identified, the performance of the individual stocks during each of the cycles was calculated and the stocks were ranked in ascending order and divided into 10 portfolios consisting of approximately an equal number of stocks. In cases where the ...

Liquor Store Business Valuation

... + $67,200) for the total invested capital to the values concluded by the market approach (see Table 4-2 on page 79), and the concluded value of the income approach in Table 4-6 on page 84. It must be noted that not all companies indicate such a range in values. With the adjusted balance sheet method ...

... + $67,200) for the total invested capital to the values concluded by the market approach (see Table 4-2 on page 79), and the concluded value of the income approach in Table 4-6 on page 84. It must be noted that not all companies indicate such a range in values. With the adjusted balance sheet method ...

Common Financial Ratios

... Common Financial Ratios Central to financial analysis is the calculation of financial ratios. A ratio has a numerator and a denominator, which converts the financial data to a percentage. This provides one approach to standardize financial information for useful comparisons. The major ratio categori ...

... Common Financial Ratios Central to financial analysis is the calculation of financial ratios. A ratio has a numerator and a denominator, which converts the financial data to a percentage. This provides one approach to standardize financial information for useful comparisons. The major ratio categori ...

Assignment-77 - The complete management portal

... 89) The time required by the company to process the received cheque and deposit the same in the bank is called=> Deposit float* 90) Which of the following assets get generated during course of operations or get utilized within one year=> Current assets ***** 91) The Capital Structure decision mainly ...

... 89) The time required by the company to process the received cheque and deposit the same in the bank is called=> Deposit float* 90) Which of the following assets get generated during course of operations or get utilized within one year=> Current assets ***** 91) The Capital Structure decision mainly ...

Interest Rate Swaps

... required in respect of an interest rate swap entered into by a customer which is a chartered bank with a capital and reserves position greater than $1 billion. For all other defined financial institutions, the margin requirement shall be the market deficiency calculated in respect of the transaction ...

... required in respect of an interest rate swap entered into by a customer which is a chartered bank with a capital and reserves position greater than $1 billion. For all other defined financial institutions, the margin requirement shall be the market deficiency calculated in respect of the transaction ...

international capital flows: sustainability, sudden reversals

... liabilities, and less incentive to renege on external debt, thereby making a turnaround in capital flows less likely. 3) reserves. Countries with lower reserves (as a fraction of imports) are more likely to experience a reversal. This result is consistent with a "reserves adequacy" approach and, on ...

... liabilities, and less incentive to renege on external debt, thereby making a turnaround in capital flows less likely. 3) reserves. Countries with lower reserves (as a fraction of imports) are more likely to experience a reversal. This result is consistent with a "reserves adequacy" approach and, on ...