2 THE REAL ECONOMY

... rating. Any losses from the set of underlying mortgage loans were to be borne by the holders of the riskier lower-rated tranches. The low risk of the best tranches was conditional on a low default correlation for the underlying subprime mortgages, which, given their similar characteristics and the a ...

... rating. Any losses from the set of underlying mortgage loans were to be borne by the holders of the riskier lower-rated tranches. The low risk of the best tranches was conditional on a low default correlation for the underlying subprime mortgages, which, given their similar characteristics and the a ...

Credit booms: implications for the public and private sector

... current account surpluses that need to be refinanced in assets denominated in foreign currency, as in the savings glut hypothesis (Bernanke (2005)), or that nonfinancial firms increase their cash balances fearing liquidity shortages (Pozsar (2011)). In the first case, a foreign investor is at an inf ...

... current account surpluses that need to be refinanced in assets denominated in foreign currency, as in the savings glut hypothesis (Bernanke (2005)), or that nonfinancial firms increase their cash balances fearing liquidity shortages (Pozsar (2011)). In the first case, a foreign investor is at an inf ...

Slide Set 5

... In terms of consumption, we all strive to achieve a “comfort zone”. Once we achieve that or are closer to it we do not need to increase our consumption as much with our income as we had done at lower levels of income. ...

... In terms of consumption, we all strive to achieve a “comfort zone”. Once we achieve that or are closer to it we do not need to increase our consumption as much with our income as we had done at lower levels of income. ...

NBER WORKING PAPER SERIES AN INTERTEMPORAL DISEQUILIBRIUM MODEL Olivier J. Blanchard Jeffrey Sachs

... simplification, at least for the experiments we consider, and that the benefit in increased simplicity is substantial. Prices adjust over time as functions, not of excess actual demands which are, by construction, identically zero, but of excess shadow demands. At any time t, an intertemporal equili ...

... simplification, at least for the experiments we consider, and that the benefit in increased simplicity is substantial. Prices adjust over time as functions, not of excess actual demands which are, by construction, identically zero, but of excess shadow demands. At any time t, an intertemporal equili ...

feedback-rule policy - Iowa State University Department of Economics

... Distinguish among the instruments, ultimate goals, and intermediate targets of monetary policy and review the Fed’s performance Describe and compare the performance of a monetarist fixed rule and Keynesian feedback rules for monetary policy Explain why the outcome of monetary policy crucially depend ...

... Distinguish among the instruments, ultimate goals, and intermediate targets of monetary policy and review the Fed’s performance Describe and compare the performance of a monetarist fixed rule and Keynesian feedback rules for monetary policy Explain why the outcome of monetary policy crucially depend ...

Sustainable growth and financial markets in a natural resource rich

... model leads to a number of paradoxical conclusions. Indeed, Barro and Salai-Martin(2003) display that the speed of convergence for capital and output is infinite, so the economy jumps into the steady state. Moreover, consumption tends to zero, except for the most patient country. Some attempts have ...

... model leads to a number of paradoxical conclusions. Indeed, Barro and Salai-Martin(2003) display that the speed of convergence for capital and output is infinite, so the economy jumps into the steady state. Moreover, consumption tends to zero, except for the most patient country. Some attempts have ...

Chapter 22

... can be produced by its labor force (L) given its physical capital (K), land and natural resources (R), and technology and entrepreneurial talent (Z). ...

... can be produced by its labor force (L) given its physical capital (K), land and natural resources (R), and technology and entrepreneurial talent (Z). ...

Document

... Motivation In the literature, remittances are often argued to have a tendency to move countercyclically with the national income (GDP) in recipient countries. Thus, remittances are expected to move in the opposite direction with the business cycle, increasing whenever there is a stagnation or econo ...

... Motivation In the literature, remittances are often argued to have a tendency to move countercyclically with the national income (GDP) in recipient countries. Thus, remittances are expected to move in the opposite direction with the business cycle, increasing whenever there is a stagnation or econo ...

Cyclical Properties of Workers` Remittances

... Motivation In the literature, remittances are often argued to have a tendency to move countercyclically with the national income (GDP) in recipient countries. Thus, remittances are expected to move in the opposite direction with the business cycle, increasing whenever there is a stagnation or econo ...

... Motivation In the literature, remittances are often argued to have a tendency to move countercyclically with the national income (GDP) in recipient countries. Thus, remittances are expected to move in the opposite direction with the business cycle, increasing whenever there is a stagnation or econo ...

CHAPTER 3 Financial Statement Analysis

... Both ratios rebounded from the previous year, but are still below the industry average. Note ROE=ROA*(total asset/total equity)=ROA/(1-total debt/total asset)=ROA/(1-debt ratio). If ROA>0, the higher the debt ratio, the higher ROE. If ROA<0, the higher the debt ratio, the lower ROE. Wider variations ...

... Both ratios rebounded from the previous year, but are still below the industry average. Note ROE=ROA*(total asset/total equity)=ROA/(1-total debt/total asset)=ROA/(1-debt ratio). If ROA>0, the higher the debt ratio, the higher ROE. If ROA<0, the higher the debt ratio, the lower ROE. Wider variations ...

Notes on the Stability Program for 2016 - 2020

... of which about €2.0 bn already executed in February. Early reimbursements of the IMF loan have been raised by €4 bn, but this does not change the gross borrowing needs for the year, as the increase results directly from the expected proceeds from the sale of financial assets now planned to occur tow ...

... of which about €2.0 bn already executed in February. Early reimbursements of the IMF loan have been raised by €4 bn, but this does not change the gross borrowing needs for the year, as the increase results directly from the expected proceeds from the sale of financial assets now planned to occur tow ...

投影片 1 - NCCU

... because it receives more money than it spends. The surplus of T - G represents public saving. If G > T, the government runs a budget deficit because it spends more money than it receives in tax revenue. ...

... because it receives more money than it spends. The surplus of T - G represents public saving. If G > T, the government runs a budget deficit because it spends more money than it receives in tax revenue. ...

Loanable Funds

... When the government spends more than it receives in tax revenues, the short fall is called the budget deficit. The accumulation of past budget deficits is called the government debt. ...

... When the government spends more than it receives in tax revenues, the short fall is called the budget deficit. The accumulation of past budget deficits is called the government debt. ...

The Calculation of Cyclically Adjusted Balances at

... different expenditure components, other than unemployment benefits, are not affected by economic activity. This characteristic is common to the cyclical adjustment methodologies implemented by important international institutions, such as the European Commission, the OECD and the IMF, and results fr ...

... different expenditure components, other than unemployment benefits, are not affected by economic activity. This characteristic is common to the cyclical adjustment methodologies implemented by important international institutions, such as the European Commission, the OECD and the IMF, and results fr ...

National debt brakes and convergence in the European

... extent private sector, deficits have turned into public sector deficits in these countries. For example the debt-to-GDP ratio of Spain have soared from 40% in 2008 to 70% in 2011, but which is still lower than the debt ratio of Germany, which stood at 82% in 2011. One should note that current-accoun ...

... extent private sector, deficits have turned into public sector deficits in these countries. For example the debt-to-GDP ratio of Spain have soared from 40% in 2008 to 70% in 2011, but which is still lower than the debt ratio of Germany, which stood at 82% in 2011. One should note that current-accoun ...

Lecture Notes: Chapter 10: Investment, Net Exports, and Interest Rates

... Second, the interest rate that is relevant for investment spending decisions is not the nominal but the real interest rate. The nominal prices a business charges rise with inflation. If a business is willing to invest when the interest rate is 5% and inflation is 2% per year (and so the real interes ...

... Second, the interest rate that is relevant for investment spending decisions is not the nominal but the real interest rate. The nominal prices a business charges rise with inflation. If a business is willing to invest when the interest rate is 5% and inflation is 2% per year (and so the real interes ...

6. Public Finance

... Public debt stock indicators have been on an improving track since September 2012. Public debt ratios declined further; the real cost of borrowing stood at low levels; the average maturity of the debt stock was extended; the share of securities with sensitivity to interest and exchange rate was redu ...

... Public debt stock indicators have been on an improving track since September 2012. Public debt ratios declined further; the real cost of borrowing stood at low levels; the average maturity of the debt stock was extended; the share of securities with sensitivity to interest and exchange rate was redu ...

Answers to Textbook Problems

... forward premium on euro to be (1.26 − 1.20)/1.20 = 0.05. The interest rate difference between one-year dollar deposits and one-year euro deposits will be 5 percent because the interest difference must equal the forward premium on euro against dollars when covered interest parity holds. 16. The value ...

... forward premium on euro to be (1.26 − 1.20)/1.20 = 0.05. The interest rate difference between one-year dollar deposits and one-year euro deposits will be 5 percent because the interest difference must equal the forward premium on euro against dollars when covered interest parity holds. 16. The value ...

Public Enterprise Finance: Towards a Synthesis Jenkins

... economy, a fraction of the additional fnds raised are drawn from displaced investment, but to the extent that the country faced an upward sloping supply schedule of foreign capital because of the cost of investment and compliance associated with cross-border financing, the social opportunity cost be ...

... economy, a fraction of the additional fnds raised are drawn from displaced investment, but to the extent that the country faced an upward sloping supply schedule of foreign capital because of the cost of investment and compliance associated with cross-border financing, the social opportunity cost be ...

This PDF is a selection from a published volume from... Economic Research Volume Title: NBER International Seminar on Macroeconom

... Wieland (1998) then showed that the zero bound represents a quantitatively important constraint on monetary policy in an environment of near‐zero steady state inflation. Recessions and deflationary episodes would be significantly deeper than in the absence of such a floor on nominal interest rates. ...

... Wieland (1998) then showed that the zero bound represents a quantitatively important constraint on monetary policy in an environment of near‐zero steady state inflation. Recessions and deflationary episodes would be significantly deeper than in the absence of such a floor on nominal interest rates. ...

the european monetary fund

... markets, this was not the case in the CDS and bond markets: Within few months, interest rates rose to levels 10 percentage points above that level of economic growth (in nominal terms) which can reasonably be expected for countries like Greece or Portugal over the medium run.3 Such interest rate lev ...

... markets, this was not the case in the CDS and bond markets: Within few months, interest rates rose to levels 10 percentage points above that level of economic growth (in nominal terms) which can reasonably be expected for countries like Greece or Portugal over the medium run.3 Such interest rate lev ...

The effectiveness of fiscal policy in Australia

... essentially an empirical question. Our investigation of this empirical question is motivated by consideration of all these potential savings offsets. International evidence suggests that an increase in public saving tends to lower private saving with an offset coefficient of around one half (Masson, ...

... essentially an empirical question. Our investigation of this empirical question is motivated by consideration of all these potential savings offsets. International evidence suggests that an increase in public saving tends to lower private saving with an offset coefficient of around one half (Masson, ...

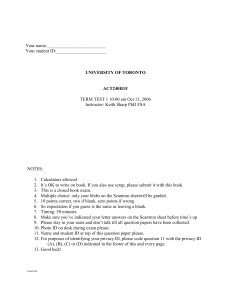

ACT 240H1F F06 Term Test 1 Privacy ID A v07

... monthly payments, starting one month from now! Or get a $X discount if you pay in a cash lump sum! The merchant is using the current market interest rate of 6% per annum compounded monthly for her calculations, and wants the same profit on a cash sale as on an ‘easy payments’ sale. Calculate X. (Not ...

... monthly payments, starting one month from now! Or get a $X discount if you pay in a cash lump sum! The merchant is using the current market interest rate of 6% per annum compounded monthly for her calculations, and wants the same profit on a cash sale as on an ‘easy payments’ sale. Calculate X. (Not ...

Chapter 29: Inflation and Its Relationship to Unemployment and

... b. Since the exchange rate was fixed, any differential in inflation rates between the two countries could not be offset a change in the exchange rate. The fact that goods in dollar equivalent pesos in Argentina were higher than in NYC suggests that the Argentinean inflation rate remained greater tha ...

... b. Since the exchange rate was fixed, any differential in inflation rates between the two countries could not be offset a change in the exchange rate. The fact that goods in dollar equivalent pesos in Argentina were higher than in NYC suggests that the Argentinean inflation rate remained greater tha ...

G. Schwartz

... o Making room for public investment not linked to definitions or accounting but to country specific policies based on sustainable macroeconomic frameworks o Scope to strengthen efficiency of spending ...

... o Making room for public investment not linked to definitions or accounting but to country specific policies based on sustainable macroeconomic frameworks o Scope to strengthen efficiency of spending ...