adviceworx old mutual inflation plus 3

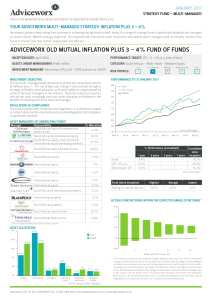

... at 1.9% and then the US at 1.6%. The marginally weaker US dollar was supportive of commodity prices in January, which led to our resource shares performing well in the month. The proposed lower tax rates and deregulation of the banking sector in the US by President Trump have seen the US equity mark ...

... at 1.9% and then the US at 1.6%. The marginally weaker US dollar was supportive of commodity prices in January, which led to our resource shares performing well in the month. The proposed lower tax rates and deregulation of the banking sector in the US by President Trump have seen the US equity mark ...

International Monetary Arrangements

... One quarter of quota in gold, the rest in that country’s currency A country could borrow up to ¼ of its quota at anytime without restrictions A country trying to borrow more came with restrictions ...

... One quarter of quota in gold, the rest in that country’s currency A country could borrow up to ¼ of its quota at anytime without restrictions A country trying to borrow more came with restrictions ...

SUSTAINABILITY OF THE PUBLIC DEBT AND BUDGET DEFICIT

... mentioned, besides the conventional public debt owned by the so-called general government there is a part which corresponds to public corporations and special credit institutions. Figures 5 and 6 present the evolution of the three constitutive components of gross public debt, evaluated in dollars an ...

... mentioned, besides the conventional public debt owned by the so-called general government there is a part which corresponds to public corporations and special credit institutions. Figures 5 and 6 present the evolution of the three constitutive components of gross public debt, evaluated in dollars an ...

How Does Post-Crisis Bank Capital Adequacy Affect Firm

... investment projects. The analysis focuses on the post-crisis period using a sample of 11,106 non-financial firms in sixteen advanced economies. The main results are as follows ...

... investment projects. The analysis focuses on the post-crisis period using a sample of 11,106 non-financial firms in sixteen advanced economies. The main results are as follows ...

Practice Questions Set Chapter 10-13

... 14. Refer to Table 11-3. The cost of the basket in 2006 was a. $32. b. $200. c. $280. d. $480. 15. Refer to Table 11-3. The cost of the basket a. increased from 2006 to 2007 and increased from 2007 to 2008. b. increased from 2006 to 2007 and decreased from 2007 to 2008. c. decreased from 2006 to 20 ...

... 14. Refer to Table 11-3. The cost of the basket in 2006 was a. $32. b. $200. c. $280. d. $480. 15. Refer to Table 11-3. The cost of the basket a. increased from 2006 to 2007 and increased from 2007 to 2008. b. increased from 2006 to 2007 and decreased from 2007 to 2008. c. decreased from 2006 to 20 ...

New Consensus - Levy Economics Institute of Bard College

... (for inclusion in the labor market and employment), and through seeking to change the rewards offered by the market. With the exception of the national minimum wage, it could be said that there has been little attempt to modify the rewards thrown up by the market. As Giddens (1998, p. 101) notes, a ...

... (for inclusion in the labor market and employment), and through seeking to change the rewards offered by the market. With the exception of the national minimum wage, it could be said that there has been little attempt to modify the rewards thrown up by the market. As Giddens (1998, p. 101) notes, a ...

Principles of Economics II – Macroeconomics Homework #1: Ch 23

... b. Calculating the percentage change in nominal GDP: Percentage change in nominal GDP in 2009 = [($400 − $200)/$200] 100 = 100%. Percentage change in nominal GDP in 2010 = [($800 − $400)/$400] 100 = 100%. Calculating the percentage change in real GDP: Percentage change in real GDP in 2009 = [($4 ...

... b. Calculating the percentage change in nominal GDP: Percentage change in nominal GDP in 2009 = [($400 − $200)/$200] 100 = 100%. Percentage change in nominal GDP in 2010 = [($800 − $400)/$400] 100 = 100%. Calculating the percentage change in real GDP: Percentage change in real GDP in 2009 = [($4 ...

Before Growth: The Malthusian Model

... support a family. This tended to keep fertility rates relatively low. In practice, as discussed in Greg Clark’s book on the Malthusian model, the evidence for a link between living standards and birth rates prior to the Industrial Revolution is fairly weak and I will assume a constant birth rate in ...

... support a family. This tended to keep fertility rates relatively low. In practice, as discussed in Greg Clark’s book on the Malthusian model, the evidence for a link between living standards and birth rates prior to the Industrial Revolution is fairly weak and I will assume a constant birth rate in ...

Ch797

... What Is The Risk Premium? • Required to Compensate Investors for Risk • Higher the Variance or Standard Deviation, the Higher the Required Risk Premium • Degree of Dependency Affects the Risk Premium – The more negative the degree of dependency – The lower the risk of the portfolio – The lower the ...

... What Is The Risk Premium? • Required to Compensate Investors for Risk • Higher the Variance or Standard Deviation, the Higher the Required Risk Premium • Degree of Dependency Affects the Risk Premium – The more negative the degree of dependency – The lower the risk of the portfolio – The lower the ...

chapter 19 lecture notes

... able to work with employees to promote structures and activities that increase employee motivation, satisfaction, and performance. The entire series of 13 half-hour videos costs less than $100. Call (800) 8661666. Inc. Business Resources produces a videotape titled Managing People, which deals with ...

... able to work with employees to promote structures and activities that increase employee motivation, satisfaction, and performance. The entire series of 13 half-hour videos costs less than $100. Call (800) 8661666. Inc. Business Resources produces a videotape titled Managing People, which deals with ...

Chapter 14:

... drawback: When credibility is low for discretionary policymakers, the inflation bias for any one country’s policymakers can be exacerbated in situations where countries are forced to coordinate their monetary policies. In addition to monetary and fiscal policy coordination, the chapter also discusse ...

... drawback: When credibility is low for discretionary policymakers, the inflation bias for any one country’s policymakers can be exacerbated in situations where countries are forced to coordinate their monetary policies. In addition to monetary and fiscal policy coordination, the chapter also discusse ...

Paper - The Institute for New Economic Thinking

... rate for Kaldor/Verdoorn reasons); (3) there are changes in the distribution of income in favor of high income earners and because of higher corporate retained earnings, which have increased the economy’s overall propensity to save (even if the personal saving rate seems to have risen only since the ...

... rate for Kaldor/Verdoorn reasons); (3) there are changes in the distribution of income in favor of high income earners and because of higher corporate retained earnings, which have increased the economy’s overall propensity to save (even if the personal saving rate seems to have risen only since the ...

Ch12-- Fiscal Policy - Porterville College

... If Government increases spending without increasing taxes, consumers and firms recognize that future taxes must rise. Therefore, they save more now and reduce private spending. The increased savings cancels out the increased government purchases in their effect on AD. Increased Govt. Spending will h ...

... If Government increases spending without increasing taxes, consumers and firms recognize that future taxes must rise. Therefore, they save more now and reduce private spending. The increased savings cancels out the increased government purchases in their effect on AD. Increased Govt. Spending will h ...

Perhaps the most salient characteristic of growth performance in

... dramatic increase in capital inflows that exceeded expectations. In addition, whenever crises struck, their negative effect on growth was dramatic. This paper will provide some clues regarding the big swings in capital inflows. It will argue that although these swings are oftentimes triggered by ext ...

... dramatic increase in capital inflows that exceeded expectations. In addition, whenever crises struck, their negative effect on growth was dramatic. This paper will provide some clues regarding the big swings in capital inflows. It will argue that although these swings are oftentimes triggered by ext ...

Monetary Policy

... 27. Why are 100% of Fed loans to commercial banks “excess reserves” to the banks? 28. What does lowering the discount rate encourage commercial banks to do? 29. How does lowering the discount rate increase the money supply? Easy Money and Tight Money 30. In the face of a recession, what are three th ...

... 27. Why are 100% of Fed loans to commercial banks “excess reserves” to the banks? 28. What does lowering the discount rate encourage commercial banks to do? 29. How does lowering the discount rate increase the money supply? Easy Money and Tight Money 30. In the face of a recession, what are three th ...

Econ202 Sp14 answers 1 2 3 4 5 6 to final exam group D

... This question is about the IS curve for a closed economy. Answer the following questions: (a) (3 points) What is the IS curve? (b) (2 points) What does each point on a given IS curve represent or correspond to? (c) (1 point) What does the negative sign of the slope of the IS curve show? (d) (12 poin ...

... This question is about the IS curve for a closed economy. Answer the following questions: (a) (3 points) What is the IS curve? (b) (2 points) What does each point on a given IS curve represent or correspond to? (c) (1 point) What does the negative sign of the slope of the IS curve show? (d) (12 poin ...

Ch13 11e Lecture Presentation

... Generational Effects of Fiscal Policy Generational Accounting and Present Value Taxes are paid by people with jobs. Social security benefits are paid to people after they retire. So to compare the value of an amount of money at one date (working years) with that at a later date (retirement years), ...

... Generational Effects of Fiscal Policy Generational Accounting and Present Value Taxes are paid by people with jobs. Social security benefits are paid to people after they retire. So to compare the value of an amount of money at one date (working years) with that at a later date (retirement years), ...

Demand-side and Supply

... • Fiscal policy comes with delays. Delays in recognizing the problem, delays in making the appropriate decision and delays until the policy has taken effect. By the time these “lags” are overcome, the problem could be ...

... • Fiscal policy comes with delays. Delays in recognizing the problem, delays in making the appropriate decision and delays until the policy has taken effect. By the time these “lags” are overcome, the problem could be ...

Document

... What is the recognition lag? The policy lag? The impact lag? The recognition lag is the time elapsed between when a change occurs in the economy’ s performance and when policy makers recognize that a change has occurred. The policy lag is the time elapsed between when policy makers recognize that a ...

... What is the recognition lag? The policy lag? The impact lag? The recognition lag is the time elapsed between when a change occurs in the economy’ s performance and when policy makers recognize that a change has occurred. The policy lag is the time elapsed between when policy makers recognize that a ...

Chapter 13 - Aufinance

... Generational Effects of Fiscal Policy Generational Accounting and Present Value Taxes are paid by people with jobs. Social security benefits are paid to people after they retire. So to compare the value of an amount of money at one date (working years) with that at a later date (retirement years), ...

... Generational Effects of Fiscal Policy Generational Accounting and Present Value Taxes are paid by people with jobs. Social security benefits are paid to people after they retire. So to compare the value of an amount of money at one date (working years) with that at a later date (retirement years), ...

Chapter 22

... excess comovement across countries in asset returns, whether debt or equity. The comovement is said to be excessive if it persists even after common fundamentals, as well as idiosyncratic factors, have been controlled for. 3. A recent variant to this approach is presented in Arias, Haussmann, and Ri ...

... excess comovement across countries in asset returns, whether debt or equity. The comovement is said to be excessive if it persists even after common fundamentals, as well as idiosyncratic factors, have been controlled for. 3. A recent variant to this approach is presented in Arias, Haussmann, and Ri ...

Chapter 59: The role of monetary policy (2.5)

... demand for investment, called the investment schedule (= demand curve for investment). Lower interest rates induce firms to increase investment for two reasons. 1. Opportunity cost issue: When the interest rate falls, a number of investment opportunities previously considered unprofitable are sudden ...

... demand for investment, called the investment schedule (= demand curve for investment). Lower interest rates induce firms to increase investment for two reasons. 1. Opportunity cost issue: When the interest rate falls, a number of investment opportunities previously considered unprofitable are sudden ...

Total demand for goods and services in a closed economy is written

... In the medium run, the increase in nominal money is re‡ected entirely in a proportional increase in the price level (LM curve shifts back). The increase in nominal money has no e¤ect on output or on the interest rate. The neutrality of money in the medium run does not mean that monetary policy canno ...

... In the medium run, the increase in nominal money is re‡ected entirely in a proportional increase in the price level (LM curve shifts back). The increase in nominal money has no e¤ect on output or on the interest rate. The neutrality of money in the medium run does not mean that monetary policy canno ...