Wage Increases, Transfers, and the Socially Determined Income

... of GDP via fiscal (broadly progressive) and financial (regressive) channels. A third major flow over time has been a ten percentage point increase in the GDP share of the top 1%. A simulation model is used to illustrate how “reasonable” modifications to tax/transfer programs and increasing low wages ...

... of GDP via fiscal (broadly progressive) and financial (regressive) channels. A third major flow over time has been a ten percentage point increase in the GDP share of the top 1%. A simulation model is used to illustrate how “reasonable” modifications to tax/transfer programs and increasing low wages ...

Fundamental Determinants of the Effects of Fiscal Policy

... consumption (but, inelastic labor supply); As a result, consumption declines more than growth, interest rates decline, investment boom, higher capital-labor ratio, and substantial improvement in current account balance and net foreign asset position. ...

... consumption (but, inelastic labor supply); As a result, consumption declines more than growth, interest rates decline, investment boom, higher capital-labor ratio, and substantial improvement in current account balance and net foreign asset position. ...

Economic Policy in the Open Economy Under Fixed Exchange Rates

... of the BP Curve – The slope of the BP curve depends on how responsive short-term private capital flows are to changes in the interest rate. – Points to the right of the BP curve represent BOP deficits, triggering an increase in i, which would cause an increase in capital inflows. – If capital inflow ...

... of the BP Curve – The slope of the BP curve depends on how responsive short-term private capital flows are to changes in the interest rate. – Points to the right of the BP curve represent BOP deficits, triggering an increase in i, which would cause an increase in capital inflows. – If capital inflow ...

Impact on Public Sector Finances

... and National Non-Domestic Rates, to be deducted from the assessment of tax obligations. This is different to ESA95 where, for these specific taxes, tax is recorded based on the expected amount of tax which would be collected with a corresponding capital transfer back to households and private sector ...

... and National Non-Domestic Rates, to be deducted from the assessment of tax obligations. This is different to ESA95 where, for these specific taxes, tax is recorded based on the expected amount of tax which would be collected with a corresponding capital transfer back to households and private sector ...

The Great Austerity War: James Crotty

... To understand the kind of political economy that today's right-wing coalition wants to achieve in the US, consider the boom of the second half of the 1920s. In that era there was little regulation of business, very low taxes on business and rich households, a crippled union movement, a powerful fina ...

... To understand the kind of political economy that today's right-wing coalition wants to achieve in the US, consider the boom of the second half of the 1920s. In that era there was little regulation of business, very low taxes on business and rich households, a crippled union movement, a powerful fina ...

Chapter 8 PPT

... stock to a limited a number of people is known as a closely held corporation. These owners rarely trade their stock. Ex: Simplot › A publicly held corporation, has many shareholders that buy and sell their stock on the open (financial) markets. › Government owned corporation- Post Office ...

... stock to a limited a number of people is known as a closely held corporation. These owners rarely trade their stock. Ex: Simplot › A publicly held corporation, has many shareholders that buy and sell their stock on the open (financial) markets. › Government owned corporation- Post Office ...

Public debt, Finite Horizons in NGM

... See appendix to Ch. 3. In 2-period version, individuals work, receive wages, consume, and save in period 1; receive asset income and consume in period 2. May also pay taxes in period 1 and receive social security in period 2. Economy goes on forever (no end of world). Individuals have finite horizon ...

... See appendix to Ch. 3. In 2-period version, individuals work, receive wages, consume, and save in period 1; receive asset income and consume in period 2. May also pay taxes in period 1 and receive social security in period 2. Economy goes on forever (no end of world). Individuals have finite horizon ...

Six of one, half a dozen of the other

... that the Government would launch a consultation into the operation of the two systems. Following the Budget, in April, the Department for Work and Pensions released a consultation paper, ‘A State pension for the 21st Century’, which requested views on proposals to remove the pensions link to Nationa ...

... that the Government would launch a consultation into the operation of the two systems. Following the Budget, in April, the Department for Work and Pensions released a consultation paper, ‘A State pension for the 21st Century’, which requested views on proposals to remove the pensions link to Nationa ...

Royal London US Growth Trust (Income

... shown a high level of volatility historically. As an investment, bonds are typically more volatile than money market instruments but less volatile than shares. This Fund has historically been primarily invested in shares. The indicator has been calculated using historical data and may not be a relia ...

... shown a high level of volatility historically. As an investment, bonds are typically more volatile than money market instruments but less volatile than shares. This Fund has historically been primarily invested in shares. The indicator has been calculated using historical data and may not be a relia ...

Valuation of Securities

... 15. Fred Tibbits has made a detailed study of the denim clothing industry. He's particularly interested in a company called Denhart Fashions that makes stylish denim apparel for children and teenagers. Fred has done a forecast of Denhart's earnings and looked at its dividend payment record. He's co ...

... 15. Fred Tibbits has made a detailed study of the denim clothing industry. He's particularly interested in a company called Denhart Fashions that makes stylish denim apparel for children and teenagers. Fred has done a forecast of Denhart's earnings and looked at its dividend payment record. He's co ...

Recommending a Strategy

... of concentration (conglomerates), the degree of specialization and division of labor, the degree of self-sufficiency) Transactions involving goods and services currently produced (thus generating current-value added) and transactions involving existing physical assets and inventories (which do not ...

... of concentration (conglomerates), the degree of specialization and division of labor, the degree of self-sufficiency) Transactions involving goods and services currently produced (thus generating current-value added) and transactions involving existing physical assets and inventories (which do not ...

CHAPTER 23: The Art of Central Banking: Targets, Instruments and

... are elected to office. There is some empirical evidence to support this theory. GDP growth has increased and unemployment rates decreased just before many elections. Compatible Fiscal Policy: A fiscal policy consistent (compatible) with monetary policy is necessary for the success of monetary polici ...

... are elected to office. There is some empirical evidence to support this theory. GDP growth has increased and unemployment rates decreased just before many elections. Compatible Fiscal Policy: A fiscal policy consistent (compatible) with monetary policy is necessary for the success of monetary polici ...

Coyote Economist The Jobless Recovery News.from.the.Department.of.Economics,.CSUSB

... seeking employment and a decline in the number of jobs made available by business, the evidence points overwhelming to the latter and not the former. One way of gauging this is by taking a look at the employment to population ratio, shown in the figure on the right. During the 1980 recession, the em ...

... seeking employment and a decline in the number of jobs made available by business, the evidence points overwhelming to the latter and not the former. One way of gauging this is by taking a look at the employment to population ratio, shown in the figure on the right. During the 1980 recession, the em ...

Documents/Classifying Damages

... she had intended to remain employed until retirement. Therefore, one can successfully introduce an appropriate amount of discount by using the actual work history of the employee, which already factors in this likelihood, and one need address the discount explicitly only when there is little or no w ...

... she had intended to remain employed until retirement. Therefore, one can successfully introduce an appropriate amount of discount by using the actual work history of the employee, which already factors in this likelihood, and one need address the discount explicitly only when there is little or no w ...

DATA ON CONTINGENT LIABILITIES OF THE GENERAL

... One-off guarantees are defined individually and the guarantor is not able to make a reliable estimate of the risk of calls. One-off guarantees are linked to debt instruments (e.g. loans, bonds). ...

... One-off guarantees are defined individually and the guarantor is not able to make a reliable estimate of the risk of calls. One-off guarantees are linked to debt instruments (e.g. loans, bonds). ...

Redesigning social security, for the 2020s

... expanded and this will pay for itself over decades through benefit savings, but even very high levels of new supply will not reduce the need for more housing benefit spending in the 2020s. Most recent proposals for reform of working-age social security have focused on the short term and therefore as ...

... expanded and this will pay for itself over decades through benefit savings, but even very high levels of new supply will not reduce the need for more housing benefit spending in the 2020s. Most recent proposals for reform of working-age social security have focused on the short term and therefore as ...

KW2_Ch13_FINAL

... 3. Fiscal policy has a multiplier effect on the economy, the size of which depends upon the fiscal policy. Except in the case of lumpsum taxes, taxes reduce the size of the multiplier. Expansionary fiscal policy leads to an increase in real GDP, while contractionary fiscal policy leads to a reductio ...

... 3. Fiscal policy has a multiplier effect on the economy, the size of which depends upon the fiscal policy. Except in the case of lumpsum taxes, taxes reduce the size of the multiplier. Expansionary fiscal policy leads to an increase in real GDP, while contractionary fiscal policy leads to a reductio ...

A Cost-Benefit Analysis of Basel III

... target of 7%. We also estimate the maximum net benefit when banks meet the Basel III longterm liquidity requirements. Our estimated permanent net benefit is larger than the average estimates of the BCBS. This significant marginal benenfit suggests that UK banks need to increase their reliance on com ...

... target of 7%. We also estimate the maximum net benefit when banks meet the Basel III longterm liquidity requirements. Our estimated permanent net benefit is larger than the average estimates of the BCBS. This significant marginal benenfit suggests that UK banks need to increase their reliance on com ...

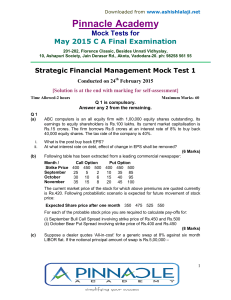

Pinnacle Academ y

... LIBOR for first reset period is 5.75%. A 3-year interest rate cap with a face value of $250 million and a strike price of 7% is available for a premium of 3.75%. Calculate effective cost of the capped loan for the following LIBOR on the next 5 rollover dates: 5.5%, 6%, 6.25%, 6.5% and 6.75%. Fixed i ...

... LIBOR for first reset period is 5.75%. A 3-year interest rate cap with a face value of $250 million and a strike price of 7% is available for a premium of 3.75%. Calculate effective cost of the capped loan for the following LIBOR on the next 5 rollover dates: 5.5%, 6%, 6.25%, 6.5% and 6.75%. Fixed i ...

Country report on Bulgaria - European Commission

... to a reduction in gross external debt, mitigating risks. However, the negative level of the net external position remains rather high and the increasing financing needs of the government create some new risks. ...

... to a reduction in gross external debt, mitigating risks. However, the negative level of the net external position remains rather high and the increasing financing needs of the government create some new risks. ...

Documento Carlos Machicado Inesad Bolivia.pdf

... the new international financial system, established from a set of new financial instruments systematically integrated: the securitization and credit deregulation, computerization of money circulation, financial globalization, financial derivatives, new speculative investment funds, among others. All ...

... the new international financial system, established from a set of new financial instruments systematically integrated: the securitization and credit deregulation, computerization of money circulation, financial globalization, financial derivatives, new speculative investment funds, among others. All ...

Four Fund Accounting Essentials

... Basis Factor: takes the average balance for each fund and allocates pool earnings to that fund based on the realized gain, unrealized gain, dividend and interest and investment expense. Averaging Factor: typically uses the average daily balance of each participating fund over the period the fund is ...

... Basis Factor: takes the average balance for each fund and allocates pool earnings to that fund based on the realized gain, unrealized gain, dividend and interest and investment expense. Averaging Factor: typically uses the average daily balance of each participating fund over the period the fund is ...

Expansionary fiscal policy

... 3. Fiscal policy has a multiplier effect on the economy, the size of which depends upon the fiscal policy. Except in the case of lumpsum taxes, taxes reduce the size of the multiplier. Expansionary fiscal policy leads to an increase in real GDP, while contractionary fiscal policy leads to a reductio ...

... 3. Fiscal policy has a multiplier effect on the economy, the size of which depends upon the fiscal policy. Except in the case of lumpsum taxes, taxes reduce the size of the multiplier. Expansionary fiscal policy leads to an increase in real GDP, while contractionary fiscal policy leads to a reductio ...

2 THE REAL ECONOMY

... rating. Any losses from the set of underlying mortgage loans were to be borne by the holders of the riskier lower-rated tranches. The low risk of the best tranches was conditional on a low default correlation for the underlying subprime mortgages, which, given their similar characteristics and the a ...

... rating. Any losses from the set of underlying mortgage loans were to be borne by the holders of the riskier lower-rated tranches. The low risk of the best tranches was conditional on a low default correlation for the underlying subprime mortgages, which, given their similar characteristics and the a ...

Slide Set 5

... In terms of consumption, we all strive to achieve a “comfort zone”. Once we achieve that or are closer to it we do not need to increase our consumption as much with our income as we had done at lower levels of income. ...

... In terms of consumption, we all strive to achieve a “comfort zone”. Once we achieve that or are closer to it we do not need to increase our consumption as much with our income as we had done at lower levels of income. ...