Can we rely upon fiscal policy estimates in countries with unreported

... shock (short-adjustment and long-run reactions) we are interested in the whole effect, because this is what we really observe with an uncritical impulse response analysis. Finally, in this framework a situation of special interest arises since several variables are driven by one or more stochastic t ...

... shock (short-adjustment and long-run reactions) we are interested in the whole effect, because this is what we really observe with an uncritical impulse response analysis. Finally, in this framework a situation of special interest arises since several variables are driven by one or more stochastic t ...

QUESTION: B.2 (10 marks) - CSUSAP

... concepts and principles are used to study the structure and performance of the Australian economy. Topics include national income measurement and the business cycle, theories of income determination, the financial system and monetary policy, international trade and the balance of payments, macroecon ...

... concepts and principles are used to study the structure and performance of the Australian economy. Topics include national income measurement and the business cycle, theories of income determination, the financial system and monetary policy, international trade and the balance of payments, macroecon ...

Leaving Certificate Economics

... Balance of Autonomous Transactions: This is the sum of private transactions in the current and capital accounts Balance of payments: The balance of payments (BOP) records all financial transactions between the UK and the Rest of the World. The BOP figures tell us about how much is being spent by Bri ...

... Balance of Autonomous Transactions: This is the sum of private transactions in the current and capital accounts Balance of payments: The balance of payments (BOP) records all financial transactions between the UK and the Rest of the World. The BOP figures tell us about how much is being spent by Bri ...

Chapter 14: Fiscal Policy, Deficits, and Debt

... Copyright 2007 by The McGraw-Hill Companies, Inc. All rights reserved. ...

... Copyright 2007 by The McGraw-Hill Companies, Inc. All rights reserved. ...

The impact of macroeconomic factors on

... residential location, educational attainment, personal financial situation, political party and ideology. We find that, in general, when economic conditions are unfavorable (i.e., higher unemployment, lower GDP growth, in recessions), respondents are more likely to believe that the U.S. is spending to ...

... residential location, educational attainment, personal financial situation, political party and ideology. We find that, in general, when economic conditions are unfavorable (i.e., higher unemployment, lower GDP growth, in recessions), respondents are more likely to believe that the U.S. is spending to ...

12 - California State University, Fullerton

... • Vertical Equity and Alternative Tax Systems • A proportional tax is one for which high-income and low-income taxpayers pay the same fraction of income. • A regressive tax is one for which high-income taxpayers pay a smaller fraction of their income than do low-income taxpayers. • A progressive tax ...

... • Vertical Equity and Alternative Tax Systems • A proportional tax is one for which high-income and low-income taxpayers pay the same fraction of income. • A regressive tax is one for which high-income taxpayers pay a smaller fraction of their income than do low-income taxpayers. • A progressive tax ...

Power Point: Aggregate Supply

... increasing prices and thus slowing down AD. When the economy experiences a recessionary gap, wages decrease, shifting the AS right, decreasing prices and thus increasing AD. ...

... increasing prices and thus slowing down AD. When the economy experiences a recessionary gap, wages decrease, shifting the AS right, decreasing prices and thus increasing AD. ...

UK - CIPFA

... The value of any investments and any income generated may go down as well as up and is not guaranteed. Past performance is not a guide to future performance. Quoted yields are not guaranteed. Changes in rates of exchange may have an adverse effect on the value, price or income of an investment. Ther ...

... The value of any investments and any income generated may go down as well as up and is not guaranteed. Past performance is not a guide to future performance. Quoted yields are not guaranteed. Changes in rates of exchange may have an adverse effect on the value, price or income of an investment. Ther ...

Document

... likely to invest now. If confidence is low, firms will withhold from making new investments New technology tends to spur new business investment, as firms rush to keep their manufacturing techniques as modern as efficient as possible and to produce the latest goods and services that consumers are de ...

... likely to invest now. If confidence is low, firms will withhold from making new investments New technology tends to spur new business investment, as firms rush to keep their manufacturing techniques as modern as efficient as possible and to produce the latest goods and services that consumers are de ...

Slide 1

... .... In stage three of EMU, Member States shall avoid excessive general government deficits: this is a clear Treaty obligation (1). The European Council underlines the importance of safeguarding sound government finances as a means to strengthening the conditions for price stability and for strong s ...

... .... In stage three of EMU, Member States shall avoid excessive general government deficits: this is a clear Treaty obligation (1). The European Council underlines the importance of safeguarding sound government finances as a means to strengthening the conditions for price stability and for strong s ...

X - Lidderdale.com Home Page

... of disequilibrium where aggregate output < aggregate demand Intermediate Macroeconomics ...

... of disequilibrium where aggregate output < aggregate demand Intermediate Macroeconomics ...

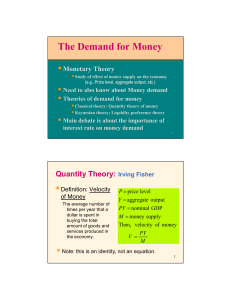

The Demand for Money - Spears School of Business

... ⇒ Neutrality of money (money cannot affect output) Interest rate has no role in money demand ...

... ⇒ Neutrality of money (money cannot affect output) Interest rate has no role in money demand ...

Budget alignment to MKUKUTA

... public spending programmes are supposed to reinforce growth and poverty reduction, not smother it. • A clear statement of government policy in as to the overall weight of public expenditures in the economy would be highly valuable in informing economic operators about the overall economic context fo ...

... public spending programmes are supposed to reinforce growth and poverty reduction, not smother it. • A clear statement of government policy in as to the overall weight of public expenditures in the economy would be highly valuable in informing economic operators about the overall economic context fo ...

GDP - Pearland ISD

... This Includes All the Items (Goods and Services) Produced and Sold Legally in Markets Within the Economy ...

... This Includes All the Items (Goods and Services) Produced and Sold Legally in Markets Within the Economy ...

Міністерство освіти і науки, молоді та спорту України Сумський

... firms into meaningful totals. To this end such concepts as gross domestic product (GDP), national income, personal income, and personal disposable income have been developed. Macroeconomic analysis attempts to explain how the magnitudes of the principal macroeconomic variables are determined and how ...

... firms into meaningful totals. To this end such concepts as gross domestic product (GDP), national income, personal income, and personal disposable income have been developed. Macroeconomic analysis attempts to explain how the magnitudes of the principal macroeconomic variables are determined and how ...

Complete Syllabus Macroeconomics (12th Grade)

... economic adviser to presidents Kennedy and Johnson, proclaimed that the business cycle was "obsolete". A year later, the American economy was in recession. Again, in the late 1990s, some economists claimed that technological innovation and globalisation meant that the business cycle was a thing of ...

... economic adviser to presidents Kennedy and Johnson, proclaimed that the business cycle was "obsolete". A year later, the American economy was in recession. Again, in the late 1990s, some economists claimed that technological innovation and globalisation meant that the business cycle was a thing of ...

The Illinois General Fund Budget and the Long

... Sources: FY2011 actual spending from GOMB, Illinois State Budget: Fiscal Year (Springfield, IL: Feb 22, 2012), CH 2-18; FY2012 actual spending from GOMB, Illinois State Budget: Fiscal Year 2014 (Springfield, IL: March 6, 2013), CH 2-16; FY2013 actual spending from GOMB, Illinois State Budget: Fiscal ...

... Sources: FY2011 actual spending from GOMB, Illinois State Budget: Fiscal Year (Springfield, IL: Feb 22, 2012), CH 2-18; FY2012 actual spending from GOMB, Illinois State Budget: Fiscal Year 2014 (Springfield, IL: March 6, 2013), CH 2-16; FY2013 actual spending from GOMB, Illinois State Budget: Fiscal ...

Mankiw 6e PowerPoints

... a. use the IS-LM diagram to show the effects of the shock on Y and r. b. determine what happens to C, I, and the unemployment rate. CHAPTER 11 ...

... a. use the IS-LM diagram to show the effects of the shock on Y and r. b. determine what happens to C, I, and the unemployment rate. CHAPTER 11 ...

Mankiw 6e PowerPoints

... a. use the IS-LM diagram to show the effects of the shock on Y and r. b. determine what happens to C, I, and the unemployment rate. CHAPTER 11 ...

... a. use the IS-LM diagram to show the effects of the shock on Y and r. b. determine what happens to C, I, and the unemployment rate. CHAPTER 11 ...

Book Review on - Portland State University

... Ball’s chapter investigates an interesting and ambitious question: how an economy facing liquidity trap, as Japan did in the early 2000s, should implement fiscal stimulus so as to have an effective effect on output while avoiding dire long-run fiscal consequences. He finds that an expansionary fisca ...

... Ball’s chapter investigates an interesting and ambitious question: how an economy facing liquidity trap, as Japan did in the early 2000s, should implement fiscal stimulus so as to have an effective effect on output while avoiding dire long-run fiscal consequences. He finds that an expansionary fisca ...

Interactive Model of Business Cycles

... … comparative statics has a long and honourable history, …[but] there is a possibility that by over-concentration on comparative statics, the profession may be omitting or playing down the key importance of the dynamic aspects of most economic problems and issues. In addition, many students may find ...

... … comparative statics has a long and honourable history, …[but] there is a possibility that by over-concentration on comparative statics, the profession may be omitting or playing down the key importance of the dynamic aspects of most economic problems and issues. In addition, many students may find ...

Document

... • Now, I’m all for including the banking sector in stories where it’s relevant; – but why is it so crucial to a story about debt and leverage?...” • Neoclassical “Loanable Funds” model ignores banks – “If I decide to cut back on my spending and stash the funds in a bank, which lends them out to some ...

... • Now, I’m all for including the banking sector in stories where it’s relevant; – but why is it so crucial to a story about debt and leverage?...” • Neoclassical “Loanable Funds” model ignores banks – “If I decide to cut back on my spending and stash the funds in a bank, which lends them out to some ...