* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Power Point: Aggregate Supply

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Fei–Ranis model of economic growth wikipedia , lookup

Business cycle wikipedia , lookup

Fiscal multiplier wikipedia , lookup

Full employment wikipedia , lookup

Phillips curve wikipedia , lookup

Economic calculation problem wikipedia , lookup

Great Recession in Russia wikipedia , lookup

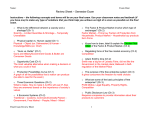

2000s commodities boom wikipedia , lookup

Aggregate Supply Chapter 10: “The Aggregate Supply Curve” Aggregate Supply Tells us how much is produced in goods and services in the country. Determinants of Aggregate Supply Prices Wages and prices of raw materials. Stock of capital State of Technology Producer’s expectations Aggregate Supply Describes the relationship between the price index and the Quantity of goods and services (Real GDP) supplied Holding all other determinants of supply constant Labor costs are constant in the short run Wages change when labor contracts expire. Workers are reluctant to accept lower wages. Employers prefer to fire unskilled workers to reduce wages of skilled workers: Wages are Reduce worker turnover: workers “sticky” in theeager to keep their jobs . short run Reduces cost of inexperience and training. Increases productivity: workers work harder. Minimum wage laws prevent wages from falling. Unions increase worker’s bargaining power Important Difference: Price: what the consumer pays and the producer receives. Cost: what the producer pays for raw materials, labor and other expenses necessary to produce. Firms maximize Profits Labor is the largest cost Wages are in the ofconstant production short run If prices rise while wages remain fixed, production becomes more profitable and firms produce more. Profit = Price - Cost same Aggregate Supply Curves Slopes Upward AS AS(Wage ) ) 0fixed Cause Price Level Profit = Price - Cost same Firms will produce more when prices increase if profits increase Profits increase, if WAGES do not increase Real GDP supplied Effect Movement Along Aggregate Supply When Prices increase, wages (costs) remain constant, profits increase, firms produce more. When Prices decrease, wages (costs) remain constant, profits decrease, firms produce less. Changes in Prices cause a movement along Aggregate Supply An increase in wages shifts AS left AS(Wage1) Profit = Price - Cost Price Level same P0 Firms produce LESS when wages increase Y1 Y0 Real GDP supplied AS(Wage0) Improvements in technology, increase in Stock of Capital & labor force AS0 Price Level AS1 P0 Firms produce MORE with better technology, larger labor force and stock of capital Y0 Y1 Real GDP supplied Direct Direct AS1 AS0 P0 Y0 AS0 AS1 P0 Y0 Price Level Demand increases when Prices drop: Move Along AD = C+ I + G + NX 15 Aggregate Supply – Aggregate Demand Aggregate Supply Price Level Goods and Services Produced At this price level all At this price level production is sold: no Aggregate Supply = accumulation of Aggregate Demand inventories Po Aggregate Demand Goods and Services Purchased GDPo Real GDP 16 Stagflation Goods and Services Produced CPI1 Inflation CPIo Unemployment increases Recession GDP1 GDPo Goods and Services Purchased CPI0 Inventories rise, prices drop, output rises Deflation CPI1 GDPo GDP1 Growth Unemployment drops 18 Increase Government Spending Buy More Inventories Drop, prices and output rise CPI1 CPIo Inflation GDPo GDP1 Growth Unemployment drops 19 stock prices fall Buy Less Inventories rise, prices and output drop CPIo Deflation CPI1 Unemployment increases GDP1 GDPo Recession Recession and deflation Price Level Recession and inflation Growth and inflation Growth and deflation Price Level ASo AS1 ASo 1 2 AD1 ADo ADo Real GDP Real GDP Price Level Price Level AS1 ASo ASo 4 3 ADo AD1 ADo Real GDP Real GDP 21 B A D A. Increased costs B. Increase consumption Which graph best describes the effect of the following events C E F C. Increase in labor costs and increase in government spending D. Increase in wages E. Increase in labor productivity F. Lower oil prices AS shifts more than AD AD shifts more than AS S1 E1 P S1 S2 E2 E1 S2 E2 D2 D2 D1 D1 GDP AS and AD increase: Prices may go up, down or remain the same Output definitely increase. AS shifts by the same amount as AD S1 E1 S2 E2 D1 D2 2. Recession caused by a decrease in consumption and increase in productivity 2 3 3. Recession & deflation mainly caused by drop in AD 5 Which graph best describes the effect of the following events 4.Growth & inflation caused mainly by increase in Government Spending 1. Economic growth and inflation 5.Expansion with deflation mainly caused by improvement in technology 1 4 5 Factors that affect Supply Cost of Production Wages and prices of inputs (oil) Increase Size of stock of capital and labor force Increase Technology Improvement Firms produce less when costs increase AS shifts left Firms produce more with a larger labor force or a larger stock of physical capital: AS shifts right Firms produce more with better technology: AS shifts right. What Causes Inflation/Deflation? Prices change when Aggregate Demand for goods and services runs ahead or lags behind Production of goods and services (Aggregate Supply) 26 What Causes Inflation/Deflation? Prices change when Aggregate Demand for goods and services runs ahead or lags behind Production of goods and services (Aggregate Supply) 27 Increase Production Produce More Aggregate Supply Supply larger than Demand: Inventories rise, Firms cut prices Po P1 Aggregate Demand Demand GDPo GDPo GDP1 Supply Supply 28 Determining the Price Level P As prices rise, real wealth drops, C drops, AD drops. 45 AS As prices rise, real wealth drops, C drops, AE drops. 6,400 100 6,000 5,600 80 AD 0 5,600 Y 6,000 6,400 5,600 6,000 Y=AE AE Excess Demand: AE > Y, inventories drop, firms increase both production and prices. Price index Determining the Price Level As prices drop, real wealth rise, C rise, AD rise. 120 AS As prices drop, real wealth rises, C rises, AE shifts up. 6,400 6,000 5,600 100 AD 0 5,600 AE 6,000 Y=AE 6,400 6,000 6,400 Excess Supply: AE < Y, inventories Y rise, firms decrease both production and prices 45 The Shape of the Aggregate Supply Curve The book uses an upward sloping AS curve…is this always the case? Why is it upward sloping? 31 The Shape of the Aggregate Supply Curve AS: describes the reaction of firms to changes in demand. 32 The Effect of an Increase in Unemployed workers: Lower Unemployment: wages Aggregate Demand Only PriceslowMinimal wages Unemployment rise Excess easy rise excess costs capacity Lesscapacity: excessno capacity: to produce more. riseNo as Unemployment: firms produce more. To Firms do NOTrise raise cover increase in faster costs, firms and Lower Unemployment wages prices butraise instead prices less excess capacity No excess increase output capacity: Firms cannot produce Prices Increase more, only increase prices Prices do not change Unemployment and Excess Capacity Output Increases Output Output Increases can not increase The book uses an upward sloping AS curve…is this always the case? NO. The reaction of firms depends on where the economy is along the business cycle. During a Recession (high Unemployment and Excess Capacity) AS is horizontal Wages do not rise: kept low by unemployment. Firms can increase production without raising prices. 34 Why would AS slope upwards? As the economy recovers, unemployment dropws and there is less excess capacity: AS is upward sloping Firms can increase output But costs rise: lower unemployment means hiring workers becomes more expensive and equipment breaks down more often. Firms increase both production and prices (to cover increase in costs). 35 The book uses an upward sloping AS curve…is this always the case? NO. The reaction of firms depends on where the economy is along the business cycle. At full employment with zero cyclical Unemployment and NO Excess Capacity: AS is vertical. Firms can NOT increase production. And costs rise: zero unemployment means that firms must hire workers away from other firms and equipment breaks down more often. Firms increase prices 36 The Self Adjusting Mechanism Prices rise, gap closes: purchasing power decreases AD decreases Potential GDP AS(W2) Economy’s self correcting AS(W1) mechanism to close an inflationary gap Inflationary Gap Price level P1 Labor market shortages: Excessive spending is Difficult for firms to hire, reduced by an increase in easy for workers to win prices wage increases P0 AD0 4,000 5,000 Real GDP Wages rise: AS shifts left Which graph describes the effect of an increase in Consumption Near Full employment Near Full employment Below Full Employment Below Full Employment Adjusting to a Recessionary Gap Prices fall, gap closes: purchasing power increases, AD increases Unemployment: easy for firms to hire, difficult for workers to win wage increases wages and prices do Potential GDP Price level If not fall: self correcting AS(W 1) Recessionary gaps occur mechanism operates because wages and Gap Recessionary only weakly to cure prices do not fall. AS(W2) recessions Wages fall: AS shifts right P1 P2 AD0 5,000 Real GDP 6,000 Does the US economy has a self correcting mechanism? YES When the economy experiences an inflationary gap, wages increase, shifting the AS left, increasing prices and thus slowing down AD. When the economy experiences a recessionary gap, wages decrease, shifting the AS right, decreasing prices and thus increasing AD. BUT This mechanism works slowly so there is an argument to be made in favor of stabilization policies.