Calculation of Simple Interest and Maturity Value

... Any partial loan payment first covers any interest that has built up. The remainder of the partial payment reduces the loan principal. Allows the borrower to receive proper interest credits. ...

... Any partial loan payment first covers any interest that has built up. The remainder of the partial payment reduces the loan principal. Allows the borrower to receive proper interest credits. ...

Leverage Effects In The Mauritian`s Stock Market

... volatility more than a positive surprises. Contrary to the expectations, there seem to be no leverage effects on the SEM as the coefficient is statistically positive. As such, negative news on the SEM cause volatility to increase less than positive news of the same magnitude. ...

... volatility more than a positive surprises. Contrary to the expectations, there seem to be no leverage effects on the SEM as the coefficient is statistically positive. As such, negative news on the SEM cause volatility to increase less than positive news of the same magnitude. ...

Lecture 6 Chapter 6 PPT

... • If you pay $99 for a $100 face value bond, you will receive both the interest payments and the increase in value from $99 to $100. • This rise in value is referred to as a capital gain and is part of the return on your investment. • When the price of a bond is higher than face value, the bondholde ...

... • If you pay $99 for a $100 face value bond, you will receive both the interest payments and the increase in value from $99 to $100. • This rise in value is referred to as a capital gain and is part of the return on your investment. • When the price of a bond is higher than face value, the bondholde ...

AEGON

... Netherlands initiated a program to hedge its interest rate risks in connection with these guarantees. Implementation of this program was completed by the end of 2006. Derivative instruments used to hedge these interest rate risks are carried at fair value. Any changes in the fair value are recognize ...

... Netherlands initiated a program to hedge its interest rate risks in connection with these guarantees. Implementation of this program was completed by the end of 2006. Derivative instruments used to hedge these interest rate risks are carried at fair value. Any changes in the fair value are recognize ...

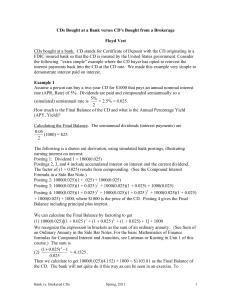

CDs Bought at a Bank verses CD`s Bought from a Brokerage Floyd

... secondary market, this may not be true. The dividends of a brokered CD are typically paid into a “sweep” money market fund in the name of the CD owner. Of course, dividends might be reinvested at a “good” rate. (See the Side Bar Notes.) However, for the small investor, this is not easy to do and not ...

... secondary market, this may not be true. The dividends of a brokered CD are typically paid into a “sweep” money market fund in the name of the CD owner. Of course, dividends might be reinvested at a “good” rate. (See the Side Bar Notes.) However, for the small investor, this is not easy to do and not ...

ab global high yield portfolio

... dividend per share (i.e. multiplying it by 12, or 365 days in the case of daily dividend rate) and dividing by the net asset value (NAV) per share at the determination date (i.e., month end). The yield is retrospective, and so is not necessarily representative of the yield an investor will receive o ...

... dividend per share (i.e. multiplying it by 12, or 365 days in the case of daily dividend rate) and dividing by the net asset value (NAV) per share at the determination date (i.e., month end). The yield is retrospective, and so is not necessarily representative of the yield an investor will receive o ...

Risk-neutral Density Extraction from Option Prices

... represents a powerful approach since the expectations of market participants about future developments are extracted and modeled, which is essential in many contexts. For instance, it is possible to analyze the deviations of the extracted risk-neutral density from the log-normal density of the Black ...

... represents a powerful approach since the expectations of market participants about future developments are extracted and modeled, which is essential in many contexts. For instance, it is possible to analyze the deviations of the extracted risk-neutral density from the log-normal density of the Black ...

Spring 2013 Advanced Portfolio Management Solutions

... and liabilities of a 70bps downward shift using durations or dollar durations. Alternatively it can be estimated by directly looking at the impact to surplus using duration of surplus or dollar duration of surplus. You might get different answers depending on which input you used (for example, the d ...

... and liabilities of a 70bps downward shift using durations or dollar durations. Alternatively it can be estimated by directly looking at the impact to surplus using duration of surplus or dollar duration of surplus. You might get different answers depending on which input you used (for example, the d ...

Executive stock and option valuation in a two state

... executive option values suffer from important limitations. First, we find that the executive option values are often too high, exceeding the option values derived using the traditional risk-neutral model (henceforth the RN model). For example, an executive holding $3.75 million of outside wealth, $1 ...

... executive option values suffer from important limitations. First, we find that the executive option values are often too high, exceeding the option values derived using the traditional risk-neutral model (henceforth the RN model). For example, an executive holding $3.75 million of outside wealth, $1 ...

Lecture Presentation to accompany Investment

... risky assets and how does it differ from the standard deviation of an individual risky asset? • Given the formula for the standard deviation of a portfolio, why and how do you diversify a portfolio? • What happens to the standard deviation of a portfolio when you change the correlation between the a ...

... risky assets and how does it differ from the standard deviation of an individual risky asset? • Given the formula for the standard deviation of a portfolio, why and how do you diversify a portfolio? • What happens to the standard deviation of a portfolio when you change the correlation between the a ...

FTSE Value-Stocks Index Series Extended with a New

... FTSE is well known for index innovation and customer partnerships as it seeks to continually enhance the breadth, depth and reach of its offering. FTSE is wholly owned by London Stock Exchange Group. About Value Partners Group Limited Value Partners is one of Asia’s largest independent asset manage ...

... FTSE is well known for index innovation and customer partnerships as it seeks to continually enhance the breadth, depth and reach of its offering. FTSE is wholly owned by London Stock Exchange Group. About Value Partners Group Limited Value Partners is one of Asia’s largest independent asset manage ...

Short- Sale Constraints and Dispersion of Opinion: Evidence from

... binding all stocks and investors. The model follows Chen et al. (2002), but it differs in that all investors are short sale constrained. The model assumes that there is one risky asset in the market. Investors choose how much to invest in that asset, considering that their only alternative is to inv ...

... binding all stocks and investors. The model follows Chen et al. (2002), but it differs in that all investors are short sale constrained. The model assumes that there is one risky asset in the market. Investors choose how much to invest in that asset, considering that their only alternative is to inv ...

Interest Rate Variance Swaps and the Pricing of

... income market and serves as the underlying for standardized futures and options contracts for volatility trading. A model-free options-based volatility pricing methodology prices and exchange rates) was branded and popularized as the ogy has been carried over to other markets, such as those for gold ...

... income market and serves as the underlying for standardized futures and options contracts for volatility trading. A model-free options-based volatility pricing methodology prices and exchange rates) was branded and popularized as the ogy has been carried over to other markets, such as those for gold ...

A new approach for option pricing under stochastic volatility

... the risk-neutral process for instantaneous variance is a diffusion. Assuming that a money market account acts as numeraire, the coefficients of this risk-neutral diffusion process are independent of the variance swap maturity. In order to determine whether our approach can be rendered consistent wit ...

... the risk-neutral process for instantaneous variance is a diffusion. Assuming that a money market account acts as numeraire, the coefficients of this risk-neutral diffusion process are independent of the variance swap maturity. In order to determine whether our approach can be rendered consistent wit ...