The risky asymmetry of low bond yields

... characterised by a large mass at low levels and a long thin right tail. Another example is the lottery, where the great majority of people win nothing while a very small number win a lot, leading to a similar distribution pattern. In investing, return distributions with a positive skew are fairly ra ...

... characterised by a large mass at low levels and a long thin right tail. Another example is the lottery, where the great majority of people win nothing while a very small number win a lot, leading to a similar distribution pattern. In investing, return distributions with a positive skew are fairly ra ...

An Ingenious, Piecewise Linear Interpolation Algorithm for Pricing

... prices over time, so Asian options are also attractive for them. This is because Asian options are often used as they more closely replicate the requirements of end-users exposed to price movements on the underlying asset. To this date, more and more financial instruments include the average feature ...

... prices over time, so Asian options are also attractive for them. This is because Asian options are often used as they more closely replicate the requirements of end-users exposed to price movements on the underlying asset. To this date, more and more financial instruments include the average feature ...

bond prices

... Everyone in the market believes that the interest one 1year bond next year will decrease to 6% (E(r2) = 6%) Investment A: year 1: buy 1-year bond year 2: buy another 1-year bond Investment B: year 1: buy 2-year bond In order for investment B to be competitive with investment A, B has to offer an ave ...

... Everyone in the market believes that the interest one 1year bond next year will decrease to 6% (E(r2) = 6%) Investment A: year 1: buy 1-year bond year 2: buy another 1-year bond Investment B: year 1: buy 2-year bond In order for investment B to be competitive with investment A, B has to offer an ave ...

Paper-14: Advanced Financial Management

... beta of the stock is 1.60 and the return on the market index is 13%. If the risk free-free rate of return is 8%, by how much should the price of the stock be raised in percentage terms so that it is at equilibrium? (c) Write any three differences between the primary market and the secondary market. ...

... beta of the stock is 1.60 and the return on the market index is 13%. If the risk free-free rate of return is 8%, by how much should the price of the stock be raised in percentage terms so that it is at equilibrium? (c) Write any three differences between the primary market and the secondary market. ...

TOPIC 1: WHAT IS A SHARE

... Transfer of title (shares) vs. creation of contract (options) ....................................................... 8 Rights and obligations............................................................................................................. 8 Topic 3: Settlement and exercise ............. ...

... Transfer of title (shares) vs. creation of contract (options) ....................................................... 8 Rights and obligations............................................................................................................. 8 Topic 3: Settlement and exercise ............. ...

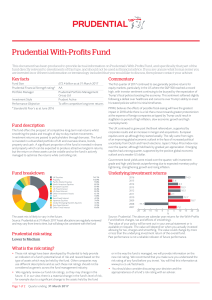

Prudential With

... Source: Prudential. The above are calendar year returns for the With-Profits Fund (before charges, tax and effects of smoothing). The value of your policy will be sent out in your annual statement or is available on request. The value will depend on when you actually invested allowing for tax, charg ...

... Source: Prudential. The above are calendar year returns for the With-Profits Fund (before charges, tax and effects of smoothing). The value of your policy will be sent out in your annual statement or is available on request. The value will depend on when you actually invested allowing for tax, charg ...

How Wave-Wavelet Trading Wins and" Beats" the Market

... paper use the data from the SPY data set. A date of the year will often be displayed in the same style of the SPY data set. For example, January 29th, 1993 is written as 1/29/93. The tables posted on the website are integral parts of the paper but they are too long to be included here. Each table wi ...

... paper use the data from the SPY data set. A date of the year will often be displayed in the same style of the SPY data set. For example, January 29th, 1993 is written as 1/29/93. The tables posted on the website are integral parts of the paper but they are too long to be included here. Each table wi ...

At the market limit order

... Your order is then executed at 13 provided there is enough quantity at that price. ...

... Your order is then executed at 13 provided there is enough quantity at that price. ...

Introduction to Managerial Accounting

... Identifies investments that recoup cash investments quickly. ...

... Identifies investments that recoup cash investments quickly. ...

Ch. 2. Asset Pricing Theory (721383S)

... approach. The main idea is that asset prices should be equal to discounted expected payo¤. I start reviewing the main concepts related to expected utility and risk aversion. Indeed, the expected utility provides a convenient way to rank risky investments between each other. Next, I turn on state pri ...

... approach. The main idea is that asset prices should be equal to discounted expected payo¤. I start reviewing the main concepts related to expected utility and risk aversion. Indeed, the expected utility provides a convenient way to rank risky investments between each other. Next, I turn on state pri ...