tactical timing of low volatility equity strategies

... the low volatility strategy was still above 9%. Moreover, in terms of risk-adjusted returns as measured by the Sharpe Ratio the two were even closer (0.09 difference). Though the expectation of interest rates increasing further might be widespread, generally central banks have indicated that this wi ...

... the low volatility strategy was still above 9%. Moreover, in terms of risk-adjusted returns as measured by the Sharpe Ratio the two were even closer (0.09 difference). Though the expectation of interest rates increasing further might be widespread, generally central banks have indicated that this wi ...

Course 3: Capital Budgeting Analysis

... with our project. Changes in net working capital will sometimes reverse themselves at the end of the project. 3. Overhead: Many capital projects can result in increases to allocated overheads, such as computer support services. However, the subjective nature of overhead allocations may not make any ...

... with our project. Changes in net working capital will sometimes reverse themselves at the end of the project. 3. Overhead: Many capital projects can result in increases to allocated overheads, such as computer support services. However, the subjective nature of overhead allocations may not make any ...

MN20211A-2009 - people.bath.ac.uk

... Jensen’s evidence from the oil industry. After 1973, oil industry generated large free cashflows. Management wasted money on unnecessary R and D. also started diversification programs outside the industry. Evidence- McConnell and Muscerella (1986) – increases in R and D caused decreases in stock pr ...

... Jensen’s evidence from the oil industry. After 1973, oil industry generated large free cashflows. Management wasted money on unnecessary R and D. also started diversification programs outside the industry. Evidence- McConnell and Muscerella (1986) – increases in R and D caused decreases in stock pr ...

Valuation - Ohio University College of Business

... cash flows and then determine the value of those cash flows. Without some competencies in this art, the rest of this module, while technically correct, will be of little value. We will discuss some basic elements of the art the next section and will suggest some readings in this area in Section 3. O ...

... cash flows and then determine the value of those cash flows. Without some competencies in this art, the rest of this module, while technically correct, will be of little value. We will discuss some basic elements of the art the next section and will suggest some readings in this area in Section 3. O ...

Forecasting Stock Market Volatility and the Informational Efficiency

... decisions. For example, it is common practice to reduce asset allocation decisions to a two–dimensional decision problem by focusing solely on the expected return and risk of an asset or portfolio, with risk being related to the volatility of the returns. The volatility of returns plays also a centr ...

... decisions. For example, it is common practice to reduce asset allocation decisions to a two–dimensional decision problem by focusing solely on the expected return and risk of an asset or portfolio, with risk being related to the volatility of the returns. The volatility of returns plays also a centr ...

Real Options Approach to Gas Plant Valuation

... Assumption 3 states that when the investments in gas fires power plants are considered the investment decisions are made as a function of the equilibrium price ξ (⋅) . Thus, neither building nor upgrading is started due to the current realization of short-term deviations. The short-term dynamics sti ...

... Assumption 3 states that when the investments in gas fires power plants are considered the investment decisions are made as a function of the equilibrium price ξ (⋅) . Thus, neither building nor upgrading is started due to the current realization of short-term deviations. The short-term dynamics sti ...

The Low-Volatility Anomaly Not So Anomalous After

... The historical performance of different asset classes over the long term is indeed consistent with the principle that greater risk leads to greater reward. However, this principle does not extend to individual equities. Many academic studies, as well as historical backtests of low-volatility indexes ...

... The historical performance of different asset classes over the long term is indeed consistent with the principle that greater risk leads to greater reward. However, this principle does not extend to individual equities. Many academic studies, as well as historical backtests of low-volatility indexes ...

an alternative approach for teaching the interest

... amortized is the difference between the present values of the bond at the end of the interest payment period and at the beginning of the period. The formulas for the present value of a single payment and the present value of an ordinary annuity can be used to calculate this difference. The steps of ...

... amortized is the difference between the present values of the bond at the end of the interest payment period and at the beginning of the period. The formulas for the present value of a single payment and the present value of an ordinary annuity can be used to calculate this difference. The steps of ...

Relationship Between Trading Volume And

... expectation linking trading volume to stock prices volatility under asymmetric information. He finds a positive relation between trading volume and absolute changes in stock prices but informed and uninformed investors behave differently in his model. Where as Harris and Raviv (1991) developed a mod ...

... expectation linking trading volume to stock prices volatility under asymmetric information. He finds a positive relation between trading volume and absolute changes in stock prices but informed and uninformed investors behave differently in his model. Where as Harris and Raviv (1991) developed a mod ...

US Economic Data and the Australian Dollar

... of 0.028 per cent (2 basis points). However, when volatility is ‘high’, a similar surprise will, on average, lead to an AUD/USD appreciation of 0.071 per cent (5 basis points). On the other hand, for US housing and consumption-related releases there are no clear effects on the AUD/USD, irrespective ...

... of 0.028 per cent (2 basis points). However, when volatility is ‘high’, a similar surprise will, on average, lead to an AUD/USD appreciation of 0.071 per cent (5 basis points). On the other hand, for US housing and consumption-related releases there are no clear effects on the AUD/USD, irrespective ...

Monte Carlo Simulation

... Users can select to simulate returns and wealth values for assets and created portfolios. We begin with the expected return, standard deviation, and correlation of the assets. The returns for each asset are assumed to be lognormally distributed. The lognormal distribution is skewed to the right. Tha ...

... Users can select to simulate returns and wealth values for assets and created portfolios. We begin with the expected return, standard deviation, and correlation of the assets. The returns for each asset are assumed to be lognormally distributed. The lognormal distribution is skewed to the right. Tha ...

stocks - McGraw Hill Higher Education

... o If Blue Sky invests in projects which generate a return less than its discount rate, then its stock price would drop to $37.50. o With zero growth, Blue Sky stock was worth $41.67. o The share price is $4.17 lower because of investing in projects with an unattractive rate of return! Lesson from Pr ...

... o If Blue Sky invests in projects which generate a return less than its discount rate, then its stock price would drop to $37.50. o With zero growth, Blue Sky stock was worth $41.67. o The share price is $4.17 lower because of investing in projects with an unattractive rate of return! Lesson from Pr ...

Storage costs in commodity option pricing

... back to the normal price level. Such a pattern is not possible for the gold spot price. Consider now a calendar spread call option, which can be viewed as a regular call written on the price spread between commodity futures with different maturities. Such a contract is obviously sensitive to spot pri ...

... back to the normal price level. Such a pattern is not possible for the gold spot price. Consider now a calendar spread call option, which can be viewed as a regular call written on the price spread between commodity futures with different maturities. Such a contract is obviously sensitive to spot pri ...

OF_Ch06

... Quotes and prices of Eurodollar futures – For a 3-month Eurodollar futures with the quote price Z, its price is 10,000×[100 – 0.25×(100 – Z)] [100 – 0.25×(100 – Z)] can be understood as the market price of a virtual 3-month zero coupon bond (ZCB) with $100 face value corresponding to the interest ra ...

... Quotes and prices of Eurodollar futures – For a 3-month Eurodollar futures with the quote price Z, its price is 10,000×[100 – 0.25×(100 – Z)] [100 – 0.25×(100 – Z)] can be understood as the market price of a virtual 3-month zero coupon bond (ZCB) with $100 face value corresponding to the interest ra ...

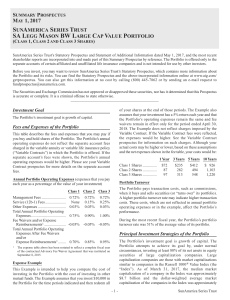

SAST - SA Legg Mason BW Large Cap Value

... Corporation. As with any mutual fund, there is no guarantee that the Portfolio will be able to achieve its investment goal. If the value of the assets of the Portfolio goes down, you could lose money. ...

... Corporation. As with any mutual fund, there is no guarantee that the Portfolio will be able to achieve its investment goal. If the value of the assets of the Portfolio goes down, you could lose money. ...