Long-Term Insurance Act: Prescribed

... acquisition expenses relating to the cost of acquiring new business; (ii) the write-down of inventories to net realisable value and the write-down of property, plant and equipment to recoverable amount as well as the reversal of such Write-downs; (iii) a restructuring of the activities of an enterpr ...

... acquisition expenses relating to the cost of acquiring new business; (ii) the write-down of inventories to net realisable value and the write-down of property, plant and equipment to recoverable amount as well as the reversal of such Write-downs; (iii) a restructuring of the activities of an enterpr ...

Xinfu Chen Mathematical Finance II - Pitt Mathematics

... Mathematically, we are going to find optimal weights that minimizes risk with given expected return or maximizes the expect return with given risk. These two problems are dual to each other. Since µ is a linear and σ is a quadratic function of the weights, as one shall see, the problem can be solved ...

... Mathematically, we are going to find optimal weights that minimizes risk with given expected return or maximizes the expect return with given risk. These two problems are dual to each other. Since µ is a linear and σ is a quadratic function of the weights, as one shall see, the problem can be solved ...

What drives investor risk aversion? - Bank for International Settlements

... preference-weighted PDF with a constant horizon. If the effect of the downward trend in the maturity of the options were neglected, the parameters might change solely due to the fact that the expiry date was approaching. In particular, volatility decreases with each time increment, as uncertainty ab ...

... preference-weighted PDF with a constant horizon. If the effect of the downward trend in the maturity of the options were neglected, the parameters might change solely due to the fact that the expiry date was approaching. In particular, volatility decreases with each time increment, as uncertainty ab ...

UK Contracts for Difference: Risks and

... suggested that the big suppliers may become even less willing to enter into long-term PPAs under the CfD mechanism, since they will no longer be looking to purchase ROCs to manage exposures imposed by the RO. The reasons for the decline in PPA availability may include a preference for the large play ...

... suggested that the big suppliers may become even less willing to enter into long-term PPAs under the CfD mechanism, since they will no longer be looking to purchase ROCs to manage exposures imposed by the RO. The reasons for the decline in PPA availability may include a preference for the large play ...

First-Time Home Buyers and Residential Investment Volatility

... dramatic drop in volatility? We argue in this paper that lower rates of household formation, delayed marriage, and an increase in the cross-sectional variance of earnings account for most of the residential investment volatility decline. There are two possible sources of a decline in economic volati ...

... dramatic drop in volatility? We argue in this paper that lower rates of household formation, delayed marriage, and an increase in the cross-sectional variance of earnings account for most of the residential investment volatility decline. There are two possible sources of a decline in economic volati ...

Emerging Market Volatility - Columbia Threadneedle ETF

... with global market capitalization weights. Yet such increases may come at the price of higher overall portfolio volatility. It is possible to construct EM portfolios with lower volatility profiles. Doing so may not only allow for more meaningful EM allocations, but can also help wealth managers diff ...

... with global market capitalization weights. Yet such increases may come at the price of higher overall portfolio volatility. It is possible to construct EM portfolios with lower volatility profiles. Doing so may not only allow for more meaningful EM allocations, but can also help wealth managers diff ...

the Diversity of Financial Institutions and Accounting Regulation

... investments. According to Persaud [20], these two problems can be linked to the same cause: the setting up of rules and practices that incentivize all financial institutions to behave the same way. Fair value accounting belongs to this set of rules and practices. The main issue concerning fair value ...

... investments. According to Persaud [20], these two problems can be linked to the same cause: the setting up of rules and practices that incentivize all financial institutions to behave the same way. Fair value accounting belongs to this set of rules and practices. The main issue concerning fair value ...

CF Canlife Asia Pacific Fund

... steel. The result of this has been numerous closures in loss-making steel mills and coal mines. This gave rise to better profitability in both coal and steel companies. On the other hand, it is pushing through additional infrastructure spending to support growth. As a result, public investment picked ...

... steel. The result of this has been numerous closures in loss-making steel mills and coal mines. This gave rise to better profitability in both coal and steel companies. On the other hand, it is pushing through additional infrastructure spending to support growth. As a result, public investment picked ...

Benchmarks as Limits to Arbitrage: Understanding the Low

... A, B is less likely than A but seems more “representative” of Linda. What does this experiment have to do with stocks and volatility? Consider defining the characteristics of “great investments.” The layman and the quant address this question with two different approaches. On the one hand, the layma ...

... A, B is less likely than A but seems more “representative” of Linda. What does this experiment have to do with stocks and volatility? Consider defining the characteristics of “great investments.” The layman and the quant address this question with two different approaches. On the one hand, the layma ...

Session 25- Dividends II (The trade off)

... (a) There are no tax differences to investors between dividends and capital gains. (b) If companies pay too much in cash, they can issue new stock, with no flotation costs or signaling consequences, to replace this cash. (c) If companies pay too little in dividends, they do not use the excess cash f ...

... (a) There are no tax differences to investors between dividends and capital gains. (b) If companies pay too much in cash, they can issue new stock, with no flotation costs or signaling consequences, to replace this cash. (c) If companies pay too little in dividends, they do not use the excess cash f ...

Financial Leverage Does Not Cause the Leverage Effect

... In both economies, the cash flows generated by a firm’s assets are specified exogenously, have a constant volatility, and are split into an exogenously specified riskless debt service and a dividend stream to equityholders. We derive the equilibrium prices and dynamics of all financial claims. We ar ...

... In both economies, the cash flows generated by a firm’s assets are specified exogenously, have a constant volatility, and are split into an exogenously specified riskless debt service and a dividend stream to equityholders. We derive the equilibrium prices and dynamics of all financial claims. We ar ...

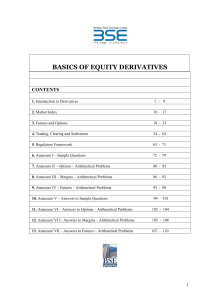

basics of equity derivatives

... globalisation of financial activities. The recent developments in information technology have contributed to a great extent to these developments. While both exchange-traded and OTC derivative contracts offer many benefits, the former have rigid structures compared to the latter. It has been widely ...

... globalisation of financial activities. The recent developments in information technology have contributed to a great extent to these developments. While both exchange-traded and OTC derivative contracts offer many benefits, the former have rigid structures compared to the latter. It has been widely ...

High Discounts and High Unemployment

... off wage bargaining and to continue to search is not credible, because the employer—in the environment described in the basic DMP model with homogeneous workers—always has an interest in making a wage offer that beats the jobseeker’s option of breaking off bargaining. Similarly, the jobseeker alway ...

... off wage bargaining and to continue to search is not credible, because the employer—in the environment described in the basic DMP model with homogeneous workers—always has an interest in making a wage offer that beats the jobseeker’s option of breaking off bargaining. Similarly, the jobseeker alway ...

GEBA MAX - at www.GEBA.com.

... taken each contract year, free of withdrawal charges, even if the required amount exceeds the free withdrawal amount. An excess interest adjustment will be made if applicable. • Terminal Illness Benefit. If you or your Joint Owner is diagnosed with a medical condition expected to result in death wit ...

... taken each contract year, free of withdrawal charges, even if the required amount exceeds the free withdrawal amount. An excess interest adjustment will be made if applicable. • Terminal Illness Benefit. If you or your Joint Owner is diagnosed with a medical condition expected to result in death wit ...

Screening for Growth and Value Based on “What Works on Wall

... paying too much for a growth stock, while the price momentum screen helps to highlight well-priced stocks with market recognized value. O’Shaughnessy tested a number of combinations and settled on two strategies superior on a risk-adjusted basis: a cornerstone value screen geared towards large cap s ...

... paying too much for a growth stock, while the price momentum screen helps to highlight well-priced stocks with market recognized value. O’Shaughnessy tested a number of combinations and settled on two strategies superior on a risk-adjusted basis: a cornerstone value screen geared towards large cap s ...

STAKEHOLDER THEORY AND VALUE CREATION

... externalities (i.e., nobody bears the costs, risks or benefits of actions performed by other agents with which he does not have a market relationship), and so on. In practice, needless to say, these conditions are never met. If some agents have market power, if there are externalities, or if inform ...

... externalities (i.e., nobody bears the costs, risks or benefits of actions performed by other agents with which he does not have a market relationship), and so on. In practice, needless to say, these conditions are never met. If some agents have market power, if there are externalities, or if inform ...

130510496X_441953

... Business risk vs. financial risk Derivatives A derivative is a financial contract whose returns are derived from those of an underlying factor. Size of the derivatives market at year-end 2013 $710 trillion notional principal U.S. Fourth Quarter GDP was only $17 trillion See Figure 1.1 for OT ...

... Business risk vs. financial risk Derivatives A derivative is a financial contract whose returns are derived from those of an underlying factor. Size of the derivatives market at year-end 2013 $710 trillion notional principal U.S. Fourth Quarter GDP was only $17 trillion See Figure 1.1 for OT ...