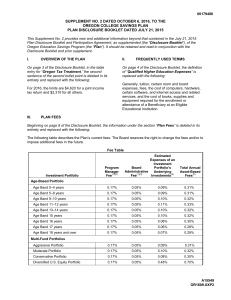

Disclosure Booklet - Oregon College Savings Plan

... Portfolio. The Board Administrative Fee will be used to administer and market the Plan. Any amounts deemed not necessary for such uses may be used for any purpose authorized by Statute. (4) The percentages set forth in this column are based on the expense ratios of the mutual funds in which an Inves ...

... Portfolio. The Board Administrative Fee will be used to administer and market the Plan. Any amounts deemed not necessary for such uses may be used for any purpose authorized by Statute. (4) The percentages set forth in this column are based on the expense ratios of the mutual funds in which an Inves ...

Reservation bid and ask prices for options and covered

... of the optimally hedged existing portfolio.15 We also need to distinguish between the marginal reservation value, which can be either positive or negative (for long or short marginal option positions respectively) and the marginal reservation price per option,16 which is always positive. Transaction ...

... of the optimally hedged existing portfolio.15 We also need to distinguish between the marginal reservation value, which can be either positive or negative (for long or short marginal option positions respectively) and the marginal reservation price per option,16 which is always positive. Transaction ...

Value at Risk (VaR)

... It requires the risk analyst to develop appropriate valuation models for the assets in a portfolio and to specify realistic values for the parameters of the random variables contained in the models. Otherwise, “garbage in, garbage out”. It requires more computer time and power and more analyst j ...

... It requires the risk analyst to develop appropriate valuation models for the assets in a portfolio and to specify realistic values for the parameters of the random variables contained in the models. Otherwise, “garbage in, garbage out”. It requires more computer time and power and more analyst j ...

Download paper (PDF)

... a decrease in the disclosure friction corresponds to greater average cost of capital and lower ex-ante efficiency. By contrast, when most firms are informed (i.e., the disclosure friction is low), firms that do not disclose are not financed, leading to underinvestment as some uninformed high -value ...

... a decrease in the disclosure friction corresponds to greater average cost of capital and lower ex-ante efficiency. By contrast, when most firms are informed (i.e., the disclosure friction is low), firms that do not disclose are not financed, leading to underinvestment as some uninformed high -value ...

Stop-loss and Investment Returns - Actuaries

... Figure 4 highlights the required autocorrelation α given by (3) for the stop-loss strategy to beat buy and µ hold as a function of the annualised return to risk ratio r = 252 . Given the magnitude of daily σ autocorrelation observed in financial markets (mostly below 0.04), the stop-loss strategy sh ...

... Figure 4 highlights the required autocorrelation α given by (3) for the stop-loss strategy to beat buy and µ hold as a function of the annualised return to risk ratio r = 252 . Given the magnitude of daily σ autocorrelation observed in financial markets (mostly below 0.04), the stop-loss strategy sh ...

Loan impairment modeling according to IAS 39 by

... The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received ...

... The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received ...

Speculative Betas - Faculty Directory | Berkeley-Haas

... Substantial evidence supports both of these assumptions. First, there is time-varying disagreement among professional forecasters’ and households’ expectations about many macroeconomic state variables such as market earnings, industrial production growth, and inflation (Cukierman and Wachtel (1979), ...

... Substantial evidence supports both of these assumptions. First, there is time-varying disagreement among professional forecasters’ and households’ expectations about many macroeconomic state variables such as market earnings, industrial production growth, and inflation (Cukierman and Wachtel (1979), ...

AN ECONOMIC PREMIUM PRINCIPLE (a) The notion of premium

... a) for all i, S 7us Ui[wi — X{(s) + Y, (s) — 2psYj(s)] = max for all possible a -1 ...

... a) for all i, S 7us Ui[wi — X{(s) + Y, (s) — 2psYj(s)] = max for all possible a -1 ...

The Hedge Fund Landscape

... At this point, it is worth defining the key differences between managed accounts (separate accounts), managed funds and the other alternative to investors, the fund of one. A summary of the key differences is illustrated in the sidebar (page 5). A managed account is held at the investor’s custodian ...

... At this point, it is worth defining the key differences between managed accounts (separate accounts), managed funds and the other alternative to investors, the fund of one. A summary of the key differences is illustrated in the sidebar (page 5). A managed account is held at the investor’s custodian ...

Margin Regulation and Volatility

... asset’s volatility, the second effect reduces it. In equilibrium, these two effects approximately offset each other and thus the return volatility of the regulated asset barely changes. We also show that for the asset with unregulated margins, the first effect leads to a reduction of its volatility ...

... asset’s volatility, the second effect reduces it. In equilibrium, these two effects approximately offset each other and thus the return volatility of the regulated asset barely changes. We also show that for the asset with unregulated margins, the first effect leads to a reduction of its volatility ...

Credit Portfolio Management in a Turning Rates

... Over the past few years, we have witnessed an (albeit slow) economic recovery and a concurrent emergence of a benign credit cycle associated with tight spreads and low volatility. The management of credit portfolios in such an environment requires a more precise positioning with respect to the movem ...

... Over the past few years, we have witnessed an (albeit slow) economic recovery and a concurrent emergence of a benign credit cycle associated with tight spreads and low volatility. The management of credit portfolios in such an environment requires a more precise positioning with respect to the movem ...

The Valuation of Collateralised Debt Obligations - DORAS

... I would especially like to thank m y supervisor, Professor Liam Gallagher, for his wise counsel and good humour over the period. I would also like to thank Professor Emmanuel Buffet for his advice and direction in the early stages o f this project. M y friend and mentor, Professor Finbarr Bradley, w ...

... I would especially like to thank m y supervisor, Professor Liam Gallagher, for his wise counsel and good humour over the period. I would also like to thank Professor Emmanuel Buffet for his advice and direction in the early stages o f this project. M y friend and mentor, Professor Finbarr Bradley, w ...

The Composition of Capital Flows: Is South Africa Different? -

... -7by push factors. In a more comprehensive study, Chuhan and others (1998) analyzed monthly U.S. equity and bond flows to nine Latin American and nine Asian countries during 1988-92. They find that although global factors—U.S. interest rates and industrial production—are important, country-specific ...

... -7by push factors. In a more comprehensive study, Chuhan and others (1998) analyzed monthly U.S. equity and bond flows to nine Latin American and nine Asian countries during 1988-92. They find that although global factors—U.S. interest rates and industrial production—are important, country-specific ...

NBER WORKING PAPER SERIES BELIEFS ARE HETEROGENEOUS

... economy’s output is lower than that of the original economy, that implies that the expansion in heterogeneity in the original economy tend to shrink the volatility in asset returns. This is simply because the volatility of asset prices increases with output volatility in the first order. The powerfu ...

... economy’s output is lower than that of the original economy, that implies that the expansion in heterogeneity in the original economy tend to shrink the volatility in asset returns. This is simply because the volatility of asset prices increases with output volatility in the first order. The powerfu ...

Portfolio Risk Calculation and Stochastic Portfolio Optimization by A

... PORTFOLIO OPTIMIZATION BY A COPULA BASED APPROACH ...

... PORTFOLIO OPTIMIZATION BY A COPULA BASED APPROACH ...

Is the Willingness to Take Financial Risk a Sex

... portfolios, ceteris paribus. The insignificance of the gender effect in those countries refutes the belief that gender is a good predictor of financial risk-taking. The self-reported risk tolerance provides the correct information about the individual’s readiness to invest in risky assets, but gender d ...

... portfolios, ceteris paribus. The insignificance of the gender effect in those countries refutes the belief that gender is a good predictor of financial risk-taking. The self-reported risk tolerance provides the correct information about the individual’s readiness to invest in risky assets, but gender d ...

Evaluation of the performance of a pairs trading strategy of JSE

... must be the same (Ingersoll 1987). Similarly, for markets to be perfectly integrated (which is commonly assumed), two portfolios created from two markets cannot exist with different prices if the pay offs are identical (Chen and Knez 1995). If these conditions are not satisfied, arbitrage opportunit ...

... must be the same (Ingersoll 1987). Similarly, for markets to be perfectly integrated (which is commonly assumed), two portfolios created from two markets cannot exist with different prices if the pay offs are identical (Chen and Knez 1995). If these conditions are not satisfied, arbitrage opportunit ...

Optimal Consumption and Portfolio Choices with Risky

... Our analysis of alternative housing-choice policies indicates that housing choice has a significant impact on the investors’ portfolio decisions. Compared with the optimal portfolio choice, which allows investors to endogenously choose renting versus owning a house, investors overweigh in equity whe ...

... Our analysis of alternative housing-choice policies indicates that housing choice has a significant impact on the investors’ portfolio decisions. Compared with the optimal portfolio choice, which allows investors to endogenously choose renting versus owning a house, investors overweigh in equity whe ...

The Empirical Measurement of Interest Rate Risk of

... Li Yan (2002) used interest rate sensitive ratio and deviation rate to make an empirical study on the interest rate risk of China’s commercial banks based on the data between 1996 and 1999, and pointed out that China’s commercial banks faced the tremendous interest rate risk during this certain peri ...

... Li Yan (2002) used interest rate sensitive ratio and deviation rate to make an empirical study on the interest rate risk of China’s commercial banks based on the data between 1996 and 1999, and pointed out that China’s commercial banks faced the tremendous interest rate risk during this certain peri ...

Who are the Value and Growth Investors?

... systematic risk other than market portfolio return risk (Fama and French 1992), such as recession risk (Cochrane 1999, Jagannathan and Wang 1996), cash-flow risk (Campbell and Vuolteenaho 2004, Campbell, Polk, and Vuolteenaho 2010), long-run consumption risk (Hansen, Heaton, and Li 2008), or the cos ...

... systematic risk other than market portfolio return risk (Fama and French 1992), such as recession risk (Cochrane 1999, Jagannathan and Wang 1996), cash-flow risk (Campbell and Vuolteenaho 2004, Campbell, Polk, and Vuolteenaho 2010), long-run consumption risk (Hansen, Heaton, and Li 2008), or the cos ...

Stale or Sticky Stock Prices?

... predictability to stale prices. By a stale price, Fisher meant that the current value of a security was based upon a price from a trade that occurred earlier in time and thus did not incorporate any new information from the time of the trade to the current time. Because of this lag, the change in th ...

... predictability to stale prices. By a stale price, Fisher meant that the current value of a security was based upon a price from a trade that occurred earlier in time and thus did not incorporate any new information from the time of the trade to the current time. Because of this lag, the change in th ...