Markowitz Model of Portfolio

... * Investment Decision is same for all investors as every one selects the market portfolio of risky assets. * Financing Decision is left for the individual investor. He/she can decide how much to borrow or to lend at risk free rate depending upon his/her degree of risk averseness. * Thus, investment ...

... * Investment Decision is same for all investors as every one selects the market portfolio of risky assets. * Financing Decision is left for the individual investor. He/she can decide how much to borrow or to lend at risk free rate depending upon his/her degree of risk averseness. * Thus, investment ...

practice

... b. identification of anticipated changes in production, inflation and term structure as key factors in explaining the risk-return relationship c. superior measurement of the risk-free rate of return over historical time periods d. variability of coefficients of sensitivity to the APT factors for a g ...

... b. identification of anticipated changes in production, inflation and term structure as key factors in explaining the risk-return relationship c. superior measurement of the risk-free rate of return over historical time periods d. variability of coefficients of sensitivity to the APT factors for a g ...

First Avenue Sanlam Collective Investments Equity Fund

... All reasonable steps have been taken to ensure the information on this MDD is accurate. The information to follow does not constitute financial advice as contemplated in terms of the Financial Advisory and Intermediary Services Act. Use or rely on this information at your own risk. Independent profe ...

... All reasonable steps have been taken to ensure the information on this MDD is accurate. The information to follow does not constitute financial advice as contemplated in terms of the Financial Advisory and Intermediary Services Act. Use or rely on this information at your own risk. Independent profe ...

Portfolio Theory Lecture

... The variance of Y is then split into the part explained by the X variables, and the residual variance, which is the (conditional) variance left over after conditioning on the observed X values. An optimal forecast has the property that the residuals (forecast errors) and the forecasts are uncorrelat ...

... The variance of Y is then split into the part explained by the X variables, and the residual variance, which is the (conditional) variance left over after conditioning on the observed X values. An optimal forecast has the property that the residuals (forecast errors) and the forecasts are uncorrelat ...

manual - IME-USP

... numeric template button(N). This template has six rows and eight columns, plus the buttons Recalculate, Plot, Report and Save. The rows are named Selection A to F and can be used to analyze up to six efficient portfolios simultaneously. The 1st column shows , a ponderation parameter between expecte ...

... numeric template button(N). This template has six rows and eight columns, plus the buttons Recalculate, Plot, Report and Save. The rows are named Selection A to F and can be used to analyze up to six efficient portfolios simultaneously. The 1st column shows , a ponderation parameter between expecte ...

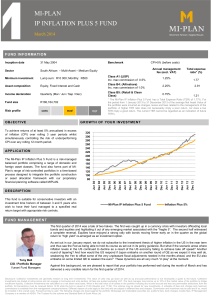

mi-plan ip inflation plus 5 fund

... Disclosure: Collective investments are generally medium to long term investments. The value of units may go down as well as up and past performance is not necessarily a guide to the future. Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. All fees are ...

... Disclosure: Collective investments are generally medium to long term investments. The value of units may go down as well as up and past performance is not necessarily a guide to the future. Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. All fees are ...

FIN350 In-Class-Work No. 2 First Name Last Name The capital asset

... Stock A has a beta of 1.5 and stock B has a beta of 0.5. Which of the following statements must be true a bout these securities? (Assume the market is in equilibrium.) a)When held in isolation, Stock A has greater risk than Stock B. b)Stock B would be a more desirable addition to a portfolio than St ...

... Stock A has a beta of 1.5 and stock B has a beta of 0.5. Which of the following statements must be true a bout these securities? (Assume the market is in equilibrium.) a)When held in isolation, Stock A has greater risk than Stock B. b)Stock B would be a more desirable addition to a portfolio than St ...

Chapter 9 lecture slides

... The Bottom Line on Riskfree Rates Using a long term government rate (even on a coupon bond) as the riskfree rate on all of the cash flows in a long term analysis will yield a close approximation of the true value. For short term analysis, it is entirely appropriate to use a short term government sec ...

... The Bottom Line on Riskfree Rates Using a long term government rate (even on a coupon bond) as the riskfree rate on all of the cash flows in a long term analysis will yield a close approximation of the true value. For short term analysis, it is entirely appropriate to use a short term government sec ...

relative return strategies classic portfolio

... circumstances, the liquidity period may be longer. Liquidation will occur as soon as possible in accordance with market practice and conditions. ...

... circumstances, the liquidity period may be longer. Liquidation will occur as soon as possible in accordance with market practice and conditions. ...

Risk assessment of portfolios of exotic derivatives

... While the risk measures and statistical uncertainty quantifies the risk in a very nice way, it could be interesting to compare the model used with real market outcomes. This is done by using some kind of backtesting method. In this study we will use a pretty straightforward and simple backtest. The ...

... While the risk measures and statistical uncertainty quantifies the risk in a very nice way, it could be interesting to compare the model used with real market outcomes. This is done by using some kind of backtesting method. In this study we will use a pretty straightforward and simple backtest. The ...

risk and returns

... • Coefficient of Variation (CV) – a better measure of total risk than the standard deviation, especially when comparing investments with different expected returns • CV = Standard Deviation = Standard Deviation ...

... • Coefficient of Variation (CV) – a better measure of total risk than the standard deviation, especially when comparing investments with different expected returns • CV = Standard Deviation = Standard Deviation ...

B233note

... Probability distribution: Possible outcomes with their probabilities. Variance: expected value of the squared deviation from the mean. Standard deviation: square root of the variance. Risk Premiums: Risk free rate: return of T-bill. Risk premium: return in excess of risk-free rate. Risk aversion: re ...

... Probability distribution: Possible outcomes with their probabilities. Variance: expected value of the squared deviation from the mean. Standard deviation: square root of the variance. Risk Premiums: Risk free rate: return of T-bill. Risk premium: return in excess of risk-free rate. Risk aversion: re ...

The benefits of growth with lower volatility

... Multi-asset, lower-volatility growth portfolios often include a range of investments that are difficult for other portfolios to access. For instance, among these might be relative value strategies across both equities and interest rates. Positions like these rely on traditional assets but, by taking ...

... Multi-asset, lower-volatility growth portfolios often include a range of investments that are difficult for other portfolios to access. For instance, among these might be relative value strategies across both equities and interest rates. Positions like these rely on traditional assets but, by taking ...

APS 502 Financial Engineering 1 Winter 2015

... (a liability payment is due at the end of each year), and you wish to invest now to meet that obligation. You can invest in the following two zero coupon bonds: Bond A Bond B ...

... (a liability payment is due at the end of each year), and you wish to invest now to meet that obligation. You can invest in the following two zero coupon bonds: Bond A Bond B ...

Portfolio Analysis and Theory in a Nutshell

... in the form of extra return, for assuming financial risk • The risk-free asset has zero risk and is usually assumed to be the one-year U. S. treasury bill • A risk averse investor will hold a risky portfolio only if its expected return is greater than the risk-free rate ...

... in the form of extra return, for assuming financial risk • The risk-free asset has zero risk and is usually assumed to be the one-year U. S. treasury bill • A risk averse investor will hold a risky portfolio only if its expected return is greater than the risk-free rate ...

I_Ch05

... 的不確定性) for an investment – This definition of risk is the most common and classical assumption in finance and economics – Note that the risk is NOT how much you could LOSE from the investment – As long as the realized returns deviate from your expectation, it is risk ※ At the end of this chapter, an ...

... 的不確定性) for an investment – This definition of risk is the most common and classical assumption in finance and economics – Note that the risk is NOT how much you could LOSE from the investment – As long as the realized returns deviate from your expectation, it is risk ※ At the end of this chapter, an ...

ch697

... – Select assets with the lowest variance for the same E(R) – Select assets with the highest E(R) for the same variance • Assumes – Investors like higher E(R’s) – Investors dislike higher variances ®1999 South-Western College Publishing ...

... – Select assets with the lowest variance for the same E(R) – Select assets with the highest E(R) for the same variance • Assumes – Investors like higher E(R’s) – Investors dislike higher variances ®1999 South-Western College Publishing ...

chapter 27 powerpoint abridged for students

... If you are risk averse, the pain of losing $1000 would exceed the pleasure of winning $1000, and both outcomes are equally likely, so you should not take this gamble. THE BASIC TOOLS OF FINANCE ...

... If you are risk averse, the pain of losing $1000 would exceed the pleasure of winning $1000, and both outcomes are equally likely, so you should not take this gamble. THE BASIC TOOLS OF FINANCE ...

BMO Asset Management Global Equity Fund

... The team builds focused portfolios of high quality companies which are held regardless of their popularity or size. The key risk to be avoided is that of losing money for our clients, not that of appearing different from a benchmark. The stock selection process includes two separate strands. The fir ...

... The team builds focused portfolios of high quality companies which are held regardless of their popularity or size. The key risk to be avoided is that of losing money for our clients, not that of appearing different from a benchmark. The stock selection process includes two separate strands. The fir ...