http://www.econstor.eu/bitstream/10419/89039/1/IDB-WP-276.pdf

... Central Bankers have long known that financial stability depends on the health of the financial system as a whole and not necessarily the stability of each and every financial institution. Indeed, Central Bankers have frequently stressed that individual institutions may fail and that the possibility ...

... Central Bankers have long known that financial stability depends on the health of the financial system as a whole and not necessarily the stability of each and every financial institution. Indeed, Central Bankers have frequently stressed that individual institutions may fail and that the possibility ...

Financial Management ( ocw.mit.edu) Lecture Notes - edu,

... Introduction to Risk and Return (PDF) ...

... Introduction to Risk and Return (PDF) ...

Strategy RIsk and the Central Paradox for Active Management

... variation in IC must arise purely from sampling error, making the standard deviation of IC equal to the reciprocal of the square root of breadth. The product of the two factors is therefore unity, and active risk is equal to tracking error. If the manager’s skill level is time-varying the dispersion ...

... variation in IC must arise purely from sampling error, making the standard deviation of IC equal to the reciprocal of the square root of breadth. The product of the two factors is therefore unity, and active risk is equal to tracking error. If the manager’s skill level is time-varying the dispersion ...

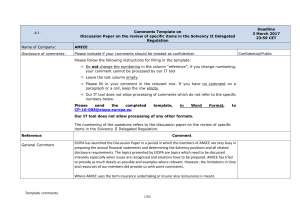

AMICE response to EIOPA Consultation on the review of specific

... terms or to recalculate the SCR using a more accurate method in order to demonstrate that the difference between the result of the chosen method and the result of a more accurate method is immaterial. It is often difficult to assess the exact error induced by the proposed simplification since it is ...

... terms or to recalculate the SCR using a more accurate method in order to demonstrate that the difference between the result of the chosen method and the result of a more accurate method is immaterial. It is often difficult to assess the exact error induced by the proposed simplification since it is ...

Introduction - I-Board Allied Schools

... Steagall Act prohibiting banks from affiliating with securities firms. This allowed commercial banks, investment banks, insurance companies, and securities firms to consolidate. Additionally, it created a new “financial holding company” that could engage in insurance and securities underwriting acti ...

... Steagall Act prohibiting banks from affiliating with securities firms. This allowed commercial banks, investment banks, insurance companies, and securities firms to consolidate. Additionally, it created a new “financial holding company” that could engage in insurance and securities underwriting acti ...

liquidity risk - Islamic Development Bank

... Baking Theory—Why banks exist? Liquidity Issues in Islamic banks -----------------------------Sources of liquidity risk in IBs How it is managed and the consequences -----------------------------What is being done and further ...

... Baking Theory—Why banks exist? Liquidity Issues in Islamic banks -----------------------------Sources of liquidity risk in IBs How it is managed and the consequences -----------------------------What is being done and further ...

Chapter 8

... premiums as compensation Experimental psychology also confirms that humans tend to be risk averse ...

... premiums as compensation Experimental psychology also confirms that humans tend to be risk averse ...

The Instruments of Macroprudential Policy

... which promotes resilience. The credit cycle may also be impacted. An increase in lending spreads may negatively affect credit demand as credit is more costly, while credit supply may be reduced if banks chose to reduce assets. The effectiveness of the buffers may be lessened due to a reduction in vo ...

... which promotes resilience. The credit cycle may also be impacted. An increase in lending spreads may negatively affect credit demand as credit is more costly, while credit supply may be reduced if banks chose to reduce assets. The effectiveness of the buffers may be lessened due to a reduction in vo ...

Income Drawdown Plan - Home | Capita Financial

... financial strength of a company or government issuing a fixed interest security, or bond, determines their ability to make some or all the payments they are committed to. If their financial strength weakens, the chances of them not making payments increases. The funds may hold company bonds that pay ...

... financial strength of a company or government issuing a fixed interest security, or bond, determines their ability to make some or all the payments they are committed to. If their financial strength weakens, the chances of them not making payments increases. The funds may hold company bonds that pay ...

Risk Measures and Risk Capital Allocation

... acceptable to the regulator. Many risk measures exist in the literature, however lately main interest shifted to coherent risk measures that is defined by some axioms; positive homogeneity, monotonicity, sub-additivity and translation invariance [2]. We will analyse these axioms in the following sec ...

... acceptable to the regulator. Many risk measures exist in the literature, however lately main interest shifted to coherent risk measures that is defined by some axioms; positive homogeneity, monotonicity, sub-additivity and translation invariance [2]. We will analyse these axioms in the following sec ...

FM11 Ch 04 Mini

... The standard deviation gets smaller as more stocks are combined in the portfolio, while rp (the portfolio’s return) remains constant. Thus, by adding stocks to your portfolio, which initially started as a 1-stock portfolio, risk has been reduced. In the real world, stocks are positively correlated w ...

... The standard deviation gets smaller as more stocks are combined in the portfolio, while rp (the portfolio’s return) remains constant. Thus, by adding stocks to your portfolio, which initially started as a 1-stock portfolio, risk has been reduced. In the real world, stocks are positively correlated w ...

Evaluation Cultures? On Invoking `Culture` in the Analysis of

... CDOs were a later development than mortgage-backed securities. While, as noted, the first modern private-label U.S. mortgage-backed security was issued in 1977, the first CDO was created only in 1987. CDOs were typically structured in a way similar to mortgage-backed securities and other ABSs (again ...

... CDOs were a later development than mortgage-backed securities. While, as noted, the first modern private-label U.S. mortgage-backed security was issued in 1977, the first CDO was created only in 1987. CDOs were typically structured in a way similar to mortgage-backed securities and other ABSs (again ...

Pacific Global Equity Opportunity UCITS

... The Synthetic Risk and Reward Indicator table demonstrates where the Fund ranks in terms of risk and reward. The higher the rank the greater the risk of losing money. It is based on past date, may change over time and may not be a reliable indication of the future risk profile of the Fund. The shade ...

... The Synthetic Risk and Reward Indicator table demonstrates where the Fund ranks in terms of risk and reward. The higher the rank the greater the risk of losing money. It is based on past date, may change over time and may not be a reliable indication of the future risk profile of the Fund. The shade ...

Integrated Strategic Case Study

... ◦ Look for clues in the pre seen and unseen such as availability of information which will be used to generate the necessary reports ◦ Discuss the pros and cons MOST RELEVANT to the company situation bringing in information from the pre-seen and unseen where possible. ...

... ◦ Look for clues in the pre seen and unseen such as availability of information which will be used to generate the necessary reports ◦ Discuss the pros and cons MOST RELEVANT to the company situation bringing in information from the pre-seen and unseen where possible. ...

FIXING A BROKEN NATIONAL FLOOD INSURANCE PROGRAM

... to damage totals. However, Katrina’s damages were far in excess of most large flood events since flood waters did not recede following the event, saturating homes and multiplying damages. Due to these unusual circumstances and the rarity of a Katrina-type storm, losses were weighted at the hundred-y ...

... to damage totals. However, Katrina’s damages were far in excess of most large flood events since flood waters did not recede following the event, saturating homes and multiplying damages. Due to these unusual circumstances and the rarity of a Katrina-type storm, losses were weighted at the hundred-y ...

Key Investor Information

... the name of which is at the top of this document. The prospectus and periodic reports are prepared for the entire umbrella fund. To protect investors, the assets and liabilities of each compartment are segregated by law from those of other compartments. Switches: Subject to conditions, you may apply ...

... the name of which is at the top of this document. The prospectus and periodic reports are prepared for the entire umbrella fund. To protect investors, the assets and liabilities of each compartment are segregated by law from those of other compartments. Switches: Subject to conditions, you may apply ...

Foreign Exchange Risk Management

... the bank may have. The only true foreign exchange risk incurred here is the difference between the spot and forward trade in each currency. Should a bank buy spot Sterling against US Dollars and sell the identical amount of Sterling, say 3 months forward, the foreign exchange risk is the difference ...

... the bank may have. The only true foreign exchange risk incurred here is the difference between the spot and forward trade in each currency. Should a bank buy spot Sterling against US Dollars and sell the identical amount of Sterling, say 3 months forward, the foreign exchange risk is the difference ...

Exit Strategies: Know Your Options

... • Reduced costs and administration – the costs and management time associated with running a captive can be significant. In addition to direct management costs in running a vehicle, there can also be significant indirect costs at a corporate level. A full buy-out will eliminate these burdens, and a ...

... • Reduced costs and administration – the costs and management time associated with running a captive can be significant. In addition to direct management costs in running a vehicle, there can also be significant indirect costs at a corporate level. A full buy-out will eliminate these burdens, and a ...

Revisiting the Role of Insurance Company ALM

... Most publicly-traded life insurers classify the majority of their fixed income assets as available for sale under US Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) accounting regimes. This means that fixed income assets are held on the balance s ...

... Most publicly-traded life insurers classify the majority of their fixed income assets as available for sale under US Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) accounting regimes. This means that fixed income assets are held on the balance s ...

Are investment certificates too complex?

... pp For investors it is important to know the underlying on which a financial product is based. The transparency of these underlyings is high if the individual elements of the financial product are known and available to the public at all times. A certificate’s performance is always linked to that of ...

... pp For investors it is important to know the underlying on which a financial product is based. The transparency of these underlyings is high if the individual elements of the financial product are known and available to the public at all times. A certificate’s performance is always linked to that of ...

seven steps for effective enterprise risk management

... RISK ASSESSMENT: Risks are analyzed, considering likelihood and impact, as a basis for determining how they should be managed. Risks are assessed on an inherent and a residual basis. RISK RESPONSE: Management selects risk responses – avoiding, accepting, reducing or sharing risk – developing a set o ...

... RISK ASSESSMENT: Risks are analyzed, considering likelihood and impact, as a basis for determining how they should be managed. Risks are assessed on an inherent and a residual basis. RISK RESPONSE: Management selects risk responses – avoiding, accepting, reducing or sharing risk – developing a set o ...

DOC - Europa.eu

... having to pay out the full amount of the insurance if the reference entity on which the CDS is written defaults. As the revenue he receives is usually but a fraction of the payment that he would need to make, he is exposed to the risk of incurring a substantial loss in case a default does occur. C ...

... having to pay out the full amount of the insurance if the reference entity on which the CDS is written defaults. As the revenue he receives is usually but a fraction of the payment that he would need to make, he is exposed to the risk of incurring a substantial loss in case a default does occur. C ...

Disclosure on Market Discipline as required under Pillar III of Basel

... Quarterly risk assessment and capital adequacy review against target Annual Review of ICAAP Under the supervision of the senior management of the bank, the Country Risk Management Committee (CRMC) discusses, reviews and manages the material risks faced by the bank. The committee is headed by Chief R ...

... Quarterly risk assessment and capital adequacy review against target Annual Review of ICAAP Under the supervision of the senior management of the bank, the Country Risk Management Committee (CRMC) discusses, reviews and manages the material risks faced by the bank. The committee is headed by Chief R ...

Risk Sharing between Banks and Markets

... agrees to absorb default losses up to a specified limit. To achieve this, the bank can buy the nonrated tranche (equity tranche), which absorbs all default losses up to its par value, before other tranches have to bear any further losses. In addition, or alternatively, the SPV can set up a reserve a ...

... agrees to absorb default losses up to a specified limit. To achieve this, the bank can buy the nonrated tranche (equity tranche), which absorbs all default losses up to its par value, before other tranches have to bear any further losses. In addition, or alternatively, the SPV can set up a reserve a ...

Corporate Risks and Property Insurance: Evidence From the

... The PRC has two major stock exchanges—Shanghai (SHSE) and Shenzhen (SZSE)—with a combined listing of 976 companies at the end of 1999. We thus drew our sample data from these markets (see “Data Description” section). The CIRC not only sets the benchmark premium rates for the majority of corporate in ...

... The PRC has two major stock exchanges—Shanghai (SHSE) and Shenzhen (SZSE)—with a combined listing of 976 companies at the end of 1999. We thus drew our sample data from these markets (see “Data Description” section). The CIRC not only sets the benchmark premium rates for the majority of corporate in ...