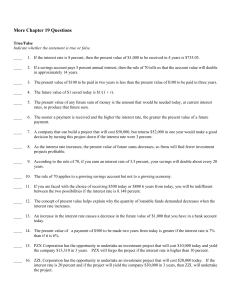

More Finance Questions

... ____ 23. Historically the return on stocks has been higher than the return on bonds. In part this reflects the higher risk from holding stock. ____ 24. Risk-averse persons will take no risks. ____ 25. The market for insurance is one example of reducing risk by using diversification. ____ 26. A perso ...

... ____ 23. Historically the return on stocks has been higher than the return on bonds. In part this reflects the higher risk from holding stock. ____ 24. Risk-averse persons will take no risks. ____ 25. The market for insurance is one example of reducing risk by using diversification. ____ 26. A perso ...

Research on Evaluation of Regional Innovation System Environmental Risk

... control or system reform, these will bring very big impact to development and movement of RIS. In addition, in our country, some policy and law hasn't yet be sound, one of the results is the government adopt the direct administration measure directly to interfere RIS operation, although the interven ...

... control or system reform, these will bring very big impact to development and movement of RIS. In addition, in our country, some policy and law hasn't yet be sound, one of the results is the government adopt the direct administration measure directly to interfere RIS operation, although the interven ...

Financial cycle

... • then starts to decline, although in the early phase of the crisis remains high (given falling nominal GDP it can even rise in the initial post-crisis years). • The deleveraging phase can therefore last several years, and in the event of a deep crisis the leverage ratio can, after a time, fall belo ...

... • then starts to decline, although in the early phase of the crisis remains high (given falling nominal GDP it can even rise in the initial post-crisis years). • The deleveraging phase can therefore last several years, and in the event of a deep crisis the leverage ratio can, after a time, fall belo ...

What drives investor risk aversion? - Bank for International Settlements

... the pessimism of market participants about the economic climate, because of the linkage of the term structure to investors’ portfolio decisions. If investors expect the business climate to improve, they will shift some of their assets from short-maturity instruments into long-term bonds. This change ...

... the pessimism of market participants about the economic climate, because of the linkage of the term structure to investors’ portfolio decisions. If investors expect the business climate to improve, they will shift some of their assets from short-maturity instruments into long-term bonds. This change ...

What Does the Equity Premium Mean? - UQ eSpace

... diverting some of their contributions into private stock-market accounts. The Clinton scheme pooled the returns while the Bush scheme places more risk on individuals. If the equity premium exists because individuals overestimate risks of equity investments, such policies would produce a clear gain f ...

... diverting some of their contributions into private stock-market accounts. The Clinton scheme pooled the returns while the Bush scheme places more risk on individuals. If the equity premium exists because individuals overestimate risks of equity investments, such policies would produce a clear gain f ...

Chapter 3: Australia`s existing regulatory framework

... company and distribution of its assets before the potential losses become too great. The process of winding-up any company, but particularly financial institutions, can be lengthy, complex and expensive. ...

... company and distribution of its assets before the potential losses become too great. The process of winding-up any company, but particularly financial institutions, can be lengthy, complex and expensive. ...

Equilibrium Analysis of Expected Shortfall

... on the terminal wealth. The risk is evaluated at the beginning of the investment and the agent needs to commit himself to comply with the constraint in all future dates. This is due to the static nature of ES. There are papers, e.g., Yiu (2004); Cuoco and Liu (2006); Leippold et al. (2006); Cuoco et ...

... on the terminal wealth. The risk is evaluated at the beginning of the investment and the agent needs to commit himself to comply with the constraint in all future dates. This is due to the static nature of ES. There are papers, e.g., Yiu (2004); Cuoco and Liu (2006); Leippold et al. (2006); Cuoco et ...

terrorism insurance bill 2002 - Federal Register of Legislation

... Commercial property owners, banks, superannuation funds and funds managers have been forced to assume insurance risk as policies reached their expiry date. These institutions are not set up to manage insurance risk, and in the case of some bodies, notably superannuation funds, are specifically precl ...

... Commercial property owners, banks, superannuation funds and funds managers have been forced to assume insurance risk as policies reached their expiry date. These institutions are not set up to manage insurance risk, and in the case of some bodies, notably superannuation funds, are specifically precl ...

Types of Term Life Insurance

... – Less than half of consumers aged 25-64 own life insurance policies – The average amount of coverage for U.S. adults in 2013 was $167,000, down $30,000 from 2004 – Consumers believe life insurance is expensive. They procrastinate, and have difficulty in making correct decisions about the purchase o ...

... – Less than half of consumers aged 25-64 own life insurance policies – The average amount of coverage for U.S. adults in 2013 was $167,000, down $30,000 from 2004 – Consumers believe life insurance is expensive. They procrastinate, and have difficulty in making correct decisions about the purchase o ...

Nonagency MBS, CMBS, ABS

... The provision is aimed at averting potential deterioration in the overall credit quality of the collateral when the best property in the pool is prepaid. ...

... The provision is aimed at averting potential deterioration in the overall credit quality of the collateral when the best property in the pool is prepaid. ...

Microsoft Word - Bab2_15Jul10

... where they are unable to further increase either their own or the firm’s debt load. Issuing firm via an IPO can be beneficial which are providing needed funds and reducing the firm’s debt to Assets ratio. As found by Pagano, Panetta & Zingales, 1998, Rock, 1986 that even in those instances where add ...

... where they are unable to further increase either their own or the firm’s debt load. Issuing firm via an IPO can be beneficial which are providing needed funds and reducing the firm’s debt to Assets ratio. As found by Pagano, Panetta & Zingales, 1998, Rock, 1986 that even in those instances where add ...

Long-Term Capital Market Assumptions

... portfolio may achieve. Assumptions, opinions and estimates are provided for illustrative purposes only. They should not be relied upon as recommendations to buy or sell securities. Forecasts of financial market trends that are based on current market conditions constitute our judgment and are subjec ...

... portfolio may achieve. Assumptions, opinions and estimates are provided for illustrative purposes only. They should not be relied upon as recommendations to buy or sell securities. Forecasts of financial market trends that are based on current market conditions constitute our judgment and are subjec ...

Rutter Associates

... a) Loans generate sufficient profit that they add shareholder value b) Loans do not add shareholder value by themselves; they are used as a way of establishing or maintaining a relationship with the client … but the loan product must be priced to produce a ...

... a) Loans generate sufficient profit that they add shareholder value b) Loans do not add shareholder value by themselves; they are used as a way of establishing or maintaining a relationship with the client … but the loan product must be priced to produce a ...

10-1 Reasons for Saving and Investing

... Which of these saving/investing options has the highest risk? a. Stocks If you bought an investment for $1,000 and it grew to $1,050 1 year later, what is your ROI? c. 5% When investing, the higher the risk you are willing to take b. the greater your possible return may be A long-term, planned appro ...

... Which of these saving/investing options has the highest risk? a. Stocks If you bought an investment for $1,000 and it grew to $1,050 1 year later, what is your ROI? c. 5% When investing, the higher the risk you are willing to take b. the greater your possible return may be A long-term, planned appro ...

The Freedom Recovery Plan

... Plan would provide cost savings and incentives to both borrower and lender, as detailed below, so as to encourage then to settle without going through the very costly proceedings of foreclosure or bankruptcy. The federal government, in addition to providing certain tax incentives, would compel compl ...

... Plan would provide cost savings and incentives to both borrower and lender, as detailed below, so as to encourage then to settle without going through the very costly proceedings of foreclosure or bankruptcy. The federal government, in addition to providing certain tax incentives, would compel compl ...

Soft Landings (February 2000), with Martin Schneider

... This argument overlooks the fact that bailout guarantees typically insure lenders only against systemic risk. A bailout will not occur if just an isolated firm defaults, especially not a small one. Instead, bailouts happen only when there is a critical mass of defaults. Collateral then still matters ...

... This argument overlooks the fact that bailout guarantees typically insure lenders only against systemic risk. A bailout will not occur if just an isolated firm defaults, especially not a small one. Instead, bailouts happen only when there is a critical mass of defaults. Collateral then still matters ...

Constant Proportion Portfolio Insurance in presence

... Portfolio insurance refers to portfolio management techniques designed to guarantee that the portfolio value at maturity or up to maturity will be greater or equal to a given lower bound (floor), typically fixed as a percentage of the initial investment [18]. These techniques allow the investor to lim ...

... Portfolio insurance refers to portfolio management techniques designed to guarantee that the portfolio value at maturity or up to maturity will be greater or equal to a given lower bound (floor), typically fixed as a percentage of the initial investment [18]. These techniques allow the investor to lim ...

Dutch economy in calmer waters - Sociaal

... obliged to save via pension funds and this has been made attractive by making the related investment income exempt from tax. On the other side, taking out a loan to buy a house is encouraged by making mortgage interest tax-deductible, without – until recently – any obligation or incentive to pay off ...

... obliged to save via pension funds and this has been made attractive by making the related investment income exempt from tax. On the other side, taking out a loan to buy a house is encouraged by making mortgage interest tax-deductible, without – until recently – any obligation or incentive to pay off ...

1. Introduction to risk

... horizon. Generally, the time horizon chosen should not be shorter than the time frame over which risk-mitigating actions can be taken. It does not prescribe any one particular time horizon but suggests two possible time horizons that can provide management information relevant for credit risk manage ...

... horizon. Generally, the time horizon chosen should not be shorter than the time frame over which risk-mitigating actions can be taken. It does not prescribe any one particular time horizon but suggests two possible time horizons that can provide management information relevant for credit risk manage ...

Temi di Discussione

... delinquent at the end of 2005: after two years, roughly 20 per cent had been declared bad loans. Banks should therefore closely monitor this information both when deciding whether to grant a loan to a household and when specifying the price and nonprice terms of the contract. In order to estimate th ...

... delinquent at the end of 2005: after two years, roughly 20 per cent had been declared bad loans. Banks should therefore closely monitor this information both when deciding whether to grant a loan to a household and when specifying the price and nonprice terms of the contract. In order to estimate th ...

Systematic risk

... 4. In the boom market, which stock do you choose 5. In the recession market, which stock do you choose 6. How do investors know whether the return they get in the market is high enough to reward for the level of risk taken ...

... 4. In the boom market, which stock do you choose 5. In the recession market, which stock do you choose 6. How do investors know whether the return they get in the market is high enough to reward for the level of risk taken ...