Three Approaches to Better Outcomes in Fixed

... The table below shows how using credit default swaps in place of cash bonds can create a cleaner barbell portfolio that isolates the credit and default components of high yield. This would have been hard to do 30 years ago, but today it’s relatively simple. For example, investors can get their credi ...

... The table below shows how using credit default swaps in place of cash bonds can create a cleaner barbell portfolio that isolates the credit and default components of high yield. This would have been hard to do 30 years ago, but today it’s relatively simple. For example, investors can get their credi ...

Premium Factors and the Risk-Return Trade

... Over time, the determination of risk factors that are priced (or not) and the consideration of risk-return trade-off across capital markets have been a critical issue in finance. The first empirically acceptable model for determining priced and non-priced factors is the Capital Asset Pricing Model ( ...

... Over time, the determination of risk factors that are priced (or not) and the consideration of risk-return trade-off across capital markets have been a critical issue in finance. The first empirically acceptable model for determining priced and non-priced factors is the Capital Asset Pricing Model ( ...

Insuring climate catastrophes in Florida: an analysis of insurance pricing and capacity under various scenarios of climate change and adaptation measures: Working Paper 50 (787 kB) (opens in new window)

... The coastal insured value in the United States for the top 10 states combined accounts for more than $8.3 trillion (Kunreuther and Michel-Kerjan 2011). If one adds what is covered against flood-related damage by the National Flood Insurance Program, the insured property value at risk would be augme ...

... The coastal insured value in the United States for the top 10 states combined accounts for more than $8.3 trillion (Kunreuther and Michel-Kerjan 2011). If one adds what is covered against flood-related damage by the National Flood Insurance Program, the insured property value at risk would be augme ...

characteristics of financial instruments and a description of risk

... 4) The risk associated with topping up of the margin Secured deposit transactions are subject to risks. They allow you to open a position worth more than the value of the account, so if the trading of the underlying instrument changes for the worse from the point of view of the investor, the invest ...

... 4) The risk associated with topping up of the margin Secured deposit transactions are subject to risks. They allow you to open a position worth more than the value of the account, so if the trading of the underlying instrument changes for the worse from the point of view of the investor, the invest ...

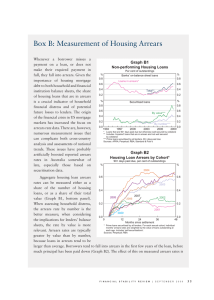

Box B: Measurement of Housing Arrears Graph B1

... where repayments are at least 90 days past due, but the loan is well covered by collateral – or ‘impaired’ – at least 90 days past due or not in arrears but otherwise doubtful, and the loan is not well covered by collateral. Data from authorised deposit-taking institutions (ADIs) record both past-du ...

... where repayments are at least 90 days past due, but the loan is well covered by collateral – or ‘impaired’ – at least 90 days past due or not in arrears but otherwise doubtful, and the loan is not well covered by collateral. Data from authorised deposit-taking institutions (ADIs) record both past-du ...

Home Equity Lines of Credit: Market Trends and Consumer Issues

... Banks have made significant investments in marketing and promoting readvanceable mortgages. Sales representatives are expected to introduce and sell the product to their customers. As a result, HELOCs are now marketed to a wider cross-section of consumers. In practice, readvanceable mortgages now se ...

... Banks have made significant investments in marketing and promoting readvanceable mortgages. Sales representatives are expected to introduce and sell the product to their customers. As a result, HELOCs are now marketed to a wider cross-section of consumers. In practice, readvanceable mortgages now se ...

What Determines the Survival of Internet IPOs?

... Investment banks, also referred to as underwriters, depend on their reputation to generate new business. The investment banks with the highest reputation are considered to be more successful at performing activities, such as taking firms public. This creates an incentive to be selective at picking f ...

... Investment banks, also referred to as underwriters, depend on their reputation to generate new business. The investment banks with the highest reputation are considered to be more successful at performing activities, such as taking firms public. This creates an incentive to be selective at picking f ...

Alerta HARBOR: A Pesar de Reducción Crediticia por Fitch Ratings

... AAA An obligation rated 'AAA' has the highest rating assigned by Standard & Poor's. The obligor's capacity to meet its financial commitment on the obligation is EXTREMELY STRONG. AA An obligation rated 'AA' differs from the highest rated obligations only in small degree. The obligor's capacity to me ...

... AAA An obligation rated 'AAA' has the highest rating assigned by Standard & Poor's. The obligor's capacity to meet its financial commitment on the obligation is EXTREMELY STRONG. AA An obligation rated 'AA' differs from the highest rated obligations only in small degree. The obligor's capacity to me ...

The cultural revolution in risk management

... The industry concurred, with the Institute of International Finance (IIF) stating: “... part of the management challenge of creating and sustaining a strong risk culture is to make explicit what is going on tacitly, to correct the negative aspects, and to enhance and entrench the strong aspects alre ...

... The industry concurred, with the Institute of International Finance (IIF) stating: “... part of the management challenge of creating and sustaining a strong risk culture is to make explicit what is going on tacitly, to correct the negative aspects, and to enhance and entrench the strong aspects alre ...

Global Insurance Market Opportunities - Thought Leadership

... First, we have learned the need to model all perils in all geographies. Regulatory and rating agency frameworks have adapted to require companies to have their own best estimate of losses based on the most up-to-date science. ...

... First, we have learned the need to model all perils in all geographies. Regulatory and rating agency frameworks have adapted to require companies to have their own best estimate of losses based on the most up-to-date science. ...

The Composite Index of Propensity to Risk – CIPR

... The spectrum of risk attitudes is related to the form of utility functions reflecting the behavior of individuals when choosing between risky, uncertain outcomes and certain equivalents. For example, consider two possible monetary outcomes or lotteries, z1 and z2 that may occur with chances p and (1 ...

... The spectrum of risk attitudes is related to the form of utility functions reflecting the behavior of individuals when choosing between risky, uncertain outcomes and certain equivalents. For example, consider two possible monetary outcomes or lotteries, z1 and z2 that may occur with chances p and (1 ...

SECURITIZATION, RISK TRANSFERRING AND FINANCIAL

... studying the interaction of lending and housing prices both at the international (Hofmann, 2001; Tsatsaronis and Zhu, 2004) and the individual country levels (Gerlach and Peng, 2005; Gimeno and Martínez-Carrascal, 2005). In addition the cyclical component of mortgage credit and its interaction with ...

... studying the interaction of lending and housing prices both at the international (Hofmann, 2001; Tsatsaronis and Zhu, 2004) and the individual country levels (Gerlach and Peng, 2005; Gimeno and Martínez-Carrascal, 2005). In addition the cyclical component of mortgage credit and its interaction with ...

Borrower characteristics and mortgage choice in Sweden

... Literature on the impact of loan takers’ tolerance of sudden increases in mortgage costs is scarce. However, a Swedish study by Kulander and Lind (2009) found statistically significant differences between groups that experienced worry and those who felt more secure in their ability to manage their m ...

... Literature on the impact of loan takers’ tolerance of sudden increases in mortgage costs is scarce. However, a Swedish study by Kulander and Lind (2009) found statistically significant differences between groups that experienced worry and those who felt more secure in their ability to manage their m ...

A: An investment

... The risk for one security can be calculated using the standard deviation measure. Why? Std deviation is the measure of dispersion of a data set. So, in terms of returns, std deviation actually represents RISK of that investment. The standard deviation is a reliable measure of ...

... The risk for one security can be calculated using the standard deviation measure. Why? Std deviation is the measure of dispersion of a data set. So, in terms of returns, std deviation actually represents RISK of that investment. The standard deviation is a reliable measure of ...

Dynamic portfolio and mortgage choice for homeowners

... • Investor acts as if house is worth only h because – Adjustment for PV(market imputed rent until T) – Take into account unhedgeable idiosyncratic house risk ...

... • Investor acts as if house is worth only h because – Adjustment for PV(market imputed rent until T) – Take into account unhedgeable idiosyncratic house risk ...

The Changing Landscape of the Financial Services

... which loosens restrictions on banks’ abilities to engage in the previously restricted activity of underwriting securities and permits banks to underwrite insurance policies. This paper examines some of the potential consequences of GLB for the structure of the U.S. financial services industry. In it ...

... which loosens restrictions on banks’ abilities to engage in the previously restricted activity of underwriting securities and permits banks to underwrite insurance policies. This paper examines some of the potential consequences of GLB for the structure of the U.S. financial services industry. In it ...

Security Matters: How Instability in Health Insurance Puts U.S.

... Lack of insurance for any family member increases family risk of financial insecurity due to medical bills.* All Uninsured Now ...

... Lack of insurance for any family member increases family risk of financial insecurity due to medical bills.* All Uninsured Now ...

A Partial Internal Model for Credit and Market Risk Under Solvency II

... of a representative European-based life insurer’s balance sheet and investment portfolio as determined by Höring (2012), who created these based on several sources, e.g. statistics from regulators, insurance associations and rating agencies, as well as individual insurance companies’ annual report ...

... of a representative European-based life insurer’s balance sheet and investment portfolio as determined by Höring (2012), who created these based on several sources, e.g. statistics from regulators, insurance associations and rating agencies, as well as individual insurance companies’ annual report ...

risk premia on key asset classes: a south african perspective

... should not be construed, as advice or recommendation in any way. The author and his employer accept no responsibility for any direct or indirect consequences arising from anyone relying on or using these materials or the opinions expressed in this paper. Actual experience may very well deviate from ...

... should not be construed, as advice or recommendation in any way. The author and his employer accept no responsibility for any direct or indirect consequences arising from anyone relying on or using these materials or the opinions expressed in this paper. Actual experience may very well deviate from ...

Community Development Investment Review: Conference

... nhancing the community development finance field’s access to the capital markets is an important topic and one that I care about quite a bit. Facilitating capital flows to address the economic needs of people in distressed areas is an element of overall economic growth, and so the Federal Reserve Sy ...

... nhancing the community development finance field’s access to the capital markets is an important topic and one that I care about quite a bit. Facilitating capital flows to address the economic needs of people in distressed areas is an element of overall economic growth, and so the Federal Reserve Sy ...

What is a realistic aversion to risk for real

... wealth, where the investment wealth includes appropriately discounted, some kind of certainty equivalent of, labor income. My arguments would not hold if an agent calculates her investment as a proportion of currently available cash, while she is reasonably certain of (and ignores for the purposes o ...

... wealth, where the investment wealth includes appropriately discounted, some kind of certainty equivalent of, labor income. My arguments would not hold if an agent calculates her investment as a proportion of currently available cash, while she is reasonably certain of (and ignores for the purposes o ...

view - Pacra.com

... Premium Mix: CSI is a small sized company with 0.8% of market share at endSep14. GPW portfolio is dominated by motor (46%), and Health (39%), with minor share of other segments. Top ten customer concentration is very high. Performance: In 9M14, CSI achieved a GPW size of PKR 200mln, in the first ...

... Premium Mix: CSI is a small sized company with 0.8% of market share at endSep14. GPW portfolio is dominated by motor (46%), and Health (39%), with minor share of other segments. Top ten customer concentration is very high. Performance: In 9M14, CSI achieved a GPW size of PKR 200mln, in the first ...

The Case for a Concentrated Portfolio

... non-concentrated portfolios when the market is healthy, and they tend to hold up better during difficult market environments. ...

... non-concentrated portfolios when the market is healthy, and they tend to hold up better during difficult market environments. ...

Financial Integration and Economic Welfare

... countries steady state level of capital stock is far below that of rich countries they themselves are not that far away from their own steady state. Thus even instantaneous convergence to the steady state as a result of opening up the capital account might deliver small welfare gains. This is partic ...

... countries steady state level of capital stock is far below that of rich countries they themselves are not that far away from their own steady state. Thus even instantaneous convergence to the steady state as a result of opening up the capital account might deliver small welfare gains. This is partic ...