2/27 - David Youngberg

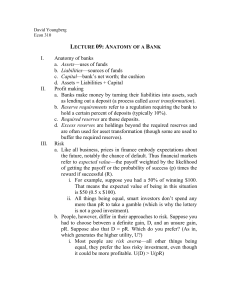

... That means the expected value of being in this situation is $50 (0.5 x $100). ii. All things being equal, smart investors don’t spend any more than pR to take a gamble (which is why the lottery is not a good investment). b. People, however, differ in their approaches to risk. Suppose you had to choo ...

... That means the expected value of being in this situation is $50 (0.5 x $100). ii. All things being equal, smart investors don’t spend any more than pR to take a gamble (which is why the lottery is not a good investment). b. People, however, differ in their approaches to risk. Suppose you had to choo ...

Global insurance regulation and systemic risk

... Insurance is funded by upfront premiums, providing strong operating cash-flow without requiring wholesale short-term funding Insurance policies are generally long-term, with predictable outflows. Liquidity risk is negligible in the insurance industry The main risk for insurers is underwriting risk, ...

... Insurance is funded by upfront premiums, providing strong operating cash-flow without requiring wholesale short-term funding Insurance policies are generally long-term, with predictable outflows. Liquidity risk is negligible in the insurance industry The main risk for insurers is underwriting risk, ...

Economics and Moral Sentiments: The Case of Moral Hazard

... The unintended effect of insurance as increasing the willingness to take on risk (with limits on monitoring) Origins in insurance literature: implied moral judgement Developed in decision theory as the outcome of the rational pursuit of selfish ends, ie opportunism Credit rationing literature: moral ...

... The unintended effect of insurance as increasing the willingness to take on risk (with limits on monitoring) Origins in insurance literature: implied moral judgement Developed in decision theory as the outcome of the rational pursuit of selfish ends, ie opportunism Credit rationing literature: moral ...

BankThink Dodd-Frank, Obamacare grew out of same faulty reasoning

... the Federal Reserve bailouts of insolvent firms should be strengthened and enforced. Fourth, no prudential regulator should have conflicting social objectives. Fifth, the FDIC as insurer should be the primary regulator for all insured institutions and held accountable for protecting its insurance fu ...

... the Federal Reserve bailouts of insolvent firms should be strengthened and enforced. Fourth, no prudential regulator should have conflicting social objectives. Fifth, the FDIC as insurer should be the primary regulator for all insured institutions and held accountable for protecting its insurance fu ...

Public Policy and Financial Crises

... although there are buyers willing to pay a higher price for higher quality. Lenders will lend less than otherwise, negatively affecting investment and growth ...

... although there are buyers willing to pay a higher price for higher quality. Lenders will lend less than otherwise, negatively affecting investment and growth ...

Objectives of a Sound Enterprisewide Risk

... Objectives of a Sound Enterprisewide Risk Management Framework ...

... Objectives of a Sound Enterprisewide Risk Management Framework ...

Insurance

... Insurance • Insurance: an arrangement where a company or government agency provides guaranteed compensation in case of a certain event for a premium (payment). • This provides you with a certain financial protection. • Types of insurance: – Car, health, renters, life, liability (lawsuits), travel, d ...

... Insurance • Insurance: an arrangement where a company or government agency provides guaranteed compensation in case of a certain event for a premium (payment). • This provides you with a certain financial protection. • Types of insurance: – Car, health, renters, life, liability (lawsuits), travel, d ...

Causes of the Financial Crisis

... – Increasing consumer debt – credit cards – Housing and stock bubbles mortgages and home equity loans Homeowners taking out loans on homes until stripped of equity (predatory lending by some banks) How Long can an economy be stable when too much wealth is concentrated in too few hands? Who wil ...

... – Increasing consumer debt – credit cards – Housing and stock bubbles mortgages and home equity loans Homeowners taking out loans on homes until stripped of equity (predatory lending by some banks) How Long can an economy be stable when too much wealth is concentrated in too few hands? Who wil ...

FINA 406 ASSGN 1 ANSWERS

... Explain the difference between pure and speculative risk. Pure risk refers to possibilities that can result only in either loss or no change. Speculative risk refers to those exposures to price change that may result in either gain or loss. ...

... Explain the difference between pure and speculative risk. Pure risk refers to possibilities that can result only in either loss or no change. Speculative risk refers to those exposures to price change that may result in either gain or loss. ...

Document

... Three Faulty Assumptions About 21st Century Finance Securitization • Capital markets are so advanced that banks can lend more aggressively while off-loading risk through debt securities ...

... Three Faulty Assumptions About 21st Century Finance Securitization • Capital markets are so advanced that banks can lend more aggressively while off-loading risk through debt securities ...

"Uncertainty and the Welfare Economics of Medical Care" Arrow

... Imperfect capital markets for borrowing for medical school Great deal of anticompetitive conduct Financial intermediaries Ideal insurance markets – not achieved Moral Hazard Alternative provider payment not equivalent Third party control over payment Administrative costs Hints at adverse selection, ...

... Imperfect capital markets for borrowing for medical school Great deal of anticompetitive conduct Financial intermediaries Ideal insurance markets – not achieved Moral Hazard Alternative provider payment not equivalent Third party control over payment Administrative costs Hints at adverse selection, ...

Balancing LOLR Assistance with Avoidance of Moral Hazard

... as promised, it can always issue its own IOU. • Specific paper money, the concept of liquidity, and the need for banks, all derive from the fact that default can never be ruled out completely. • So a liquidity need almost always, absent physical problems, implies an underlying solvency concern. ...

... as promised, it can always issue its own IOU. • Specific paper money, the concept of liquidity, and the need for banks, all derive from the fact that default can never be ruled out completely. • So a liquidity need almost always, absent physical problems, implies an underlying solvency concern. ...