risk management

... What is the risk? Consumption shortfalls due to outliving assets & inflation Key instruments of consumption protection: must be free of default risk; must match the maturity and time pattern of the spending target; must be protected against adverse selection and moral hazard. ...

... What is the risk? Consumption shortfalls due to outliving assets & inflation Key instruments of consumption protection: must be free of default risk; must match the maturity and time pattern of the spending target; must be protected against adverse selection and moral hazard. ...

Chapter 6

... What is the role of securitization in practice? Securitization has been a prominent feature of U.S. financial markets for decades, and has gradually displaced banks as the ultimate source of funds lent to households. An early example was so-called mortgage passthroughs, in which investors purchased ...

... What is the role of securitization in practice? Securitization has been a prominent feature of U.S. financial markets for decades, and has gradually displaced banks as the ultimate source of funds lent to households. An early example was so-called mortgage passthroughs, in which investors purchased ...

Capital Flows, Interest Rates and Precautionary Behaviour: a model of

... issues worth developing. – alternative view: learning and overshooting misperception on the economic costs of crisis ...

... issues worth developing. – alternative view: learning and overshooting misperception on the economic costs of crisis ...

2009

... to hold capital of at least 8 percent of loans on balance sheets, but requirements were lower for SIVs (structured investment vehicles, i.e. off balance sheet entities created by banks) Rating arbitrage – transfer assets to SIVs and issue AAA rated papers rather than A- rated papers ...

... to hold capital of at least 8 percent of loans on balance sheets, but requirements were lower for SIVs (structured investment vehicles, i.e. off balance sheet entities created by banks) Rating arbitrage – transfer assets to SIVs and issue AAA rated papers rather than A- rated papers ...

building the new regulatory framework: challenges ahead

... • As there is a cost in ex ante prevention, a balance should be found between ex ante prevention and crisis management costs. The marginal dollar should produce the same net return. • Define strong restructuring and resolution mechanisms (bail-ins, cocos, loss absorbing debt capacity) so as to reach ...

... • As there is a cost in ex ante prevention, a balance should be found between ex ante prevention and crisis management costs. The marginal dollar should produce the same net return. • Define strong restructuring and resolution mechanisms (bail-ins, cocos, loss absorbing debt capacity) so as to reach ...

The Reckoning NY Times

... derivatives, which insure debt holders against default. They are fashioned privately and beyond the ken of regulators — sometimes even beyond the understanding of executives peddling them. Originally intended to diminish risk and spread prosperity, these inventions instead magnified the impact of ba ...

... derivatives, which insure debt holders against default. They are fashioned privately and beyond the ken of regulators — sometimes even beyond the understanding of executives peddling them. Originally intended to diminish risk and spread prosperity, these inventions instead magnified the impact of ba ...

IBLI Performance Paper

... Index insurance is a variation on traditional insurance: - Do not insure individual losses. - Instead insure some “index” measure that is strongly correlated with individual losses. (Examples: rainfall, remotely sensed vegetation index, area average yield, area average herd mortality loss). Index ne ...

... Index insurance is a variation on traditional insurance: - Do not insure individual losses. - Instead insure some “index” measure that is strongly correlated with individual losses. (Examples: rainfall, remotely sensed vegetation index, area average yield, area average herd mortality loss). Index ne ...

Compared to U.S. Treasury investors, should U.S. Agency MBS

... is not certain and does vary especially over short periods of time. securities. The other specific events are characterized by less dramatic but similar market moving events in the financial There are a few reasons for these divergences. In the United markets. States, a mortgage borrower can refinan ...

... is not certain and does vary especially over short periods of time. securities. The other specific events are characterized by less dramatic but similar market moving events in the financial There are a few reasons for these divergences. In the United markets. States, a mortgage borrower can refinan ...

HKMA column 251

... risks. And it is not just credit risks that are of concern to banks. When they choose to invest money in financial assets denominated in foreign currencies, they incur exchange risk as well. When investing in debt securities that pay a fixed rate of interest, they additionally incur interest rate r ...

... risks. And it is not just credit risks that are of concern to banks. When they choose to invest money in financial assets denominated in foreign currencies, they incur exchange risk as well. When investing in debt securities that pay a fixed rate of interest, they additionally incur interest rate r ...

Causes of the Financial Crisis

... •Extremely complex system of pipes. •Lag times •Interdependent flows, dependencies. •Not even sure where the water will come out ...

... •Extremely complex system of pipes. •Lag times •Interdependent flows, dependencies. •Not even sure where the water will come out ...

Financial Times

... Shadow Banking System In the past two decades nonbank financial institutions replicated the commercial banking model via money markets Banks also shifted from deposits to money markets Size of the shadow system in 2007 reached $10.5 trillion, while commercial banking system was $10 trillion ...

... Shadow Banking System In the past two decades nonbank financial institutions replicated the commercial banking model via money markets Banks also shifted from deposits to money markets Size of the shadow system in 2007 reached $10.5 trillion, while commercial banking system was $10 trillion ...

a macro-perspective

... i) DRF provides financial compensation post event and thus reduces the cost of follow-on consequences from slow reactions, ii) DRF shares pre event risk by removing systemic risk inherent in decision making (i.e. What money should be spent on) ...

... i) DRF provides financial compensation post event and thus reduces the cost of follow-on consequences from slow reactions, ii) DRF shares pre event risk by removing systemic risk inherent in decision making (i.e. What money should be spent on) ...

Answer 2 - Problem set 7

... presumes that the riskiness is observable for the insurance company (e.g. FDIC), which may not be entirely true due to asymmetric information. Finally, with deposit insurance depositors may also be more careless about where to deposit their savings. Knowing that deposits are insured, depositors have ...

... presumes that the riskiness is observable for the insurance company (e.g. FDIC), which may not be entirely true due to asymmetric information. Finally, with deposit insurance depositors may also be more careless about where to deposit their savings. Knowing that deposits are insured, depositors have ...

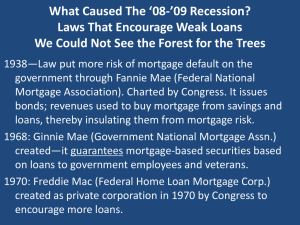

What Caused This Mess? Bad Laws Built Up Over Time

... billion worth of Fannie Mae backed loans. Insurance companies, AIG, insure the purchase of the SIVs and other mortgage products by “credit default swaps.” No loss possible! Hedge funds take positions on mortgages—derivatives. Those on the wrong side took huge losses. Lehman bankrupt overnight in ‘08 ...

... billion worth of Fannie Mae backed loans. Insurance companies, AIG, insure the purchase of the SIVs and other mortgage products by “credit default swaps.” No loss possible! Hedge funds take positions on mortgages—derivatives. Those on the wrong side took huge losses. Lehman bankrupt overnight in ‘08 ...

Powerpoint Presentation

... down payments to comply with the regulations against redlining. Adjustable rate mortgages were an innovation allowing home buyers to afford mortgages that wouldn’t have been possible with the high 30 year fixed rate. ...

... down payments to comply with the regulations against redlining. Adjustable rate mortgages were an innovation allowing home buyers to afford mortgages that wouldn’t have been possible with the high 30 year fixed rate. ...

FINANCIAL RISK MANAGEMENT

... FINANCIAL RISK MANAGEMENT Course Objective: This course will focus on variety of risks faced by financial managers and the tools available for managing these risks. Particularly, we shall focus on credit risk, interest rate and liquidity risks, market risk, foreign exchange risk and country risk. We ...

... FINANCIAL RISK MANAGEMENT Course Objective: This course will focus on variety of risks faced by financial managers and the tools available for managing these risks. Particularly, we shall focus on credit risk, interest rate and liquidity risks, market risk, foreign exchange risk and country risk. We ...

Risk Management Objectives

... Result of Market Structure Crises for no apparent reason… 1. Crash of 1987 Loss: Market value equal to one year’s GDP for Japan ...

... Result of Market Structure Crises for no apparent reason… 1. Crash of 1987 Loss: Market value equal to one year’s GDP for Japan ...

Multiple Choice Questions

... 1. Utilization of more medical care services may improve population health. An improvement in population health results in an increase in total hours worked (i.e., an increase in the labor force) and an increase in output produced per hour (i.e., productivity). The increase in total hours worked and ...

... 1. Utilization of more medical care services may improve population health. An improvement in population health results in an increase in total hours worked (i.e., an increase in the labor force) and an increase in output produced per hour (i.e., productivity). The increase in total hours worked and ...

The Risk and Term Structure of Interest Rates

... — Runs on SIVs and ABCPs by not rolling over their commercial papers and repos (Repurchase Agreements). — Liquidity crunch spills over to commercial papers and repos collateralized by other real estate related assets. — A cascade of runs for liquidity: healthy financial institutions and businesses a ...

... — Runs on SIVs and ABCPs by not rolling over their commercial papers and repos (Repurchase Agreements). — Liquidity crunch spills over to commercial papers and repos collateralized by other real estate related assets. — A cascade of runs for liquidity: healthy financial institutions and businesses a ...

BUSINESS ETHICS - LIFE at UCF - University of Central Florida

... • “THE ENDS JUSTIFY THE MEANS” • “GREATEST GOOD FOR THE GREATEST NUMBER” -- UTILITARIAN (e.g., BENTHAM; J. S. MILL) -- MORE GENERALLY, “CONSEQUENTIALIST” ...

... • “THE ENDS JUSTIFY THE MEANS” • “GREATEST GOOD FOR THE GREATEST NUMBER” -- UTILITARIAN (e.g., BENTHAM; J. S. MILL) -- MORE GENERALLY, “CONSEQUENTIALIST” ...

1 - Massey University

... consumption good. Thus entrepreneurs have to borrow all the consumption good they invest in their projects. Show (given that borrowing possibilities are limited by capital) how productivity shocks can trigger credit cycles. ...

... consumption good. Thus entrepreneurs have to borrow all the consumption good they invest in their projects. Show (given that borrowing possibilities are limited by capital) how productivity shocks can trigger credit cycles. ...

Recent Financial Turmoil - What`s New by Dr Peter

... By-pass the intermediary (Sell direct to surplus countries) This assumes intermediaries add nothing ...

... By-pass the intermediary (Sell direct to surplus countries) This assumes intermediaries add nothing ...

Lecture Slides - European University Institute

... Public regulators and central banks as monitors of last resort. Regulatory capital requirements that are based on public information can help reduce the adverse-selection problem in selling new equity. Central bank's lending can signal confidence in value of a bank's assets. Basel tried to encourage ...

... Public regulators and central banks as monitors of last resort. Regulatory capital requirements that are based on public information can help reduce the adverse-selection problem in selling new equity. Central bank's lending can signal confidence in value of a bank's assets. Basel tried to encourage ...

Chapter 14 1. Explain how a bank run can turn into a bank panic

... If banks’ fragility arises from the fact that they provide liquidity to depositors, as a bank manager, how might you reduce the fragility of your institution? You could reduce the risk of large-scale unexpected withdrawals by increasing the portion of your liabilities accounted for by deposits that ...

... If banks’ fragility arises from the fact that they provide liquidity to depositors, as a bank manager, how might you reduce the fragility of your institution? You could reduce the risk of large-scale unexpected withdrawals by increasing the portion of your liabilities accounted for by deposits that ...